Global dividend roundup

Our quarterly global dividends outlook produced by Markit Dividend Forecasting sees dividends surging across the world; we review the countries and sectors driving this growth.

- US companies lead the way globally with S&P 500 companies expected to boost payments by 9.7%

- Banks are expected to cast a shadow on European dividends, with finance heavy France and Spain both lagging behind the region’s average

- The UK’s payments are set to notch up a 4.7% increase from the previous year

US

The bullish mood in the US which has seen the S&P surge to new all-time highs is reflected in company dividend payments forecast for the current fiscal year. Markit Dividend Forecasting is expecting another bumper year of dividend payments across the S&P 500. Overall, Markit is forecasting 428 of the index’s companies to pay dividends over fiscal 2014, the highest proportion since 1997. The payments are forecast to total $367bn, 9.7% higher than the previous fiscal year’s total.

The rise in payments is expected to be pretty much across the board, with 17 of the 19 sectors in the index expected to see a rise in aggregate dividend payments. Retail and basic resources are the only two sectors expected to see a fall in aggregate payouts.

It’s worth noting that these decreases in payments are distorted somewhat by special payments, as large one off payments made to take advantage of expiring tax breaks. An example of this is Freeport McMoran Copper &God which distributed $1bn through a special payment last year and is not forecast to do so again this year. Over the whole index, special payments are expected to represent less than 1% of total payments at $2.6bn.

As for the sector leading the way with the largest jump in expected dividend payments, Automobiles & Parts is set to see its aggregate payout jump by 90% from the previous fiscal year to $5.5bn. This surge is driven by General Motors which is set to initiate an annual $1.9bn payment as it continues its turnaround after being bailed out in the midst of the crisis.

Europe

European companies are expected to grow their payments in the current fiscal year from fiscal 2013, with members of the MSCI Europe (ex UK) setting the tone with a 7.2% rise in total payments.

Mainland European payments are driven by large rises in the aggregate payments made by German and Italian firms, which are expected to see an 8.3% and 11.6% increase in aggregate payments respectively.

As for the major countries lagging behind the regional average, France and Spain, we see issues with banks dragging the average down.

In France, the largest contributing country of the MSCI Europe index, BNP Paribas recent troubles with US authorities has forced the company to hold its payment flat at an aggregate €1.8bn for the current fiscal year, in order to pay for a $9bn in fines. This has taken the wind out of French dividends somewhat, as the company was previously set to raise its payment by 50% according to the plan approved by its board prior to its recent legal troubles.

As for Spain, special dividends have skewed the picture. Repsol, which paid a special dividend last year, is not expected to do so again in the coming fiscal year, meaning a cut to the aggregate payment by 49% compared to 2013. This effect, combined with the fact that BBVA is expected to cut its dividend, sees the aggregate payments made by Spanish banks come in 5% lower than in the previous fiscal year.

UK

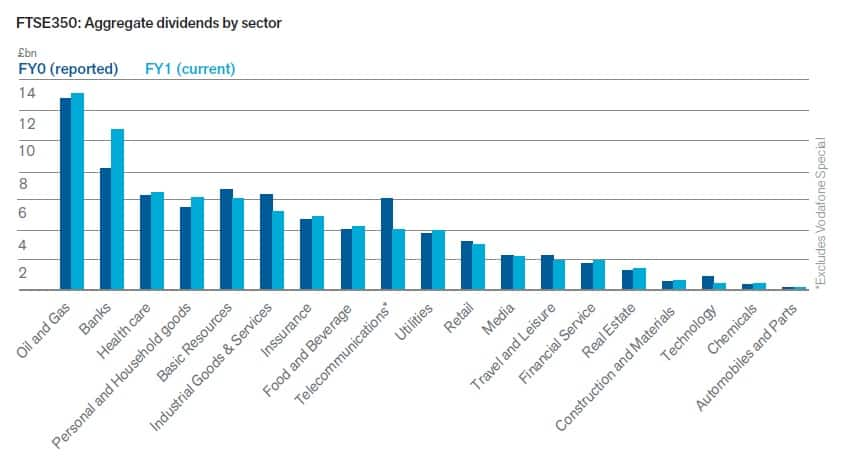

UK payments are also forecast to rise, although the 4.7% increase of FTSE 350 dividends in the coming fiscal year is lower than our expectations for the rest of Europe and the US. Interestingly, this weaker dividend growth number is partly driven by the strength of the UK economy, as the strength of the pound against the dollar, the currency which many companies set their payments in has seen the pound value of payments fall.

Oil and Gas firms are the main companies affected by these developments and the sector is forecast to see its pound payments fall by 0.8% given the current currency headwinds. This is largely driven by Royal Dutch Shell and BP which account for two thirds of the sector’s payments.

On the positive note, healthcare firms and banks are expected to see strong rises in payments, which will make the sectors the second and third largest payers respectively.