Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

May 09, 2014

Most shorted ahead of earnings

We review how short sellers are reacting to companies due to announce earnings in the week to come:

- Nii Holdings is the most shorted company ahead of earnings globally

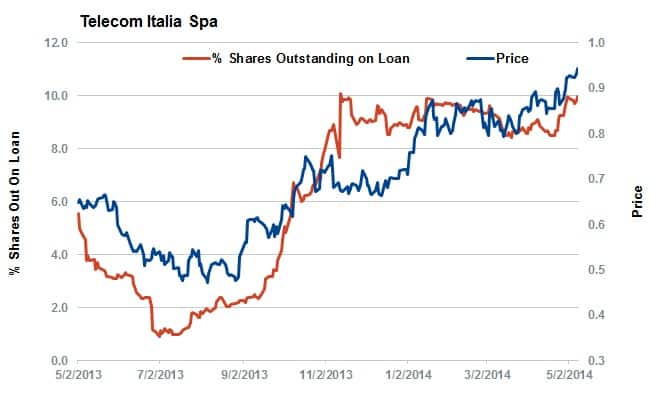

- In Europe, Italian firms Tod’s and Telecom Italia see heavy short interest ahead of earnings

- Japanese firms dominate the most shorted Asian companies ahead of earnings

North American earnings

This week sees first quarter earnings announcements continue in full swing. On the heavily shorted end of the scale, there are 20 companies with 12.5% or more of their shares out on loan ahead of earnings.

Telecoms firm Nii Holdings is the most shorted of all the companies announcing earnings next week with nearly a quarter of its shares outstanding on loan. Short sellers have taken profits off the table in recent months, as Nii shares headed towards a 90% fall from where they were traded a year ago. The current high demand to borrow no doubt stands from fact that Nii has a heavy exposure to the hyper competitive Latin American markets and growing debt pile.

Also shorted in the telecoms space is Magicjack. The company,s which used to be a stalwart of the late night infomercial space, has recently seen a run of form after its shares posted a 46% year to date surge. Short sellers have piled on after the latest run as many start to wonder about the firm’s relevance in the face of competition from the likes of Skype and WhatsApp.

Along the same cost saving pitch as MagicJack is home soda making firm Sodastream International. Though SODA shares popped in the last three months after competitor Keurig teamed up with Coca Cola, short sellers have stayed the course. This could be a shrewd move as Sodastream has a history of disappointing investors. SODA shares fell by over a quarter in January after the company announced disappointing results in the closing months of last year.

Finally, short favourite J C Penney has seen its demand to borrow more than halve over the last three months as its shares rebounded from ten year lows. Though analysts are not forecasting the firm to return to profitability until the closing quarter of the year, the company is expected to report a smaller loss than it did in this quarter last year. Investors have clearly taken well to these developments as JCP share are up by 61% in the last three months.

European earnings

Europe also sees heavy earnings activity, with 14 firms with more than 7% of shares out on loan ahead of imminent results.

The most shorted company ahead of earnings is Italian bank Banca Monte Dei Paschi Di Siena which has nearly 27% of its shares out on loan. This heavy demand to borrow appears to be tied to the company’s potential €5b capital raising exercise which came to light in April.

The Latin American struggles felt by Nii in the states are also driving short sellers towards European national carrier Telecom Italia.

Telecom Italia has seen heavy demand to borrow as it draws over a quarter of its revenue from its Mobile Brazil unit which has seen its sales fall over the last 12 months.

Rounding out the Italian shorts is luxury leather goods firms Tod’s which has 7.8% of its shares out on loan. Demand to borrow Tod’s shares is up four folds in the last six months after the company’s revenues fell from 2012. Analysts see lower sales for the coming year than they did three months ago, citing weak demand in both domestic markets and China, the company’s third largest market.

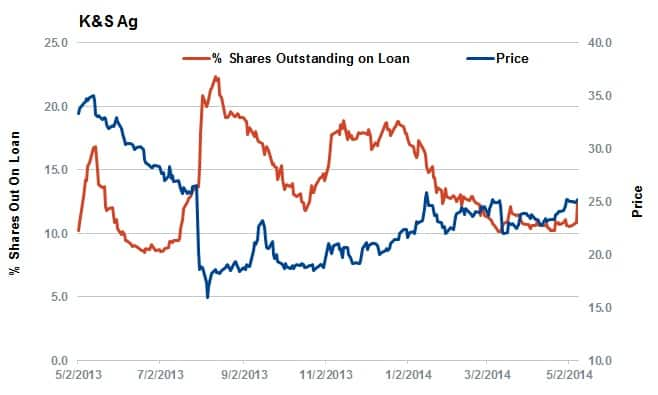

Looking beyond Italy, German potash company K&S has seen a resurgence in demand to borrow in the last four weeks with demand to borrow now standing at 12.6% of shares outstanding. This resurgence in short interest comes despite the fact that SDF shares are on track to claw back their losses posted after the potash pricing cartel unravelled. Investors will no doubt be looking to see whether the chilly North American winter has warmed up profits in its salt division which has grown to represent nearly half of its business.

Asian earnings

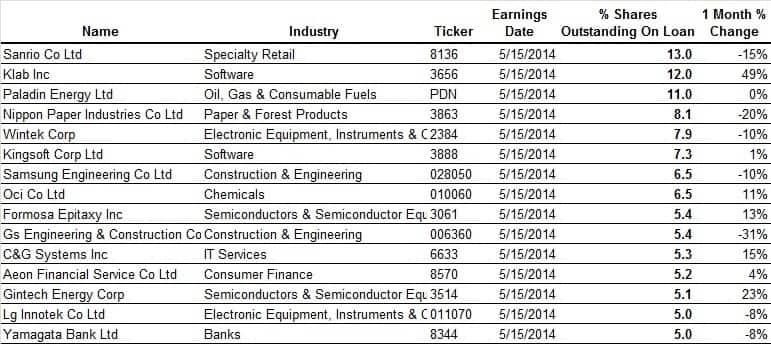

The Asian reporting season is also in full swing, with 16 firms with more than 6% of shares out on loan ahead of earnings.

Coming in as the most shorted Asian share is Hello Kitty maker Sanrio which has seen its demand to borrow jump six fold in the last seven months as its shares halved.

The second most shorted firm in the region in the run-up to earnings is mobile software firm Klab which has 12% of shares out on loan.

Klab short interest now stands at a recent high after peers such as DeNA announced worse than expected earnings. Looking back over the last year, Klab shares are down by nearly three quarters from their highs in August.

South Korean firms also feature on the list of heavily shorted share with engineering companies Samsung Engineering and Gs Engineering & Construction Corp both making the heavily shorted list.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09052014120000Most-shorted-ahead-of-earnings.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09052014120000Most-shorted-ahead-of-earnings.html&text=Most+shorted+ahead+of+earnings","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09052014120000Most-shorted-ahead-of-earnings.html","enabled":true},{"name":"email","url":"?subject=Most shorted ahead of earnings&body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09052014120000Most-shorted-ahead-of-earnings.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Most+shorted+ahead+of+earnings http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09052014120000Most-shorted-ahead-of-earnings.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}