Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

STRUCTURED FINANCE COMMENTARY

Mar 08, 2017

CAS Me Outside

CRT RMBS market tightens on improved fundamentals

Spread tightening

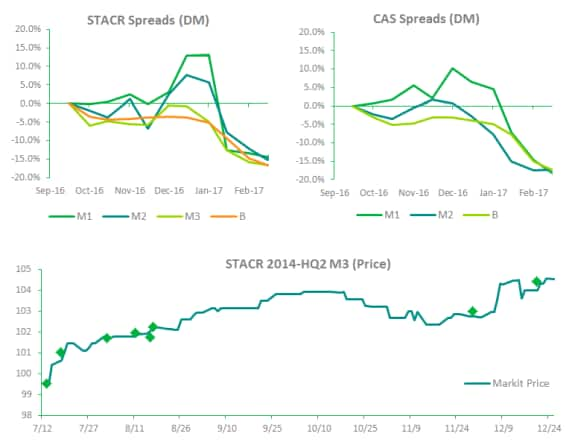

The Credit Risk Transfer (CRT) market has experienced steady spread tightening since the second half of 2016. Our IHS Markit Weekly Mortgage Snapshot shows the movement in M1, M2, and B tranches that have tightened approximately 23, 63, and 202 bps, respectively, over the past six months.

The spread tightening in this sector is largely attributable to credit rating upgrades, newly issued NAIC designations, and macro market tightening, stemming from the speculation of future fiscal policy changes.

Rating upgrades

Over the recent months we have observed upgrades to 59 CRT tranches, which represents roughly 15% of the offered CRT universe. Of the approximate $1.4 trillion in securities originated by Fannie and Freddie, only $40.8 billion represent the offered universe (see "CRT overview" section below). These rating actions have largely occurred on the back of improving collateral performance of the bond's reference pools. The upgrades and introduction of ratings have helped tighten spreads and attract more demand from investors.

In December the M3 tranche of STACR 2015-DNA1 (3137G0EW5) was upgraded from B1 to Ba3 by Moodys. The upgrade was followed by a Fitch Rating and caused the bond's spread to tighten from 258DM to 212DM. Similarly, the 1M2 tranche of the CAS 2014-C02 deal (30711XAF1), a previously unrated security, came in by approximately 45 bps from 332DM to 284DM as Fitch upgraded it to BB designation in September.

Market events

In addition to the rating action performed by Moody's, Fitch, Kroll, and others, the National Association of Insurance Commissioners ("NAIC") has recently assigned designations to both STACR and CAS loss tranches. NAIC designations are used to categorize the credit quality of a given security and select firms are unable to expose themselves to securities without NAIC designations. These ratings, coupled with rating agencies upgrading various tranches, may bring more buyers into the market that were previously side lined as the bonds did not meet their minimum investment standards.

Economic growth via employment, and infrastructure expansion has been a crucial theme of the Trump administration's plan for the next four years. While specific policies remain unclear, investors have remained optimistic that the new administration's strategy will ultimately impact the economy positively. While default rates remain low, and home price appreciation continues to increase, market participants will likely continue to take advantage of the elevated returns and steady cash flows of CRT deals.

CRT overview

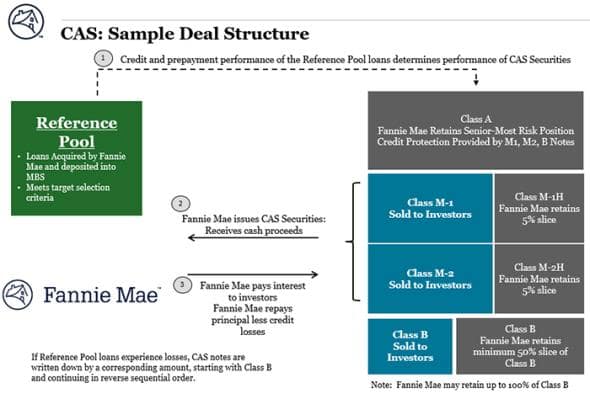

CRT deals are mortgage backed securities (MBS) issued off the Freddie Mac Structured Agency Credit Risk (STACR) shelf and the Fannie Mae Connecticut Avenue Securities (CAS) shelf. The underlying collateral for these deals is generally comprised of newly issued, fixed rate loans, with an average loan size of approximately $200K. All borrowers within the underlying loan pool must meet the conforming loan standards that are dictated by both Fannie Mae and Freddie Mac.

Fannie and Freddie will retain the most senior tranche of the capital stack, along with portions of the mezzanine and first loss piece per the recently issued risk retention rules. The remaining portion of the mezzanine and first loss tranches are sold to private investors thus shifting credit risk from taxpayers to the private sector.

IHS Markit's Securitized Products Pricing service provides independent evaluated pricing, sector level time series and transparency metrics across Agency Pass-Through, Agency CMO, Non-Agency RMBS, Consumer ABS, European ABS, CMBS, TruPS, CDO and CLO asset classes. For further information please email: USABSPricing@Markit.com

Adam Mauro

Assistant VP, Securitized Products

Tel: +1 646 679 3433

Email: Adam.Mauro@IHSMarkit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08032017-Structured-Finance-CAS-Me-Outside.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08032017-Structured-Finance-CAS-Me-Outside.html&text=CAS+Me+Outside","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08032017-Structured-Finance-CAS-Me-Outside.html","enabled":true},{"name":"email","url":"?subject=CAS Me Outside&body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08032017-Structured-Finance-CAS-Me-Outside.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=CAS+Me+Outside http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08032017-Structured-Finance-CAS-Me-Outside.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}