Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Mar 06, 2017

Global growth slows for first time in six months

Global economic growth lost a little momentum in February, according to PMI survey data, but remained robust. The JPMorgan Global PMI", compiled by Markit from its various national surveys, fell for the first time in six months, down from January's 22-month high of 53.9 to a three-month low of 53.5.

Global economic growth

Despite the slight slowing, the survey data are consistent with global GDP rising at an annual rate of 2.5% in the first quarter, assuming no major change in momentum during March.

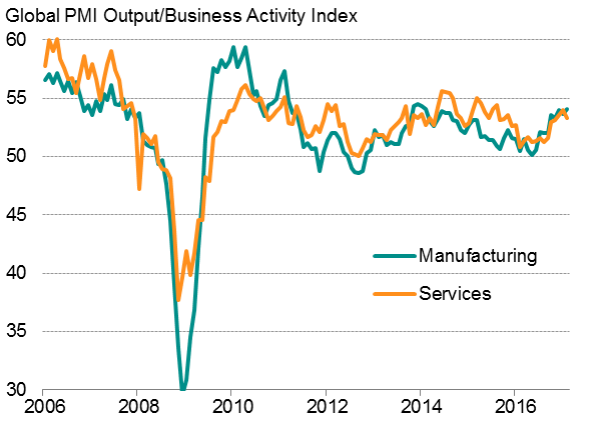

The upturn was broad-based with similarly robust rates of expansion seen in both manufacturing and services. However, while worldwide factory output grew at the fastest rate for three years, service sector activity growth waned to a three-month low, linked mainly to a slower rate of expansion across the developed world.

Global manufacturing v services

Sources for charts: IHS Markit, JPMorgan.

Eurozone leads developed world upturn

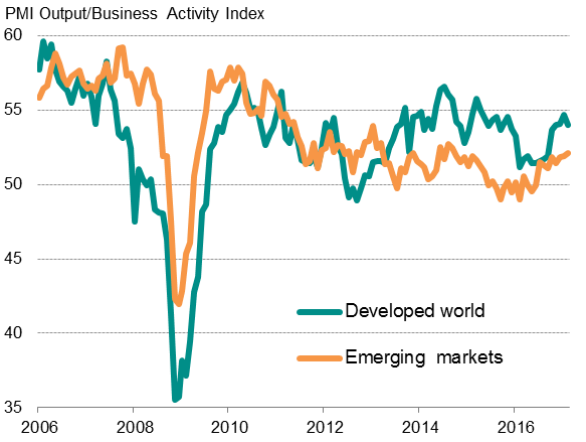

Measured overall, emerging market growth edged up to a 29-month high, but continued to underperform relative to the rich world, despite the latter recording the weakest expansion for three months.

Current output: developed v emerging markets

Sources for charts: IHS Markit, JPMorgan.

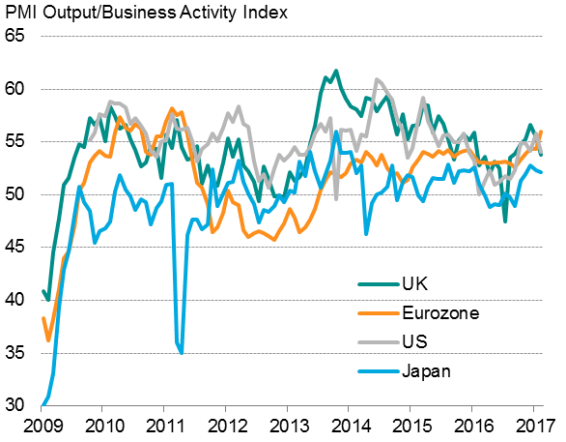

Developed world growth was led by the eurozone, where growth hit a near six-year high. Growth meanwhile slowed in the US, UK and Japan, albeit remaining robust in all cases by recent standards.

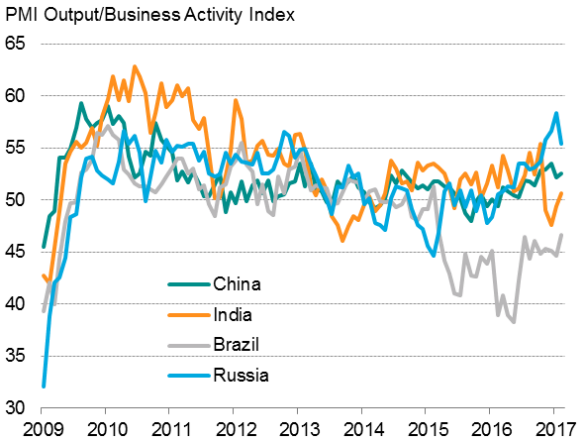

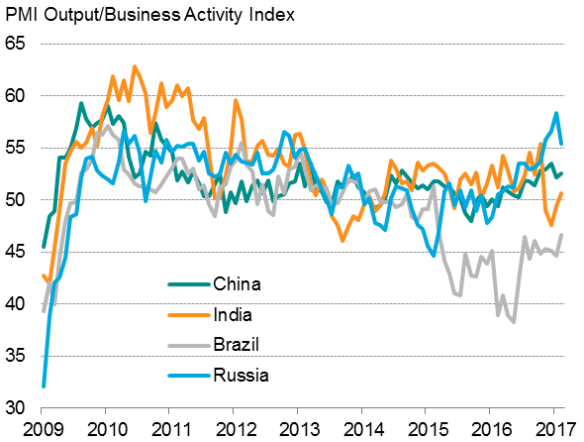

Russia continued to lead the emerging market upturn, recording the highest PMI reading of the BRICs for the fourth successive month. Growth accelerated in China, and India returned to expansion for the first time since October, to suggest the economy is recovering from the disruptions of demonetisation. Brazil remained firmly in decline, though the contraction was the shallowest for almost two years.

Developed world output

Emerging markets output

Sources for charts: IHS Markit, CIPS, Nikkei, Caixin.

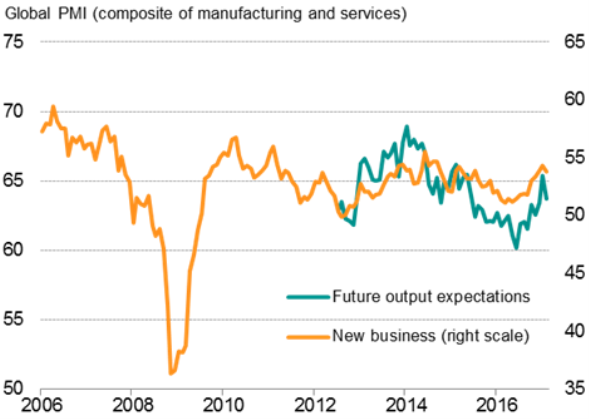

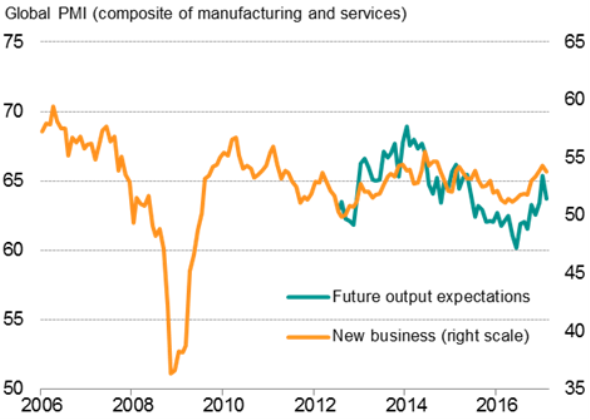

Optimism and new orders dip from highs

Other indicators also pulled back from highs at the start of the year but remain consistent with steady growth of business activity. Business optimism about future output dipped from January's 20-month high, linked to reduced expectations in the developed world, though remained at the second-highest level for over one and a half years.

Future expectations and new business

Growth of new business likewise eased back from a two-year high in January, but also remained elevated by standards of the past few years. Faster growth of new work was seen across the emerging markets, contrasting with a slowdown in the developed world.

Hiring close to two-year high

The slower growth of business activity and new orders did little to dent firms' appetite to hire. Job creation continued to run at a rate unchanged on January's 20-month high despite a further marginal fall in emerging market employment.

Employment

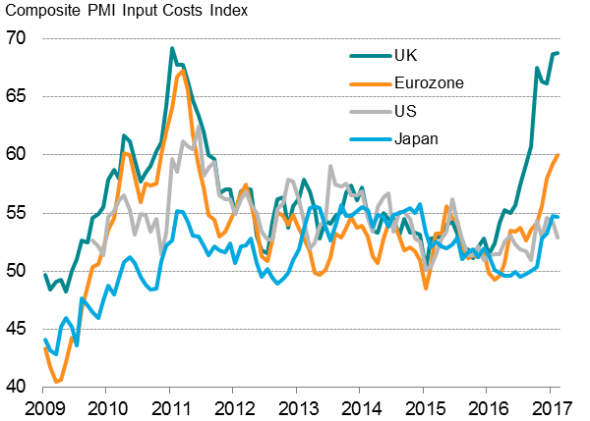

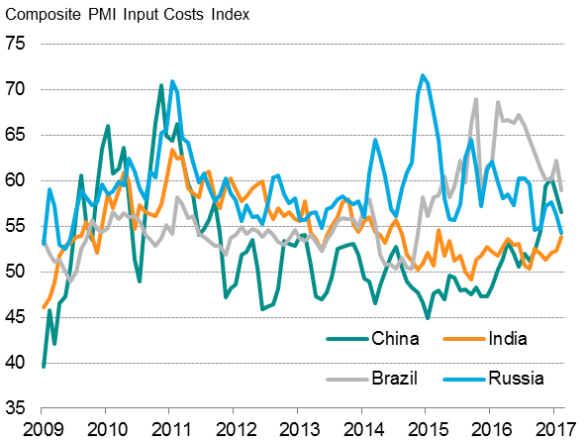

Price pressures fall from highs

February also saw a modest waning of inflationary pressures. The rate of increase in average prices charged for goods and services eased slightly for a second month running from December's five-and-a-half year high, albeit continuing to rise especially markedly in manufacturing.

Higher oil and other commodity prices, notably for fuel and energy, once again pushed up average input costs, though the overall rate of cost inflation cooled from January's five-and-a-half year peak.

Global prices

Sources for charts: IHS Markit, JPMorgan.

Developed world input costs

Emerging markets input costs

Sources for charts: IHS Markit, CIPS, Nikkei, Caixin.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06032017-Economics-Global-growth-slows-for-first-time-in-six-months.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06032017-Economics-Global-growth-slows-for-first-time-in-six-months.html&text=Global+growth+slows+for+first+time+in+six+months","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06032017-Economics-Global-growth-slows-for-first-time-in-six-months.html","enabled":true},{"name":"email","url":"?subject=Global growth slows for first time in six months&body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06032017-Economics-Global-growth-slows-for-first-time-in-six-months.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Global+growth+slows+for+first+time+in+six+months http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06032017-Economics-Global-growth-slows-for-first-time-in-six-months.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}