Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Dec 05, 2016

PMI surveys indicate 0.5% UK GDP growth in fourth quarter, alongside rising inflation

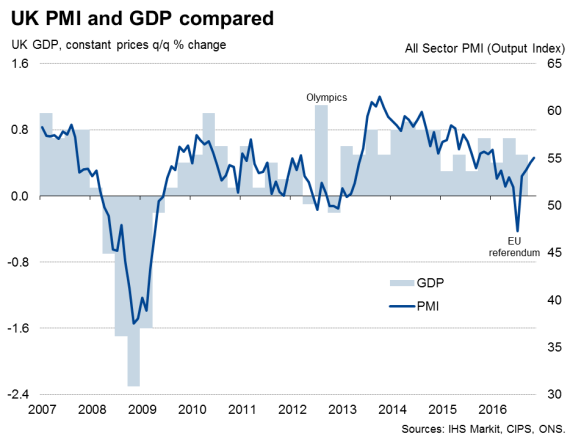

UK business activity grew at an increased rate again in November, showing the largest monthly expansion since January. The upturn indicates that the pace of economic growth remains solid in the fourth quarter despite ongoing uncertainty caused by the Brexit vote and rising prices.

The Markit/CIPS 'all-sector' PMI rose from 54.5 in October to a ten-month high of 55.0 in November. The average reading over the past two months is consistent with the economy growing 0.5% in the fourth quarter.

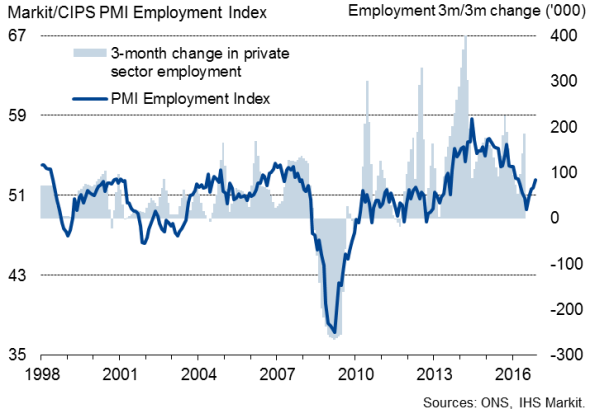

Employment growth likewise picked up to an eight-month high in November as firms sought to boost capacity in line with stronger demand. However, rates of job creation remained well below a year ago as many companies continued to take a cautious approach to hiring.

Employment

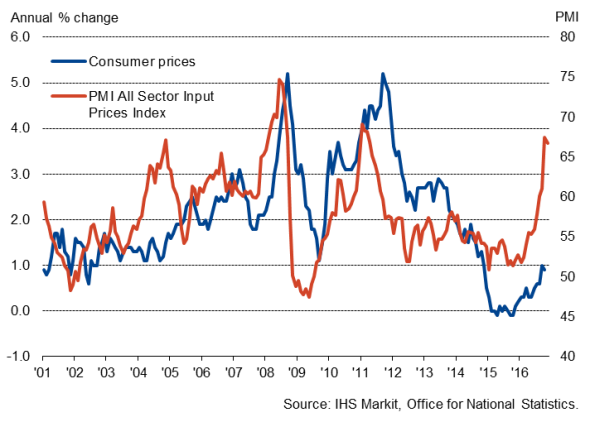

Price pressures meanwhile remained elevated, often linked to the weakened pound, suggesting inflation is set to rise. Input prices rose sharply again in November, with the past two months seeing the steepest upward pressure on businesses' costs for five-and-a-half years. Average selling prices for goods and services meanwhile showed the second-largest rise since mid-2011 in November.

UK inflation

The sustained improvement in the business surveys and sharp rise in prices suggest that the odds will continue to shift away from the Bank of England adding more stimulus.

However, any policy tightening still seems a long way off, given the uncertainty facing the UK economy. The service sector PMI showed business optimism about the coming year dipped in November, to the second-lowest in four years.

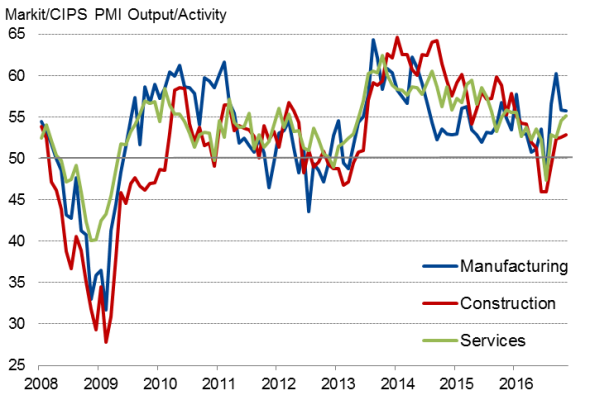

The expansion continued to be led by the manufacturing sector, even though factory output grew at the slowest rate for four months. In contrast, growth accelerated in both the service sector and construction to ten- and eight-month highs respectively.

Output by sector

Manufacturers struggle with higher costs

While manufacturing was again buoyed by rising exports, attributable in turn to the weaker pound, the survey also brought evidence that some of the export gains may be being eroded by the need to pass on higher costs.

The flip-side of the weaker exchange rate has been sharply higher input costs, which have been widely blamed for manufacturers' selling prices rising at the fastest rate since mid-2011 so far in the fourth quarter.

Export order growth has slowed markedly from September's five-and-a-half year high, causing growth in total new order inflows to ease to a four-month low in November.

Service sector sees mixed performance

Service sector activity also saw a smaller rise in inflows of new business compared with October, but business activity in the vast tertiary sector nevertheless grew at the fastest rate since January.

There was a wide array of performances by sub-sector within services. Based on three-month averages, growth accelerated in financial services, business-to-business services, transport & communications and consumer services, but slowed in computing & IT. Activity meanwhile fell in the hotels & restaurants sector.

Construction helped by housebuilding

Output of the construction industry grew at the fastest rate since March, thanks to a further improvement in housebuilding. However, commercial activity and civil engineering showed only marginal rises compared with October.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05122016-Economics-PMI-surveys-indicate-0-5-UK-GDP-growth-in-fourth-quarter-alongside-rising-inflation.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05122016-Economics-PMI-surveys-indicate-0-5-UK-GDP-growth-in-fourth-quarter-alongside-rising-inflation.html&text=PMI+surveys+indicate+0.5%25+UK+GDP+growth+in+fourth+quarter%2c+alongside+rising+inflation","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05122016-Economics-PMI-surveys-indicate-0-5-UK-GDP-growth-in-fourth-quarter-alongside-rising-inflation.html","enabled":true},{"name":"email","url":"?subject=PMI surveys indicate 0.5% UK GDP growth in fourth quarter, alongside rising inflation&body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05122016-Economics-PMI-surveys-indicate-0-5-UK-GDP-growth-in-fourth-quarter-alongside-rising-inflation.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=PMI+surveys+indicate+0.5%25+UK+GDP+growth+in+fourth+quarter%2c+alongside+rising+inflation http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05122016-Economics-PMI-surveys-indicate-0-5-UK-GDP-growth-in-fourth-quarter-alongside-rising-inflation.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}