Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Dec 05, 2014

US job creation surges in November

Yet another month of strong job creation in November suggests the US economy continues to grow at an encouragingly robust pace in the fourth quarter. Wage growth is also showing welcome signs of edging higher, and key indicators of labour market slack continue to improve. All of which adds to the case for policymakers to start the process of bringing interest rates back to normal levels sooner rather than later.

Hiring surges

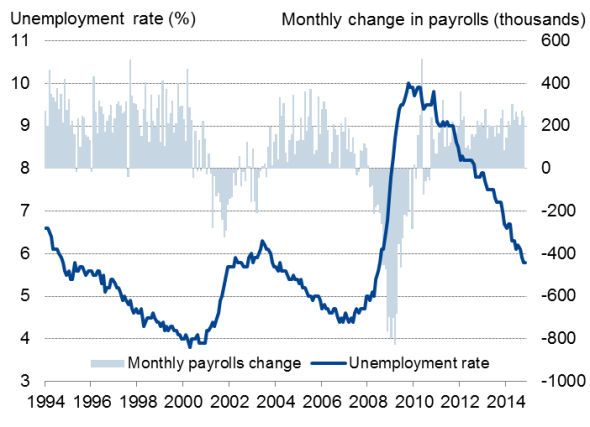

Non-farm payrolls surged by 321,000 in November, smashing expectations of a 230,000 rise and registering the biggest monthly gain since January 2012. Job creation in the previous two months was also revised higher by 44,000, painting an even brighter picture of recent hiring trends. The US economy has added more than 200,000 jobs in each month since January (when the polar vortex hit the economy), making it the best period of such sustained strong job creation for 20 years.

The unemployment rate was unchanged from October's six-year low of 5.8%, but other key measures being watched by the Fed showed some further improvement. Underemployment (such as those who want to work more hours or want to work but have stopped searching) fell from 11.5% to 11.4%, as did long-term joblessness (those seeking work for 27 weeks or more), down from 2.916 million to 2.815 million.

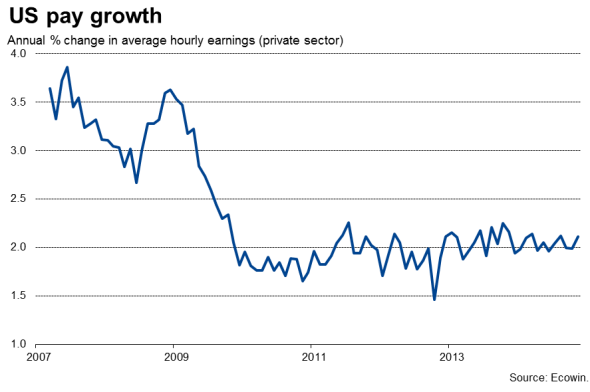

The flow of good news on hiring was accompanied by signs that private sector wage growth is showing tentative signs of picking up, albeit only from 2.0% to 2.1%. That's still well below levels that will worry policymakers, but it is nevertheless reassuring that wage growth is at least moving in the right direction.

Growth cooling

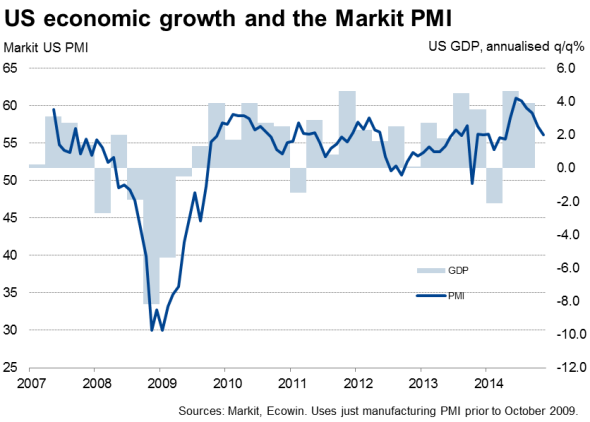

We anticipate some modest cooling of the labour market is possible in coming months. Markit's PMI surveys have been especially buoyant through much of the year but have signalled an easing in the rate of economic growth to approximately 2.5% in the fourth quarter, slowing in November to the weakest since April. While the surveys have also suggested that job creation has proven resilient in the face of this slowdown, the concern is that, unless the pace of economic growth picks up again, employment growth could soon start to ease.

Rate hikes

However, at present, as far as policy is concerned, the signs from the labour market are all positive. Policymakers will no doubt be minded that, with job creation as strong as this and wages picking up, the economy looks increasingly able to withstand a modest tightening of policy. On the other hand, the lack of any significant wage growth points to a benign inflation outlook, which in turn suggests there remains no immediate rush to hike rates

We should therefore continue to expect policymakers to start edging interest rates higher in mid-2015, barring any further downshifting in the pace of economic growth beyond that already signalled by the surveys.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05122014-Economics-US-job-creation-surges-in-November.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05122014-Economics-US-job-creation-surges-in-November.html&text=US+job+creation+surges+in+November","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05122014-Economics-US-job-creation-surges-in-November.html","enabled":true},{"name":"email","url":"?subject=US job creation surges in November&body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05122014-Economics-US-job-creation-surges-in-November.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=US+job+creation+surges+in+November http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05122014-Economics-US-job-creation-surges-in-November.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}