Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Nov 05, 2014

Japan PMI surveys show economy taking backwards step at start of fourth quarter

Japan's economy took a backwards step at the start of the fourth quarter, intensifying concerns that the country is struggling in the aftermath of the sales tax hike earlier in the year. There are several reasons to be hopeful, however, that growth will pick up again.

Renewed downturn

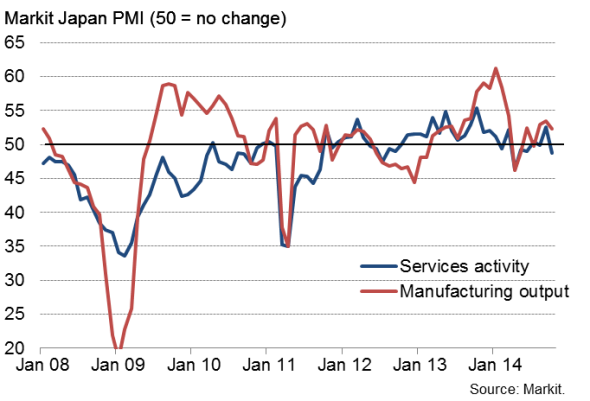

Service sector activity fell for the sixth time this year in October, reversing an upturn that had been recorded in September, according to PMI data produced by Markit. The drop in activity was the largest since April, when the economy was hit by the introduction of a higher sales tax.

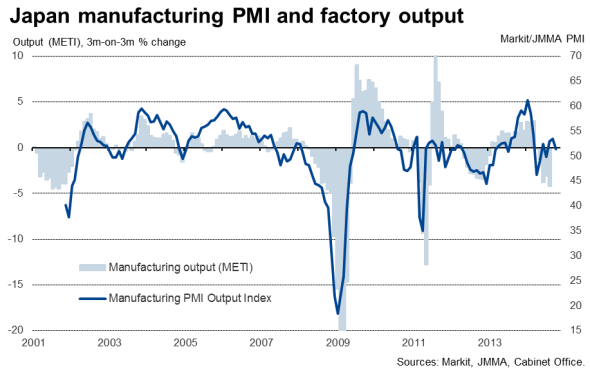

The disappointing service sector news follow manufacturing results, which showed growth of goods production slowing closer to stagnation in October.

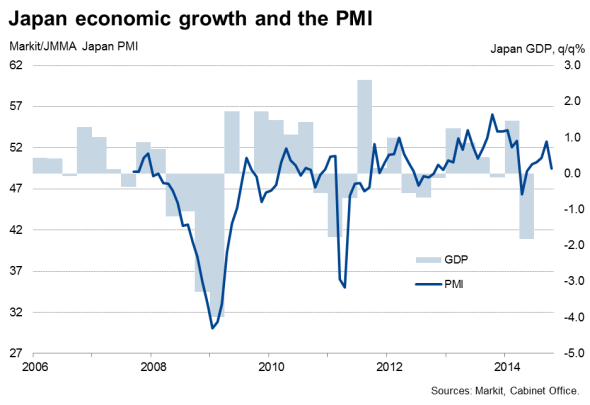

A GDP-weighted average of the two surveys' output indices slumped from a six-month high of 52.8 in September to 49.5 in October. By dropping below 50, the index signalled a marginal contraction of private sector business activity during the month, the first such deterioration since May.

Having therefore indicated that GDP will have rebounded in the third quarter after the 1.8% decline recorded in the three months to June, the economy is in danger of sliding back into a downturn in the fourth quarter.

Reasons to be cheerful

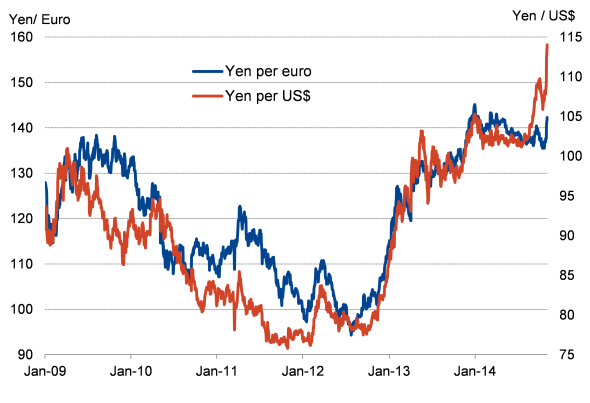

The drop in the service sector survey data highlights the weakness of domestic demand in Japan, something which was also revealed in the manufacturing survey. However, one of the major effect of the "Abenomics' stimulus plan has been a striking depreciation of the yen against the US dollar (see chart), which has made Japanese goods more competitively priced in many overseas markets. This resulted in goods export orders rising in October at the fastest rate since December of last year.

Output by sector

With the announcement of additional asset purchases in late October, bringing the Bank of Japan's quantitative easing programme up to "80 trillion per annum, the further depreciation of the currency as well as the financial stimulus should help engender stronger economic growth in coming months.

An additional factor is the weather. With Japan having been hit by a series of "super typhoons' in October, business was disrupted to a greater extent than usual for the time of year. The impact of weather disruptions was cited by many domestically-focused companies as having materially affected trading. The return of more normal weather conditions should therefore herald a bounce-back of business activity in November, especially in the service sector.

Other survey indicators also hint at the possibility of growth picking up again. In the manufacturing sector, the amount of goods purchased for use in future production showed the sharpest rise since March. Backlogs of uncompleted orders also rose in the manufacturing sector to the greatest extent since March, suggesting a developing pipeline of work to undertake.

However, any future growth may be disappointingly modest. Employment barely rose in both sectors in October, suggesting limited appetite to take on extra staff to boost capacity, and expectations of business activity in the service sector for the year ahead deteriorated compared to September.

Exchange rate

PMI survey and official data on goods exports

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05112014-economics-japan-pmi-surveys-show-economy-taking-backwards-step-at-start-of-fourth-quarter.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05112014-economics-japan-pmi-surveys-show-economy-taking-backwards-step-at-start-of-fourth-quarter.html&text=Japan+PMI+surveys+show+economy+taking+backwards+step+at+start+of+fourth+quarter","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05112014-economics-japan-pmi-surveys-show-economy-taking-backwards-step-at-start-of-fourth-quarter.html","enabled":true},{"name":"email","url":"?subject=Japan PMI surveys show economy taking backwards step at start of fourth quarter&body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05112014-economics-japan-pmi-surveys-show-economy-taking-backwards-step-at-start-of-fourth-quarter.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Japan+PMI+surveys+show+economy+taking+backwards+step+at+start+of+fourth+quarter http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05112014-economics-japan-pmi-surveys-show-economy-taking-backwards-step-at-start-of-fourth-quarter.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}