Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Sep 05, 2014

UK unemployment to fall further as job vacancies rise at fastest rate in 16 years

Recruitment industry survey data point to a further drop in UK unemployment over the summer, but also highlight worsening staff availability and a resulting upturn in pay pressures.

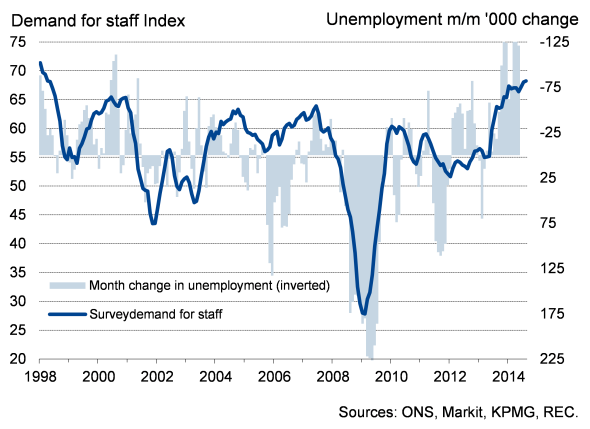

Demand for staff grew at the fastest rate in over 16 years in August, according to data collected by Markit in August on behalf of REC and KPMG. Recruitment agencies reported that client demand for staff rose at the fastest rate since April 1998 as companies sought to boost workforce numbers in the face of the UK's on-going economic growth surge.

The increase reflects further near-record upturns in the number of job vacancies for permanent, temporary and contract staff. Demand surged across all main job types, from blue collar workers through to executive and professional staff.

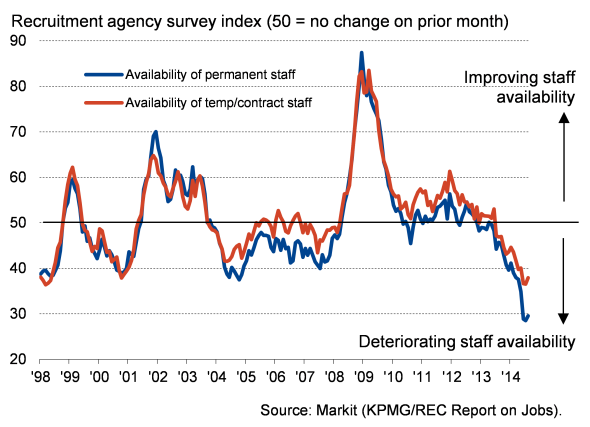

Although the survey also found actual employment numbers to have again risen at one of the fastest rates seen since survey data were first collected in 1997, an increase in skill shortages often meant companies were unable to fill vacancies, contributing to a slowdown in hiring to the weakest for five months.

With shortages of suitable staff worsening, successful candidates were often able to negotiate higher pay, resulting in another month of near-record pay growth for both new permanent staff and temporary and contract workers.

Recruitment survey staff availability

Policymakers' pay puzzle

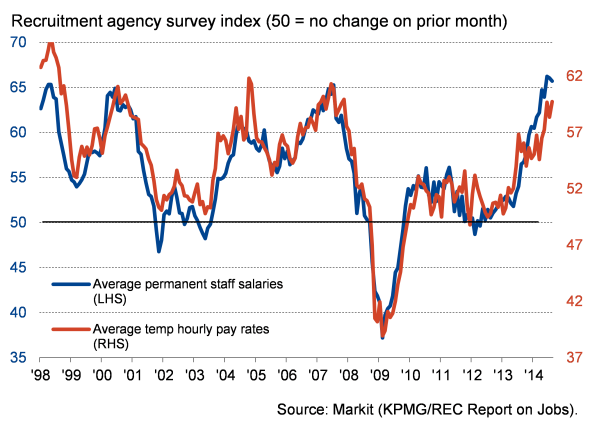

The survey data suggest official pay growth data should start showing signs of strengthening in coming months. The latest official data, available only up to the second quarter, showed pay growth up just 0.6% on a year ago, the slowest annual rate of increase ever recorded.

The wage data have particular importance, as the lack of pay growth is the most important factor restraining the Bank of England from hiking interest rates as the economy booms. PMI data suggest the economy will have grown by 0.8% again in the third quarter, matching the increases seen in the first half of the year. Such a strong pace of expansion would normally encourage policy makers to hike interest rates to cool the pace of expansion and prevent inflation from picking up. However, an unusual lack of upward movement in the official pay data that has accompanied this growth so far persuaded the Bank of England to keep rates on hold at the record low of 0.5%.

Recruitment survey pay indices

Unemployment to continue falling

The upturn in the demand for staff signalled by the survey also suggests that unemployment will have continued to fall in the summer. The latest official data showed the jobless rate dropping to 6.4% in the three months to June, its lowest since late 2008. The improvement in the recruitment survey data indicates that the official unemployment rate should fall by at least 0.1% in both July and August, taking the rate down to 6.2% or even lower. The jobless rate therefore looks to drop below 6% by the end of the year.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05092014uk-unemployment-to-fall-further-as-job-vacancies-rise-at-fastest-rate-in-16-years.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05092014uk-unemployment-to-fall-further-as-job-vacancies-rise-at-fastest-rate-in-16-years.html&text=UK+unemployment+to+fall+further+as+job+vacancies+rise+at+fastest+rate+in+16+years","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05092014uk-unemployment-to-fall-further-as-job-vacancies-rise-at-fastest-rate-in-16-years.html","enabled":true},{"name":"email","url":"?subject=UK unemployment to fall further as job vacancies rise at fastest rate in 16 years&body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05092014uk-unemployment-to-fall-further-as-job-vacancies-rise-at-fastest-rate-in-16-years.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=UK+unemployment+to+fall+further+as+job+vacancies+rise+at+fastest+rate+in+16+years http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05092014uk-unemployment-to-fall-further-as-job-vacancies-rise-at-fastest-rate-in-16-years.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}