Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Sep 04, 2014

PMI data show US and UK spearheading global economic upturn in August

The global economy continued to grow at a robust pace in August, with the rate of expansion dipping slightly but remaining close to the strongest seen at any time seen since early 2011. However, growth remained unbalanced, and all too reliant on the US and UK driving the upturn.

The JPMorgan Global PMI", compiled by Markit, dipped from 55.5 in July to 55.1 but remained well above the 50.0 no-change level, signalling on-going expansion. The survey data available so far for the third quarter are roughly consistent with the global economy growing at an annual rate of just over 3%, up from 2.1% in the second quarter.

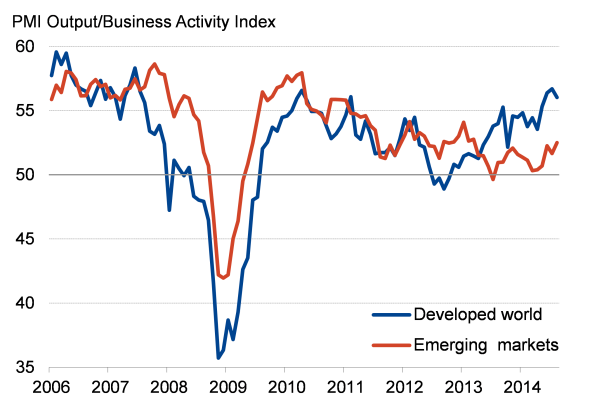

The outperformance of the developed world over emerging markets that has been evident since early-2013 persisted, though the gulf narrowed. A modest acceleration of growth in the latter pushed the pace of expansion to the fastest since March of last year. The developed world PMI meanwhile moderated slightly to the weakest for three months, though nonetheless remained well above that for the emerging markets.

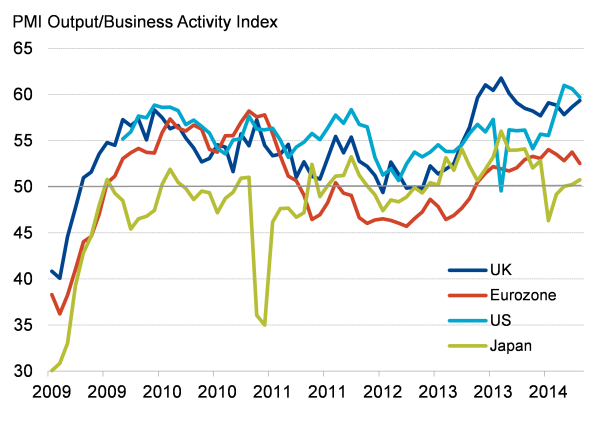

US and UK power global upturn

The global upturn was once again spearheaded by the US and UK, the PMI data for which showed strong rates of expansion again in August, broadly consistent with these economies growing at a quarterly rate of around 1%.

The US saw slightly stronger growth than the UK, despite the pace of increase having slipped slightly as a moderation in the pace of services expansion outweighed an acceleration in manufacturing. Both sectors nevertheless grew strongly, pointing to a broad-based upturn.

The data beg the question as to how long the US economy can grow at this pace without requiring a hike in interest rates to cool demand, suggesting the first rate hike may occur in the first quarter of next year, earlier than current market pricing of a hike in the second quarter.

Growth in the UK accelerated to the fastest since last November, albeit with a worrying slowdown in manufacturing being offset by faster growth in services and construction. The data paint a mixed picture for policymakers mulling over whether the economy is ready to withstand higher interest rates. The strong services number is likely to carry the most weight with policymakers, adding to the likelihood of a rate rise later this year.

There was also welcome news from Japan, where the PMI rose further above the 50.0 no-change level to indicate that GDP is likely to have rebounded in the third quarter, having shrunk in the three months to June as the sales tax hike led to a downturn in spending. However, growth was limited to the export-oriented manufacturing, with the service sector stagnating again, suggesting home demand remained subdued. While a renewed recession may be avoided in Japan, the economic recovery remains fragile.

The main worry in the developed world remained the stuttering recovery of the eurozone. The headline PMI fell in August, but remained in growth territory to suggest that the economy is on course to expand by a modest 0.3% in the third quarter. However, manufacturing output growth slowed sharply, leaving services to drive the upturn. Italy stagnated, failing to grow for the first time since last December, and France saw a further modest downturn. Growth meanwhile slowed in Germany, leaving Spain as the fastest growing major euro nation, expanding at the sharpest rate since March 2007.

The overall disappointing picture of eurozone growth put the ECB in the difficult position of whether to push ahead with further stimulus or wait for previously announced measures to take effect.

Developed world (manufacturing & services)

Emerging world shows renewed life

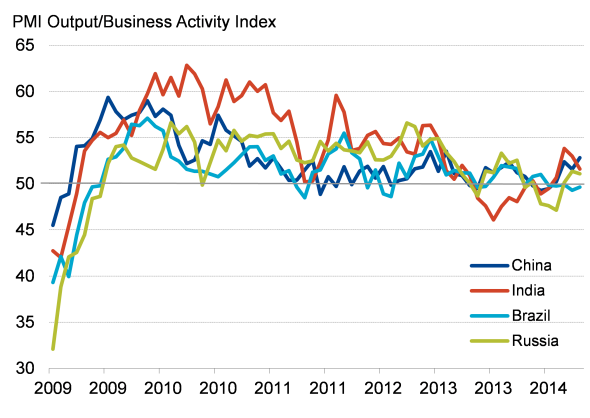

The pace of economic growth in the emerging markets continued to revive from the stagnation seen earlier in the year. August saw the fastest pace of expansion for 17 months, buoyed in particular by growth moving up a gear in China's services economy.

Although the pace of expansion in China's factories slowed, its overall PMI hit the highest since March of last year to suggest that the economy remains on course to at least hit the government's 7.5% growth target for the year. The upturn follows mini-stimulus measures implemented earlier in the year, when the economy showed signs of flat-lining.

Further growth was also recorded in India, albeit with the pace of expansion moderating. However, the renewed growth trend in recent months represents a welcome improvement from the prior downturn.

Russia also saw on-going modest expansion, contrasting with the downturn seen in the three months to May, suggesting the economy will avoid a recession despite sanctions and uncertainty caused by the crisis in Ukraine.

The weakest picture in the emerging markets was therefore seen in Brazil, where a marginal decline was recorded by the PMI surveys for a fifth successive month.

Developed world v emerging markets

Emerging markets (manufacturing & services)

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04092014PMI-data-show-US-and-UK-spearheading-global-economic-upturn-in-August.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04092014PMI-data-show-US-and-UK-spearheading-global-economic-upturn-in-August.html&text=PMI+data+show+US+and+UK+spearheading+global+economic+upturn+in+August","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04092014PMI-data-show-US-and-UK-spearheading-global-economic-upturn-in-August.html","enabled":true},{"name":"email","url":"?subject=PMI data show US and UK spearheading global economic upturn in August&body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04092014PMI-data-show-US-and-UK-spearheading-global-economic-upturn-in-August.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=PMI+data+show+US+and+UK+spearheading+global+economic+upturn+in+August http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04092014PMI-data-show-US-and-UK-spearheading-global-economic-upturn-in-August.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}