Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Feb 04, 2015

January's PMI surveys signal first global growth upturn for six months

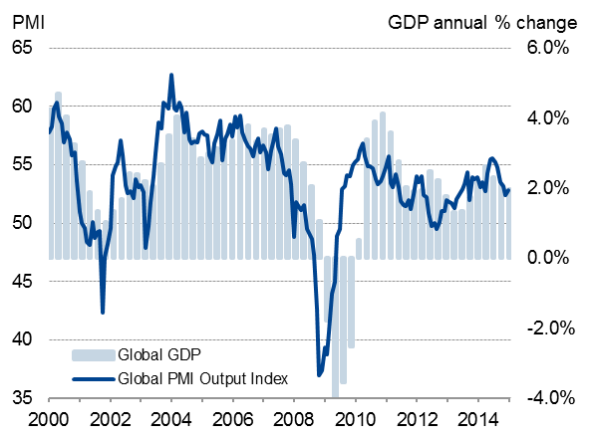

The global economy started 2015 on a weak footing, according to PMI survey data, although the rate of expansion picked up slightly compared with December's 14-month low.

The JPMorgan Global PMI, compiled by Markit from its worldwide manufacturing and services PMI surveys, edged up from 52.4 in December to 52.8, signalling the first acceleration of growth for six months. However, the index remains consistent with global GDP rising at an annual rate of just 2.0%; far below typical pre-crisis growth rates.

Global economic growth

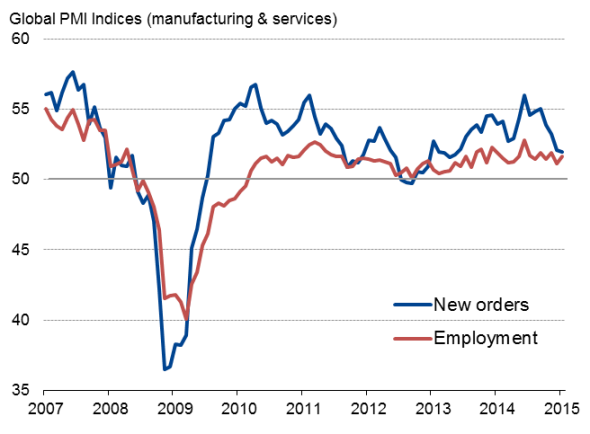

Whether growth will revive further in coming months is uncertain. Order books showed the smallest rise since May 2013, suggesting the pace of growth could weaken again in February. A common threat to the PMI survey was that firms and their customers remain cautious in relation to spending, in turn often linked to the ongoing fragility of the global economy and its susceptibility to risks. Companies around the world noted increased geopolitical concerns, including the Greek debt crisis and the crisis with Russia, as well as uncertainties surrounding currency fluctuations, notably the increased strength of the US dollar.

However, employment growth held up in January, and firms even took on staff at a slightly increased rate, suggesting employers may be seeing the softness in demand as temporary.

Global employment and new orders

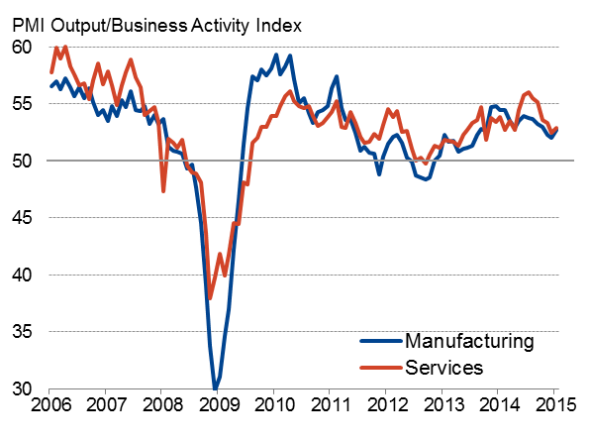

There are reasons to support such optimism, as the survey also recorded the smallest monthly increase in firms' costs since September 2009. Companies in both manufacturing and service reported downward pressure on costs from lower oil prices in particular. Lower costs should help to drive global headline inflation rates down further in coming months, boosting household spending.

The announcement from the ECB that the euro area's central bank will embark on full-scale quantitative easing should also help boost business confidence.

Global manufacturing and services

Sources for all charts: Markit, JPMorgan, HSBC

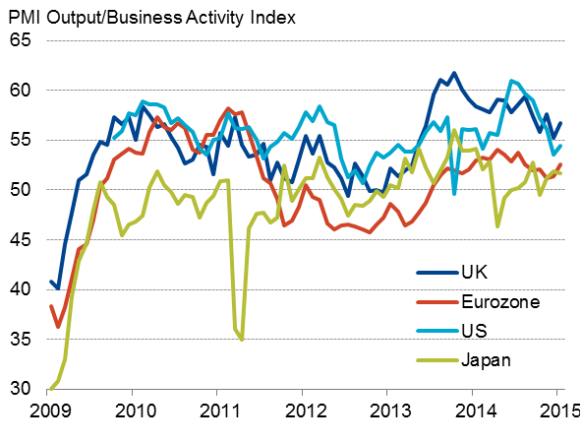

Growth upturn in Eurozone, US and UK

Growth ticked higher in both manufacturing and services in January, though in both cases remained well below the peaks seen last year.

Growth rates also picked up in the US and the UK, which had both led the economic upturn in 2014. However, both countries' PMIs are running at levels consistent with 0.5-0.6% quarterly GDP growth in the first quarter (2.0-2.5% annualised), similar to that seen in the closing quarter of last year but far below the strong rates seen prior to the fourth quarter.

Growth also picked up in the eurozone for a second month running, reaching a six-month high and suggesting that GDP growth should accelerate from the marginal 0.1% expansion seen in the final quarter of 2014. The index for the region as a whole is running at a level consistent with 0.2-0.3% GDP growth so far in the first quarter, but there are substantial variations within the region. Ireland and Spain are seeing strong growth spurts, and the pace of expansion is picking up in Germany and Italy. France, in contrast, continued to register a marginal contraction of business activity, suggesting its GDP will stagnate at best in the first quarter unless business picks up.

Developed world

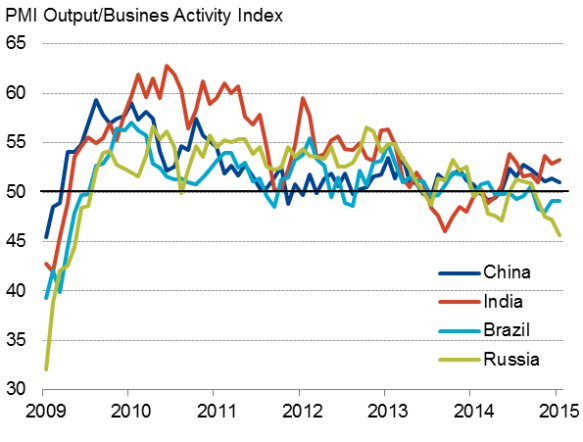

Asia struggles, Russia and Brazil decline

Business conditions meanwhile remained lacklustre in much of Asia. China's PMI survey recorded the weakest monthly expansion for eight months, suggesting GDP growth will weaken from the 7.3% rate seen in the fourth quarter.

In Japan, the rate of expansion signalled by the PMI slipped from December's nine-month high due to weaker service sector growth, but the surveys remain consistent with the economy continuing to slowly recover from the brief recession seen last year.

The PMI surveys for India signalled faster growth, continuing the country's best growth spell since early-2013, but in Brazil and Russia ongoing declines were seen. Brazil looks to have slipped back into recession and Russia - hit by sanctions and the collapse in the oil price - is seeing its steepest downturn since 2009.

Emerging markets

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04022015-Economics-January-s-PMI-surveys-signal-first-global-growth-upturn-for-six-months.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04022015-Economics-January-s-PMI-surveys-signal-first-global-growth-upturn-for-six-months.html&text=January%27s+PMI+surveys+signal+first+global+growth+upturn+for+six+months","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04022015-Economics-January-s-PMI-surveys-signal-first-global-growth-upturn-for-six-months.html","enabled":true},{"name":"email","url":"?subject=January's PMI surveys signal first global growth upturn for six months&body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04022015-Economics-January-s-PMI-surveys-signal-first-global-growth-upturn-for-six-months.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=January%27s+PMI+surveys+signal+first+global+growth+upturn+for+six+months http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04022015-Economics-January-s-PMI-surveys-signal-first-global-growth-upturn-for-six-months.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}