Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Sep 03, 2014

Japanese PMI surveys point to modest GDP rise in third quarter

Japan's economy looks set to avoid a renewed recession as PMI data suggest the economy has rebounded after shrinking in the second quarter.

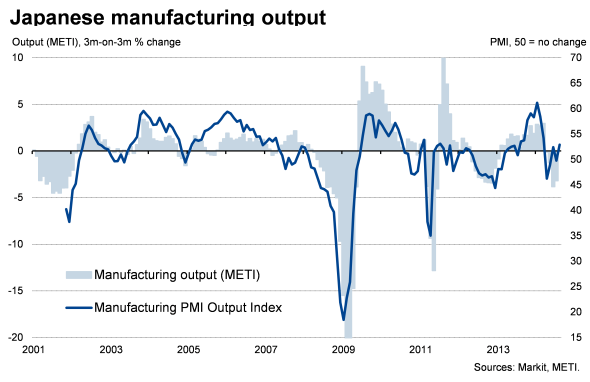

Gross domestic product fell 1.7% in the three months to June as spending was hit after a rise in the country's sales tax from 5% to 8% on 1 April. However, PMI survey data, which had also signalled a contraction of business activity in second quarter, have since indicated a return to growth so far in the third quarter. The all-sector PMI" rose to 50.8 in August, up from 50.2 in July, signalling the fastest rate of growth since March and a second successive month of rising activity.

However, at 50.8, the relative weakness of the PMI compared with late last year nevertheless means the economic recovery remains fragile. Policy makers will therefore be concerned that the economy will be susceptible to a further weakening if the further increase in the sales tax to 10% in October 2015 goes ahead without additional measures being taken to offset the fiscal tightening.

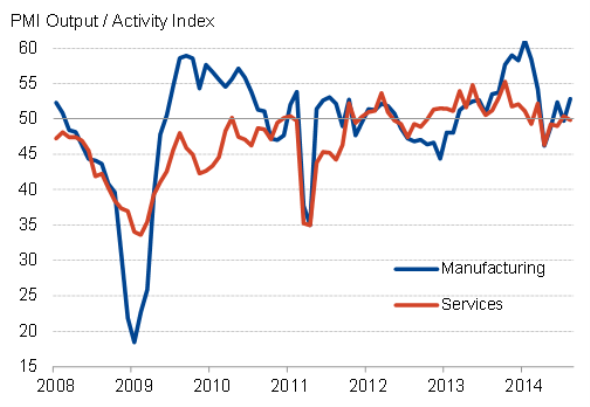

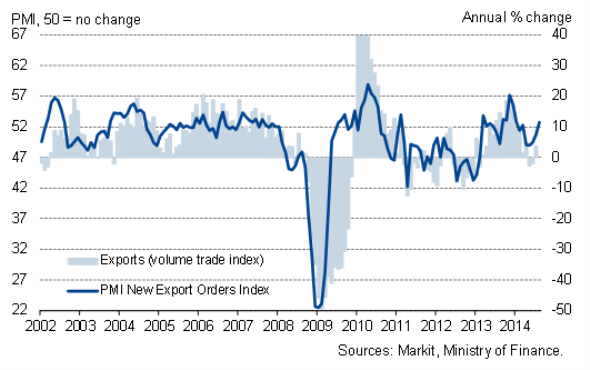

Of particular concern is that the improvement signalled by the PMI in August was limited to the manufacturing sector, which was in turn partly driven by export orders showing the largest monthly gain since January. The more domestically-focused services sector, on the other hand, suffered a marginal contraction of business activity in August, having eked out a marginal expansion for the first time in four months in July.

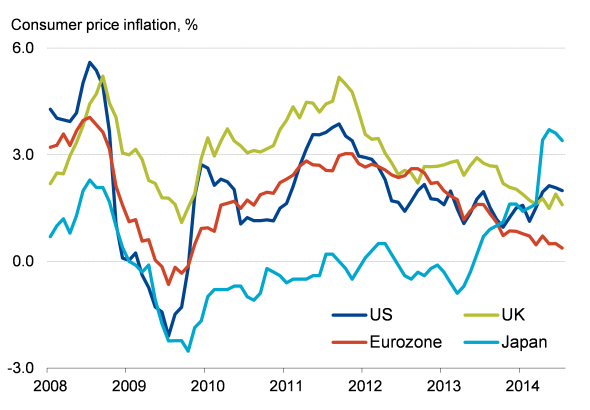

Inflation upturn could be short lived

A key aim of Abenomics is to boost inflation, which is proving successful. Consumer prices rose in July at an annual rate of 3.4%, down from a recent peak of 3.7% in May, but when compared with rates in other major countries, including the 0.3%, 1.6% and 2.0 rates seen in the Eurozone, UK and US respectively, the authorities can claim some success on this front.

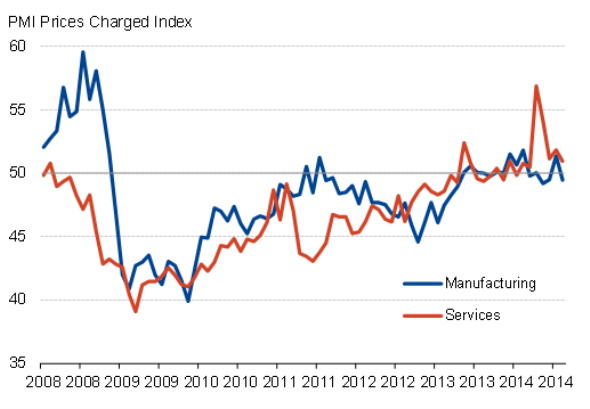

However, although the PMI surveys showed input costs continuing to rise in both manufacturing and services in August, data on selling prices were more muted, suggesting month on month price inflation has started to ease since the immediate impact of the sales tax rise as companies compete on prices to win back customers. Prices charged by goods producers in fact fell slightly in August and rates levied for services rose to the smallest extent since March.

The authorities will want to see both the rate of economic growth and underlying price pressures revive to a greater extent than being currently signalled by the PMI surveys before being comfortable with their economic policy stance.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03092014japanese-pmi-surveys-point-to-modest-gdp-rise-in-third-quarter.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03092014japanese-pmi-surveys-point-to-modest-gdp-rise-in-third-quarter.html&text=Japanese+PMI+surveys+point+to+modest+GDP+rise+in+third+quarter","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03092014japanese-pmi-surveys-point-to-modest-gdp-rise-in-third-quarter.html","enabled":true},{"name":"email","url":"?subject=Japanese PMI surveys point to modest GDP rise in third quarter&body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03092014japanese-pmi-surveys-point-to-modest-gdp-rise-in-third-quarter.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Japanese+PMI+surveys+point+to+modest+GDP+rise+in+third+quarter http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03092014japanese-pmi-surveys-point-to-modest-gdp-rise-in-third-quarter.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}