Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jul 03, 2017

UK Manufacturing PMI hints at loss of momentum at end of an otherwise solid Q2

UK manufacturing ended an otherwise solid second quarter on a disappointing note, with output, order book and employment growth all slowing and optimism about the future sliding to its lowest since last November.

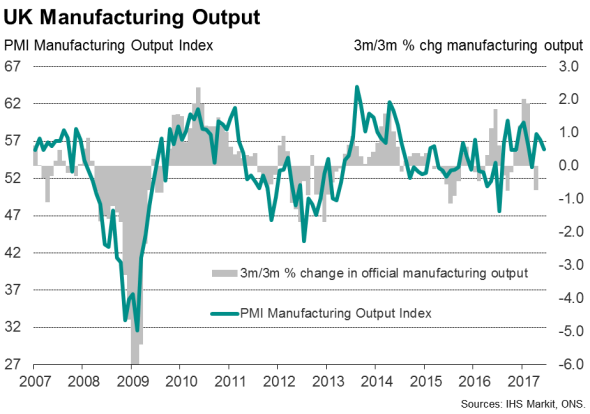

The headline IHS Markit/CIPS Manufacturing PMI fell from 56.3 in May to 54.3 in June, its lowest since March. By remaining above 50, the index continued to signal an overall improvement in business conditions, but the rate of growth was considerably cooler than seen in April and May.

Encouragingly, even after taking account of the slowdown seen in June, the average reading of the survey's output index in the latest three months was the highest for three years and broadly consistent with manufacturing output rising 0.5% in the second quarter. However, the weaker than expected survey data for June raises concerns about the near-term outlook for manufacturing.

Slower sales

Key to the slippage of the headline PMI was a waning in growth of new business. New order growth slowed markedly compared to the strong gains seen in the prior two months. The latest rise in orders was the weakest since the dip seen in the immediate aftermath of the EU referendum this time last year.

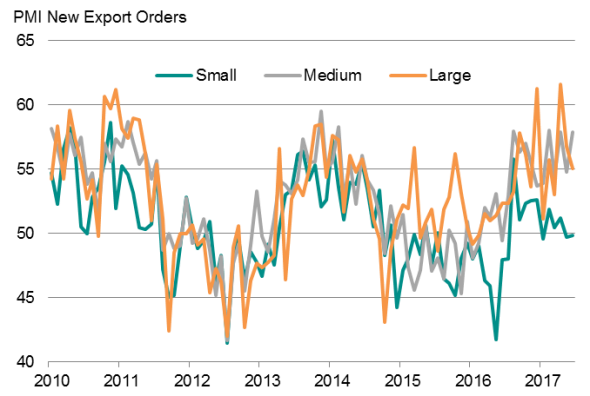

Slower export sales growth contributed to the deteriorating order book picture, registering the smallest rise since January. The slackening export trend is a disappointment, given the historical weakness of sterling and the resurgent robust economic expansion of the UK's main trading market, the eurozone.

UK Manufacturing Exports

Export performance has varied markedly by company size. While export sales have held up relatively well at larger firms, many of which are multinationals, smaller manufacturers have seen export orders drop slightly in each of the past two months. Analysis of the PMI export orders index by company size reveals that smaller manufacturers have failed to reap the export gains achieved by larger firms over the past year.

Backlogs of work - orders received but not yet completed - meanwhile fell to the greatest extent since last November; an indication of excess capacity relative to demand. If backlogs continue to decline, employment growth could start to cool from the sustained robust rate of job creation seen in recent months. The June survey recorded another month of net job gains, albeit the weakest in four months.

Exports by company size

Source: IHS Markit

Less optimism

The data were collected after the general election, and the failure of the government to form a majority contributed to a waning of business sentiment regarding the year ahead. Although optimists continued to outnumber pessimists, the overall degree of positive sentiment was the lowest since last November and significantly below the average seen over the past five years.

It remains to be seen whether the drop in confidence merely reflected post-election jitters, especially in relation to how it may affect the strength of the government's hand in the Brexit negotiations, or whether companies have become more cautious about future prospects on the basis of weaker inflows of new business.

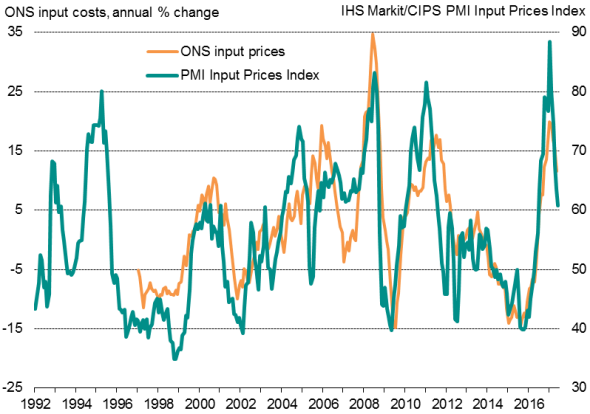

Cost inflation eases

One area where manufacturers were benefitting was via slower growth of input costs, The survey's input price index fell for a fifth straight month, signalling another marked easing in the rate of increase of input prices (including raw materials) to the lowest for a year.

The reduced rate of increase in costs should feed through to mean less upward pressure on factory gate prices, the rate of increase of which also slowed in June, though remained elevated.

Manufacturing input costs

Sources: IHS Markit, ONS.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03072017-economics-uk-manufacturing-pmi-hints-at-loss-of-momentum-at-end-of-an-otherwise-solid-q2.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03072017-economics-uk-manufacturing-pmi-hints-at-loss-of-momentum-at-end-of-an-otherwise-solid-q2.html&text=UK+Manufacturing+PMI+hints+at+loss+of+momentum+at+end+of+an+otherwise+solid+Q2","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03072017-economics-uk-manufacturing-pmi-hints-at-loss-of-momentum-at-end-of-an-otherwise-solid-q2.html","enabled":true},{"name":"email","url":"?subject=UK Manufacturing PMI hints at loss of momentum at end of an otherwise solid Q2&body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03072017-economics-uk-manufacturing-pmi-hints-at-loss-of-momentum-at-end-of-an-otherwise-solid-q2.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=UK+Manufacturing+PMI+hints+at+loss+of+momentum+at+end+of+an+otherwise+solid+Q2 http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03072017-economics-uk-manufacturing-pmi-hints-at-loss-of-momentum-at-end-of-an-otherwise-solid-q2.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}