Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Mar 03, 2015

UK construction sector picks up momentum again in February

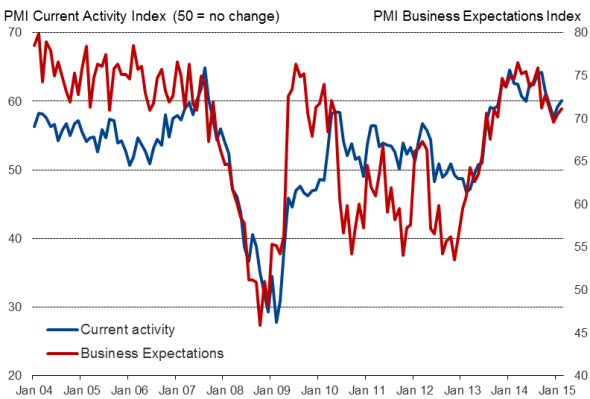

UK building activity showed the largest rise for four months in February, with optimism about the future also picking up. The Markit/CIPS Construction PMI rose from 59.1 in January to 60.1 in February, its highest reading since October.

The survey has recorded a remarkably strong spell of continuous growth since July 2013, fuelled initially by rising house building activity amid government incentives for home buyers, but rapidly becoming more broad-based as the wider economic recovery took hold. The latest data suggest that, while the pace of expansion has cooled since the peaks seen late last year, the recovery retains strong momentum.

Current and future construction activity

Sources: Markit, CIPS.

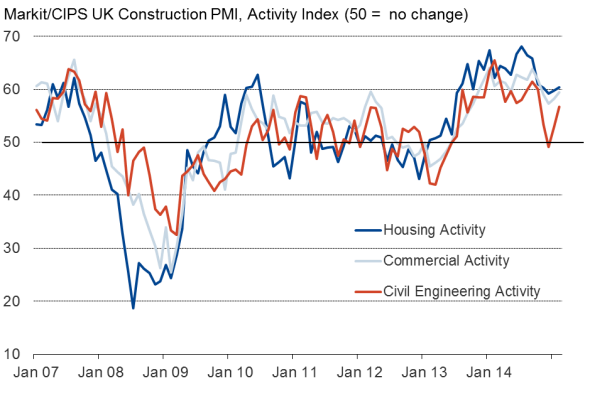

February saw particularly strong growth of house building and commercial construction activity, both of which rose at the fastest rates since October, alongside a robust (albeit less steep) rise in civil engineering work. The latter nevertheless also rose at the fastest rate since October, recovering further from a brief downturn in December.

Construction activity by sector

Sources: Markit, CIPS.

Dividends jump 50% after strong year

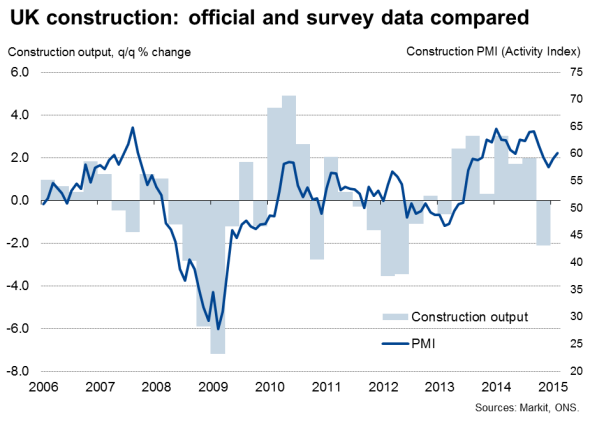

The elevated readings in the first two months of 2015 suggest the sector is on course to provide a meaningful contribution to the economy's performance in the opening quarter of 2015. With manufacturing also showing signs of gaining momentum and the all-important service sector faring well at the start of the year, GDP growth could strengthen in the first quarter from the 0.5% expansion seen late last year.

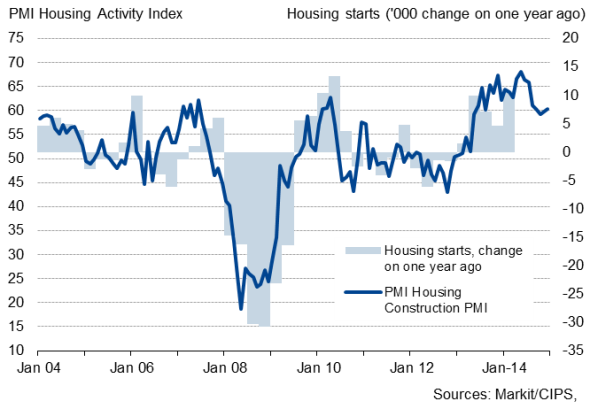

Not only do the strong survey readings bode well for economic growth, but also for corporate earnings in the sector, especially house builders. Markit's dividend forecasting team is consequently expecting dividend distributions to shareholders among homebuilders in the FTSE 350 to rise by some 50% this financial year, reaching "1.3bn. Ordinary payments are anticipated to rise 25% to "668m and expected special distributions to "642m.

UK house building

The picture of steady, strong growth from the PMI survey in recent months contrasts with official data, which showed the sector's output dropping 2.1% in the fourth quarter of last year, reversing a 2.0% gain in the third quarter. However, official data have been both volatile and subject to heavy revision in recent years, and the strength of the survey data therefore raise the possibility that construction output could be revised higher for the closing months of last year, eventually boosting GDP slightly compared to the current reading of 0.5% growth.

Growth set to cool

Although construction sector optimism picked up in February, it remained well below last year's highs. This adds to evidence which suggests the pace of expansion, and therefore earnings and dividend growth, in the construction sector is expected to slow in 2015. The sector is likely to see weaker demand for building projects as some uncertainty sets in around the General Election. Moreover, indicators such as the Knight Frank House Price Sentiment Index, which hit an 18-month low in February, suggest that the housing market is cooling, which may lead to lower residential construction.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03032015-Economics-UK-construction-sector-picks-up-momentum-again-in-Fe.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03032015-Economics-UK-construction-sector-picks-up-momentum-again-in-Fe.html&text=UK+construction+sector+picks+up+momentum+again+in+February","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03032015-Economics-UK-construction-sector-picks-up-momentum-again-in-Fe.html","enabled":true},{"name":"email","url":"?subject=UK construction sector picks up momentum again in February&body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03032015-Economics-UK-construction-sector-picks-up-momentum-again-in-Fe.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=UK+construction+sector+picks+up+momentum+again+in+February http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03032015-Economics-UK-construction-sector-picks-up-momentum-again-in-Fe.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}