Brazil seen as longshot ahead of world cup

Despite the recent rebound in the country’s main index and improving corporate mood, investors have been steadily reducing their exposures in Brazilian equities. In the wake of last week’s disappointing growth figures, this appears to be a well-founded strategy.

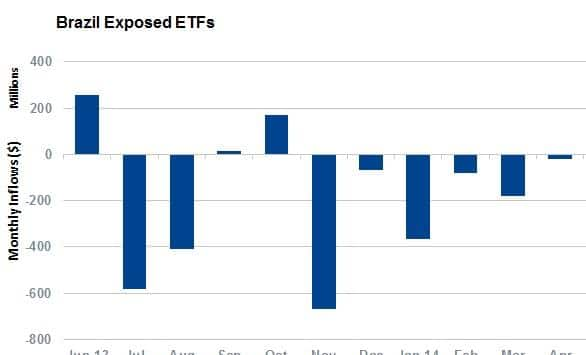

- ETF investors have withdrawn from Brazil exposed funds for nine of the last 12 months

- US listed MSCI Brazil Capped ETF saw the largest outflows with almost $305m withdrawn

- Basic materials firms have seen the most bearish analyst sentiment in the last three months

If investor sentiment in Brazil is anything to go by in the lead up to the imminent world cup, the country’s pre-tournament favourite spot on field is not reflected appetite for Brazilian equities. With the country continuing to see investors reduce their ETF exposure, we look at which stocks see the worst investor sentiment.

This pessimism comes as the county’s heavy dependence on volatile commodities, such as slumping iron ore, looks set to slow economic growth in South America’s largest economy.

ETF investors flee

While the county’s national team has seen its FIFA World Ranking score recover from an uncharacteristic dip over the last couple of years, ETF investors have been busily trimming their exposure. Current AUM is now just above the $10b mark, a number that has fallen by over $400m since the start of the year. This fall in AUM in the 46 Brazil exposed ETFs marks the lowest aggregate AUM figure since the start of 2008 when the total number of funds tracking the country was a third of the current offering.

Although last year’s large fall in AUM was partly attributed to falling equity and currency values, the recent dip in AUM is entirely driven by outflows as both the country’s currency and main equity index have performed strongly since the start of the year.

As for the flows in the months immediately preceding the tournament, investors have trimmed their exposure to Brazilian ETFs for the last seven months running with over $1.4b of outflows.

Year to date, the largest outflow of any Brazil ETF was in the Wisdom Tree Brazilian Real Fund which saw a one day outflow of $454m in January of this year.

On the equities side, the US listed MSCI Brazil Capped ETF saw the largest outflows with just shy of $305m withdrawn since the start of January.

Mining driving the slump

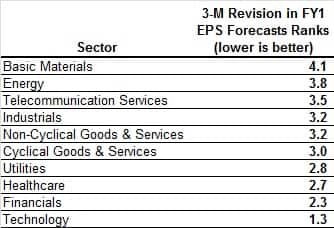

The country’s heavy reliance on mining and natural resources is one of the weak points in the developing economy. The 11 Brazilian basic materials firms in the Markit Research Signal Emerging Latin America universe have seen the worst analyst revisions in the last three months out of any of their country peers, according to the 3-M Revision in FY1 EPS Forecast factor.

Iron ore’s sinking value has seen three of the five Brazilian steel firms sink to the lowest analyst revision quintile group. Leading the bearish analyst sentiment is Gerdau which has seen analysts trim their forecasted profits by a fifth in the last three months.

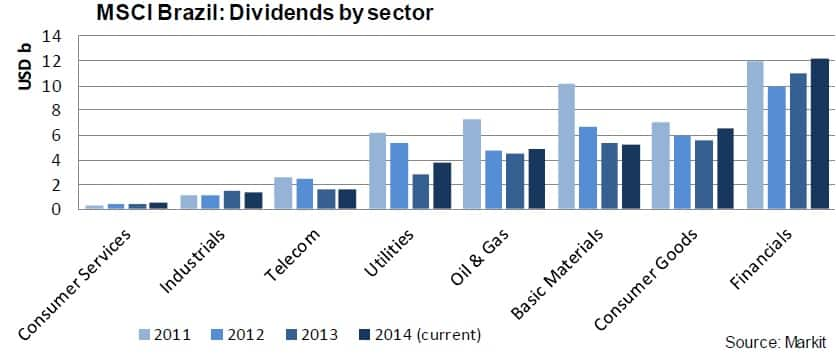

Basic Materials lag dividend payments

The gloomy mood in basic materials is also reflected in the forecasted dividend payments made by the country’s mining firms which are expected to lag behind the rest of their country peers. The basic materials constituents of the MSCI Brazil index are expected to see the value of their local payments jump by 3% from the previous fiscal year, while the index as a whole is forecasted to grow payments by over three times that.

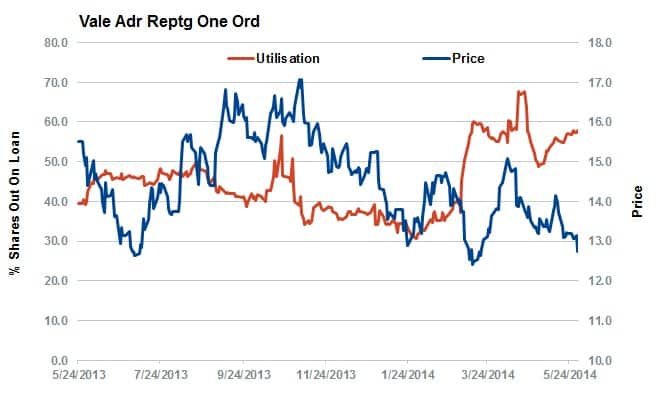

Industry giant Vale, which has also seen a trim in analyst forecasts in the last three months, is expected to drive the sector’s weak dividend grown. Our dividend team is expecting the company to hold its dividend flat in the coming fiscal year. These weak results have seen short sellers circle the country’s largest single dividend payer as nearly 60% of the ADRs available to sell short are already out on loan.