Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

May 02, 2014

Most shorted ahead of earnings

We review how short sellers are reacting to companies due to announce earnings in the week to come:

- Pharma company Myriad Genetic is the most shorted ahead of earnings globally

- In Europe, Sainsbury’s is up one of the most shorted companies ahead of earnings

- Japanese firms dominate the most shorted Asian companies ahead of earnings

North American earnings

This week sees first quarter earnings announcements continue in full swing. On the heavily shorted end of the scale, there are 18 companies with 20% or more of their shares out on loan ahead of earnings.

Biotech company Myriad Genetics sees the highest short interest ahead of earnings globally this week with a hefty 44.6% of its shares out on loan. The heavy demand to borrow the company’s shares is driven by a contentious legal case regarding its efforts to patent genes which can predispose patients to cancer. Despite recent legal setbacks in the case, the company’s shares have still managed to nearly double since the start of the years.

Fellow biotechs Vivus and Tearlab also make the list of heavily shorted companies ahead of earnings, with over 22% of their shares out on loan. These firms have proved more profitable for short sellers as their shares have both fallen by over 40% since the start of the year.

The company seeing the largest rise in demand to borrow ahead of earnings is Neonode, which has seen a 22% rise in demand to borrow. The firm’s current demand to borrow now stands at a three year high, as analysts have predicted the firm to post a larger loss than thought three months ago.

In a similar position is the second most shorted firm ahead of earnings, GT Advanced Technologies, which has 31.3% of shares out on loan. GT’s shares have jumped fivefold in the last 12 months as analysts have forecast the company to turn around after posting a string of lossmaking quarters.

Finally, gun maker Sturm Ruger has seen a resurgence in short interest since the start of the year as its shares pull back after last year’s good performance. Analysts are now forecasting the company’s revenues to trail off somewhat after American consumers panic bought guns in anticipation of tighter gun control legislation.

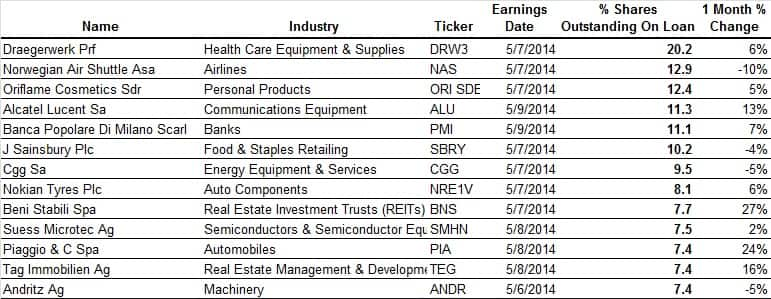

European earnings

Europe also sees heavy earnings activity, with 13 firms with more than 7% of shares out on loan ahead of imminent results.

Short favourite Norwegian Air Shuttle (NAS) saw the largest amount of short covering ahead of earnings over the last month. NAS’ expansion plans, which raised concerns about the airline’s ability to compete in the hypercompetitive European budget airline market, have been more successful than anticipated. NAS has posted a string of better than anticipated results over the past nine months. As a result, shorts have trimmed their positions by a third over the last six months as the company’s shares rebounded.

While NAS basks in a recent relatively strong market, UK grocery chain Sainsbury’s has seen the opposite. The grocer is the sixth most shorted company announcing results this week, after seeing shorts increase their positions to an all-time high, as its shares have fallen by 12% this year to date. Analysts will be looking to see how the company has been able to cope with increased competition from discount grocers which have been aggressively investing in the UK market.

Finally, Alcatel Lucent has seen short interest shoot up by 13% in the last four weeks to nearly twice the level seen at the start of the year. Short sellers will no doubt be emboldened by the fact that Nokia, which recently became a pure play communication equipment firms, failed to live up to analyst expectations in its first quarter results.

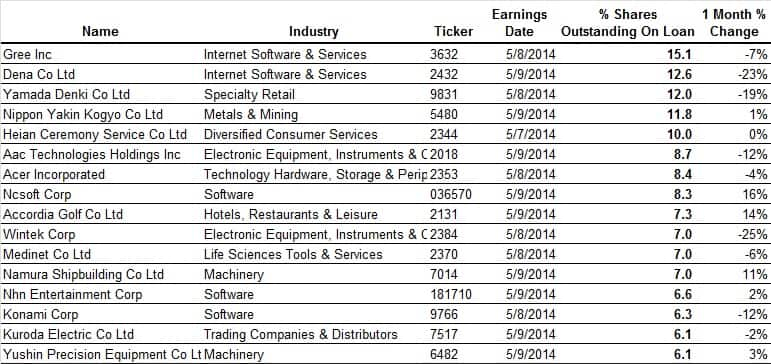

Asian earnings

The Asian reporting season is also in full swing, with 16 firms with more than 6% of shares out on loan ahead of earnings.

Japanese companies make up 11 of the 16 most shorted company ahead of earnings.

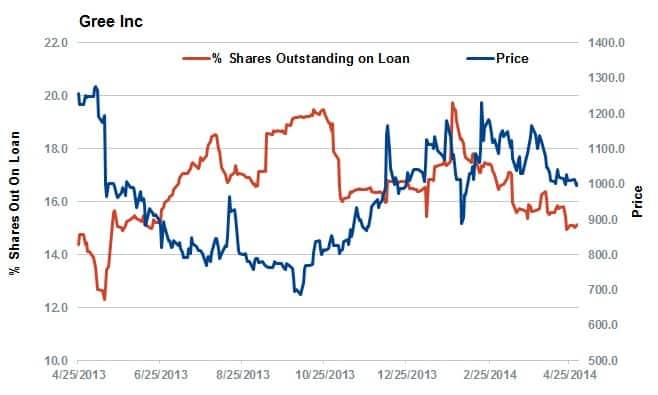

Leading the way in the region are social media software companies Gree and Dena which have 15% and 12.6% of shares out on loan respectively. Both companies seem to have turned a corner in the last few months, however, as demand to borrow now stands at yearly lows.

Consumer software seems to be high on the short agenda this week. Korean company MCsoft, along with Japanese firms Konami and Nhn entertainment, all feature in the list of heavily shorted companies ahead of earnings.

Also topical in Japan is consumer spending, as the recent 2% sales tax hike looks to have boosted spending in the run-up to the start of April. This will no doubt be the reason why analysts are forecasting electronic retailer Yamada Denki to post a 14% rise in revenue compared to the same period last year. Shorts have covered nearly a fifth of their positions in Yamada in the last month.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02052014120000most-shorted-ahead-of-earnings.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02052014120000most-shorted-ahead-of-earnings.html&text=Most+shorted+ahead+of+earnings","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02052014120000most-shorted-ahead-of-earnings.html","enabled":true},{"name":"email","url":"?subject=Most shorted ahead of earnings&body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02052014120000most-shorted-ahead-of-earnings.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Most+shorted+ahead+of+earnings http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02052014120000most-shorted-ahead-of-earnings.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}