Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

May 01, 2014

Riding the yield curve

As investors brace for a steeper yield curve, we analyse the sectors looking to benefit from a steep curve environment

- Companies which do well in steep yield curve times have outperformed the rest of the market

- Banks have historically performed the best in steep yield curve environments

- Precious metal producers, utilities and REITs stand to perform the worst

Yesterday’s review of interest rate exposed ETPs found that investors are bracing themselves for a steeper yield curve environment, in which the spread between short and long term interest rates starts to rise. These calls look to have been well placed, as the onset of QE’s demise has seen the extra yield demanded by investors to hold longer dated bonds shoot up in recent months.

With yet more tapering in the pipeline, we see look at the companies which stand to benefit from the recent bout of tapering.

Steep yield helps those that thrive

Companies which have historically benefitted from a steeper yield curve have taken well to the recent bout of steepening. The 10% of shares in the US largecap universe with the top scores in the Markit Research Signal Yield Curve Slope Sensitivity factor have returned 3.2% a month on average over recent years, making them the best performing decile group amongst their large cap peers. This outperformance cumulates to 17.8% over the last 12 months.

On the other end of scale, the third of companies whose share struggles the most in steeper yield environments have all underperformed the marker by an average of 7.5%.

Banks fare the best

Banks make up the single largest constituents among the 10% of shares which fare the best in steep yield curve environments. This comes as little surprise as these companies borrow in the short term and lend further down the maturity curve.

With this in mind, the diversified banks Citigroup, JP Morgan and Bank of America, which have the luxury of having large pools of retail deposits, all feature in the best performing decile group.

Performing well in steep yield environment is not the sole reserve of large diversified banks; regional banks such as Zion Bancorp and City National also feature in the top performing group. Both firms have seen heavy short covering in the last 12 months as their shares surged to new recent highs.

Financials as a whole perform well in steep slope environments, with insurance and diversified financials companies rounding out the top three most represented sector groups in the best performing decile.

Other side of the coin

As for firms struggling to get a grip of the recent yield curve slope, we have seen precious metals firms hold the lowest average sector ranking. The fact that these firms operate capital intensive operations doesn’t help their position, and their cost of capital looks set to rise along with the recent pickup in rates.

Ten of the 11 precious metals miners feature in the group of shares with the worst decile rank. Industry giant Freeport-Mcmoran is the only firm outside of the list.

Capital heavy utilities also stand to struggle with steeper yield, demonstrated by the 20 utilities companies in the US largecap universe holding the second worst average yield sensitivity rank.

REITs, which are essentially pseudo asset backed bonds, also feature on the list of shares which underperform in high yield times. These companies come in with the third lowest average rank. The asset class has struggled over the last 12 months as the MSCI US REIT Index has fallen by 2% in this time frame.

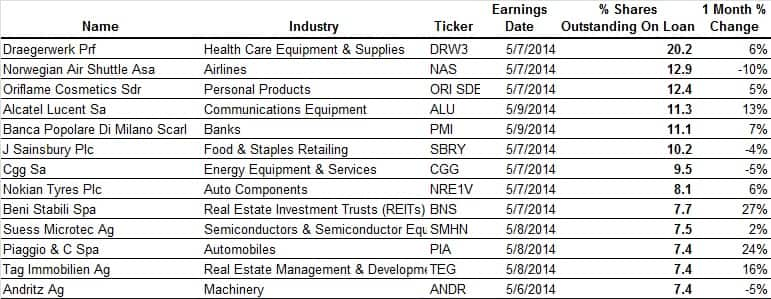

Short interest surging

While the shares which perform the worst in a steep slope environment have inconclusive average short interest when compared to the rest of the universe, we’ve have seen demand to borrow pickup among companies which struggle in steep slope environments. Although demand to borrow constituents of the US Largecap universe has fallen by 8% on average, the shares in the worst scoring decile have seen short interest surge by 12% in the last year. Leading this increased demand to borrow is biotech company Myriad Genetics, which has seen short interest surge to 44% of shares in the last 12 months.

REITS Digital Realty Trust and Realty Income are among the shares seeing the largest surge in short interest.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01052014120000Riding-the-yield-curve.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01052014120000Riding-the-yield-curve.html&text=Riding+the+yield+curve","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01052014120000Riding-the-yield-curve.html","enabled":true},{"name":"email","url":"?subject=Riding the yield curve&body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01052014120000Riding-the-yield-curve.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Riding+the+yield+curve http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01052014120000Riding-the-yield-curve.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}