US manufacturing continues to decouple from rest of world

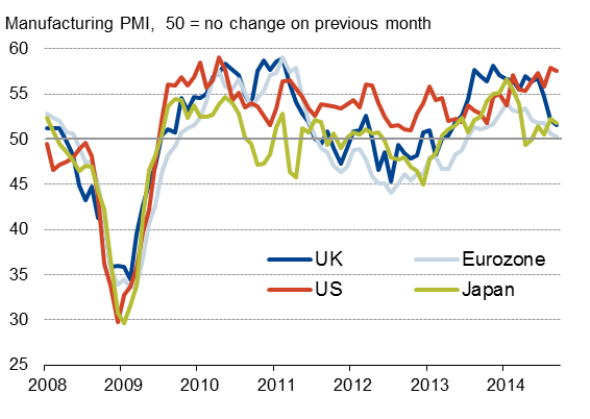

An initial glance at the global manufacturing PMI suggest that business activity in the world's factories continued to grow at a steady rate in September, albeit with the pace dipping slightly on August. However, a deeper dive into the numbers presents more worrying picture. The global upturn has become increasingly dependent on the fast-expanding US manufacturing economy, with the pace of expansion in the rest of the world slipping to near stagnation.

Manufacturing expansion driven by US

The JPMorgan Global Manufacturing PMI", compiled by Markit, edged down from 52.5 in August to 52.2 in September, its lowest since May. The survey data are broadly consistent with global manufacturing output growing at an annual rate of 4% in recent months, broadly similar to the pace seen over the past year.

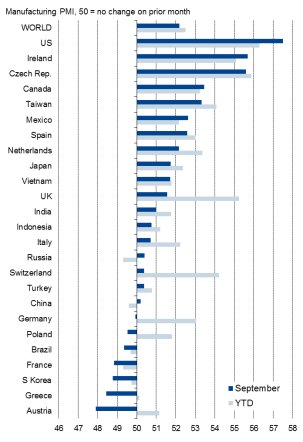

However, growth has become increasingly unbalanced, and largely confined to the US, without which the pace of expansion is close to stalling. The US continued to lead the PMI rankings in September, and has also notched up the highest average PMI reading of all countries in the year to date. If the strong Markit US Manufacturing PMI reading of 57.5 is excluded from the calculations, the global PMI would have fallen to 50.7 in September, its lowest since July of last year.

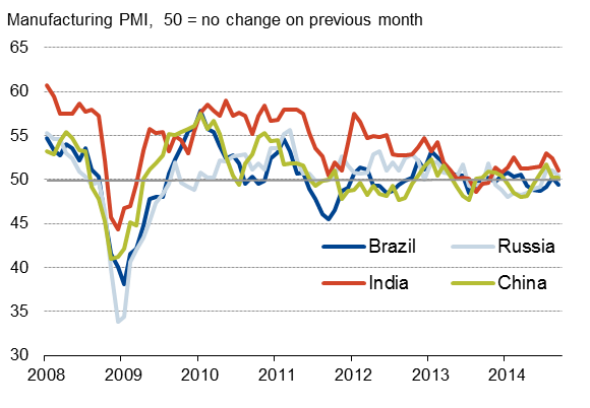

The near stagnation of factory activity is broad-based outside of the US, with few exceptions. The average weighted PMI for Asia hit a four-month low of 50.7, including a 50.2 reading for China. A weighted "BRIC' manufacturing PMI likewise fell to 50.2, reflecting almost no growth in India and Russia and a slight contraction of activity in Brazil.

In Europe, the PMI for the eurozone slipped to 50.3, a 14-month low, which included the first sub-50 reading for Germany since June of last year. The UK, which had been among the fastest growing manufacturing economies earlier in the year, has meanwhile seen its PMI slump over the summer, hitting a 17-month low of just 51.6 in September.

The only countries besides the US seeing strong manufacturing growth in September were the Czech Republic and Ireland, and to a lesser extent Canada and Taiwan. Modest expansions were also seen in a handful of other countries, such as Mexico, Spain and the Netherlands, but in many cases growth is waning rather than accelerating.

Manufacturing PMI rankings

Global economy hit by varied headwinds

The survey results for September therefore paint a worrying picture of a global manufacturing economy that is reliant upon the US to sustain even a modest pace of expansion. Emerging markets continue to underperform compared to pre-financial crisis growth rates as the global recession has highlighted structural weaknesses. The eurozone remains in the doldrums, suffering a lack of domestic demand, while Japan's growth surge has been hit by the country's sales tax hike. Even the UK's recovery looks to be under threat, most likely as a result of weak demand in key export markets such as the eurozone being exacerbated by sterling's appreciation in recent months.

Only in North America, and in particular the US, where producers are benefitting from a buoyant domestic economy and low energy costs, are factories showing any signs of booming.

US dependence: Manufacturing PMI

US decouples

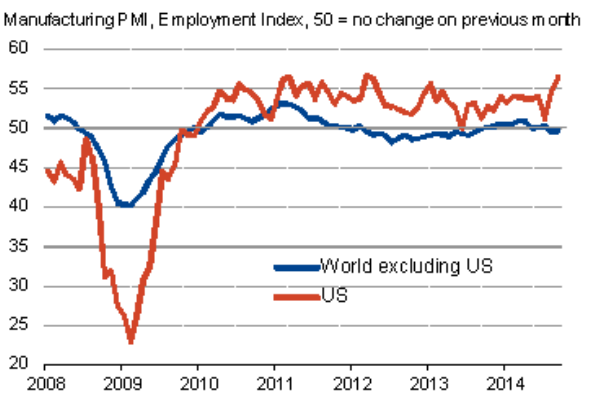

This US divergence, in what is being seen as a decoupling from the rest of the world, looks set to continue, as indicated by employment trends. While US factories stepped up their hiring in September, reporting one of the largest monthly payroll gains recorded by the PMI since the financial crisis struck, payrolls numbers elsewhere around the globe fell slightly on average for a second successive month.

PMI Employment Index

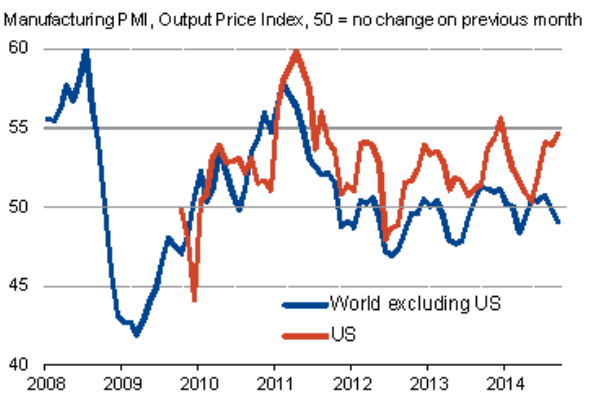

A similar divergence was seen in price trends: while US factories hiked their selling prices to the greatest extent in the year so far in September, charges elsewhere fell at a slightly increased rate on average, highlighting the need to offer discounts in the face of lacklustre demand outside of North America.

PMI Output Prices Index

Emerging market PMI surveys

Developed world PMI surveys

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com