Our clients rely on our expertise for a wide range of insurable classes of business:

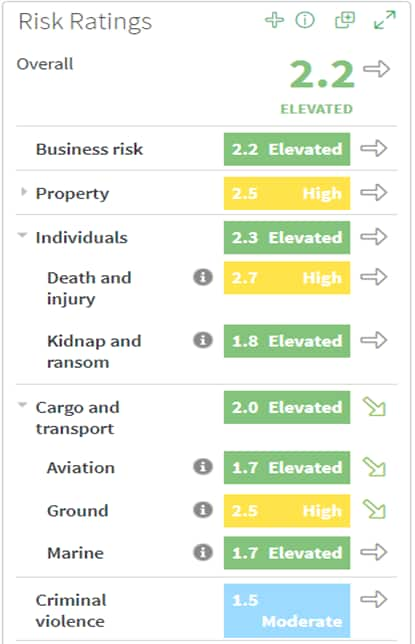

- Accident & Health

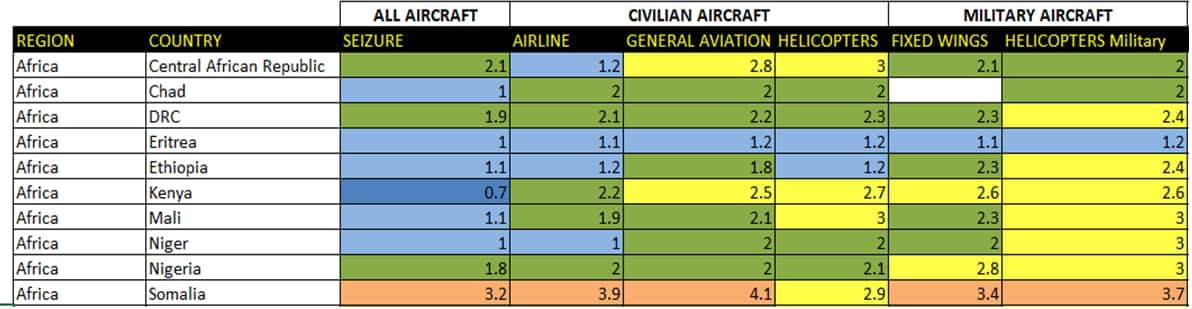

- Aviation

- Aviation War

- Business Interruption

- Casualty

- Construction

- Energy

- Financial Institutions

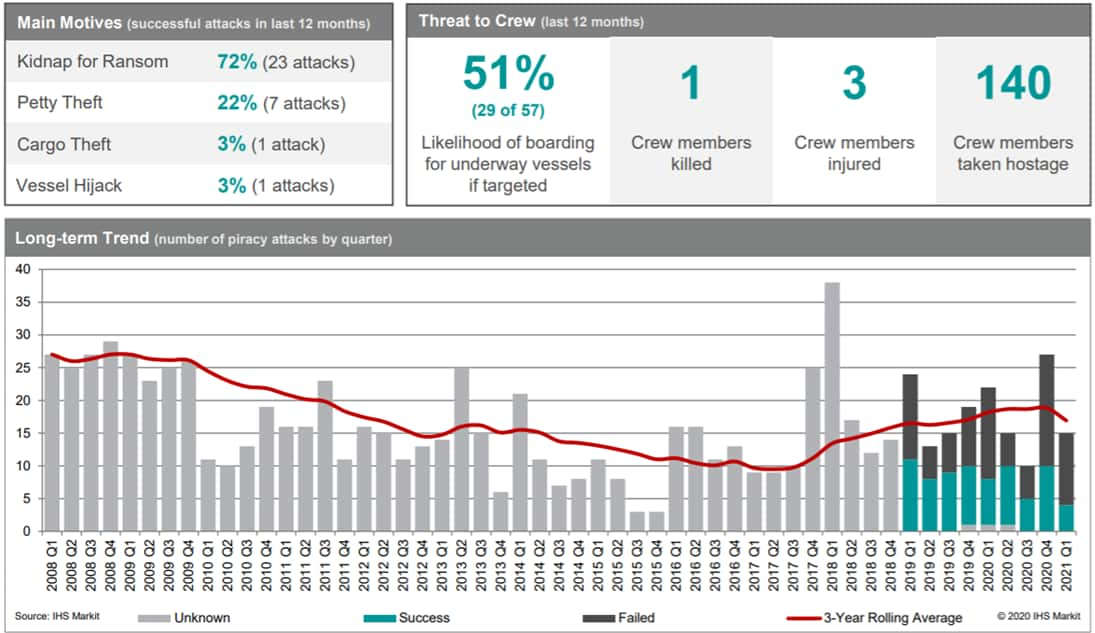

- Kidnap and Ransom

- Marine

- Marine War

- Marine Hull

- Marine Liability

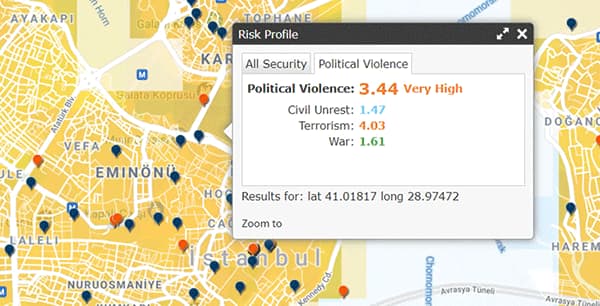

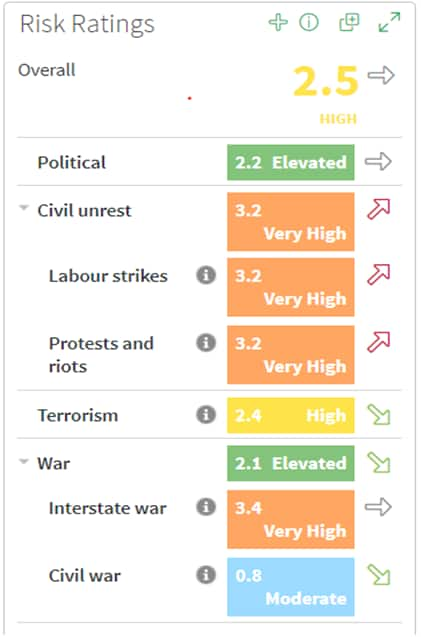

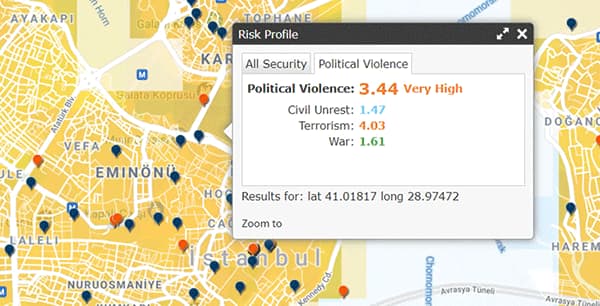

- Political Risk

- Property

- Terrorism

- Trade Credit

- War

{"items" : [

{"name":"facts","url":"","enabled":false,"desc":"","alt":"","mobdesc":"PDF","mobmsg":""},{"name":"login","url":"https://my.ihs.com/Connect?callingUrl=https%3a%2f%2fconnect.ihs.com%2f%20/","enabled":true,"desc":"Product Login for existing customers","alt":"Login","large":true,"mobdesc":"Login","mobmsg":"Product Login for existing customers"},{"name":"sales","override":"","number":"[num]","enabled":true,"desc":"Call Sales [num]","proddesc":"[num]","alt":"Call Sales</br>[num]","mobdesc":"Sales","mobmsg":"Call Sales: [num]"}, {"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fproducts%2feconomics-country-risk-forecasting.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fproducts%2feconomics-country-risk-forecasting.html&text=Foresight+Country+Risk+Assessment%2c+Ratings%2c+%26+Forecasts+%7c+S%26P+Global","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fproducts%2feconomics-country-risk-forecasting.html","enabled":true},{"name":"email","url":"?subject=Foresight Country Risk Assessment, Ratings, & Forecasts | S&P Global&body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fproducts%2feconomics-country-risk-forecasting.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Foresight+Country+Risk+Assessment%2c+Ratings%2c+%26+Forecasts+%7c+S%26P+Global http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fproducts%2feconomics-country-risk-forecasting.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}