Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Mar 22, 2021

Is an upstream M&A market recovery sustainable during the energy transition?

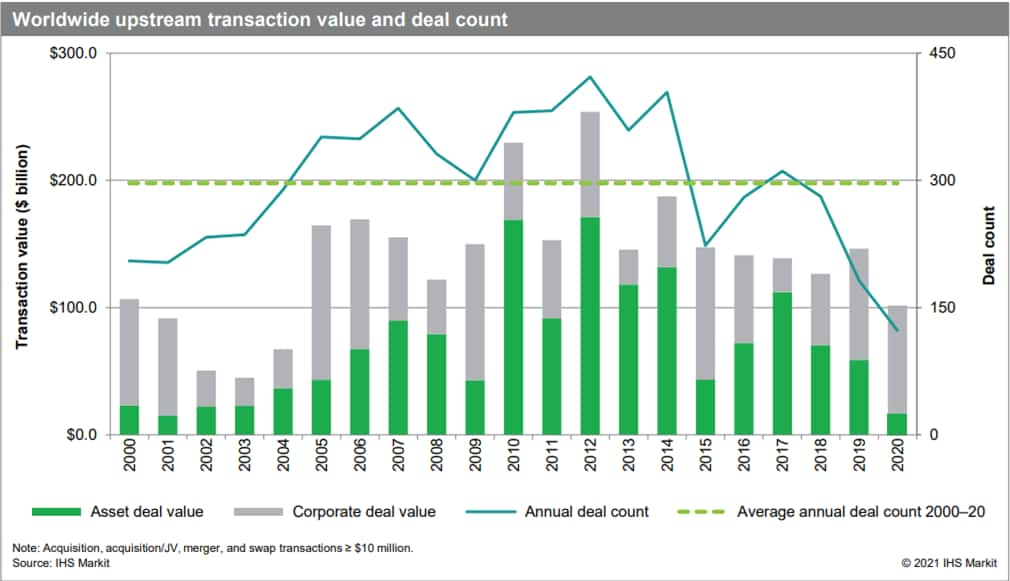

Following the dreadful year of the COVID-19 global pandemic that led to historical lows in deal activity in 2020, upstream M&A deal flow has begun to rebound from the bottom as industry conditions improve.

Is this early-stage, fragile recovery sustainable in the midst of the energy transition?

The upstream oil and gas sector remains under a shroud of negative investor sentiment as the momentum for low carbon continues to gain steam. Despite the recent resurgence in crude oil prices and share prices of producers, the E&P sector's weighting of the stock market remains in the low single digits. E&P players continue to be under pressure to improve their financial performance and, along with international oil companies (IOCs), to respond to the growing global emphasis on the need to rapidly reduce greenhouse gas (GHG) emissions. Many companies are reacting to the winds of change and accelerating their shift toward net zero, while others are delicately striking a balance or could decide to double down on the future of fossil fuels.

In the upstream M&A market, who will be buying and selling as companies restructure their global portfolios? What regions will attract M&A investment? Will valuations decline or rise? As strategy shifts continue to rapidly unfold, we believe that fluid M&A market dynamics provide myriad of opportunities for resilient companies to transform their portfolios and reposition, as the oil and gas industry pivots in an era of complex uncertainties but thought-provoking possibilities.

8 key take-aways from the Global Upstream M&A Outlook 2021

- The global upstream M&A asset market activity will rebound substantially from the historic bottom.

- Deal pricing will rise for both oil-weighted and gas-weighted asset transactions.

- There will be more diversity in North American deal activity on a geographic basis, targeting resource basins outside the Permian

- Corporate consolidation in the Permian Basin will shift from large mergers between the "haves" to mergers between the "have-less" producers.

- National oil companies' (NOCs) and state-owned firms' M&A spending on cross-border acquisitions will rise from subdued levels in recent years.

- Privately held and private equity (PE)-backed E&Ps and financial players will play a vital role in the international acquisition market.

- Contingent payments will be a critical component in buyers and sellers reaching agreements in international asset transactions.

- The scarce inventory of world-class international oil and gas assets on the market will continue to attract financially strong buyers and transact swiftly compared with the broader set of mixed-quality opportunities for sale.

For more in-depth analysis, register for our 2021 Global Upstream M&A Review and Outlook webinars:

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fupstream-ma-market-recovery-during-energy-transition.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fupstream-ma-market-recovery-during-energy-transition.html&text=Is+an+upstream+M%26A+market+recovery+sustainable+during+the+energy+transition%3f++%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fupstream-ma-market-recovery-during-energy-transition.html","enabled":true},{"name":"email","url":"?subject=Is an upstream M&A market recovery sustainable during the energy transition? | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fupstream-ma-market-recovery-during-energy-transition.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Is+an+upstream+M%26A+market+recovery+sustainable+during+the+energy+transition%3f++%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fupstream-ma-market-recovery-during-energy-transition.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}