Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ARTICLES & REPORTS

Mar 23, 2021

Reduce, Repurpose Reinvent: Distilling an Energy Transition path for refiners

COVID-19 hastens the inevitable energy

transition

2020 was a harsh year for oil markets in general and refiners in

particular. Even during the 2015-19 period, referred to by some as

the "mini-golden age of oil refining", IHS Markit was already

forecasting storm clouds for refiners. US oil demand peaked in 2005

and European demand in 2006, and with oil demand in decline in both

regions another significant round of refinery rationalization was

forecasted.

The COVID-19 pandemic, and associated oil demand crash, even though most of this is expected to be temporary, has in fact brought forward this rationalization and accelerated the Energy Transition.

Oil refiners across the world are facing tough decisions - whether to Reduce capacity, Repurpose the refinery or Reinvent themselves.

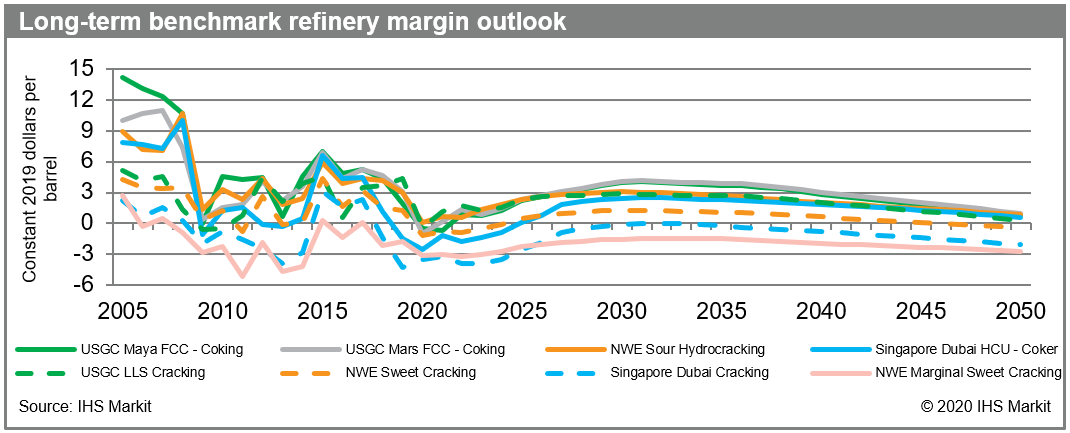

The future will still be challenging for the refinery sector: while refined product demand and prices are expected to gradually recover over the next two years, ongoing refinery capacity additions East of Suez, and modest product demand growth beyond 2021-22, will depress margins and put further pressure on refineries, particularly the ones located in regions where oil demand is already well past its peak.

Figure 1: Global refinery margin outlook

The Great Shakeout has started, more than 2 MMb/d of refinery capacity closures were announced in 2020, IHS Markit expects around 3.7 MMb/d of total closures between 2020-25, while 5.5 MMb/d of new refinery capacity is simultaneously being added in other regions.

Consider a broad portfolio of options in order to

survive and even thrive through Energy Transition

In a context of difficult market conditions for traditional oil

derived fuel markets, refiners are increasingly focusing on energy

transition with the double goal of improving the profitability of

their assets and securing long term operations, looking for

opportunities in new sectors and environmental imperatives.

This challenge is combined and aligned with trying to reduce greenhouse gas emissions and a move towards carbon neutrality.

Traditional refinery investments are typically aimed at:

1. Enhancement of current refinery operations

2. Increase in biofuel processing and production

3. Include chemical integration

The review of refinery configuration to adapt to the main drivers of energy transition, encourages the screening of opportunities to develop chemical production, as chemical demand continues to grow. Depending on the configuration and size of the refinery, propylene, C4 streams, aromatic streams as well as feedstocks such as LPG and naphtha may be available in sufficient quantity to develop downstream chemical production. The review of feedstock availability, its current placement and value, as well as product disposition and pricing, provide the basis for an options screening evaluation. Fitting into local value chains, by substituting imports or finding alternative use for relatively low-value refining streams, can lead to attractive propositions.

Not all refinery-integrated chemical opportunities are large, and some do push refiners to venture, for the first time, into a chemical industry they feel ill at ease with. Hence, higher returns on investment may be needed as incentives, or collaboration with partners more familiar with the industry, such as traders to secure product off-take, or local chemical producers, could help refiners mitigate their perceived risks of integrating into chemical production.

In addition, in light of the increasing pressure of energy

transition imperatives and requirements, refiners are looking at

broader options, utilizing their general technical and industrial

skills, their land, utilities and infrastructure to consider:

1. Energy Transition projects, such as CCUS (Carbon Capture

Utilization and Storage), hydrogen, desalination

2. Gas import and supply

3. Plastics recycling

4. Traditional power projects

5. Renewable power including waste to energy

The questions IHS Markit is increasingly being asked by our clients are:

"What is the best way for my refinery and assets to navigate the energy transition?"

"How can we increase the petrochemical integration of our refinery?"

"Do we still want to be in the oil refining business, or do we want to broaden our horizon?"

For more details on how IHS Markit's consulting teams are helping our clients solve these downstream Energy Transition challenges, download our latest case study here:

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2freduce-repurpose-reinvent-energy-transition-path-for-refiners.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2freduce-repurpose-reinvent-energy-transition-path-for-refiners.html&text=Reduce%2c+Repurpose+Reinvent%3a+Distilling+an+Energy+Transition+path+for+refiners+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2freduce-repurpose-reinvent-energy-transition-path-for-refiners.html","enabled":true},{"name":"email","url":"?subject=Reduce, Repurpose Reinvent: Distilling an Energy Transition path for refiners | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2freduce-repurpose-reinvent-energy-transition-path-for-refiners.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Reduce%2c+Repurpose+Reinvent%3a+Distilling+an+Energy+Transition+path+for+refiners+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2freduce-repurpose-reinvent-energy-transition-path-for-refiners.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}