Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Aug 28, 2017

Total's acquisition of Maersk Oil & Gas is a positive strategic move, but capital strategy limits value creation

Total’s US$7.42 billion acquisition of Maersk Oil & Gas, a wholly owned subsidiary of shipping giant A.P. Møller–Mærsk, fits strategically within Total’s portfolio. However, we question the shares-based financing of the transaction. Under the deal, Total will issue 97.5 million shares to Møller–Mærsk valued at US$4.92 billion based on Total’s US$50.49 per share closing price one trading day prior to deal announcement. Using the IHS Markit Vantage software we have calculated the aggregate value of Maersk Oil & Gas assets globally to be US$5.6 billion (assuming $50 per barrel flat real pricing - see figure 1 below). The US$7.42 billion total transaction value includes the assumption of US$2.5 billion of Maersk Oil’s debt, according to Total’s transaction press release. Following the closing, Møller–Mærsk will hold 3.75% of the enlarged share capital of Total.

Figure 1: IHS Vantage analysis showing aggregate value of Maersk Oil & Gas assets globally

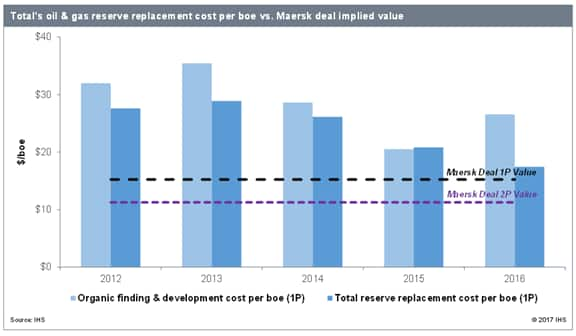

Effective 31 December 2016, Maersk Oil & Gas held working interest reserves of 339 MMboe of 1P and 555 MMboe of 2P, and 470 MMboe of 2C contingent resources, resulting in total recoverable resources of 1.025 billion boe. We valued the probable reserves and contingent resources at US$5.00 per boe and US$2.50 per boe, respectively, for a total nonproved reserve value of US$2.26 billion. The transaction implies deal values of US$15.24 per boe of 1P reserves, US$11.26 per boe of 2P reserves, and US$7.24 per boe of total recoverable resources. (See figure 2 below showing Total's reserve replacement cost versus Maersk deal implied value.)

Maersk’s assets appear to offer a good strategic fit within Total’s portfolio and provide opportunities for synergy in several regions including the North Sea, Africa, and the US Gulf of Mexico. In addition, the combination with Maersk reduces Total’s exposure to geopolitically more turbulent regions. Total is estimating that it can gain $400 million per year in synergies by 2020 while boosting its production and cash flow and maintaining its annual capex guidance of $15–17 billion for 2018–2020.

Figure 2: Total's oil and gas reserve replacement cost per boe vs Maersk deal implied value

Although the transaction price is in line with our estimated value for Maersk Oil & Gas, and the acquisition appears to be a good strategic move for Total’s profitability and growth prospects, we believe the capital strategy for financing the deal may limit value creation longer term. Given Total’s significant cash on hand of $28.7 billion at 30 June 2017 and a dividend yield of 5.4%, issuing shares is less capital efficient than financing with cash. In addition, Total’s shares are currently trading at par value with our appraised net worth, thus achieving minimal equity pricing advantage by issuing shares. Maersk’s interest in becoming a long-term shareholder in Total may have contributed to the deal’s share structure.

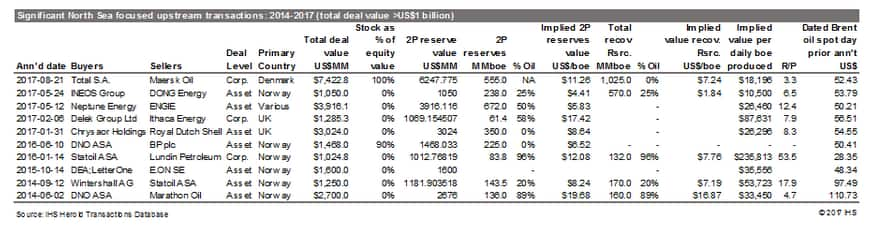

Figure 3: Significant North Sea focused upstream transactions 2014-2017

Learn more about our companies and transactions research or asset valuation software.

To see additional news on asset valuation, read our blog on the Mexico bid round 2.1.

Bassam (Sam) Hanna is a Research and Analysis Associate Director at IHS Markit.

Brian Ferguson, Principal Analyst at IHS Markit also contributed to this report.

Posted 28 August 2017

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2ftotals-acquisition-of-maersk-oil-gas-is-a-positive-strategic-move-but-capital-strategy-limits-value-creation.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2ftotals-acquisition-of-maersk-oil-gas-is-a-positive-strategic-move-but-capital-strategy-limits-value-creation.html&text=Total%27s+acquisition+of+Maersk+Oil+%26+Gas+is+a+positive+strategic+move%2c+but+capital+strategy+limits+value+creation","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2ftotals-acquisition-of-maersk-oil-gas-is-a-positive-strategic-move-but-capital-strategy-limits-value-creation.html","enabled":true},{"name":"email","url":"?subject=Total's acquisition of Maersk Oil & Gas is a positive strategic move, but capital strategy limits value creation&body=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2ftotals-acquisition-of-maersk-oil-gas-is-a-positive-strategic-move-but-capital-strategy-limits-value-creation.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Total%27s+acquisition+of+Maersk+Oil+%26+Gas+is+a+positive+strategic+move%2c+but+capital+strategy+limits+value+creation http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2ftotals-acquisition-of-maersk-oil-gas-is-a-positive-strategic-move-but-capital-strategy-limits-value-creation.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}