Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jun 14, 2017

Asset valuation for Mexico's shallow water bid round 2.1

This is a collaborative article from Bob MacKnight and Julia Hand.

Mexico's Round 2.1 offers 15 shallow water blocks in the Tampico Misantla, Veracruz, and the Sureste Basins. The blocks up for auction are subject to a Production Sharing Contract (PSC) with state participation (profit share) and an investment factor (based on additional exploration and appraisal well commitments) as the biddable parameters. The winning bidder will be determined by a formula, called the VPO, which is defined as:

VPO = State Participation + {5.72 * (State Participation/100) + 2.26} * Investment Factor

IHS Markit has valued the discovered resource base in Contact Area 3, and we ran economic sensitivities on both bidding parameters. We modeled Contract Area 3 using a representative commercial project with a discovered resource base of 127.6 MMbbl of oil and 41.3 Bcf of gas. The development plan assumes a shallow-water platform with a pipeline to shore for a total Capex and Opex of US$439 million and $763 million, respectively. Production is assumed to come onstream in 2022, achieving peak oil of 52 Mbbl/d and peak gas of 16.5 MMcf/d in 2025 with a total field life of 14 years.

Assuming an oil price of $44/bbland a gas price of $2.90/mcf, the table below shows the NPV10 sensitivity to state participation, as well as the required investment factor through additional exploration & appraisal (E&A) well commitments.

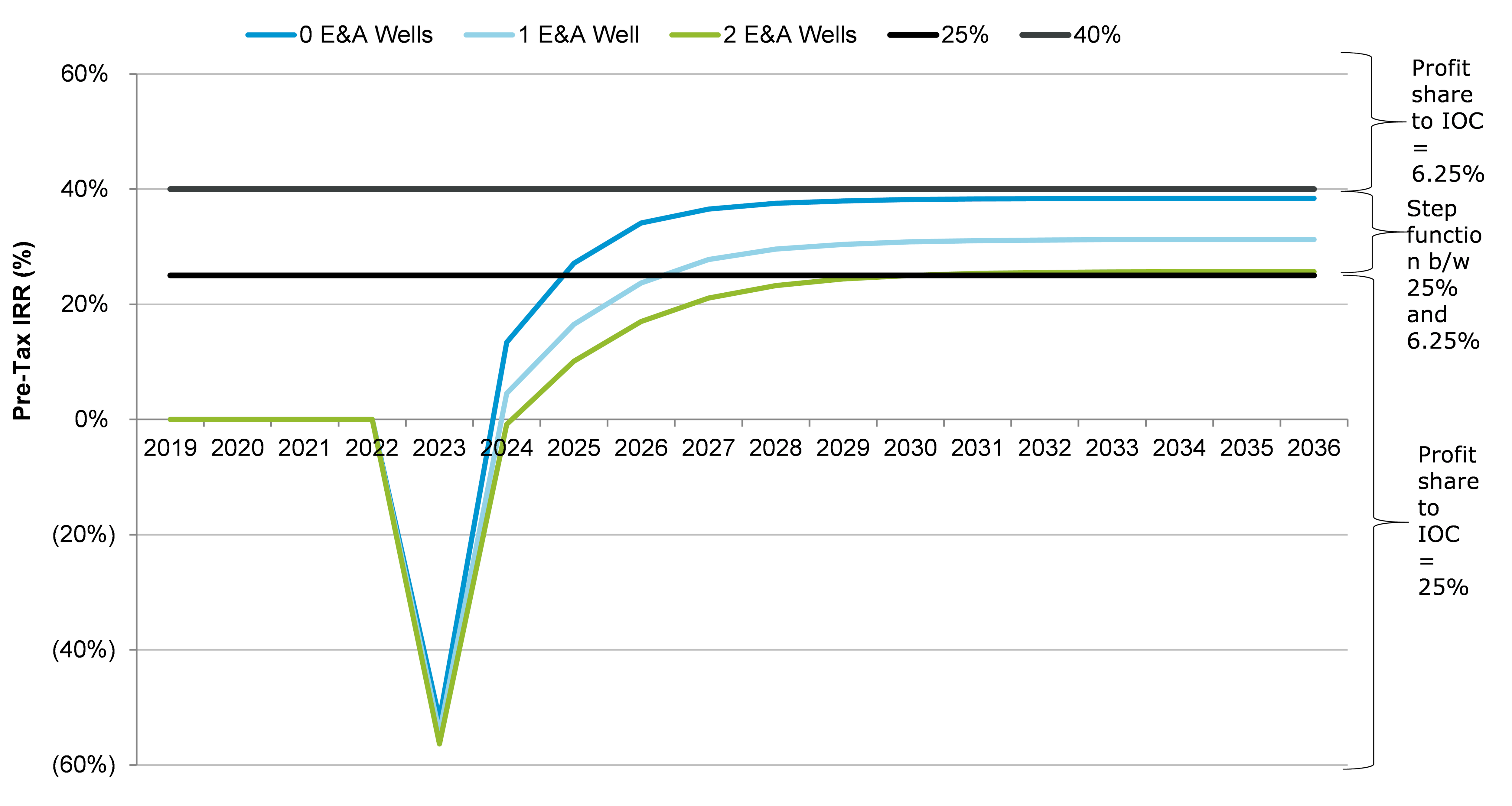

The results indicate that as you layer in additional E&A wells, thereby increasing your investment factor, you not only increase the bid's VPO but also the NPV10. This is due to an uplift mechanism in the PSC that applies to E&A costs, as well as the profit sharing mechanism. The profit share is based on pre-tax IRR and IOCs receive the maximum profit share when the project has an IRR under 25%. Adding in additional E&A wells increases the amount of time in which the project's IRR is less than 25%, thereby increasing cash flow from profit share.

Figure 1: NPV10 Sensitivity to Profit Share and Additional E&A Wells.Source: IHS Vantage

Figure 2: Pre-Tax IRR Sensitivity to Additional E&A Wells at 25% Profit Share to IOC. Source: IHS Vantage

For more analysis of Mexico's 2.1 and 2.2 Bid Rounds, register to view an on-demand webinar from our team.

Bob MacKnight is Senior Director at IHS Markit

Julia Hand is a Senior Principal Economist at IHS Markit.

Posted 14 June 2017

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fasset-valuation-for-mexicos-shallow-water-bid-round-21.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fasset-valuation-for-mexicos-shallow-water-bid-round-21.html&text=Asset+valuation+for+Mexico%27s+shallow+water+bid+round+2.1","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fasset-valuation-for-mexicos-shallow-water-bid-round-21.html","enabled":true},{"name":"email","url":"?subject=Asset valuation for Mexico's shallow water bid round 2.1&body=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fasset-valuation-for-mexicos-shallow-water-bid-round-21.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Asset+valuation+for+Mexico%27s+shallow+water+bid+round+2.1 http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fasset-valuation-for-mexicos-shallow-water-bid-round-21.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}