Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Sep 02, 2020

65% surge in polysilicon prices triggers unexpected increase in module production costs and affects solar installation outlook in 2020

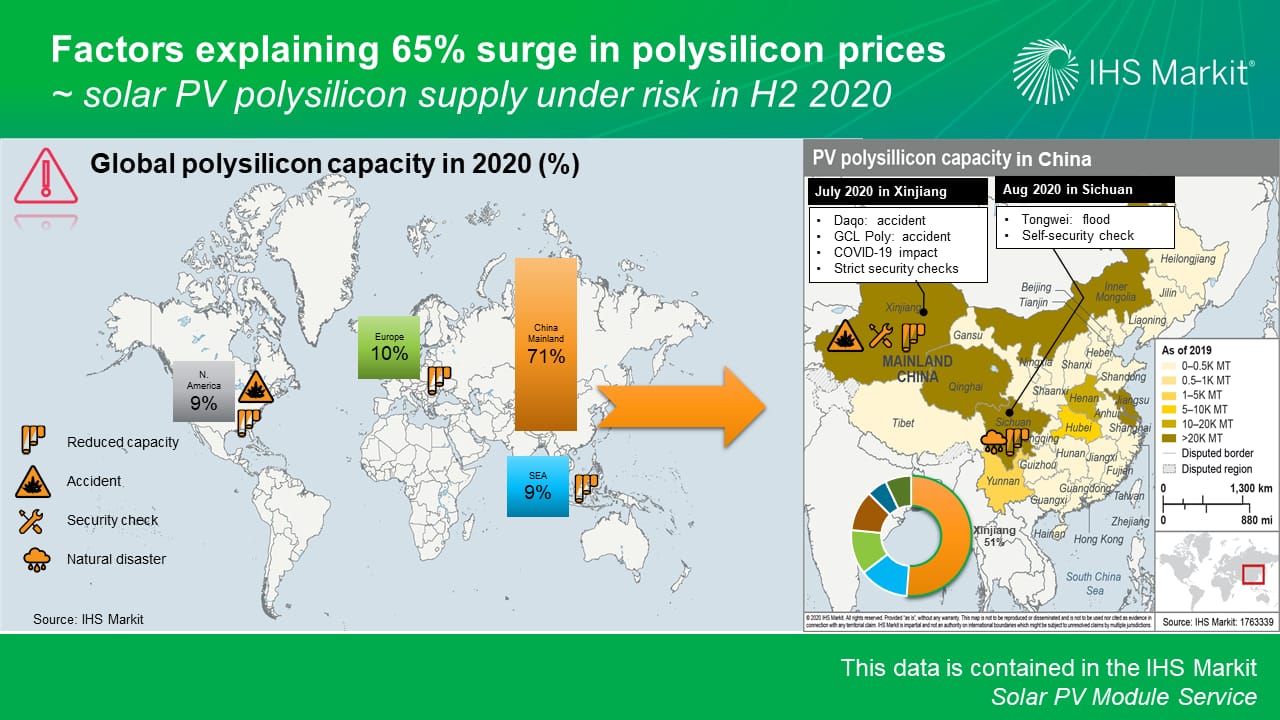

Chinese polysilicon price has risen by 65% from a historically low level in June 2020. There are three factors that explain this dramatic surge in prices. The first trigger was the serious explosion at the fab of GCL Poly, one of the world's largest polysilicon producers, which could take months to recover, together with another accident in major producer Daqo's Xinjiang fab on 1 July 2020, both limiting the total volume of material available in the market and driving Xinjiang authorities to impose strict security checks on polysilicon facilities in the province to avoid further incidents. These measures imply prolonged scheduled maintenances that are further reducing the availability of polysilicon in the market.

Second, to make matters worse, Xinjiang Uyghur Autonomous Region, where more than 50% of Chinese polysilicon capacity is located, is currently suffering an outbreak of COVID-19. Because of the stringent regulations to contain the spread of COVID-19, logistics are severely disrupted, thus making it very challenging to transport polysilicon from Xinjiang towards the largest monocrystalline wafer locations in Yunnan and Inner-Mongolia provinces.

Finally, on 18 August 2020, Yongxiang Polysilicon, owned by Tongwei Group, stopped production of its 20,000 MT facility in Leshan, Sichuan Province, due to the unprecedented flood. Restart of the production depends on potential flood threats, regulatory requirements and facility check.

Polysilicon shortage by Chinese players opens a window of opportunity for international polysilicon companies

Most international polysilicon suppliers, who have been struggling to remain profitable under a very competitive price environment dominated by Chinese suppliers, paused production in the first half of 2020. However, the current price rise and shortage, if maintained for a few months, creates an opportunity to partially restart operations for some of these international manufacturers but timing required for production ramp up and transportation would delay the supply to Chinese wafer suppliers until the fourth quarter.

IHS Markit view on the polysilicon price trend is that polysilicon capacity in Xinjiang, where 50% of Chinese total capacity is located, will not return to normal production levels before the end of the year and that international supply will not be enough to compensate the downturn in production. Prices will remain high in the next quarter, even though the price hike will slow down with capacities gradually recovering from maintenance.

Implications on the demand side in China in H2 2020 and in international markets

Following the price hike for polysilicon, wafer and cell producers have raised prices to balance out increasing raw material costs and maintain margin. Similarly, module prices are also following the upward trend. The shortage in materials and the increase in module prices in the third quarter 2020 will have a negative impact on solar demand this year.

The unsubsidized segment in China will be the most impacted with projects being delayed to 2021. Due to the increase in module prices, grid-parity projects, which do not enjoy subsidies and do not have hard deadlines within 2020, will be delayed, waiting for better procurement conditions.

Overseas projects with tight margins could be equally impacted with potential for delays into 2021.

IHS Markit will continue tracking demand in overseas markets in the following weeks, as continuing module price hike might impact the schedule of some PPA contracts or upcoming tender bids and will incorporate all this information into the next edition of our PV Installation Tracker to be published mid-September 2020.

Learn more about our solar PV module market intelligence.

Dr. Edurne Zoco is an executive director for the Clean Technology & Renewables team at IHS Markit, leading the group's research activities across renewables, batteries, and energy storage.

Siqi He is a research analyst with the Clean Technology & Renewables team at IHS Markit focusing on solar research.

Posted on 2 September 2020

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fsurge-in-polysilicon-prices-triggers-unexpected-increase-in.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fsurge-in-polysilicon-prices-triggers-unexpected-increase-in.html&text=65%25+surge+in+polysilicon+prices+triggers+unexpected+increase+in+module+production+costs+and+affects+solar+installation+outlook+in+2020+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fsurge-in-polysilicon-prices-triggers-unexpected-increase-in.html","enabled":true},{"name":"email","url":"?subject=65% surge in polysilicon prices triggers unexpected increase in module production costs and affects solar installation outlook in 2020 | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fsurge-in-polysilicon-prices-triggers-unexpected-increase-in.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=65%25+surge+in+polysilicon+prices+triggers+unexpected+increase+in+module+production+costs+and+affects+solar+installation+outlook+in+2020+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fsurge-in-polysilicon-prices-triggers-unexpected-increase-in.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}