Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Sep 01, 2020

Evolution of the NEM: Navigating Australia’s renewable energy transition

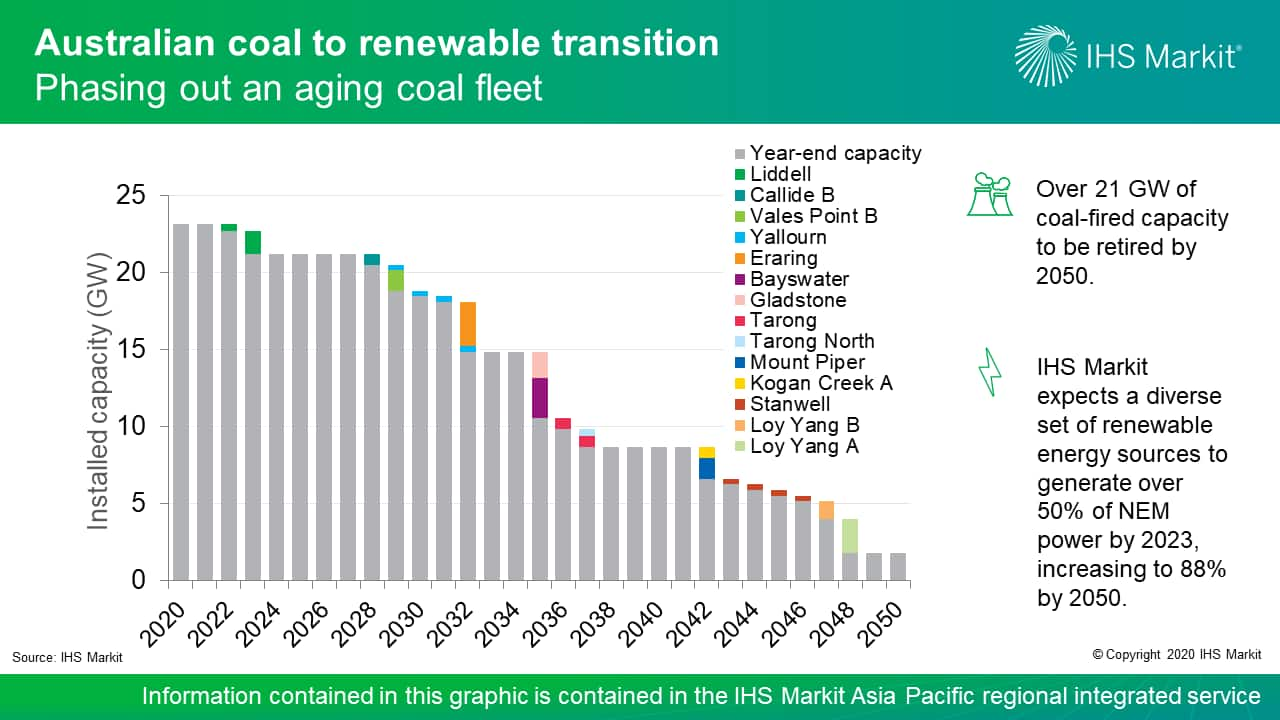

Coal-fired power has been the core power supply in Australia's National Energy Market (NEM) in terms of both installed capacity and generation. However, coal-fired power has begun to lose the dominate position with the phaseout of an aging fleet and lack of additions owing to reduced economic competitiveness and environmental concerns. IHS Markit has already seen a cheaper average renewable energy LCOE than that of coal generation, rising renewable load has led to higher cycling costs, and aging generators call for investments to improve reliability and efficiency. As a result, IHS Markit expects NEM coal-fired power capacity will drop to 1,822 MW in 2050, reducing coal's market share to just 1% of installed capacity.

The NEM has experienced a meteoric rise in renewable capacity additions from wind and solar owing to government incentives such as the large-scale and small-scale renewable energy scheme, solar feed-in tariffs and high wholesale and retail prices. However, the rapid uptake in dispersed variable generation has created challenges for the market operator to maintain grid security, requiring updates to an existing grid system that was designed based on a centralized thermal power structure. IHS Markit estimates infrastructure upgrades and developments targeting Renewable Energy Zones (REZs) will allow 65 GW of utility-scale renewables operating by the end of 2050.

Both utility-scale and distributed renewables demand flexible dispatchable power to firm up the variable output. Gas-fired generation has played this role in the initial development of variable renewable resources, but there is uncertainty in the future of gas supply in the NEM. A decline in offshore production, LNG export commitments and competition with more lucrative Asian markets will continue to keep upward pressure on domestic gas prices and increase the fuel costs for gas-fired generation. Compared with gas generators, pumped storage and battery storage are more favored for the sake of cost. Dramatic cost reduction and lack of geographic constraints enable battery storage to gain better support from the governments and is expected to become the largest type of flexible power in the long term. IHS Markit anticipates a combination of gas-fired generation, pumped hydro and battery storage will be required to firm and support a growing renewable energy mix.

An aging coal fleet, low LCOE for renewable power sources, and state climate targets will transform an energy market that is designed around thermal generation. This transformation will require significant infrastructure investments and updates to market mechanisms to further the growth in variable renewable resources. IHS Markit expects a diverse set of renewable energy sources to generate over 50% of NEM power by 2023, increasing to 88% by 2050.

Learn more about our power research in the Asia-Pacific region from our new Asia-Pacific Regional Integrated Service.

Logan Reese is an associate director covering Australia gas, power and renewables at IHS Markit.

Shan Xue is a principal analyst in the Gas, Power and Energy Futures team at IHS Markit, focusing on Asian power market modeling.

Posted 1 September 2020

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fevolution-of-the-nem-navigating-australias-renewable-energy.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fevolution-of-the-nem-navigating-australias-renewable-energy.html&text=Evolution+of+the+NEM%3a+Navigating+Australia%e2%80%99s+renewable+energy+transition+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fevolution-of-the-nem-navigating-australias-renewable-energy.html","enabled":true},{"name":"email","url":"?subject=Evolution of the NEM: Navigating Australia’s renewable energy transition | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fevolution-of-the-nem-navigating-australias-renewable-energy.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Evolution+of+the+NEM%3a+Navigating+Australia%e2%80%99s+renewable+energy+transition+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fevolution-of-the-nem-navigating-australias-renewable-energy.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}