Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Aug 08, 2018

Steep backwardation will continue to restrain North American upstream M&A

Q2'18 M&A Review

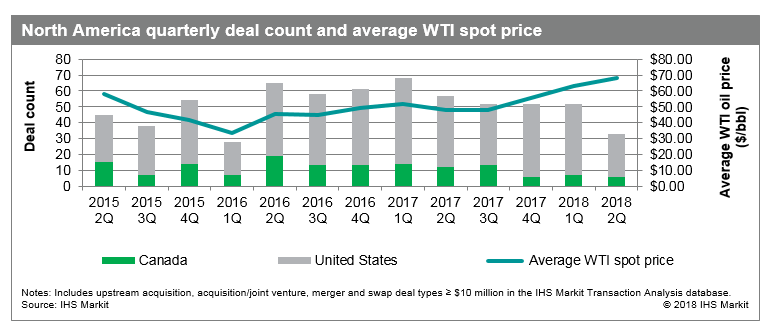

Second quarter 2018 deal count for the North America region

declined by nearly 40% to the lowest quarterly total in more than

two years. Deal count remains sluggish despite increasing spot

crude oil prices, as the longer-term crude oil futures curve

remains in steep backwardization, causing potential buyers and

sellers to differ on asset valuations. Reserves-focused

transactions accounted for 73% of the quarterly deal flow. There

were three corporate transactions, accounting for 9% of the total

deal count: two Canada and one US-focused.

Figure 1: North America quarterly deal count and average WTI spot price

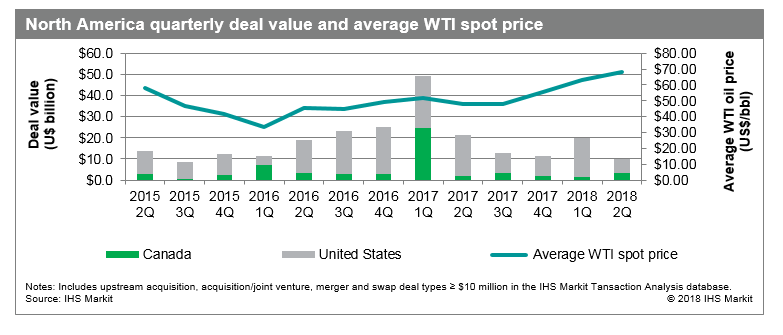

Deal value fell by half to $10 billion for the first time since the third quarter 2015. The top three transactions accounted for about 45% of total North America deal value. Three out of the four $1 billion-plus acquisitions were corporate takeovers and there were 17 acquisitions with deal value of $100 million and over. Corporate deals accounted for 39% of the total deal value. North America accounted for four of the quarter's top five worldwide deals, including the quarter's largest deal.

Figure 2: North America quarterly

deal value and average WTI spot price

Figure 2: North America quarterly

deal value and average WTI spot price

Near-Term M&A Outlook

- Despite higher crude prices and a large inventory of assets on the market, the mixed quality of opportunities for sale and the steep backwardation in long-term oil futures prices is restraining overall deal activity.

- Corporate consolidation of Canadian E&Ps is slightly accelerating, as evidenced by two $1 billion-plus corporate takeovers announced in the second quarter. We expect this trend to continue because efforts to exponentially grow reserves and expand holdings in core basins will require corporate takeovers, which will primarily target Canadian E&P companies holding high-quality assets but suffering from low stock market valuations.

- Overall deal activity in Canada will continue to be restrained, hampered by the Liability Management Rating (LMR) issue, which has reduced the number of companies financially strong enough to withstand the scrutiny of Alberta regulators when seeking the transfer of oil and gas licenses.

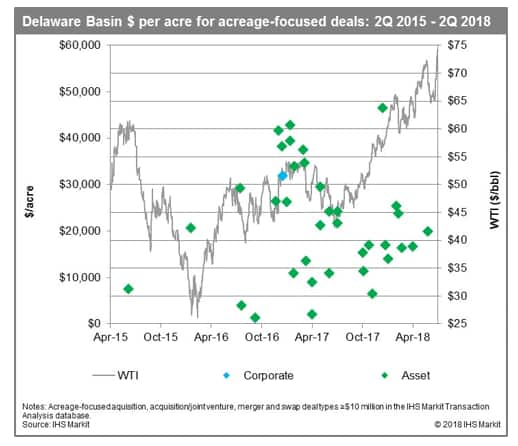

- Permian M&A activity is trending back up, targeting primarily the Delaware Basin. We expect Permian consolidation to continue, both on a corporate and asset level. To manage the enhanced execution risk in the Permian, smaller E&Ps electing to remain independent will pursue material, focused acquisitions of contiguous operated acreage that provides economies of sale.

Figure 3: Delaware Basin price per acre for acreage-focused deals

- Private buyers, often private equity backed and with a mandate to grow their portfolio, remain essential players in the North America upstream acquisition market.

Anna Wuchek is a Principal Analyst, Companies and Transactions Research, at IHS Markit.

Posted 8 August 2018

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fsteep-backwardation-restrain-north-american-upstream-mergers-and-acqusitions.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fsteep-backwardation-restrain-north-american-upstream-mergers-and-acqusitions.html&text=Steep+backwardation+will+continue+to+restrain+North+American+upstream+M%26A+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fsteep-backwardation-restrain-north-american-upstream-mergers-and-acqusitions.html","enabled":true},{"name":"email","url":"?subject=Steep backwardation will continue to restrain North American upstream M&A | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fsteep-backwardation-restrain-north-american-upstream-mergers-and-acqusitions.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Steep+backwardation+will+continue+to+restrain+North+American+upstream+M%26A+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fsteep-backwardation-restrain-north-american-upstream-mergers-and-acqusitions.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}