Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Aug 10, 2018

Kosmos Energy’s acquisition of Deep Gulf Energy provides entry to US Gulf of Mexico, with material upside potential

On 6 August 2018, Kosmos Energy announced the acquisition of Deep Gulf Energy, for $1.225 billion (consisting of $925 million in cash and $300 million in Kosmos shares). The acquisition of the US Gulf of Mexico (GOM)-focused company provides Kosmos with a new entry to a position in the United States, and adds 80 million boe of 2P reserves (bringing Kosmos's total 2P reserves to 280 million boe). Importantly, this gives access to attractive short-cycle opportunities and exploration potential outside of the heated US onshore market. Kosmos also expects to benefit from the current out-of-favor view of the offshore market, which has led to rising spare capacity, lower rig rates and reduced project costs.

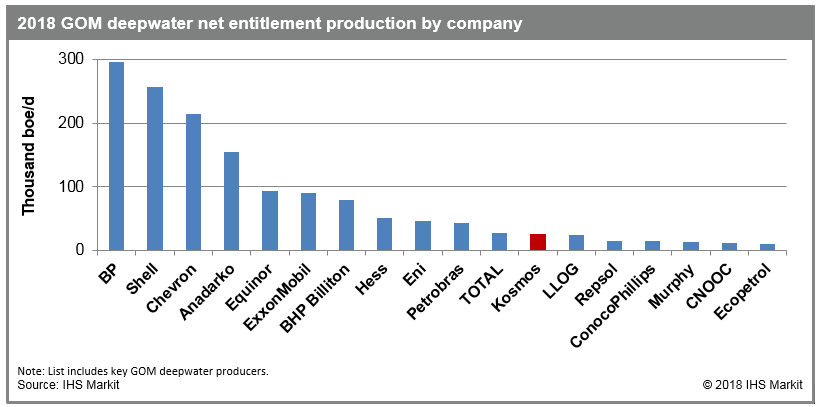

Deep Gulf Energy's GOM portfolio adds approximately 25,000 boe/d of net output (85% oil-based, entirely deepwater) to Kosmos mainly in the relatively mature Miocene play. This will give Kosmos a respectable entry to the GOM deepwater play and rank the company 12th by 2018 GOM deepwater net entitlement production, just ahead of LLOG, another GOM deepwater-focused independent with a recently expanding footprint in the play. Kosmos's entry to the play adds to the list of recent transactions where smaller GOM independents or newcomers are expanding footprints to pursue short-cycle, return-focused strategies while larger players shift attention to the US onshore for growth.

Essentially, Deep Gulf's well positioned assets in the GOM could serve as a launching pad for Kosmos, and depending on its ambition for the GOM, could easily turn Kosmos into a major GOM player along the lines of Hess, ExxonMobil and Anadarko. Along these lines, Kosmos has indicated its interest in future lease acquisitions in the GOM. Many of the portfolio fields and prospects are in the Mississippi Canyon area, which has recently attracted several large GOM players to explore for Jurassic targets. A focus on Jurassic prospects instead of Miocene in the same area could offer Kosmos a bigger upside potential, but will also come with a greater exploration risk.

Despite the addition of these producing portfolios, the company largely maintains a status as a frontier exploration company. The GOM portfolio provides a valuable addition for Kosmos, supplementing volumes from Ghana and Cote d'Ivoire. A growing producing position provides an important source of cash flow to fund exploration activity elsewhere in the portfolio. With the addition of the GOM portfolio, Kosmos plans to pay cash dividends starting in 1Q2019, marking an attempt to strike a fine balance between funding long-cycle exploration opportunities and appealing to investor demand for capital discipline and ROI. We expect that this strategy will be increasingly deployed in the GOM and other mature offshore plays.

Figure 1: 2018 GOM deepwater net entitlement production by company

Learn more about our upstream solutions and our energy company and transactions service.

Posted 10 August 2018

Ash Singh is an Associate Director with IHS Markit Financial Services team.

Chris DeLucia is an Associate Director with the Upstream Companies & Transactions team at IHS Markit.

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fkosmos-energys-acquisition-of-deep-gulf-energy.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fkosmos-energys-acquisition-of-deep-gulf-energy.html&text=Kosmos+Energy%e2%80%99s+acquisition+of+Deep+Gulf+Energy+provides+entry+to+US+Gulf+of+Mexico%2c+with+material+upside+potential+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fkosmos-energys-acquisition-of-deep-gulf-energy.html","enabled":true},{"name":"email","url":"?subject=Kosmos Energy’s acquisition of Deep Gulf Energy provides entry to US Gulf of Mexico, with material upside potential | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fkosmos-energys-acquisition-of-deep-gulf-energy.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Kosmos+Energy%e2%80%99s+acquisition+of+Deep+Gulf+Energy+provides+entry+to+US+Gulf+of+Mexico%2c+with+material+upside+potential+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fkosmos-energys-acquisition-of-deep-gulf-energy.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}