Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Mar 11, 2020

Policy, technology, company strategies, and the COVID-19 wildcard: Seven trends to watch for in global power and renewables in 2020

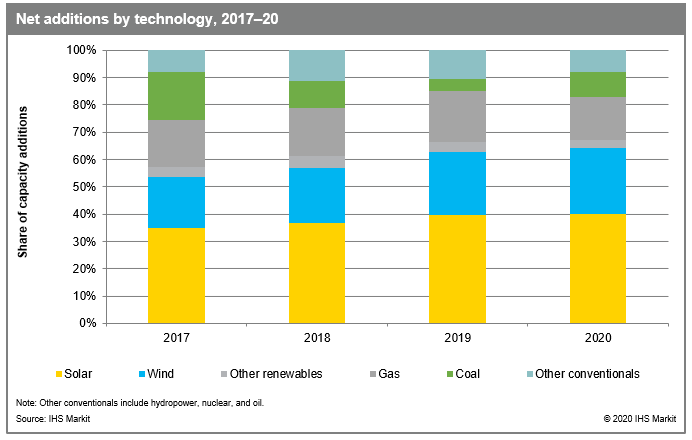

IHS Markit estimates that there will be 290 gigawatts (GW) of net power capacity added in 2020, globally, 5% more than in 2019. Grid-connected solar and wind net additions are projected to account for about 65% of the total, while coal and gas combined account for only 25%.

Figure 1: Net additions by technology, 2017-2020.

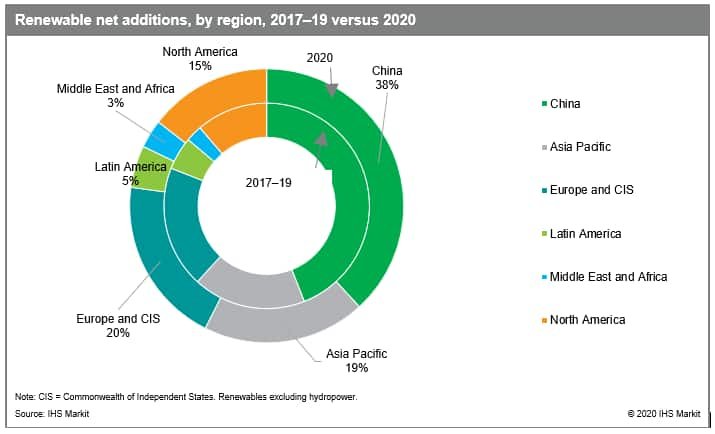

Figure 2: Renewable net additions, by region, 2017-19 versus 2020.

As renewable penetration increases, it pushes wholesale prices down in organized power markets, paving the way for financing challenges for all generation technologies. Simultaneously, emerging markets are achieving low renewable auction prices with cost declines but face implementation challenges owing to infrastructure and regulatory constraints.

Consequently, additions in 2020 and the extent to which government and corporate ambitions are realized will depend on seven trends that stem from three interconnected drivers - policy, technological advancements, and new business strategies and revenue streams - and the wildcard event of COVID-19.

- Changing subsidies: Most markets have already shifted from feed-in-tariffs (FiTs), in pursuit of market-driven pricing through renewable auctions. Key markets such as China, Japan, and Vietnam will however sustain solar and wind FiTs or FiT caps into 2021. At the same time, seasoned-auction markets are going a step further by complementing technology-specific auctions with neutral and mixed- technology auctions. However, as direct support mechanisms see reductions, renewable quotas and green certificate programs continue to be launched or extended in growth markets.

- Market reforms: Markets such as Brazil, Japan, Vietnam, India, and Belgium will continue to revise recently designed wholesale power markets or market designs to attract investment in the power sector and establish mechanisms to address the need for capacity and balancing services. These markets' focus on capacity and ancillary services is partly driven by lessons learned in more established markets, which are undergoing their own changes to market design (e.g. Germany, France, and PJM).

- Renewable cost improvements: Renewable costs will continue to decline in 2020 and convergence across markets and technologies will accelerate. As a result, IHS Markit expects renewables' levelized cost of energy to be within the range of marginal fossil fuel costs in an increasing number of markets.

- Emerging technologies: Bifacial solar panels are entering the mainstream for PV, the battery storage industry continues to grow rapidly, and floating offshore wind is taking off. As a result, solar, wind, and battery technologies continue to build scale and accelerate cost and performance improvements in 2020.

- New market players: Over 200 companies have formally committed to RE100, a global corporate initiative to cover electricity usage with 100% renewables before 2050. Of the 211 members, over 50 joined in 2019, marking a record year. Corporate-driven renewable procurement matched target enthusiasm by more than doubling its activity in 2018 and hitting a record year in 2019. We expect corporate activities to continue and to see movement in retail competition in markets such as India, South Africa, and China, in 2020.

- Utility adaptation strategies: Revenues streams for power generators are evolving as governments move toward competitive bids, renewable price cannibalization increases, and merchant power markets come under pressure as renewables penetration increases. As a result, utilities are adapting their business strategies to compete in this new environment and are aiming to capture new revenue streams generated by new stakeholders.

- COVID-19 shock: The year 2020 will be remembered by the ripple effects of the coronavirus (COVID-19). IHS Markit expects the virus to decelerate power demand growth around the world, leading to intensified competition among generation technologies - coal, gas, nuclear, and renewables. For example, the load growth of the world's largest power market, China, is projected to decrease to 3.1% in 2020 from the previous outlook of 4.1%. In terms of generation, coal will carry the brunt of the decline in China, but renewable capacity additions will be impacted as well. Globally, we expect to see a ripple effect of COVID-19 in markets near and far as demand shocks and fuel price reverberations impact competition in power generation.

Power market data is derived using regional power models in combination with a global energy model.

To download the full report or to learn more about our power and renewables analysis, visit our website.

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fseven-trends-to-watch-for-in-global-power-renewables-in-2020.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fseven-trends-to-watch-for-in-global-power-renewables-in-2020.html&text=Policy%2c+technology%2c+company+strategies%2c+and+the+COVID-19+wildcard%3a+Seven+trends+to+watch+for+in+global+power+and+renewables+in+2020+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fseven-trends-to-watch-for-in-global-power-renewables-in-2020.html","enabled":true},{"name":"email","url":"?subject=Policy, technology, company strategies, and the COVID-19 wildcard: Seven trends to watch for in global power and renewables in 2020 | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fseven-trends-to-watch-for-in-global-power-renewables-in-2020.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Policy%2c+technology%2c+company+strategies%2c+and+the+COVID-19+wildcard%3a+Seven+trends+to+watch+for+in+global+power+and+renewables+in+2020+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fseven-trends-to-watch-for-in-global-power-renewables-in-2020.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}