Papua New Guinea: A review and forecast of exploration and production

Over the last few years Papua New Guinea has established itself as a strong player in the oil and gas industry. With one major LNG project up and running and with the proposed development of two additional projects underway it has marked out its importance in the Asia Pacific markets and will likely continue to do so into the foreseeable future.

With production in 2017 from the PNG LNG project the strongest it has been for several years and multiple developments due to come on-stream over the next few years, Papua New Guinea has been a hive of activity in a struggling industry, with promising potential scheduled for the next five years.

2017 Activity Review

In early 2017, the Muruk gas field was successfully drilled by Oil Search, and confirmed a natural gas rich zone through the Toro Sandstone reservoir. The discovery was reported to be a look-a-like of the giant Hides gas field, located around 21 km to the south east, both located in the Papuan Basin. Due to its close proximity to the Hides gas plant, Oil Search has made its intentions clear that the field will most likely be developed with the PNG LNG project, opening up options for future expansion.

Towards the end of 2017 Oil Search also commenced drilling at the P'Nyang gas field, drilling the P'Nyang South 2 side-track well in the Papuan Basin. The well, which was completed in January 2018, confirmed the extension of the field to the south east and subsequently a reserves review was being undertaken as of Q1 2018. The P'Nyang field has particularly significant potential for expansion of the PNG LNG project, with ExxonMobil, as operator, previously expressing interest in combining the development options.

The PNG LNG Project had a successful year in 2017, reporting only 2% unscheduled downtime, emphasizing the world class reliability and performance the joint venture are so proud of. In October 2017 the project achieved its highest ever single day of production, reporting an impressive rate, equivalent to 8.98 MMt of LNG for the year. Oil Search also reported an annualised production rate of 8.6 MMtpa for Q3 2017, which was a direct result of compressor upgrades undertaken in May. This, combined with significantly higher production rates over the first three quarters of the year, has resulted in the project being on track to produce around 20% beyond its nameplate capacity when first designed. The overall annualised rate, announced in January 2018 was 8.3 MMtpa.

By the end of December 2017 around 110 cargoes of LNG from the PNG LNG Project were expected to have been sold to global customers throughout the year, largely Asia Pacific based, with 23 of those sold on the spot market. Following the success of recertification of reserves during the year, the project partners reported an additional 1.3 MMt sales opportunity for the Asian markets. Since the project started, back in mid-2014, around 370 LNG cargoes have been sold.

Significantly for the industry, the average oil price per barrel for Q4 2017 was 20% higher than in Q3, at around USD $63.05, which indicated a steady increase in recovery for the global oil price. This meant that the realised price for LNG and gas sales from the PNG LNG Project increased to USD $7.86 Btu, around 5% higher than the previous quarter, as reported by Oil Search in January 2018. Overall, for 2017 the total sale of LNG and gas as reported by Oil Search, resulted in revenue of US $993.1 million, compared to US $ 792.9 million in 2016 for the project.

A major milestone moment in PNG's oil and gas exploration history was the drilling at the Pasca A1 field, in the Papuan Basin, back in late 2017.

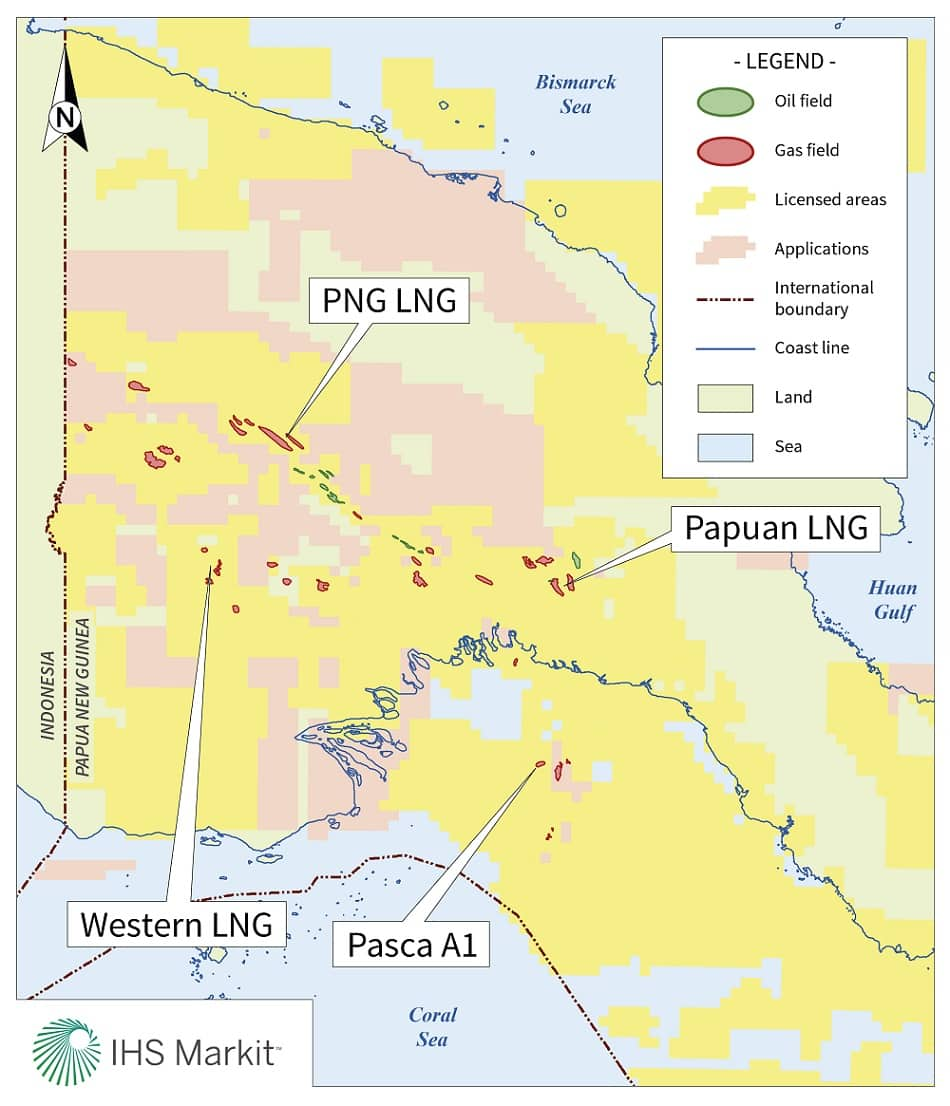

Figure One: Map showing the locations of key LNG Projects and Pasca A1 field

Figure one shows the location of the Pasca field along with the key LNG Projects. The Pasca 4A well was completed in November 2017, with flaring successfully carried out in December 2017. This move is particularly significant for Papua New Guinea, as Twinza, operator of the field, hopes to commercialise its first offshore gas and oil development in the country. To date, around $48 million has been invested by the company into the project with a further $250 million planned to be spent following the award of a development licence over the field. An expenditure of up to $550 million is estimated as a high side development cost, which would be of significant economic value to PNG.

Papuan LNG Project

The Papuan LNG Project is focused on developing and commercialising the Elk-Antelope resource, located in PRL 15 in the New Guinea Fold Belt, Papuan Basin. The project was proposed 2015 by Oil Search with the key infrastructure and facility site identified. The Elk-Antelope fields have three separate reservoir intervals in the Miocene Puri Limestone Formation, within the Puri Structural play which is present across the Fly Platform and Papuan Fold Belt.

Back in the beginning of 2017, ExxonMobil completed the acquisition of PNG focused InterOil and as a result, the company now holds operatorship of the PNG LNG Project and significant interest in the Elk-Antelope fields. As there are multiple partners, including Oil Search, who have interest in both the Papuan and PNG LNG Projects, discussions have been undertaken for the potential of developing the projects alongside each other. This has a multitude of benefits as PNG LNG is already up and running and development options could include synergies and collaboration between the projects, or, more interestingly, the possible expansion of the PNG LNG Project with gas from Elk-Antelope.

In August 2017 a significant milestone for the project was reached when joint venture partner ExxonMobil and Total announced that they hope to enter FEED in 2018 and FID in 2019. During the year pre-FEED commenced which aimed to identify the economic and technical viability of the project. First gas is not expected from the site until 2023.

PNG LNG Project - Expansion possibilities

As previously mentioned the benefit of having joint venture partners present in both the PNG LNG and Papuan LNG project, has opened up a whole realm of possibility for the future expansion of the PNG LNG Project.

Figure Two: Location of the PNG LNG Project

Figure 2 shows the project's location and associated fields and pipelines. It is estimated that around 10 Tcf of 2C discovered but undeveloped gas is located in close proximity to the main fields. These additional resources come from the Elk-Antelope fields in PRL 15, located to the west of the Gobe production facility, and the P'Nyang field in PRL 3, located to the North West. The addition of these reserves would underpin an extra two 4 MMtpa LNG trains.

Not only could these two fields significantly increase the capacity of the project, but there is an additional field which could also enhance its lifespan and capacity. As mentioned previously, Muruk was discovered in early 2017 and thought to be a look a-like of the Hides gas field and is being considered for incorporation with the PNG LNG Project. The inclusion of this field is dependent on successful appraisal, with Muruk 2 planned for early 2018, and could contribute up to 2 Bcf of gas - due to the discovery of two separate gas pools in the Greater Muruk structure and up to 40 MMb of condensate to the project.

Oil Search announced that the joint venture was planning on presenting their preferred development option for the PNG LNG expansion to the PNG Government in early 2018, along with the development concept for the Papuan LNG Project, in the hope that it will lead to negotiations for a final gas agreement. FEED is planned for 2H 2018 and Final Investment Decision targeted for 2019.

Western LNG Project

Throughout 2017 Horizon Oil Ltd continued to work on the development of its Western LNG Project, also located in the Papuan Basin along with the PNG LNG and Papuan LNG Projects. Western LNG is a proposed 1.5 MMtpa project, involving the development of Western Province gas resources, via a pipeline to a modular gas liquefaction processing facility located near Daru. The gas condensate pipeline, which is to be around 520 km long, will connect the western foreland fields which contain around 2 to 2.5 Tcf of gas and between 60 to 70 MMb of condensate. Initial economics on the project reported by Horizon indicate around a 20 year production plateau for gas, with significant input from condensate production to boost this performance outlook.

During Q2 2017 Horizon reported that it was in discussion with Kumul Petroleum, Papua New Guinea's National Oil Company, for the possible alternative development option of a pipeline to Port Moresby. The pipeline would be open access and has the potential enable the aggregation and facilitation of the undeveloped gas accumulations in the Western Province.

The cornerstone of the Western LNG Project, with a combined total of 58% of the total resources, is the Ketu and Elevala fields, which are located in PRL 21. The fields were discovered in 1991 and 1990 respectively and both have reservoirs in the Lower Cretaceous Elevala Sandstone Formation. The main play that underpins the project is the Ieru Structural play, which accounts for around 10% of the reserves within the Papuan Basin.

Horizon undertook pre-Front End Engineering and Design (pre-FEED) throughout the year, along with completing the significant acquisitions of the Ubuntu and Puk Puk/Douglas fields, following Mitsubishi's divestment of assets and the takeover of Eaglewood Energy. Kumul Petroleum also benefited from Mitsubishi's divestment, acquiring 20% interest in the Puk Puk/Douglas fields, through a separate agreement with Horizon. As a result, Horizon now owns 28% of the total certified resources that have been proposed to underpin the project. Project partner Repsol owns a total of 41% of the resources in the project and between them the two companies operate all associated licences.

Multiple development options were reported during the year for the future of the project and back in August 2017 a central gas conditioning plant was proposed, with a 300 MMcfg/d capacity located to the north of the gas fields, with a multiphase pipeline around 74 km, from the Stanley to Elevala locations. A second hub was also proposed located to the south in PRL 40, along with the possibility of a Floating LNG (FLNG) hull around 30 km from the shore. It is hoped that target Basis of Design and FEED will be completed by the end of 2018/early 2019 and that Final Investment Decision (FID) will be reached in 2019.

Whilst the project is fundamentally focused on the LNG and condensate production, there is the opportunity to consider gas sales to the domestic market and LPG sales. This in turn has the possibility of benefiting local land owners and communities along with the entire Western Province and State, as the main target market for LNG sales is the rapidly growing markets in China, Indonesian Archipelago, India and the South China Sea Rim.

Looking forward

Key upcoming events for 2018 include the tie in of the two Angore wells into the PNG LNG Project processing facilities, aiming to bring the wells into production in 2019. And, following the success at Muruk, further exploration activity, including a seismic programme, is planned over the Karoma prospect which lies to the north of Muruk. Other key prospects that are planned to be delineated over 2018 include those located in the Forelands/Gulf area of the Papuan Basin, in the licences adjacent to the Elk-Antelope field, such as the Triceratops North/West and Waxbill to name a few.

Oil Search also reported that the Antelope South prospect, targeting the Puri Limestone reservoir to the south of the Elk-Antelope field, is due to be drilled sometime in late 2018. The prospect, if successful, could add a further 5.5 Tcf of gas to the Papuan LNG Project (as estimated by InterOil in 2015).

Multiple fields are due to be brought online between 2018-2023 forming part of all three potential LNG Projects, along with the stand alone Pasca A1 field, which is planned to commence production in 2020 if all appraisal and development activities are successful.

The next few years in Papuan New Guinea's oil and gas sector look to be promising, and should further establish the country's prominence in the south-east Asian and global markets.

This is representation of the technical content delivered by our Upstream Intelligence Services GEPS. Learn more about the technical content available in our Global Exploration & Production Service.

Samantha Humphreys is a Senior Technical Researcher for

Australasia, Papua New Guinea and East Timor for IHS Markit.

Posted on 15 March 2018

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.