Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Sep 16, 2020

Case Study: In a future case with deep decarbonization, how would the operation and profitability forecasts evolve for various technologies?

Given the recent release of the Biden Plan—a $2 trillion jobs and clean energy plan proposed by President-Elect Joe Biden— there is renewed interest in cases involving faster and deeper decarbonization. IHS Markit explores decarbonization in two major modeling cases: our comprehensive power outlook through 2050, also called the "Planning Case," and "Fast Transition," our alternative case evaluating how both the power sector and the economy as a whole would have to evolve to achieve significantly faster and higher decarbonization.

Fast Transition deeply decarbonizes the US and Canadian economies and power sectors, achieving economywide carbon emission reductions exceeding 70% in both countries by 2050 (and greater than 90% decarbonization in the power sectors). You can learn more about the Fast Transition pathway to decarbonization through our summary post, as well as download the Fast Transition case's full Executive Summary.

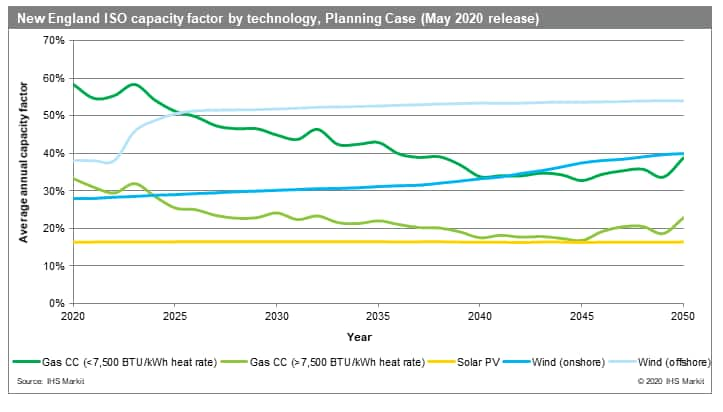

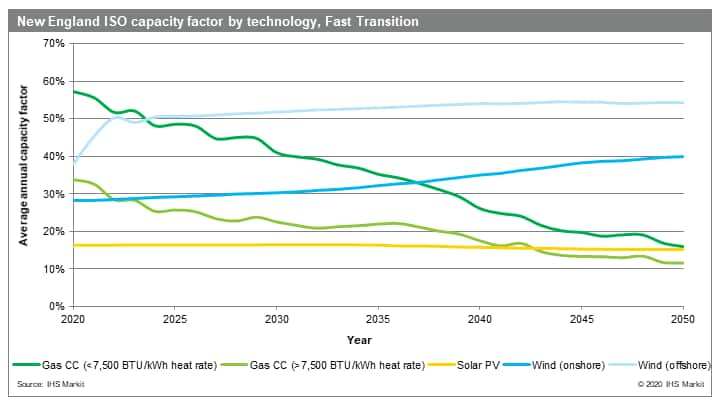

Case Study: How does a case with deep decarbonization alter the performance outlook for various power sector technologies? Using our North American Power Analytics product, we looked at the average capacity factor by technology over time in New England in both the Planning Case and Fast Transition:

Natural gas-fired combined cycle gas turbine (CCGT) plants are split into two buckets based on their heat rates, to assess how plant efficiency affects operations in the future under the two cases. In the Planning Case, natural gas-fired CCGTs see their capacity factors decline before leveling out in the latter half of the study period. In Fast Transition, however, the capacity factors continue to decrease through the 2040s and drop well under 20% by 2050 (both heat rate buckets).

Renewables do not see large differences in capacity factors between the two cases, although offshore wind sees higher fleet-wide capacity factors in the early 2020s as offshore wind is built more aggressively in Fast Transition, and newer offshore wind plants have higher capacity factors than the existing Block Island plant.

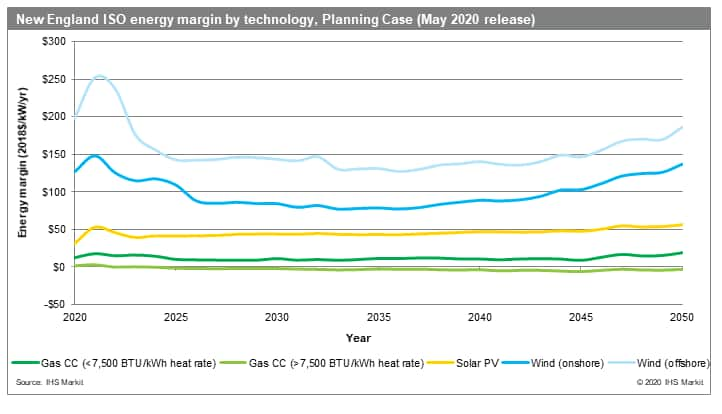

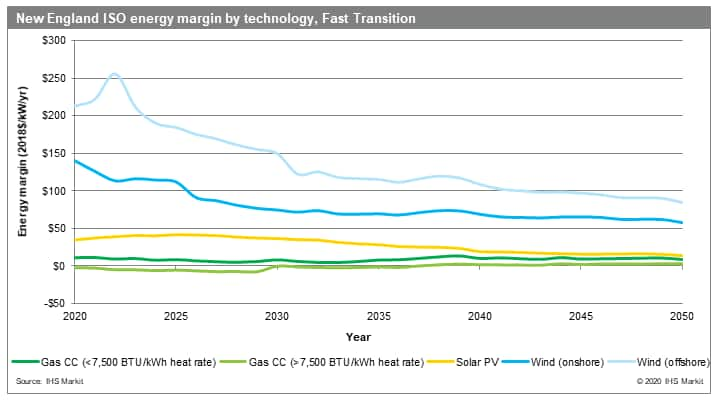

A more interesting way to delve into the cross-technology differences between the cases is to view the generator energy margins, or the revenues each plant makes in the energy market minus the variable costs of operation, including fuel costs, variable operation and maintenance costs, startup costs, and emissions costs. The evolution of each technology's energy margin is presented below.

There are some notable differences between the two cases with respect to the energy margin paths for the various technology types. While natural gas-fired CCGTs don't have high energy margin forecasts in the Planning Case, they have even lower margins in Fast Transition.

Renewables also see lower margins over time in the Fast Transition case. Onshore wind, offshore wind, and solar all see their energy margins decline in the last twenty years of Fast Transition, with their energy margins ending below half the margin values realized in the Planning Case in 2050. We know that renewables are not running less in the Fast Transition case, so much of the difference is from the lack of Federal carbon price in the Fast Transition case and higher renewable penetration levels cannibalizing the captured prices, revenues, and energy margins of renewable generators.

These insights were gained through our North American Power Analytics product. Learn more about our power analytics research and capabilities.

Drew Bobesink, Senior Research Analyst at IHS Markit, focuses on power market simulation and is a member of the North American Power and Renewables team.

Barclay Gibbs, Senior Director of Power and Renewables at IHS Markit, specializes in power market analysis, due diligence, and regulatory advisory for the North American Power and Renewables team.

Posted on 16 September 2020

Learn more about North American Power Analytics in our on-demand webinar:

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2ffuture-case-with-deep-decarbonization-operation.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2ffuture-case-with-deep-decarbonization-operation.html&text=Case+Study%3a+In+a+future+case+with+deep+decarbonization%2c+how+would+the+operation+and+profitability+forecasts+evolve+for+various+technologies%3f+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2ffuture-case-with-deep-decarbonization-operation.html","enabled":true},{"name":"email","url":"?subject=Case Study: In a future case with deep decarbonization, how would the operation and profitability forecasts evolve for various technologies? | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2ffuture-case-with-deep-decarbonization-operation.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Case+Study%3a+In+a+future+case+with+deep+decarbonization%2c+how+would+the+operation+and+profitability+forecasts+evolve+for+various+technologies%3f+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2ffuture-case-with-deep-decarbonization-operation.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}