Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Mar 27, 2020

Negative sentiment going into 2020 gives way to historical chaos in the North American service industry

In the weeks since the publication of our last WellIQ report <span/>several forces have plunged the upstream sector into what will surely be an historic downturn, and it's difficult to overstate just how dire the situation is in North America specifically.

Indeed, industry sentiment going into 2020 was "merely" bad as operators continued to be pushed towards capital discipline, and service companies had to adjust to tough market conditions shaped by lower activity demand coupled with ample supply. In just a few short weeks, the double-whammy of COVID-19 and the recent developments between Russia and OPEC have cratered demand for oil and, consequently, oil prices (further information on oil price and production outlooks can be found with our Energy: Global Oil Market team and Plays and Basins team).

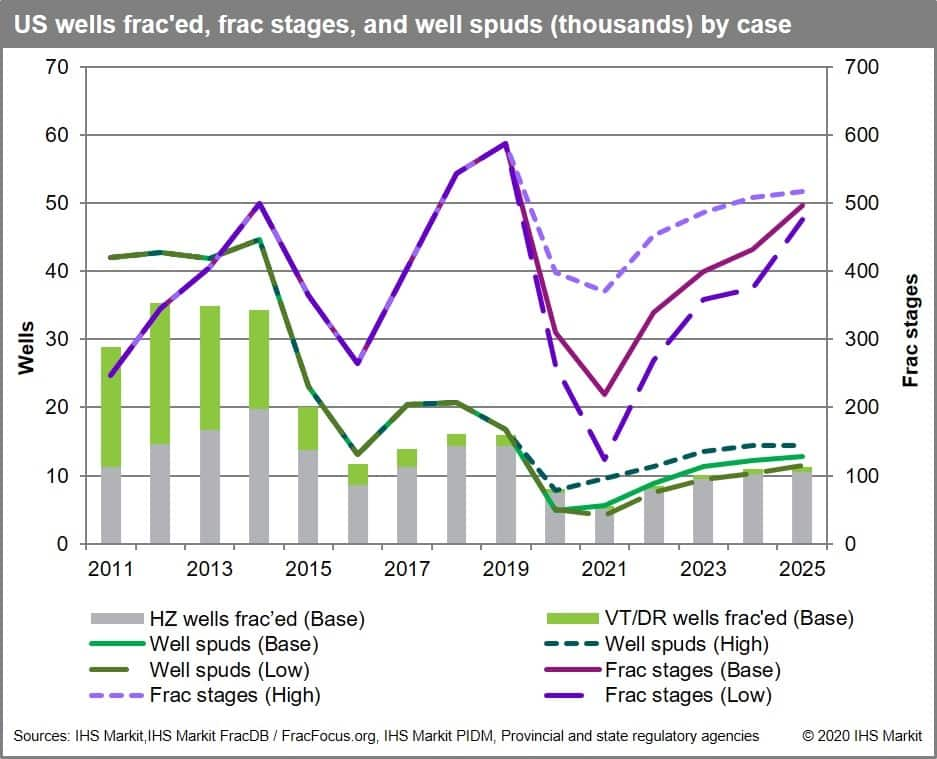

This paradigm shift caught many by surprise, and the effects to the North American service industry will be severe following the near-immediate reaction from operators to slash their capex budgets. We project spud count and frac count decreasing 76% and 42% respectively by the beginning of 2021, compared to the numbers published in February's WellIQ release.

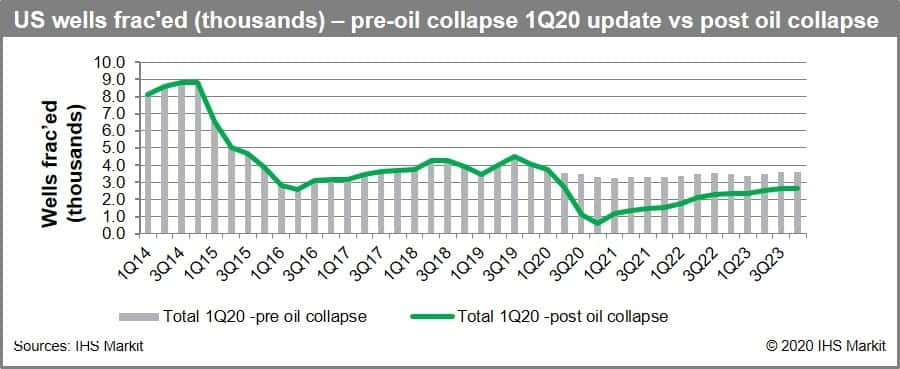

Figure 1: US wells frac'ed (thousands) - pre-oil collapse 1Q20

update vs post oil collapse.

Service companies had already been trying to get ahead of weak market conditions, with sand mines cutting costs and pumping companies stacking horsepower, notably Schlumberger and Halliburton which had announced cuts of 50% and 25%, respectively. Unfortunately, market conditions outpaced even the worst-case planning scenarios; we expect significantly more capacity cuts, and these will have to be severe to have any hope of meeting projected demand on the way down, which we believe may hit zero new wells in certain parts of the country at discrete times.

Figure 2: US wells frac'ed, frac stages, and well spuds

(thousands) by case.

Unfortunately, we do not believe that companies "on the bubble" will be able to ride this out. On one hand if there is a silver lining here at all, it's that service companies don't currently feel much pressure to grant price concessions since the feeling is they have already granted many (though some well-capitalized firms may choose to do so to maintain market share in the hopes this "investment" pays off in the long-run). On the other hand, despite somewhat steady pricing we anticipate a deep demand decline until at least the beginning of 2022, so service companies hoping to hang tight in the near-term in hopes of surviving until the next upturn will be out of luck.

Want more information on these findings? Contact us for a conversation. Learn more about our Onshore Services & Materials publications.

Paola Perez Pena is a principal research analyst in the Upstream Cost & Technology group, focusing on North American upstream operations, analytics and insights.

Posted 27 March 2020.

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fnegative-sentiment-going-into-2020-gives-way-to-historical.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fnegative-sentiment-going-into-2020-gives-way-to-historical.html&text=Negative+sentiment+going+into+2020+gives+way+to+historical+chaos+in+the+North+American+service+industry+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fnegative-sentiment-going-into-2020-gives-way-to-historical.html","enabled":true},{"name":"email","url":"?subject=Negative sentiment going into 2020 gives way to historical chaos in the North American service industry | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fnegative-sentiment-going-into-2020-gives-way-to-historical.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Negative+sentiment+going+into+2020+gives+way+to+historical+chaos+in+the+North+American+service+industry+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fnegative-sentiment-going-into-2020-gives-way-to-historical.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}