Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Mar 30, 2020

Global liquids surplus will hit hardest in crude sector

The spread of COVID-19 and, more directly, the lockdown measures being enacted by the world's governments have caused an unprecedented drop in oil product demand. IHS Markit estimates that global consumption of gasoline, diesel, and jet fuel is down nearly 20% this month (year on year basis) with a 30% decline looming in April. In volume terms, this works out to 367 million fewer barrels consumed this month and 553 million fewer next month (again, year on year basis).

In a perfect world, this demand destruction would translate evenly up the value chain, with refineries cutting back an equivalent amount of production and crude oil producers, in turn, reducing their output by the same volume. Our world, however, is not perfect and the reality is far messier. For one thing, refiners and oil companies are loath to cut production since, of course, that is how they make money. Second, shutting off a refinery or an oil well is not like flipping a light switch; it is costly and cumbersome to do and even more costly and cumbersome to undo.

However, refineries do have one general advantage over oil wells: it is easier for them to reduce production without shutting down. There is still a practical limit to how low a refinery can go, but it is more difficult for some oil producers to simply "throttle back" output. Moreover, two of the world's biggest oil producers - Russia and Saudi Arabia - are engaged in a price war and have actually increased their output over the past month. Finally, it is far more practical to store crude than product. Crude can be stored almost indefinitely, whereas diesel or jet fuel have a shelf life of around a year and gasoline can be stored for little more than a month before it starts to degrade.

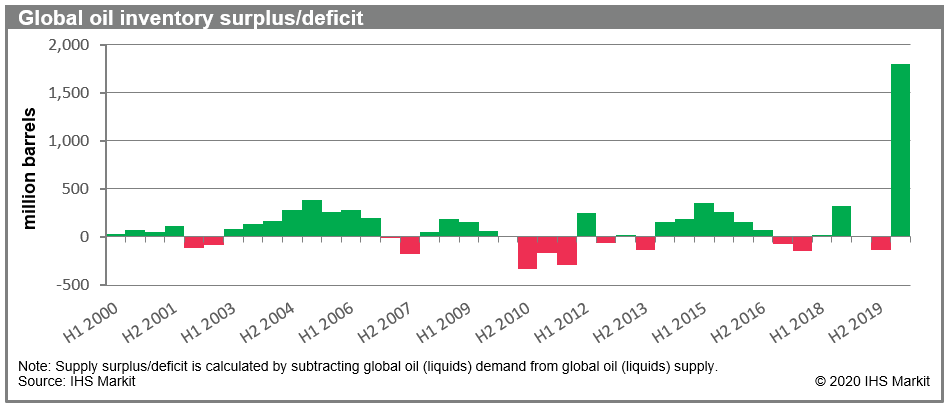

Figure 1: Global oil inventory surplus/deficit

IHS Markit predicts that global liquids supply will exceed demand by more than 1.8 billion barrels during the first half of this year. This is a staggering number; the previous "record" was a 350-million-barrel surplus in 1H2015. And for the reasons described above, most of the "burden" of managing this massive liquids surplus will fall on the crude sector. However, IHS Markit estimates that currently available crude storage capacity is only around 1.6 billion barrels. Clearly, something will have to give. Perhaps more crude will be refined into product and subsequently stored - though of course there is a finite volume of product storage as well. The unavoidable fact is that, absent a decrease in projected supply or increase in projected demand, significant bottlenecks will develop in the global liquids value chain by the end of next month.

While the looming oversupply will have negative implications for the entire oil sector, some countries are more vulnerable than others. For example, Nigeria, Alberta, and Norway (among others) have less than five days of domestic crude storage available. That is, absent an export market or functioning local refineries, these countries would run out of room for their crude production in less than five days. Put yet another way, these are countries that depend on the smooth functioning of the global oil system. This is true for all countries, of course, and the reality will be messier than a simple "days of storage" calculation, but it is clear that some countries are more vulnerable to a breakdown than others. Notably, Russia's days of available storage number is around eight; for Saudi Arabia, the figure is closer to 18.

Rob Smith is a Director of the Global Fuel Retail group at IHS Markit.

Posted 30 March 2020.

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fglobal-liquids-surplus-will-hit-hardest-in-crude-sector.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fglobal-liquids-surplus-will-hit-hardest-in-crude-sector.html&text=Global+liquids+surplus+will+hit+hardest+in+crude+sector+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fglobal-liquids-surplus-will-hit-hardest-in-crude-sector.html","enabled":true},{"name":"email","url":"?subject=Global liquids surplus will hit hardest in crude sector | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fglobal-liquids-surplus-will-hit-hardest-in-crude-sector.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Global+liquids+surplus+will+hit+hardest+in+crude+sector+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fglobal-liquids-surplus-will-hit-hardest-in-crude-sector.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}