Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Nov 26, 2019

Floating rigs with backlog extending at least two years continues to decline

IHS Markit analysis is showing that only 11% of floating drilling rigs worldwide have contracts that are longer than two years, with the vast majority of the fleet operating on shorter-term charters.

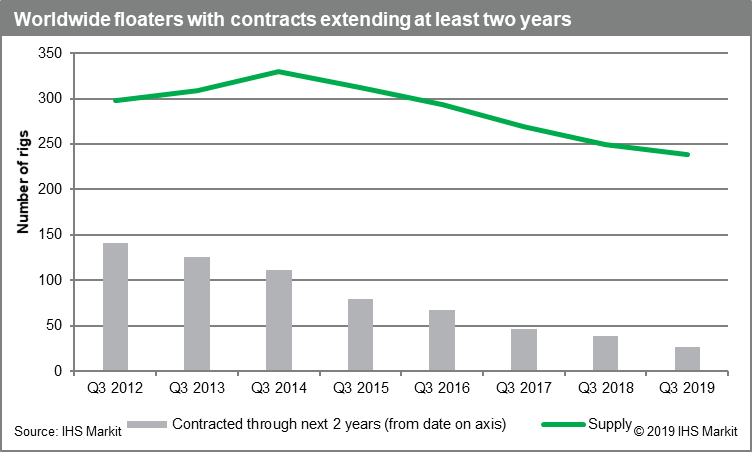

As seen in the chart below, when observing backlog at the end of the third quarter of each year, the number of floaters with contracts extending at least two years was in decline even before the most recent downturn began.

Figure 1: Worldwide floaters with contracts extending at least

two years

In the third quarter of 2012, 141 units representing 47% of the total floater fleet had two or more years remaining on their charters. By the third quarter of 2014, when the market downturn was just starting, that figure had dropped to 111, or 34% of supply. Jumping to the end of the third quarter of 2019, only 27 floaters had two or more years left on their charters. This represents 11% of the total floater fleet. When broken down by region, the US Gulf, South America, and Northwest Europe account for nearly all of this year's total.

A reduction in the number of floaters with longer-term contracts means an increase in rig availability, less pressure on operators to contract rigs quickly and for longer term, and generally a softening in the supply/demand dynamic leading to less pressure on day rates.

The trend for shorter contracts continues. Unless operators have a set requirement for multiple wells through a dedicated development or plug-and-abandonment programme, there is as yet no pressure to contract floaters for longer than is strictly required.

To learn more about our offshore rig and vessel markets coverage, visit the page for the Petrodata product suite.

Cinnamon Edralin is a Senior Offshore Rig Market Analyst at IHS Markit.

Posted 26 November 2019.

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2ffloating-rigs-with-backlog-extending-at-least-two-years.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2ffloating-rigs-with-backlog-extending-at-least-two-years.html&text=Floating+rigs+with+backlog+extending+at+least+two+years+continues+to+decline+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2ffloating-rigs-with-backlog-extending-at-least-two-years.html","enabled":true},{"name":"email","url":"?subject=Floating rigs with backlog extending at least two years continues to decline | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2ffloating-rigs-with-backlog-extending-at-least-two-years.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Floating+rigs+with+backlog+extending+at+least+two+years+continues+to+decline+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2ffloating-rigs-with-backlog-extending-at-least-two-years.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}