Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jun 04, 2021

Fast Transition presents a pathway for net zero emissions in North America

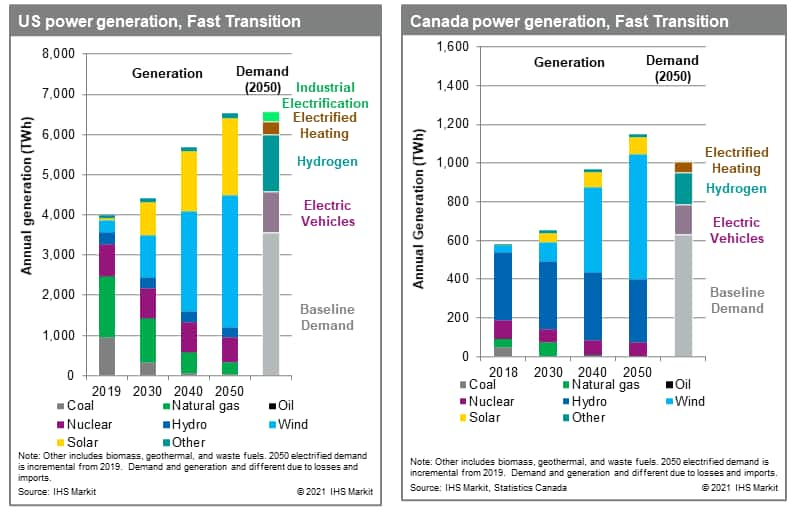

IHS Markit's upcoming 2021 Fast Transition Case demonstrates a pathway to achieve carbon neutrality in the power sector within the next two decades, and a net zero carbon economy by 2050. With a deep focus on electrification and efficiency, power sector on-grid energy demand rises by 63% even as economy-wide energy use sees a net decline.

Download the Fast Transition Executive Summary.

The Fast Transition's pathway to economy-wide carbon neutrality in the United States and Canada is comprised of three broad strategies:

- The complete electrification of surface transportation and the significant electrification of certain residential, commercial, and industrial activities;

- Near-total power sector decarbonization, over 90% by 2040 and 97% by 2050; and

- Economy-wide carbon net neutrality is achieved using offsets.

Looking at Fast Transition on a sector-by-sector basis:

Electric Power. A near-total power sector decarbonization, over 90% by 2040 and 97% by 2050, with residual carbon emissions being fully offset with land use and direct air capture technologies by 2040. The power sector's decarbonization pathway includes the phase out of conventional coal, deployment of carbon capture and sequestration, longer life extensions for nuclear plants and a fifteen-fold growth in solar and wind capacity.

A key challenge in achieving near-total power sector decarbonization is maintaining reliability to meet daily, monthly, and seasonal variations in power demand and renewable resource availability. Fast Transition provides this flexibility with

- Hundreds of GW of batteries with storage durations of up to 10 hours

- An expansion of natural gas with carbon capture and storage alongside the retirement of the last remaining conventional coal assets. Much of the conventional natural gas‒fired power assets in the United States and Canada remain online and operate flexibly and at overall low capacity factors, typically under 10% in the late 2040s.

- Flexible demands - especially the large loads resulting from vehicle electrification, which will be responsive to times when the grid is most stressed.

Transportation. On-road transportation sector is decarbonized by 2050 with a combination of battery electric vehicles (BEVs) and hydrogen fuel cell electric vehicles (FCEVs). By 2050, BEVs account for 80% of light-duty vehicles and 40% of medium and heavy duty vehicles; the balance in each sector are FCEVs. The FCEVs use green hydrogen produced via water electrolysis. The electrolyzer demand is managed as a flexible load that responds to energy price signals, operating on a schedule to utilize renewable energy output when it is not needed for other connected grid load, therefore not increasing the need for firm generating capacity. This is not simply a strategy to use "curtailed energy", rather, incremental renewable capacity is developed with the intent of serving electrolyzer demand, and the electrolyzers are scheduled to use that energy without driving a need for incremental peak capacity.

Residential and commercial sectors. Natural gas and fuel oil used for space and water heating are replaced with electricity in millions of homes and buildings, accounting for 5% of net on grid power demand by 2050. This drives a large share of demand in evening and early morning hours in cold-climates. Supportive rate structures to minimize electric vehicle charging during peak heating demand hours will be critical to reducing peak hour generation, transmission, and distribution system demands.

Industrial sector. While electrification also plays a role in the industrial sector, some industrial end uses may struggle to full electrify, and in these cases hydrogen produced with natural gas is assumed to assist decarbonization efforts.

Offsets. The use of offsets is a common strategy in carbon net-neutrality studies, and the reason most government and corporate carbon reduction goals are expressed on a net neutral basis, rather than as a total elimination of fossil fuel use. Fast Transition relies on offsets created by "carbon removal" methods, particularly "nature-based solutions" like agricultural and land use practices, or direct air capture technology, a family of related technologies using chemical media or membranes to remove carbon dioxide from ambient air and then sequester the carbon, usually in an underground reservoir. Offsets take the economy to a net zero carbon status in 2050, but not without cost. The use of offsets is expected to add about $0.76/million Btu to economy-wide average energy costs.

IHS Markit closely monitors the North American energy markets, publishing data, key insights and market analysis. Learn more about our research.

Patrick Luckow, associate director on the Climate and Sustainability team at IHS Markit, specializes in regional and national carbon policy and associated markets, including the Regional Greenhouse Gas Initiative, the California-Quebec cap and trade market, and REC markets in the US Northeast.

Posted on 4 June 2021

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2ffast-transition-presents-a-pathway-for-net-zero-emissions.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2ffast-transition-presents-a-pathway-for-net-zero-emissions.html&text=Fast+Transition+presents+a+pathway+for+net+zero+emissions+in+North+America+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2ffast-transition-presents-a-pathway-for-net-zero-emissions.html","enabled":true},{"name":"email","url":"?subject=Fast Transition presents a pathway for net zero emissions in North America | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2ffast-transition-presents-a-pathway-for-net-zero-emissions.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Fast+Transition+presents+a+pathway+for+net+zero+emissions+in+North+America+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2ffast-transition-presents-a-pathway-for-net-zero-emissions.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}