Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jun 04, 2021

Corporate renewable procurement in Asia Pacific: Opportunities amid challenges

In many Asia Pacific markets, corporate renewable procurement is still at its infancy, but the outlook is now changing as more companies are making commitment to 100% renewables and pledge a significant cut in their emissions. Companies with headquarters in Asia-Pacific now represent more than 40% of members in RE100, a global corporate initiative consisting of businesses committed to 100% renewable electricity. More than 300 companies from Asia-Pacific are also members of the science-based target initiative, which enables companies to set GHG targets in line with the climate science. With more governments responding to corporate demand for reducing their emissions by gradually lifting regulatory barriers, the corporate renewable procurement is now emerging as an attractive tool for both developers and consumers to prepare for a low-carbon future.

Key drivers for corporate renewable procurement in the region include a policy push for not only increased renewable share by governments, while also addressing regulatory hurdles in sourcing clean electricity from suppliers. For instance, South Korea, a monopoly electricity market regulated by a state-owned utility Korea Electric Power Corporation (KEPCO), will allow consumers to purchase electricity directly from renewable electricity suppliers starting this year as large conglomerates such as LG and SK group have lobbied to deregulate the retail sector amid mounting supply chain pressures from their global customers.

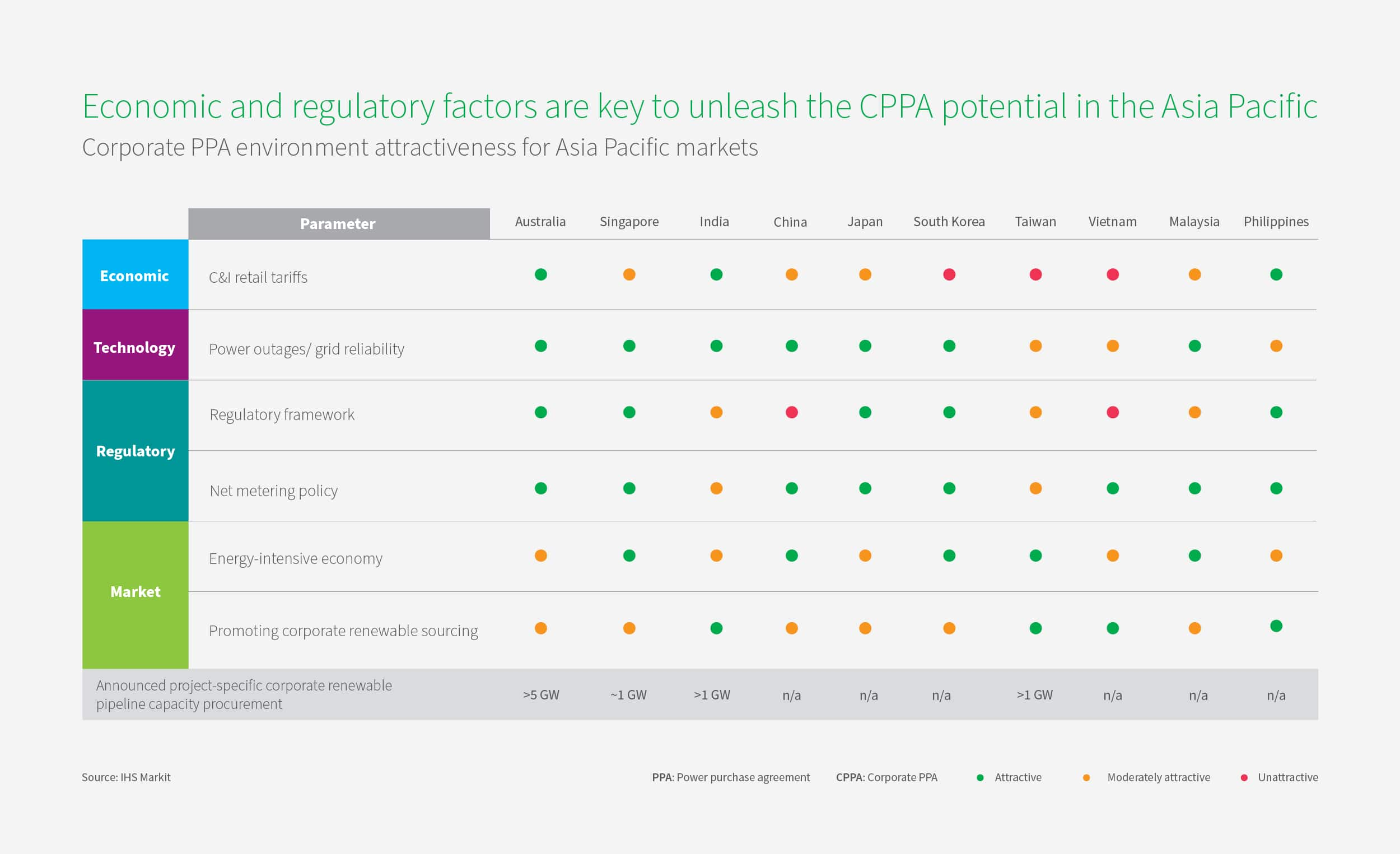

However, each market in Asia Pacific is unique in terms of the driving factors shaping corporate renewable procurement. In particular, the level of renewable generation costs against the retail tariffs - a key factor in gauging the economic attractiveness of corporate renewable procurement - vary by markets. For example, consumers in South Korea, Taiwan and Vietnam are likely to pay a significant premium over retail tariffs for a few more years when sourcing clean electricity from power suppliers, because retail tariffs in these markets are regulated to keep at low levels to promote domestic manufacturing. On the other hand, markets like India where the retail tariffs for C&I consumers are relatively high due to cross subsidization of other consumer categories and the cost of renewables are one of the lowest in the region, corporations have significant cost saving opportunity on switching to renewables.

In terms of regulatory parameters and ease of implementation for corporate renewable procurement, certain markets such as Mainland China, South Korea, Taiwan, and Vietnam do not favor corporate procurement as the utility companies have monopoly over power supply. However, these markets are attractive in terms of market potential with energy-intensive economies and pressure to procure 100% power from renewables to fulfil targets of multi-national corporations such as Apple, Google, and BMW, etc.

According to IHS Markit's database that tracks over 400 project-specific procurement activities in the APAC region, Australia and India dominate the corporate renewable procurement by projects announced so far with over 90% share. Other emerging markets in the region include Mainland China, Japan, South Korea and Taiwan, which are in the process of either lifting regulatory barriers to enable corporate renewable procurement or are slated to benefit from the decline in technology costs in the mid to long term.

In terms of procurement options, direct PPA or virtual PPA is the dominant contract type in the region depending on the power market structure and the availability of the financial hedge instrument. Going forward, a wide range sourcing options across the markets may emerge that are tailored to their market structure.

While opportunities for corporate renewable procurement are certainly rising, there are still many stumbling blocks that need to be overcome, most of them unique to each market condition. In Australia, electricity consumers are faced with a wide variety of complex procurement options, which all come with different economic implications and risk profiles. The high regulatory uncertainty across the state in India restrains the renewable procurement market from unleashing its potential. On the other hand, the emerging corporate procurement markets such as Mainland China, Japan, and South Korea face challenges from the rigid market structure as well as economics that place renewable procurement prices at a significant premium to on-grid electricity tariffs.

Learn more about our integrated energy research in Asia Pacific.

Ankita Chauhan, Senior Research Analyst on the Climate and Sustainability team at IHS Markit, has more than seven years of experience in the renewable energy and climate change sectors, with a special focus on market and policy trends for wind and solar.

Joo Yeow Lee, Associate Director on the Climate and Sustainability team at IHS Markit, leads the renewable research for Southeast Asia, covering the fundamental analysis of government policies, targets, regulations, competitive landscape, market players, pricing, market screening and market entry strategies.

Kaori Tachibana, Associate Director on the Climate and Sustainability team at IHS Markit, covers the power, gas, and renewable markets in Japan, looking at supply/demand balances, infrastructure developments, policy developments, and pricing outlooks.

Logan Reese, Associate Director on the Climate and Sustainability team at IHS Markit, leads the research and analysis for gas, power, and renewables markets in Australia, focusing on market fundamentals, power and renewable developments, and policy developments.

Shan Xue, Associate Director on the Climate and Sustainability team at IHS Markit, focuses on coal and power supply and demand fundamentals analysis, energy intensity analysis, long-term provincial coal and power supply and demand modeling, and Chinese energy company profiles.

Vince Heo, Associate Director on the Climate and Sustainability team at IHS Markit, focuses on power and renewable market development and LNG demand analysis.

Posted on 4 June 2021

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fcorporate-renewable-procurement-in-asia-pacific-opportunities.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fcorporate-renewable-procurement-in-asia-pacific-opportunities.html&text=Corporate+renewable+procurement+in+Asia+Pacific%3a+Opportunities+amid+challenges+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fcorporate-renewable-procurement-in-asia-pacific-opportunities.html","enabled":true},{"name":"email","url":"?subject=Corporate renewable procurement in Asia Pacific: Opportunities amid challenges | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fcorporate-renewable-procurement-in-asia-pacific-opportunities.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Corporate+renewable+procurement+in+Asia+Pacific%3a+Opportunities+amid+challenges+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fcorporate-renewable-procurement-in-asia-pacific-opportunities.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}