Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Nov 21, 2019

An analysis of arbitration clauses in hydrocarbon contracts

Hydrocarbon contract dispute resolution clauses are intended to resolve disputes arising between host states and investors; but how do they compare with the global best practices? Note: current best practice establishes the need to decrease the degree of uncertainty of the contracting parties from the outset by adequately detailing dispute resolution clauses in hydrocarbon contracts and/or licenses/leases (where applicable).

IHS Markit analysis identifies that shortfalls exist in the arbitration clauses in hydrocarbon contracts globally which may affect certainty in resolving potential disputes between the parties in the future.

By way of introduction, typically disputes between the host states and the investors, depending on the type of hydrocarbon regime are resolved via a number of mechanisms, such as:

- amicable resolution via meetings and/or negotiations (which is always the first course of actions)

- expert determination (typically exclusively reserved for specific types of disputes, for example, disputes arising from valuation of petroleum, disputes of technical nature and unitization dispute, amongst others)

- mediation (conciliation) or administrative procedures (both used relatively rare)

- arbitration or litigatiom

Scope of Arbitration

While litigation is a process that involves determining disputes through a court, with a judge or jury, arbitration is a process that involves two parties in a dispute who agree to work with an impartial third party to resolve the dispute. Arbitration is a private form of binding dispute resolution, conducted before an impartial tribunal of arbiters, deriving from the agreement of the parties.

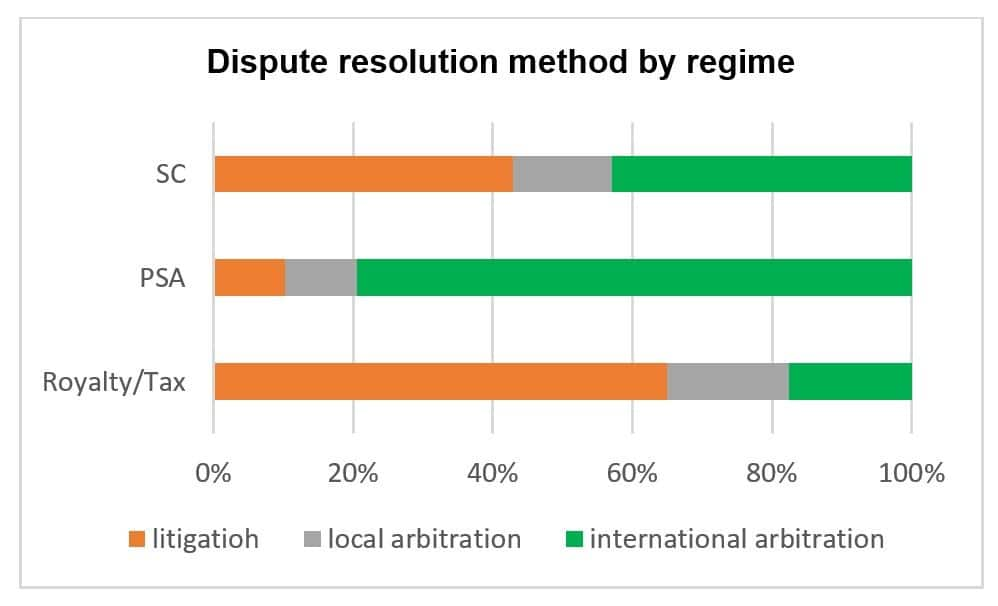

For this overview we analysed dispute resolution provisions of 132 hydrocarbon regimes (57 royalty and tax (R/T) regimes granted by conclusion of concession agreements or through issues of a licence), 68 production sharing agreements (PSA) and 7 service contract (SC)) globally[1].

As summarised in the figure below, we identified that 65% of the R/T arrangements require disputes arising between the state and investors to be resolved by either administrative procedures or by litigation, where an amicable resolution fails to resolve a dispute satisfactorily. The remaining 35% of R/T regimes are to be resolved by either international or local arbitration.

By contrast, 80% of PSAs require disputes to be resolved by

international arbitration with 10%

resolved by litigation and 10% by local arbitration.

Figure 1: Dispute resolution method by regime

Furthermore, it was observed that no unanimity is found under different regimes as to what disputes fall under the resolution by arbitration (i.e. exclusivity of arbitration). For example, many contracts provide that any dispute arising between the parties to the contract shall be resolved through arbitration (Turkmenistan PSA of 1997). At the same time, under other contracts disputes are to be resolved via litigation, that precludes exclusivity of arbitration. For example, specific matters that are subject to litigation rather than an arbitration include disputes deriving from:

- Real estate, land access matters and property rights (Georgia, Mongolia, Brazil)

- Contract interpretation (Ukraine)

- Tax matters (Ecuador)

- Contract execution, termination, invalidity (Syria)

- Administrative rescission or any act of authority (Mexico)

- Limitation based on the claim's amount (Argentina)

Arbitration rules

It is common for the host countries to have legislation that determines arbitration provisions including in certain cases the arbitration rules. It should be noted also that some jurisdictions (e.g. Ireland, Iran, Malaysia, Australia among others) have drafted their arbitration laws based on the UNCITRAL Model Law on International Commercial Arbitration (UNCITRAL Model Law). The UNCITRAL Model Law provides a framework for the alignment of domestic arbitration laws with international commercial arbitration standards on all aspects of the process, from the arbitration agreement through to enforcement.

At the same time, in many jurisdictions parties to a hydrocarbon contract are free to agree upon the procedures for their arbitration. Arbitration rules are generally far simpler and more flexible than court rules. As a result, they are relatively easily understood by parties of different nationalities, the proceedings are more easily focused on the substantive issues and the parties are better able to adapt the dispute resolution process to suit their relationship and the nature of their disputes. Such arbitration rules are the rules that the arbitrators use in "running" the arbitration.

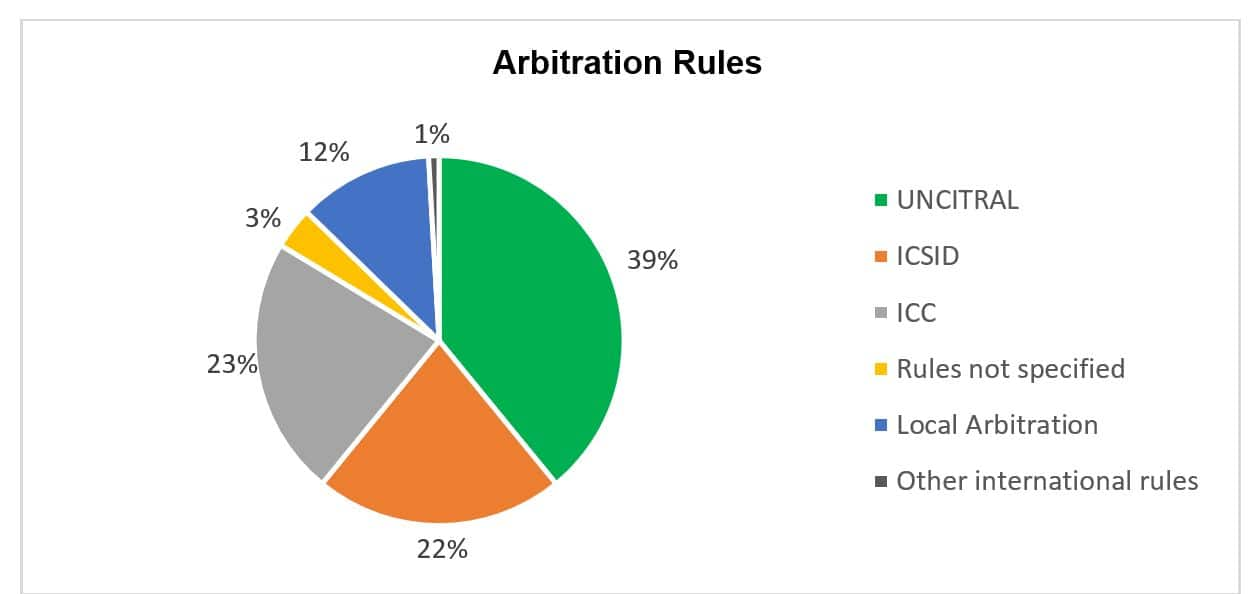

As summarised in the Figure below, 39% of hydrocarbon contracts refer to UNCITRAL rules for arbitration, 23% refer to ICC, 22% refer to ICSID rules, 12% refer to arbitration of domestic rules, for 3% of cases rules are not specified in the hydrocarbon contract and in 1% of cases other international rules are applied.

Figure 2: Arbitration Rules

The UNCITRAL Arbitration Rules provide a comprehensive set of procedural rules upon which parties may agree for the conduct of arbitral proceedings arising out of their commercial relationship and are widely used in ad hoc arbitrations as well as administered arbitrations. The Rules cover all aspects of the arbitral process, providing a model arbitration clause, setting out procedural rules regarding the appointment of arbitrators and the conduct of arbitral proceedings, and establishing rules in relation to the form, effect and interpretation of the award.

The ICC Rules of Arbitration are used all around the world to resolve disputes. They define and regulate the management of cases submitted to the International Court of Arbitration. These rules assure parties of a neutral framework for the resolution of cross-border disputes.

The ICSID Arbitration Rules apply to proceedings under the ICSID Convention or ICSID as an additional facility.

It is worth stating that in many jurisdictions requiring compliance with local arbitration rules such rules are broadly aligned with the UNCITRAL rules.

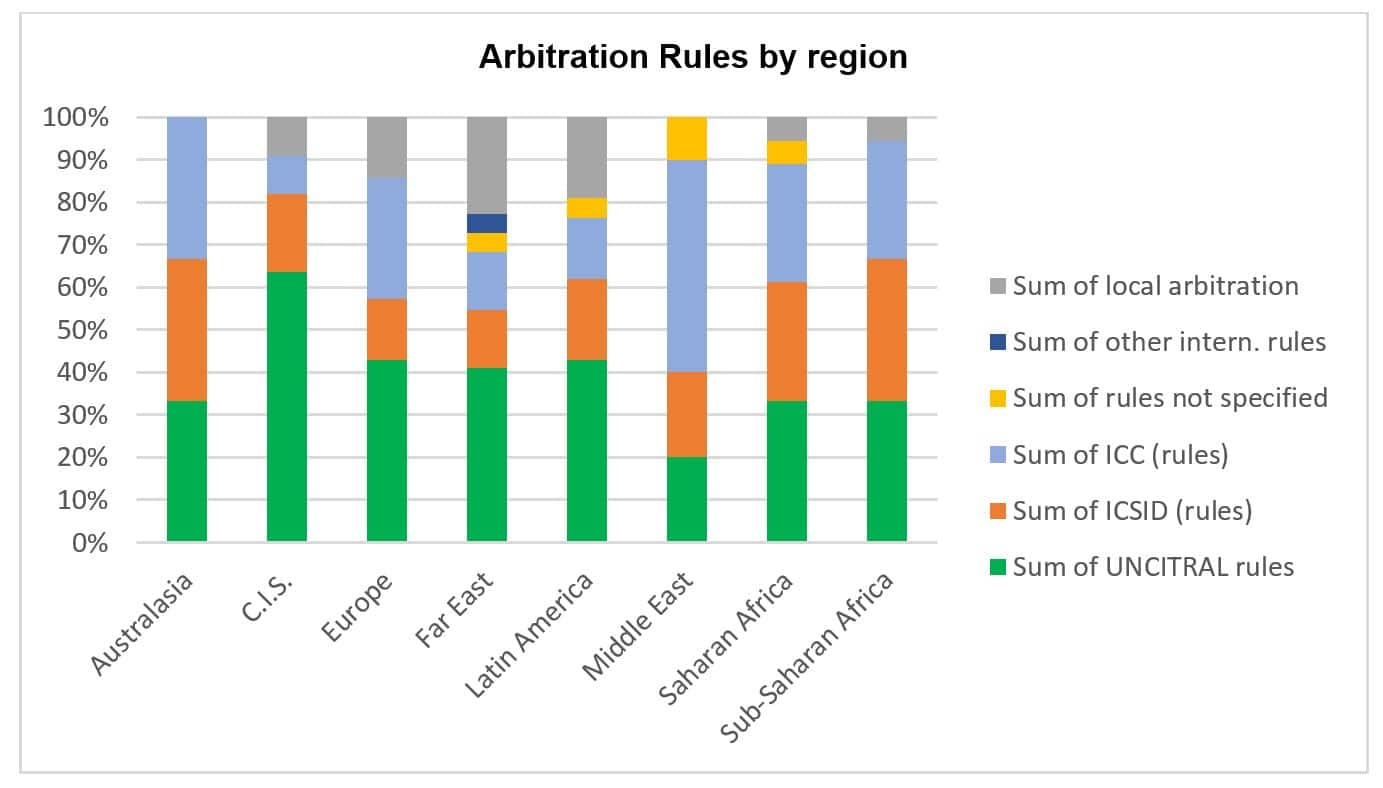

When comparing arbitration rules by a region, UNCITRAL

arbitration rules would also appear to be the preferable

arbitration rules in each region except for the Middle East,

followed equally by ICC and ICSID rules, as summarised below.

Figure 3: Arbitration Rules by region

Place (Seat) of Arbitration

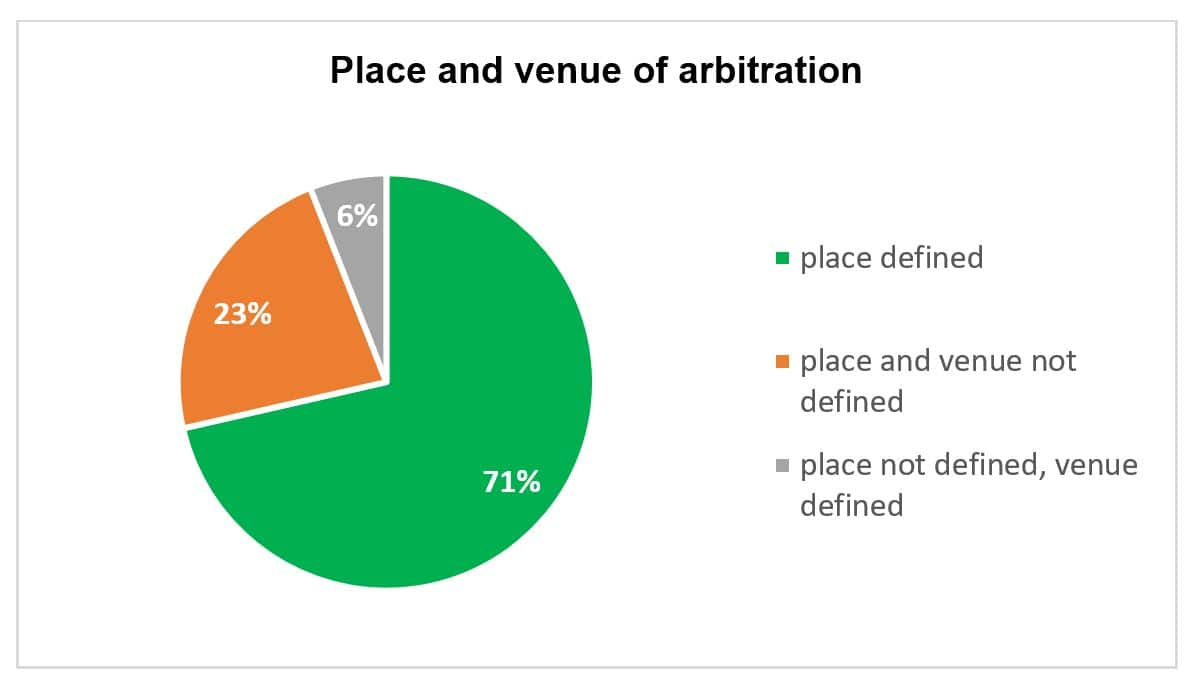

The place (seat) of arbitration is significant as it determines which country's procedural laws will apply to practical aspects of the arbitration including any rights of appeal, the availability of interim remedies and the extent to which the local courts will support or supervise the arbitration.

The place (seat) of arbitration differs from the venue of arbitration. The venue typically considers to be the physical location where the hearing of a dispute is held.

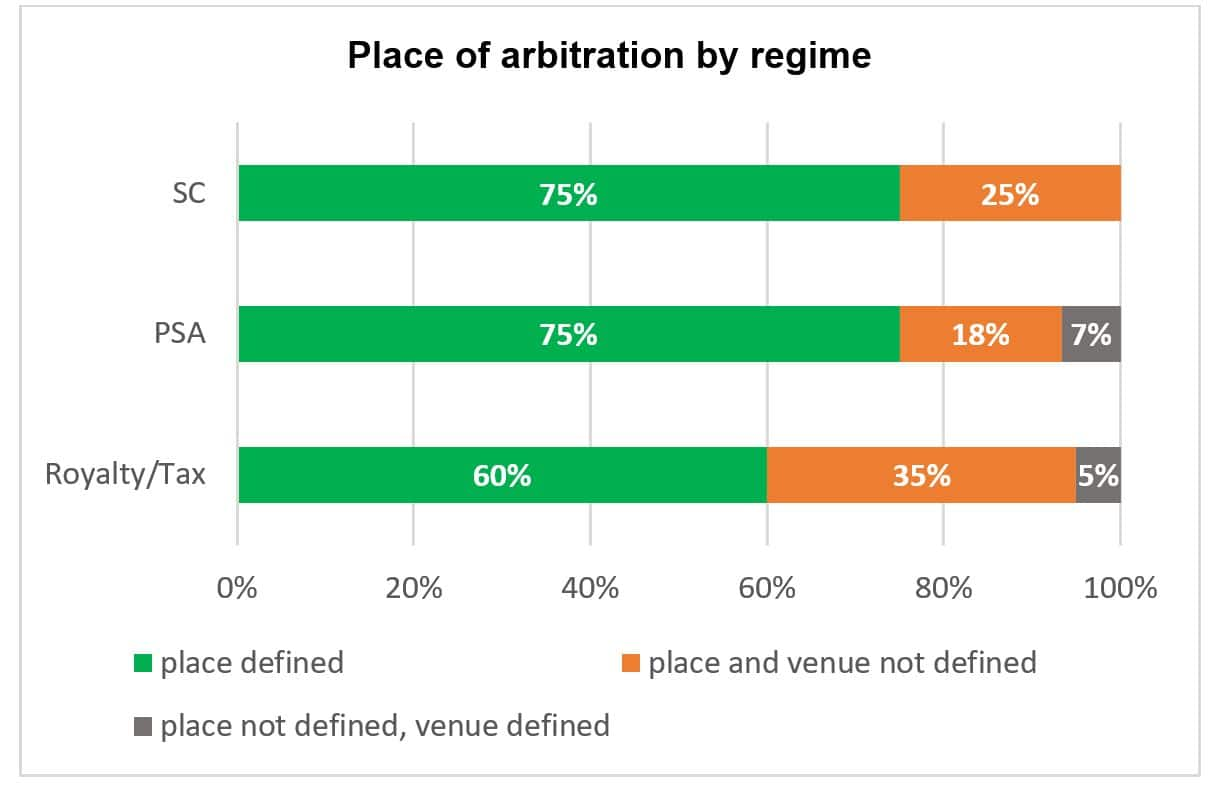

Based on our analysis, 71% of all hydrocarbon contracts that provide for disputes to be resolved by arbitration make clear provisions defining a place (seat) of arbitration, while 23% of hydrocarbon contracts do not make clear provisions to define such a place, leaving the door open to agreeing such a place when a dispute arises. At the same time, 6% of hydrocarbon contracts make provisions defining the venue of arbitration instead of a place, as summarised below.

Figure 4: Place and venue of arbitration

This overall statistic varies depending on the hydrocarbon contract type. For example, in the PSAs and SCs the place (seat) of arbitration is defined in 75% of the total number of contracts, compared with only 60% of R/T contracts.

Figure 5: Place of arbitration by regime

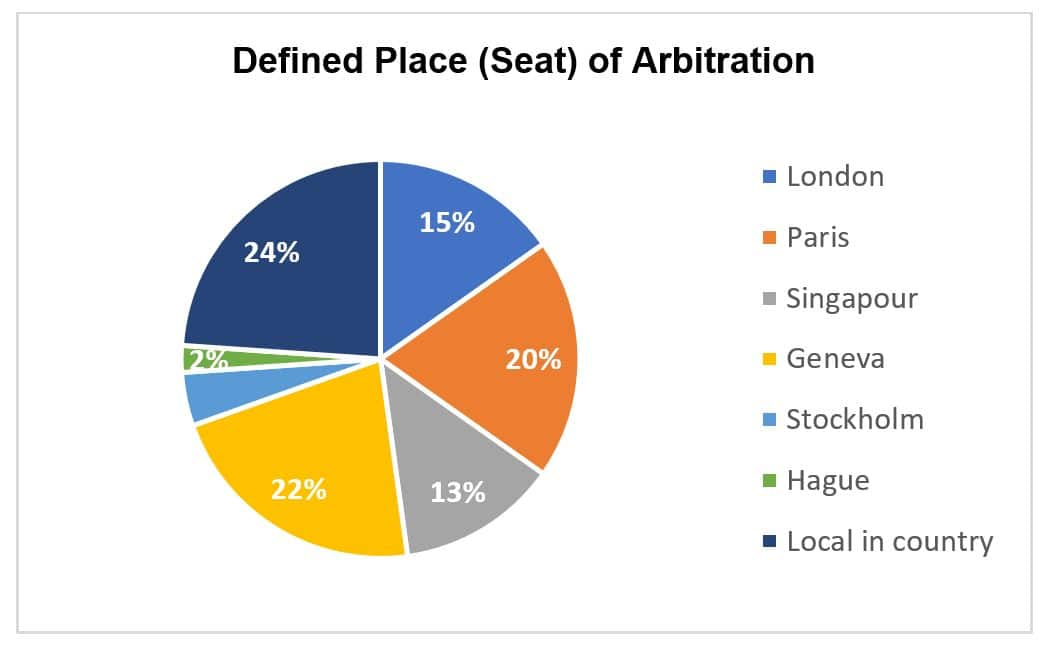

The most popular international places (seats) of arbitration are Geneva, Paris, London, Paris, Stockholm and Singapore, as summarised below. However, 24% of the contracts provide for a local or other international place (seat) of arbitration.

Figure 6: Defined Place (Seat) of Arbitration

Governing Law

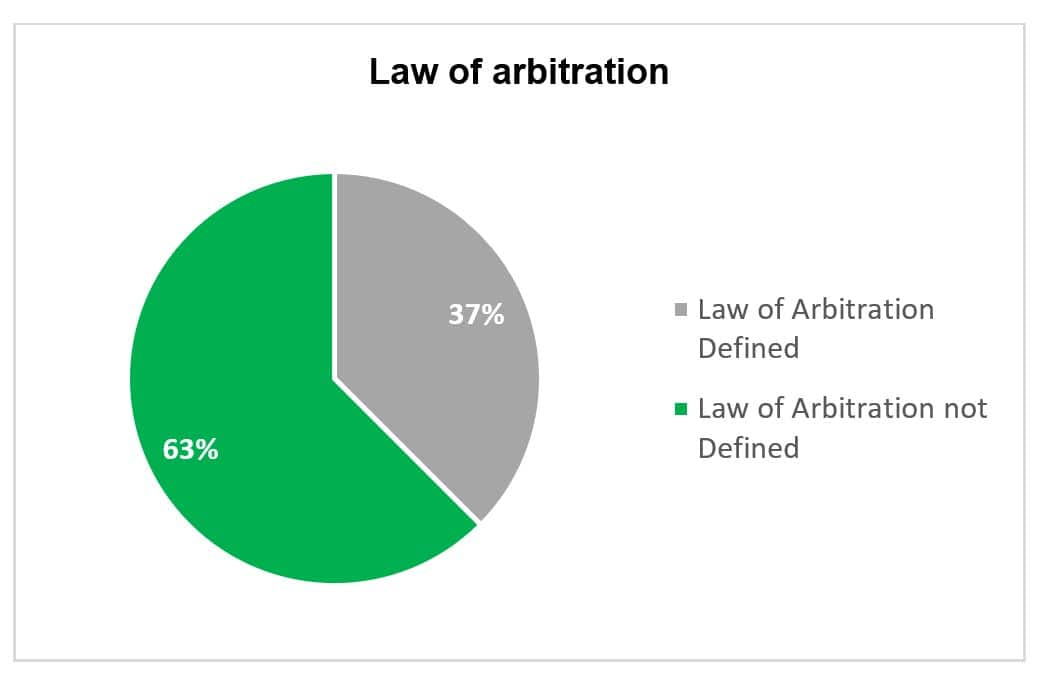

In 63% of hydrocarbon contracts reviewed globally, the governing law of arbitration is not explicitly defined in the arbitration clauses presumably on the assumption that the governing law of the contract would apply to dispute resolution. However, 37% of hydrocarbon contracts explicitly provide for law of arbitration - which is the country's law, as summarised below.

Figure 7: Law of arbitration

Such provisions are more common in hydrocarbon contracts in Africa and Latin America than in other regions globally.

Recognition and enforcement of arbitration awards

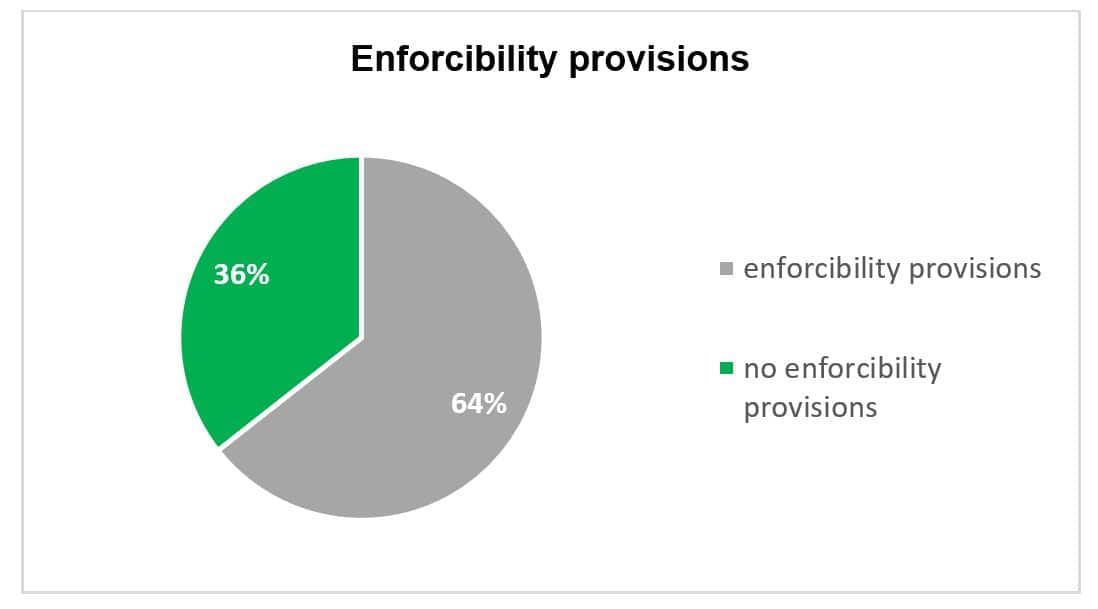

Based on our analysis, typically explicit provisions are made in hydrocarbon contracts acknowledging the final and binding nature of arbitration decisions. However, 36% of these contracts do not make any explicit provisions confirming enforceability of decisions in the courts.

Figure 8: Enforcibility provisions

Having said that it must be recognised that 160 countries globally ratified the Convention on the Recognition and Enforcement of Foreign Arbitral Awards, commonly known as the New York Convention of 1958, which is a multilateral treaty for the enforcement of arbitral awards to which over 160 countries are party.

In conclusion, it is worth reiterating that well-drafted dispute resolution and arbitration clauses give important protection both to the host government and investors in case of a dispute, conflict or disagreement. In drafting such provisions in hydrocarbon contracts, it is worth considering and defining the following:

- determination of all permissible methods of dispute resolution and the sequence of their applicability

- provision of a definition or description of what constitutes a dispute

- clarity on which disputes are subject to resolution by expert determination, where required

- clarity on which disputes are subject of arbitration - exclusivity (where certain disputes can only be resolved via local litigation as per the legislation, clear communication between the parties should take place in the process of contract negotiations)

- determination of arbitration rules

- specification of the number of arbiters and rules for their appointment, where/if such rules differ from the arbitration rules

- determination of the place (seat) of arbitration

- definition of the language of arbitration

- definition of the arbitration law (substantive law)

- provisions confirming the final and binding nature of arbitration decisions

- confirmation of enforceability of a decision through local courts, where this is applicable

Read more about IHS Markit's Dispute and Resolutions Support and how we can assist.

Yelena Shliomenzon is an Energy Regulatory Consulting Director at IHS Markit.

Posted 21 November 2019.

[1] Source of analysis: IHS Markit PEPS. Reference to hydrocarbons contract is a reference to a contractual arrangement between the host state and investor irrespective of the fiscal regime. i.e. excludes grant of rights via licenses/permits.

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fan-analysis-of-arbitration-clauses-in-hydrocarbon-contracts.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fan-analysis-of-arbitration-clauses-in-hydrocarbon-contracts.html&text=An+analysis+of+arbitration+clauses+in+hydrocarbon+contracts+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fan-analysis-of-arbitration-clauses-in-hydrocarbon-contracts.html","enabled":true},{"name":"email","url":"?subject=An analysis of arbitration clauses in hydrocarbon contracts | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fan-analysis-of-arbitration-clauses-in-hydrocarbon-contracts.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=An+analysis+of+arbitration+clauses+in+hydrocarbon+contracts+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fan-analysis-of-arbitration-clauses-in-hydrocarbon-contracts.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}