Published July 2023

Phthalic anhydride is a white crystalline solid that is the commercial form of phthalic acid. The largest markets for phthalic anhydride are phthalate plasticizers, unsaturated polyester resins and alkyd resins for surface coatings. Commercial phthalic anhydride is 99.8%-99.9% pure (99.5% is generally guaranteed) and is available in two forms — flake and molten. Most worldwide consumption of phthalic anhydride is molten.

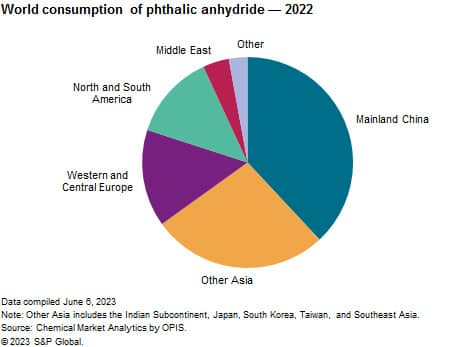

The following pie chart shows world consumption of phthalic anhydride:

The largest market for phthalic anhydride is the manufacture of phthalate plasticizers, which consumed nearly half of all phthalic anhydride consumed. Asia is the largest consumer of phthalic anhydride for the production of plasticizer. Mainland China is the world’s largest consumer of phthalic anhydride for phthalate plasticizers. The next-largest markets for phthalic anhydride outside of Asia are Western Europe and the Indian Subcontinent.

The second-largest market for phthalic anhydride is in the manufacture of alkyd resins, which consumed nearly a quarter of all phthalic anhydride. Again, Asia is the largest consumer of phthalic anhydride for this application, accounting for nearly three-quarters of the phthalic anhydride consumed for alkyd resins. Mainland China is the world’s largest consumer of phthalic anhydride for alkyd resins. The next-largest markets for phthalic anhydride outside of Asia are Western Europe and the Indian Subcontinent.

Demand for most of the downstream markets of phthalic anhydride is greatly influenced by general economic conditions. As a result, consumption of phthalic anhydride largely follows the patterns of the leading world economies. Consumption of phthalic anhydride depends heavily on construction/remodeling activity (residential and nonresidential), automobile production and original equipment manufacturing.

For plasticizers, Asia (mainland China and India) and Western Europe will be the leaders in volume growth; Asia’s growing economy will result in a higher domestic demand for phthalic anhydride.

Consumption of phthalic anhydride in alkyd resins is expected to increase slightly in 2022–27. Above-average growth is expected in Asia (particularly in mainland China), the Indian Subcontinent, and Southeast Asia, even though consumption is declining in Japan and South Korea.

Consumption of phthalic anhydride for unsaturated polyester resin production is expected to increase during 2022–27, but growth will vary by region. The Asian markets are forecast to see growth in demand, particularly mainland China, India and Southeast Asia, while consumption for unsaturated polyester resin will decline in Japan.

For more detailed information, see the table of contents, shown below.

S&P Global’s Chemical Economics Handbook – Phthalic Anhydride is the comprehensive and trusted guide for anyone seeking information on this industry. This latest report details global and regional information, including

Key benefits

S&P Global’s Chemical Economics Handbook – Phthalic Anhydride has been compiled using primary interviews with key suppliers and organizations, and leading representatives from the industry in combination with S&P Global’s unparalleled access to upstream and downstream market intelligence and expert insights into industry dynamics, trade and economics.

This report can help you

- Identify trends and driving forces influencing chemical markets

- Forecast and plan for future demand

- Understand the impact of competing materials

- Identify and evaluate potential customers and competitors

- Evaluate producers

- Track changing prices and trade movements

- Analyze the impact of feedstocks, regulations, and other factors on chemical profitability