Global ESG and sustainable indices to meet the needs of responsible investing

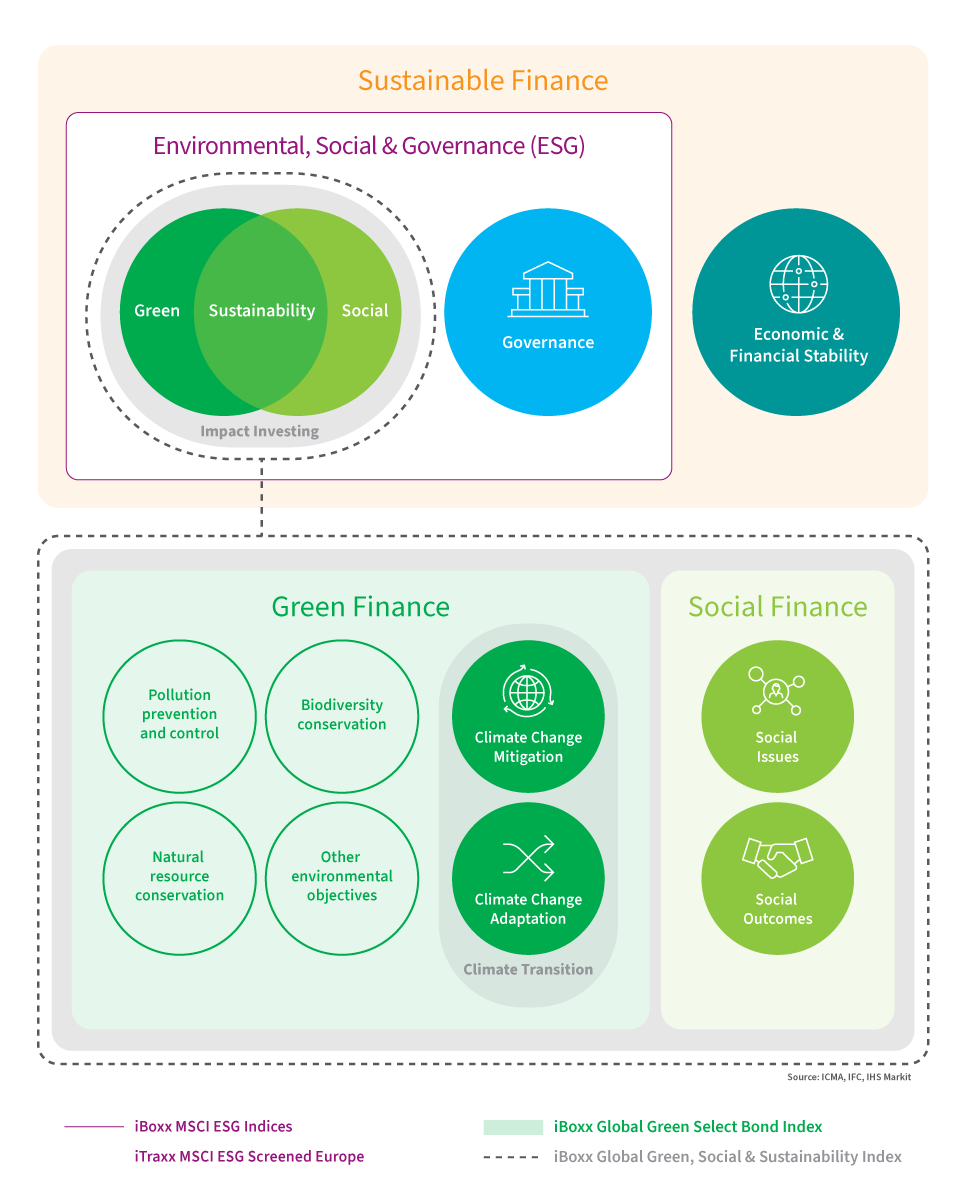

Global requirements for responsible investing are driving the demand for transparency in environmental, social and governance (ESG) considerations for benchmark and tradable indices underlying investment portfolios and other financial products. With initiatives from global supranational institutions such as EU Sustainable Finance, UN Framework Convention on Climate Change, ICMA Green and Social Bond Principles, to name a few, the appetite for incorporating ESG and sustainability factors into indices is growing. We are playing a vital role in this ecosystem and have developed a suite of sustainable fixed income indices, leveraging proprietary and third party ESG datasets. These indices provide the marketplace with insights and design choices for implementing sustainable investment objectives.