S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer LoginsS&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Forecasting & Planning

Sales Performance & Marketing

Vehicle In Use

Content

Automotive

Forecasting & Planning

Sales Performance & Marketing

Vehicle In Use

Content

Automotive

One thing is certain whether you are an evangelist or taking a more conservative approach; nobody can stop talking about EV.

Timing aside, saying the EV transition delivers a fundamental, tectonic shift in the automotive marketing world is not hyperbole. OEMs - old and new - are working with a clean slate in how to design, source, build, sell and service EV models.

These impacts on marketing investment and communications planning are significant. New vehicles, new customer types, and new ways to order, purchase, and service a vehicle are all combined with the growing importance of lifetime customer value, providing a clean slate approach to marketers and their partners.

And it's in this space - with these new customer types, motivations, and buying styles - where Polk Automotive Solutions is responding by building a new audience taxonomy specifically for EV marketers.

Helping brands connect with these new

customers

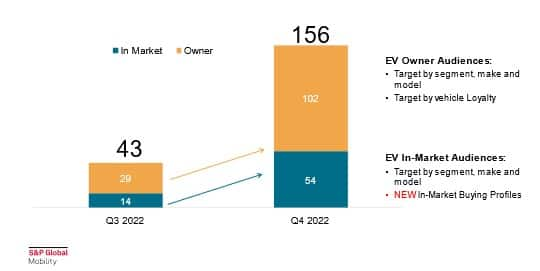

Polk Audiences has crafted over 150 EV segments - spanning owners

and in-market shoppers - that allow marketers to target the

segment, make, and model level (Figure 1).

Fig. 1: Polk Audiences EV segments increase nearly 4x

Utility migration will play a

significant role in the transition to EV

Loyalty to the SUV body style is growing at an all-time high of

74%. And for the first time, more car owners are buying a utility

(47%) instead of another car (42%)

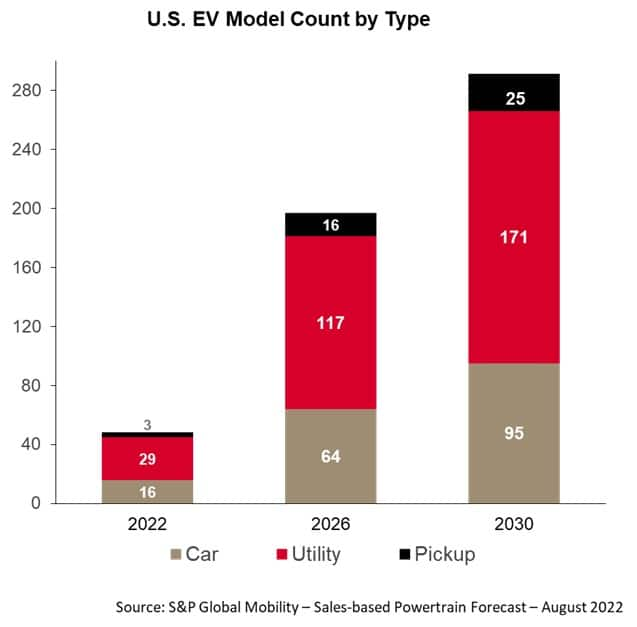

• EV model count to approach 200 in 2026 and 300 in 2030 (Figure

2)

• 60% of new EV models will be utility

• Utility is the one segment where nearly every mainstream and

luxury brand compete

These new product launches will dominate marketing investment, pushing EV shoppers to retail locations online and in dealerships.

Fig. 2: EV model count by segment

Making an EV Audience

Taxonomy

To build these segments, Polk Audiences utilized the industry's

most robust data sets and true EV modeling expertise,

including:

Fig. 3: EV in-market buying profiles

Marketing impact as EV sales grow

With an influx of new vehicles and customer types coexisting with

current and existing models, the competition for customer attention

— particularly in the utility segment — will be fierce. As

a result, the importance of investment in marketing technology and

customer relationship management (CRM) programs is growing and, in

many ways, is now a more critical, strategic decision than media

investment and placements.

Consumers expect customization and targeted messaging from brands.

Now is the time for auto marketers to fortify their CRM assets and

strengthen their EV audience development strategies to build

customer connections that deliver results.

Learn more about our EV segments

This article was published by S&P Global Mobility and not by S&P Global Ratings, which is a separately managed division of S&P Global.