Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer LoginsS&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Forecasting & Planning

Sales Performance & Marketing

Vehicle In Use

Content

Automotive

Forecasting & Planning

Sales Performance & Marketing

Vehicle In Use

Content

Automotive

Senior Research Analyst, Supply Chain & Technology, S&P Global Mobility

By a wide margin 2023 was the hottest year on record -- and scientists warn that the weather could only get warmer.

Amid escalating global temperatures and extreme weather events, the automotive industry faces increasing pressure to reduce emissions. Rising worldwide demand for battery electric vehicles is expected to alleviate some climate change effects, but it's little respite. Inherent risks and complexities across the vehicle's life cycle make realizing their true environmental impact challenging.

Decarbonization in the mobility sector is now a matter of necessity. As wildfires, heatwaves, water stress, and hurricanes become more frequent, they cause ecological and social disruptions and expose companies' assets to physical risk. The transportation sector accounts for a quarter of global greenhouse gas emissions and is receiving a solid push from government action and regulatory frameworks to pivot toward sustainability.

Global initiatives such as the Paris Agreement 2015, which aims to limit global warming to 1.5°C above pre-industrial levels by 2050, have set a clear precedent. Fifteen countries have already signed net-zero regulations into law, while another 50 countries have pledged to carbon-neutral targets. The financial sector displays similar commitments with central banks and stock exchanges integrating environmental, social, and governance (ESG) considerations into their reporting and operating requirements.

At the heart of the automotive industry's journey to sustainability is the EV revolution. Once a niche market, EVs are now seen as a critical component of the decarbonization strategy. However, the transition to electric mobility faces environmental concerns and sustainability challenges, particularly regarding the production and lifecycle of EV batteries.

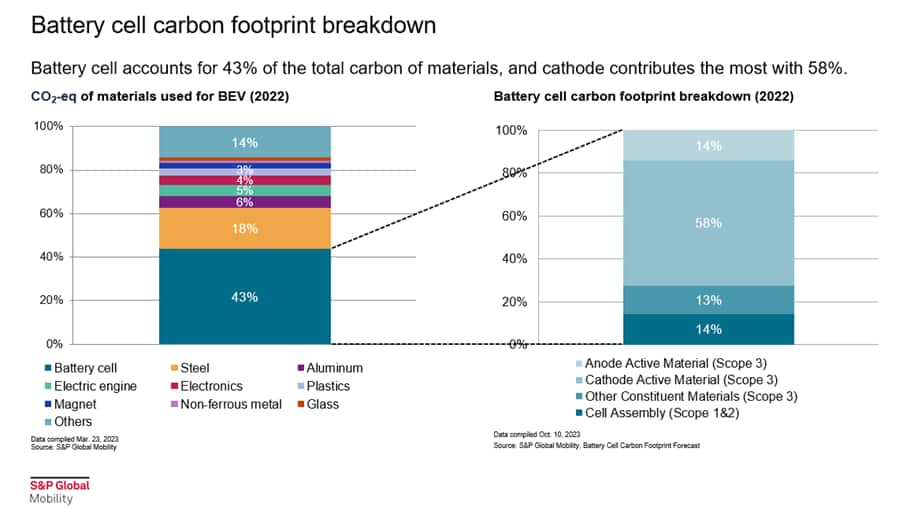

The carbon footprint of an electric vehicle is not confined to its tailpipe emissions—non-existent in EVs—but is intricately linked to its battery. The production phase of battery cells, which involves extracting and processing minerals like lithium, nickel, and cobalt, is particularly energy intensive. For example, the cathode and anode materials alone constitute about 72% of the total emissions from battery production. This aspect is concerning as it represents a significant portion of the vehicle's overall environmental impact.

To further complicate the matter, there are difficulties in

assessing the carbon footprint of EV batteries. The boundaries of

carbon footprint — whether cradle-to-gate, cradle-to-grave, or

well-to-wheel — significantly influence the results and

interpretations of these assessments. Different boundaries in

calculations can lead to varying conclusions about where to make

the most impactful emissions reductions, affecting everything from

consumer choices to regulatory policies.

The United Nations, European Union and other major countries are attempting to establish globally recognized standards and provide much-needed consistency in carbon footprint calculations. While this homogenization remains a work in progress, automakers, regulators, and manufacturers must increase their efforts to mitigate carbon emissions from BEVs across the value chain.

S&P Global Mobility's High Voltage Battery Forecast projects a 24% compound annual growth rate (CAGR) for global demand for electric vehicles, from 750 GWh in 2023 to over 3400 GWh by 2030. With this surge in demand for EVs, the automotive industry faces a dual challenge. Not only does it need to ramp up production to meet this demand, but it must also ensure that this expansion does not come at an unsustainable environmental cost. Companies such as Tesla, BYD, and General Motors aggressively pursue carbon neutrality, integrating advanced technologies and renewable energy sources into their production processes to reduce emissions.

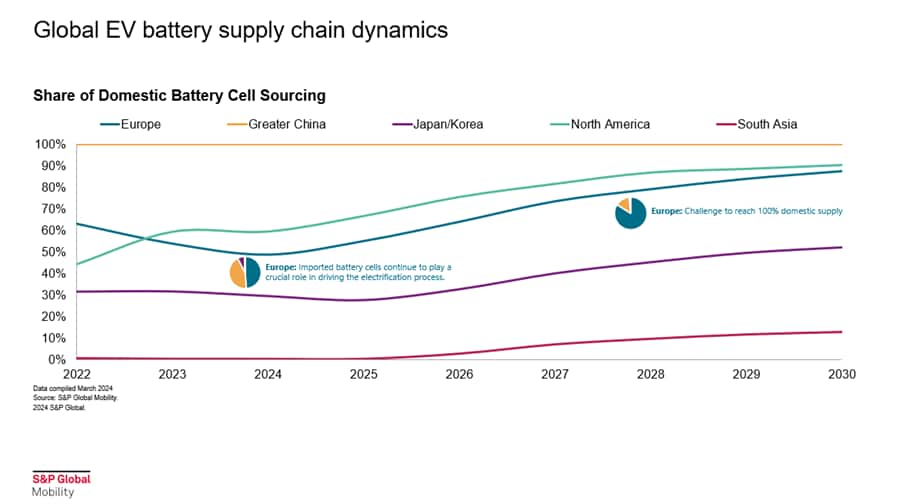

The scale of emissions from batteries by 2030 is estimated to be equivalent to the carbon footprint of 39 million people globally, reinforcing the need for aggressive carbon reduction strategies across the battery production lifecycle. Europe is leading the way with stringent regulations that push for lower carbon footprints in battery production, which may slow their progress towards becoming fully self-reliant on domestic supply.

In contrast, China, as a significant battery producer and exporter, now faces the challenge of reducing its higher carbon footprint to meet these European standards. With emissions per kWh of cell manufacturing measured at about 17 kilograms of CO2 in 2022, China is focusing on reducing this to sub-10 levels by 2030 through electrification of gigafactories and investing in provinces with abundant hydroelectricity. Decarbonizing cathode and anode material production is also critical, given their significant contribution to the overall carbon footprint. Together, these changes are setting a precedent that could define the future of automotive manufacturing worldwide.

Moreover, the entire supply chain, from mine to market, is under scrutiny for its environmental impact. The concept of "scope emissions," which categorizes emissions into direct, indirect, and supply chain categories, is helping companies identify and mitigate their environmental impacts. Using renewable energy in battery production and adopting carbon-neutral shipping practices are becoming increasingly common. Such practices are examples of innovations in supply chain management.

The push for decarbonization is also reshaping consumer expectations. Today's consumers are more environmentally conscious, often willing to pay a premium for sustainably produced goods. This shift is influencing the automotive sector and the broader manufacturing landscape as companies across industries strive to align themselves with their customers' values.

However, achieving true sustainability in the automotive sector requires more than clean manufacturing processes. It necessitates a holistic approach considering the vehicle's entire lifecycle, from design and production to end-of-life recycling. The future of mobility, therefore, lies not only in electrification but in a comprehensive rethinking of how vehicles are made and used.

As the industry navigates these complex challenges, the role of international cooperation and technological innovation becomes increasingly apparent. The journey towards a sustainable automotive sector is not a solo race but a collective effort that spans continents and industries. With the right mix of policy support, corporate governance, and consumer engagement, the goal of a carbon-neutral mobility sector will be within reach.

This article is part of a series featuring highlights from S&P Global Mobility's 2024 Solutions Webinar Series. Objective Assessment of Battery Cell Contributions to Carbon Footprint webinar occurred on April 11, 2024.

Register for upcoming webinar sessions.

This article was published by S&P Global Mobility and not by S&P Global Ratings, which is a separately managed division of S&P Global.