Listen to this Fuel for Thought

Podcast

Discover Insights from S&P Global's Report:

Reinventing the Truck 2023

Around the world, disruption is coming to the medium and heavy

commercial vehicle (MHCV) industry. An increased focus on climate

change, strict regulations, and technological innovations are

expected to change the future of this industry. In the 2023

Reinventing the Truck (RTT) update, experts from S&P Global

Mobility and S&P Global Commodity Insights have partnered to

identify and address major questions facing the industry. This

report navigates a landscape in flux. Growing optimism for

electrified vehicles is weighed against the backdrop of practical

challenges. S&P Global's scenario-based approach strives to

strike a delicate balance between the two. Updates this year focus

on improved prospects for natural gas and hybrid trucks and

challenges around the infrastructure buildout for the MHCV energy

transition, among other things.

Background

As governments worldwide depend on zero-emission vehicles (ZEV)

to meet climate and energy goals, trucking will undoubtedly play a

significant role in the upcoming energy transition. Though medium

and heavy commercial trucks represented less than 4% of on-road

vehicle sales in 2023 (excluding three-wheelers), according to our

Commodity Insights Team, they account for 39% of road transport

liquids demand and 40% of on-road CO2 emissions, respectively. This

report examines the impact of changes in technology and regulations

on truck demand, propulsion trends, powertrain shifts, energy

demand, and regional climate goals over the next three decades. It

focuses on mainland China, Europe, Japan, and the United States.

The RTT report presents two forecast scenarios to 2050: Inflections

and Green Rules. Inflections represents a continuation of the

status quo, where balancing decarbonization ambitions must be

weighed equally against adoption constraints. Green Rules, on the

other hand, is an alternative scenario that envisions a strong

energy transition driven by increased focus on climate change and

technological advancements. In this scenario, the clean energy

revolution transforms the MHCV fuel mix.

Inflections: Balancing MHCV decarbonization ambitions

with practical challenges

- Around the world the adoption of battery-electric and fuel-cell

electric MHCVs varies in pace, and catalysts for change will occur

gradually.

- In some markets, the zero-emission vehicle (ZEV) sales share is

expected to accelerate compared with forecasts published 12 months

ago.

- Diesel alternatives will extend beyond ZEVs, with natural gas

and hybridization also expected to contribute to the future

powertrain mix.

- Downside risks to the ZEV forecasts are considered, and any

changes in the political landscape and proposed regulations are top

of mind.

- Government policies and initiatives jump-start investment

activity, but their success is not yet certain.

Green Rules: A clean energy revolution transforms the

MHCV fuel mix

- Market forces and investment activity signal significant

acceleration in zero-emission alternatives. Governments will

continue to support the energy transition with new funding

opportunities combined with the implementation of new

regulations.

- Countries around the world vigorously pursue the energy

transition to create a competitive edge in the global

marketplace.

- Increased demand for clean technology will prompt a robust

market response, leading to increased supply and lower prices.

- OEM investments and industry innovation strongly pivot toward

ZEVs.

Additional insights into the new questions we answered and

drivers of change established in the latest RTT report are included

below. We also offer a glimpse into key outcomes from the long-term

forecast and discuss our tracking of energy transition signposts,

highlighting the key conclusions of this year's report, which is

now available for subscribers.

Exploring catalysts for change and answering new

questions

Each year, as we discuss a new Reinventing the Truck study, we

reflect on key developments and milestones from the past 12 months.

We also anticipate looming trends and catalysts for change that are

on the horizon, this year's report was no exception.

- Alternatives such as natural gas and most notably hybrid

electric vehicles (HEVs) show higher forecasts compared with

previous RTT reports. The sales share of HEVs increased due to

strong pressure to comply with upcoming regulations, concerns about

potential battery raw material shortages, high costs of ZEVs and,

in many cases, underdevelopment of the ZEV ecosystem.

- Battery cost (dollars per kilowatt-hour) forecasts in our MHCV

TCO have been increased. The TCO forecast uses notably higher

battery costs compared with last year's study. Potential shortage

of raw materials, lack of economies of scale, competition with the

Light Vehicle market, and uncertainty with long-term partnerships

are main reasons for this new cost assumption. However, regional

differences are important to note, we expect lower battery costs in

mainland China compared to other markets.

- Costs or savings of the ZEV adoption were closely examined,

identifying major challenges and signposts. OEMs cannot afford to

subsidize the purchase costs of ZEVs. Support to alleviate cost

burdens would be a key signpost to track. Government support and

potentially higher costs for end consumers will help offset these

elevated expenses.

- Regulations in Europe and the United States are complicating

operations and strategic decisions for global OEMs. Recent changes

aim to promote cleaner diesel trucks and electrification, but they

come with additional costs and complexity for internal combustion

engines (ICEs) and the broader ecosystem.

- In some areas of the global truck market, the ZEV sales share

in the Inflections scenario is expected to accelerate compared with

forecasts published 12 months ago. A variety of new product

launches, the introduction of new regulatory policies and the

launch of initiatives focused on supporting decarbonization are all

reasons for this increase. However, it is important to point out

that these increases are somewhat targeted, with the biggest coming

in the late 2020s and early 2030s led by battery-electric vehicles

(BEVs) and fuel-cell electric vehicles (FCEVs) in the United Sates

and Europe. By 2050, the increases are less noticeable in favor of

a more optimistic view on hybridization and natural gas compared

with last year.

- Investment in ICE and corresponding improvements in fuel

efficiency differ by scenario. In the Green Rules scenario, OEMs

somewhat abandon their investment in ICE technology, resulting in

two outcomes. First, OEMs rely almost exclusively on ZEVs to comply

with upcoming regulations. Second, this trend accelerates the total

cost of ownership (TCO) parity between zero-emission vehicles and

ICE vehicles.

- Signposts are documented and are key to the ZEV adoption in

each scenario. This study assesses key signposts in the Inflections

and Green Rules scenarios. It also evaluates necessary trends and

developments required for these forecasts to materialize,

encompassing the tracking of costs, product availability,

regulations, infrastructure deployment and other pertinent

factors.

- The infrastructure for battery-electric and hydrogen-powered

trucks is complex and requires significant investment. The report

provides insights into the challenges of zero -emission MHCV

infrastructure and presents potential scenarios for its

implementation. For instance, by 2030, the US may need to have

60,000 to 100,000 MHCV chargers available to accommodate our BEV

forecast, depending on charger utilization. In the 2040s, the US is

projected to have one of the largest hydrogen trucking fleets in

the world. To minimize costs, it will be essential to maximize the

utilization of hydrogen refueling stations. By the end of this

decade, an estimated 4,000 to 11,000 hydrogen refueling stations

will be needed for MHCVs in the US, depending on station

utilization.

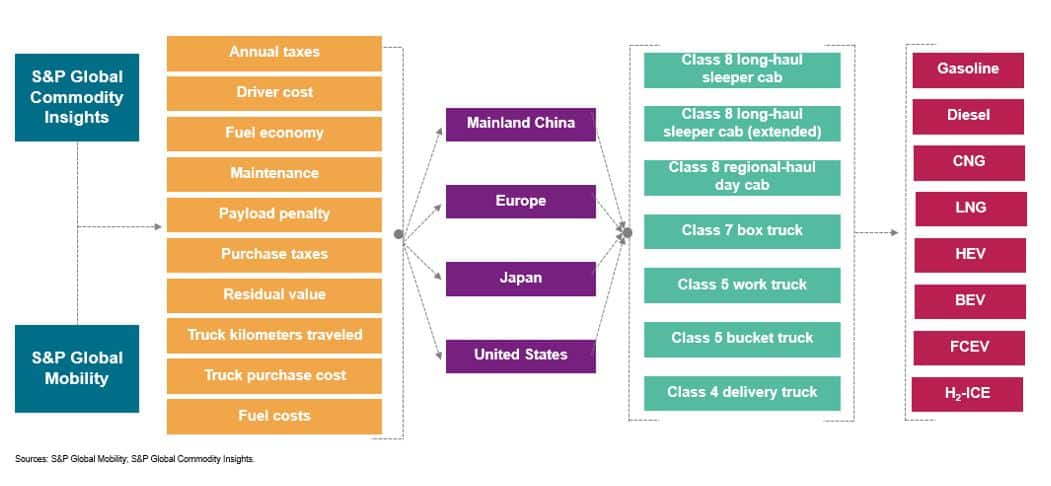

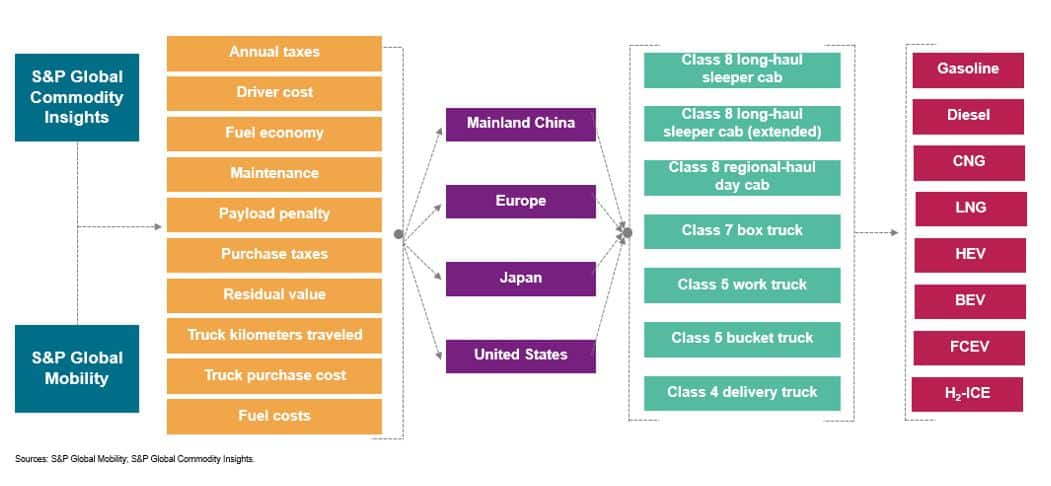

The TCO forecast is central to the Reinventing the Truck study.

It provides detailed insights and enables more informed long-term

powertrain forecasting. Given the narrow profit margins in many

sectors of this industry, market participants are highly sensitive

to changes in the cost structure of their purchases.

The scenario-based approach is also evident in the total cost of

ownership modeling and forecasting. In the Inflections Scenario,

which - represents a continuation of the status quo, - the cost and

availability of new technology gradually improve throughout the

forecast horizon, but cost remains a significant barrier to

adoption throughout the mid-term. Conversely, in the Green Rules

Scenario, market forces and investment trends favor

decarbonization, resulting in rapid improvements in cost and

availability. A tipping point is reached where the cost of new

technology significantly drops, making zero -emission alternatives

the more economically viable solution. A commonality between the

two scenarios is that we have not observed any signals indicating a

significant reduction in the cost outlook for zero -emission

technology or zero -emission trucks compared to our view from 12

months ago. Limited economies of scale, developing supply chains,

and an overall underdeveloped ecosystem suggest that costs will

continue to remain high in the immediate future. Staying on the

topic of signposts, qualitative assessment in areas like

partnerships and technology pathways played a pivotal role in

evaluating the future cost metrics of electrified trucks.

Key takeaways include:

- Different MHCV segments will likely adopt various battery

chemistries based on operating needs.

- Strategic sourcing decisions by OEMs and suppliers will be a

cornerstone of their electrification plans.

- Early signs suggest that MHCV OEMs are leaning towards

partnering and outsourcing all aspects of battery procurement,

strong partnerships are expected to emerge.

- Global OEMs continue to invest and test hydrogen technology

and, -OEMs are creating partnerships to invest in the future.

- In both scenarios, a dual ZEV strategy is expected to emerge;

as OEMs development BEVs and hydrogen powered trucks.

- According to the TCO forecasts, costs develop differently for

different vocations and in different regions.

Fueling the future of the commercial truck

market

Assessing midterm and long-term powertrain forecasts relies on

key pillars, including the regulatory environment, total cost of

ownership forecasts, and industry signposts such as product

availability and investment trends. Achieving a balance between OEM

expectations, government ambitions, and S&P Global research and

analysis is a crucial part of the RTT forecasts.

In the RTT markets—mainland China, Europe, Japan, and the

US—short- to midterm sales trends will be influenced by global

economic and geopolitical factors, as well as impending regulations

that could alter buying patterns. Long-term, growth in truck sales

will be partly offset by a modal shift in freight movement,

increased efficiency in the trucking ecosystem and, in certain

markets, a slightly weaker economic outlook. As it relates to

powertrain changes, over the past 24 months there has been

significant momentum to decarbonize the trucking industry, with

varying levels of motivation across different regions. For those

more familiar with the light vehicle market, trucking stands out

for its significance to the global economy by its movement of goods

and the expectation of a future with two distinct zero-emission

options: battery-electric and hydrogen. It is also important to

note that cleaner alternatives such as natural gas trucks and

hybridization should not be disregarded. The adoption of

zero-emission and electrified trucks will move at different speeds

across different regional markets. Key messages that inform the

long-term powertrain forecast are noted below.

- Mainland China's transition towards a

different fuel and propulsion mix will be propelled by government

regulations, policies, and investments aimed at reducing reliance

on fossil fuels and meeting climate objectives. Battery-electric

trucks are poised to become a preferred solution due to favorable

TCO economics compared to ICE trucks. Mainland China benefits from

its large market size and strong government support for developing

the ZEV ecosystem. In both scenarios, the convergence of low

battery costs, affordable manufacturing, and the inefficiency of

diesel trucks allows various truck vocations to quickly achieve

parity in TCO between battery-electric vehicles and diesel.

Compared to our view from 12 months ago, the absence of new, more

stringent regulations and other indicators suggests that the

forecast for electrified trucks in mainland China remains largely

unchanged. The adoption of zero-emission trucks is expected to

gradually strengthen as the overall ZEV ecosystem improves.

- Europe's ambitious goal to decarbonize the

transport sector ranks among the strongest globally. However,

initial adoption is expected to be somewhat modest in our

Inflections scenario as impending regulations and policy targets

begin to take shape in the late 2020s and into the 2030s. Europe's

CO2 reduction regulations will heavily influence mid- to

long-term powertrain forecasts, with compliance varying across

different scenarios. These forthcoming regulations are anticipated

to significantly impact the future of this market. Compared to our

view last year, the electrification outlook through the early 2030s

will remain largely unchanged, despite a notable increase in the

sales share of HEVs. Additionally, an elevated outlook for

electrified trucks in the 2040s is expected due to OEMs adhering to

anticipated EU CO2 reduction regulations. In the Green

Rules scenario, ZEV sales are projected to see a significant

increase to meet regulatory requirements.

- Japan exhibits a robust commitment to

hydrogen, evident in the involvement of key OEMs such as Toyota,

Honda, Isuzu, and Mitsubishi, all engaged in various levels of FCEV

investment and product launches. In addition, several OEM

partnerships are emerging in Japan and the impact of new

partnerships on the market can be interpreted in various ways.

Collaboration, cost-sharing, and any efforts to enhance economies

of scale can be viewed as a positive for the market. However, with

lack of aggressive regulations or ZEV mandates, adoption of BEVs

and FCEVs in this market will be lower compared with other RTT

markets. However, in the Green Rules scenario, improved TCO

economics of ZEVs will be enough to drive significant demand in the

mid to long-term forecast horizon. In the Inflections scenario, two

major drivers of ZEV growth are absent: stringent regulations and a

TCO structure that would encourage higher ZEV adoption.

- United States market changes can be seen as

policy driven. In recent years, the current administration has

shown a steadfast commitment to reducing and potentially

eliminating emissions from the transportation sector. The passage

of several large spending bills, incorporating climate change

initiatives, coupled with the introduction of new regulations has

escalated the pressure on the industry to reduce emissions to

unprecedented levels. However, there are significant downside risks

to consider. Uncertainties around energy costs and product costs

loom large, as do domestic and international political risks, which

could impact public support or raw material availability, for

example.

Overall, the uptake ZEVs in the US will follow this trend; first

demand will be driven by the regulatory environment and subsidies

before TCO of ZEVs reaches parity with ICEs. In the US, the

Inflections scenario suggests that the market will experience a

dual strategy to electrify the trucking industry. Increasing

pressure to comply with imminent regulations and initiatives

stemming from the IRA are driving factors behind the rise in sales

of HEVs and FCEVs, respectively.

The long-term impact on oil demand

The adoption of alternative power sources for medium and heavy

commercial trucks will significantly impact the entire logistics

ecosystem and economies worldwide. Oil demand will be a metric

severely affected. Beyond the obvious uptake of ZEVs, several

factors contribute to the decline in oil demand. It's crucial to

emphasize that no single reason independently drives demand down;

rather, it's the cumulative impact of multiple factors such as:

- The continued improvement in fuel efficiency of diesel-powered

trucks. We are in an era especially in the US and Europe, where

tightening emission regulations will force OEMs to invest in more

fuel-efficient technology.

- Advancements in the trucking and logistics ecosystem are

expected to enhance industry efficiency putting downward pressure

on the demand to add trucks to the fleet.

- In the long term, growth in truck sales will be partly offset

by a modal shift in freight movement toward other modes of

transport such as rail or water. This trend will be particularly

evident in Europe and mainland China.

- Trucking forecasts are closely tied to economic performance in

their local markets. Any slowdown in average gross domestic product

(GDP) growth may adversely impact demand to add new trucks to the

fleet.

Conclusion

The Reinventing the Truck report unveils two plausible scenarios

amidst a changing landscape. The different scenario storylines

unfold narratives of how the future market landscape will evolve

and how clean energy technology will transform the MHCV fuel mix.

Each insight in the report emphasizes a consistent takeaway: change

is inevitable.

The report is

available now for subscribers.

Please

contact us for more information on the latest Reinventing the

Truck report!

--------------------------------------------------------------

Dive deeper into these mobility insights:

Gain a new perspective on the

commercial vehicle market with Fleet Intelligence

Get a free Truck Model Production

Forecast from S&P Global Mobility

This article was published by S&P Global Mobility and not by S&P Global Ratings, which is a separately managed division of S&P Global.