S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer LoginsS&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Forecasting & Planning

Sales Performance & Marketing

Vehicle In Use

Content

Automotive

Forecasting & Planning

Sales Performance & Marketing

Vehicle In Use

Content

Automotive

Age-based buying is no longer an efficient way to drive revenue and grow auto sales.

The media and automotive industries have long had a mutually beneficial relationship. The Fall TV season was built to align with new vehicles coming to market each year. This season gave automotive marketers large swaths of the prized 25- to 54-year-old consumer base to reach and generate awareness for new vehicle launches. The advertising dollars spent in turn funded TV content creation through massive upfront media investments for ads and product integrations.

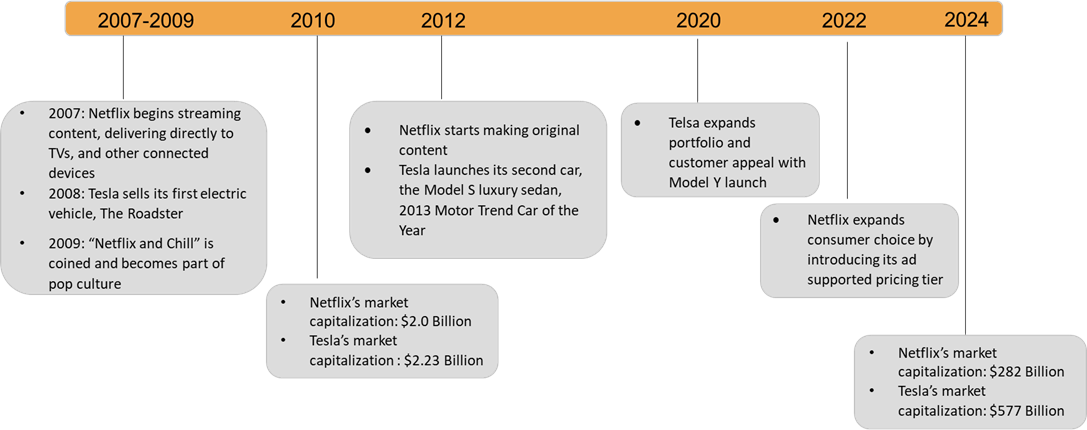

Both of these industries are now undergoing massive transformation and upheaval in response to technology, consumer behavior and new competitors. Look at this timeline from two disruptors — Netflix and Tesla — that are now marketplace leaders:

More content, more vehicle types and more connection points = more options for what consumers drive and watch. Consumer opportunities and choice continue to expand, placing greater pressure on marketing budgets. Consider this:

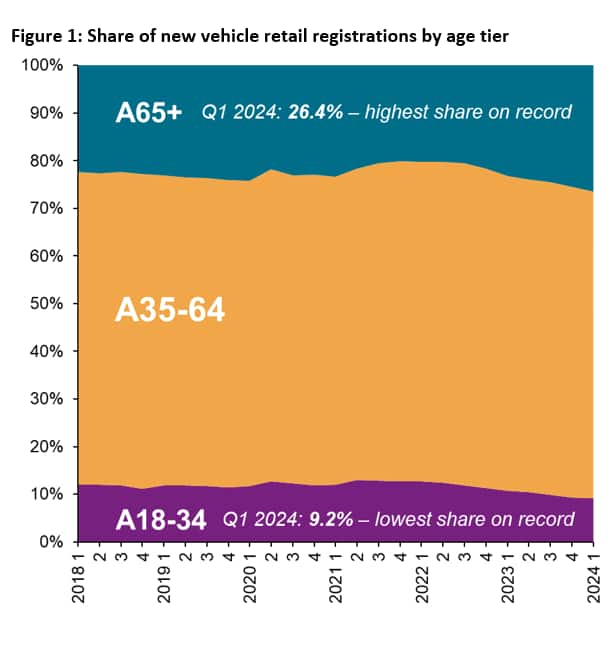

As cost of ownership increases, younger buyers are getting priced out of new vehicle consideration. Share of new vehicle sales by the coveted 18- to 34-year-old demographic has dropped to 9.2%, its lowest share on record. Meanwhile, the 65+ crowd has more purchasing power than ever before, surpassing 26% of new vehicle sales, its highest share on record (Figure 1). How many new car launches are targeting the 65+ demographic?

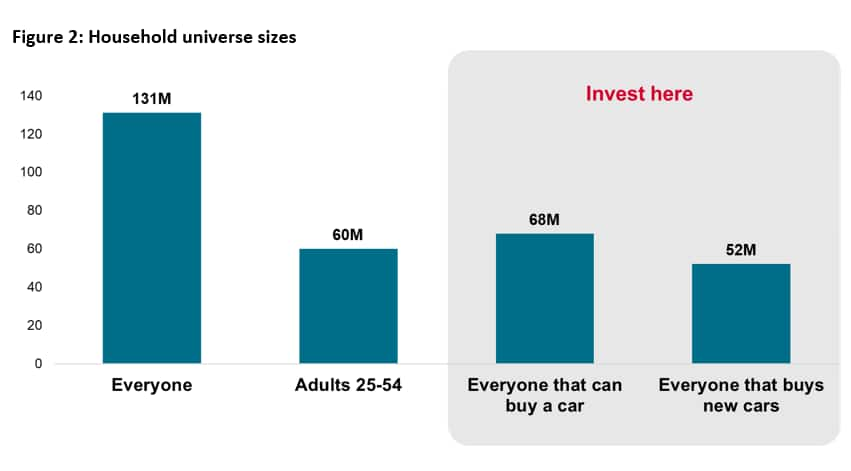

S&P Global Mobility data provides an overview on the size of the US automotive market today. There are roughly 131 million households in the US. (Figure 2)

Being able to target the 52% of US households with car-buying potential while limiting the waste with the 50 million households that don't buy cars is where automotive marketers are going to start maximizing their return-on-ad-spend (ROAS).

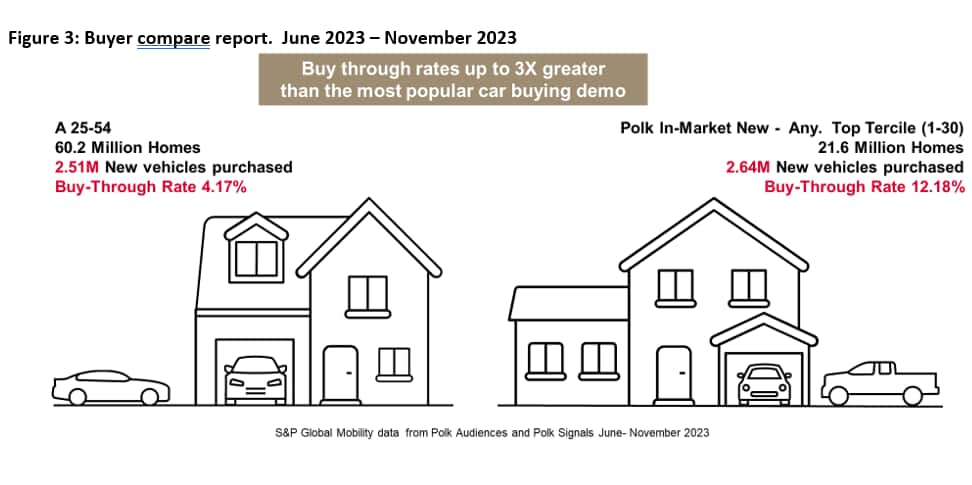

We can take this a step further and look at buy-through rates and sales performance from the most popular automotive buying demographic of adults ages 25 to 54 and compare that to an advanced audience of in-market households (0-12 months) for a new vehicle (Figure 3).

The 60 million households with adults aged 25 to 54 bought 2.51 million new vehicles over a 6-month period, a purchase rate of 4.17%. Comparably, the in-market for new vehicle segment represents 21.6 million homes that purchased 2.64 million vehicles for a buy-through rate of 12.18%. That's 3x greater efficiency and the same impact to sales.

The takeaway: Maximizing sales and buy-through rates by identifying and targeting the households that are ready and able to buy is the realized value of Polk's advanced audiences.

Business outcomes are crucial for assessing the success of your marketing investment. Savvy marketers are prioritizing campaign measurement solutions that deliver real-times sales lift and buy-through rates over options that rely on click stream behavior proxy metrics, like site visits and content views.

Polk Signals data allows marketers to see total sales impact — for themselves and the competition — getting actionable insights that lead to smarter strategies and better decisions. Using real-time sales data for optimization allows marketers to analyze data mid-flight and shift toward best-performing media, reducing waste and improving KPIs like cost-per-vehicle sale and target buy through rates.

S&P Global Mobility projects more than 130 new vehicle launches in the next two years — and more than half will be for EVs. As automotive and media industries navigate the bumpy paths to electric vehicle and alternative TV currency adoption, marketers can be taking these measures to mitigate waste and maximize performance:

From launching new vehicles to targeting specific customers with a customized service offer, automotive marketing has always employed a large arsenal of tactics to engage customers and drive dealership traffic. The available tools are getting better now, leveraging technology and data science to develop advanced audiences, messaging strategies, improved digital communications and more robust measurement solutions.

These are going to be critical for success because automotive marketers will have to manage more customer types, vehicle types, connection points, and buying motivations — all while making sure they don't pass by any more customers outside that 25- to 54-year age range.

Learn more about Polk Audiences.

Sign up for the Polk Automotive Solutions newsletter.

Authored by David Kaufman, Sales and Customer Care Executive Director, and Jason Jordhamo, Product Management Director, S&P Global Mobility.

This article was published by S&P Global Mobility and not by S&P Global Ratings, which is a separately managed division of S&P Global.