Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer LoginsCase study - Traded Market Risk

Background of study

The Fundamental Review of the Trading Book (FRTB) requires banks to make a more rigorous assessment of their exposure to market risk, including new eligibility tests for risk factors used (RFET) to derive capital requirements under a revised Internal Model Approach (IMA).

With changing deadlines for compliance and varying local interpretations, firms continue to struggle with the complexity of the guidelines under fluctuating budgets.

A leading tier 1 bank looked for an agile yet robust solution that would help them gain insight on and build their internal business case for FRTB IMA. This both supported regulatory QIS and refined their business and infrastructure strategies ahead of regulatory go-live.

Pain Points

The bank’s risk management team needed to build out an FRTB-ready risk infrastructure in a timely manner and with budgetary constraints. In particular they needed to:

- Reduce the total cost of ownership of their FRTB infrastructure and shorten time to delivery both for programmes and QIS

- Gain visibility on the capital impact of new trades, model assumptions and changing market conditions

- Manage exposure and resulting market risk capital requirements more effectively

- Hedge their implementations against global or local regulatory updates

The risk management team were aware that S&P Global Market Intelligence is a leading provider of traded market risk solutions and contacted us to learn more about the offering.

“We rolled out a full scale QIS capability in 2 months delivered the business case 9-12 months earlier than with an internal build model.”

The Solution

S&P Global Market Intelligence specialists first described the Traded Market Risk solution, which combines market-leading data with cutting-edge analytics in a hosted service delivered by a team of subject matter experts. The specialists described how the solution can enable compliance with the Basel market risk requirements whilst reducing the impact, cost and complexity of market risk projects.

For FRTB more specifically, the solution delivers IMA and SA capital management through to IMA specific requirements of passing the Risk Factor Eligibility Test (RFET), ES vs SES scenario generation and NMRF proxying.

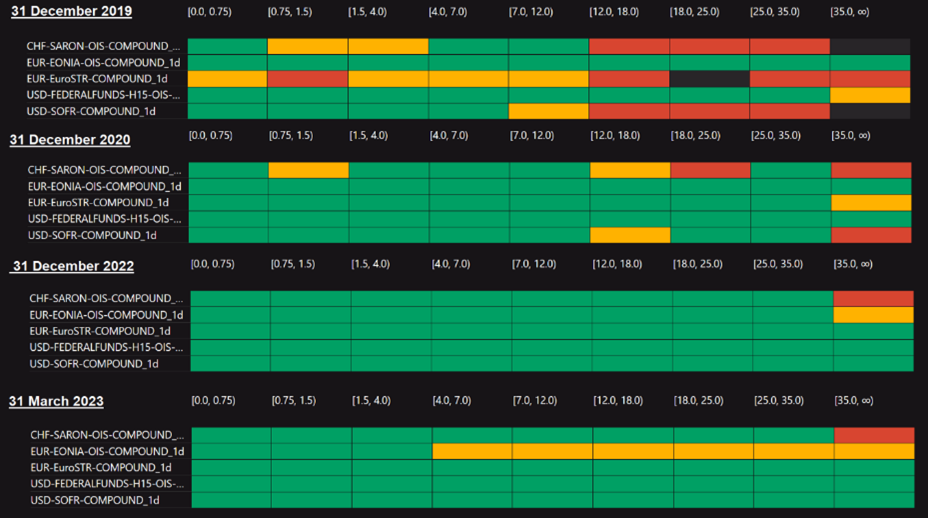

Under volatile market conditions, banks can leverage our pre-populated, extensive RPO datasets delivering realistic and actionable RFET results. These datasets, updated daily, drove pro-active investigations across interest rate, fixed income, credit, equity or FX derivatives depending on portfolio composition. As one user commented, “it was very easy to demonstrate the benefit of S&P curated RPO data sets on IMA capital”.

Whilst many banks have similar broad RFET definitions, the consequences of risk factor observability translate very differently in IMA capital terms on individual portfolios. Using our Traded Market Risk solution, risk quants could measure the capital impact of a change in modellability mapping assumption and NMRF proxy decision in a matter of minutes using its sensitivity-based capital what-if capability. This gave the bank a powerful decision-making tool to inform day-to-day project activities. This in turn drove buy-in from senior management as well as regulators and enabled the bank to run multiple capital scenarios concurrently with minimal impact on their existing infrastructure.

Figure 1: FRTB RFET/Modellability showing the OIS curves transition to RFR

Figure 1: FRTB RFET/Modellability showing the OIS curves transition to RFR

“The bank was able to increase modellable risk factors eligible for ES models under IMA by 40% on average.”

Other FRTB teams using our Traded Market Risk solution have also built rapid insight into IMA vs SA benefits and key focus areas for data and model fine-tuning by leveraging our agile self-service configuration capability. This has helped shape regulatory interactions and maximise value under growing budget constraints, while educating internal stakeholders and regulators alike on their model assumptions and capital analyses.

Project outcomes and benefits

Accelerated time-to-delivery

The Traded Market Risk solution offered an accelerated time-to-delivery where the bank rolled out full-scale QIS capability for the first asset class in two months and the whole portfolio in under 6 months after an initial proof of concept. A single user can now update current QIS analyses as a part-time activity in a month. Another bank was able to deliver an IMA vs SA business case decision 9 to 12 months earlier compared to internal builds.

Reduced capital charges

The bank was able to increase modellable risk factors eligible for ES models under IMA by 40% on average for interest rate derivatives by using the Traded Market Risk FRTB data service. They were able to proxy another 20% non-modellable risk factors on average across asset classes by using the scenario service thereby attracting much lower SES capital charges on the resulting basis.

Reduced total cost of ownership

The client significantly reduced the Total Cost of Ownership (TCO) for FRTB with Traded Market Risk and significantly accelerated their IMA programme using fewer internal resources than originally estimated. The resulting reprioritisation of resources enabled this client to focus on key internal requirements instead, which benefited the bank beyond FRTB, such as pricing library enhancements or data remediation.

Agile implementations

By using the Traded Market Risk modular implementation, the bank could prioritise the most relevant infrastructure components first and leverage in-house developments (or third-party projects) as and when required. This also helped smooth “stop/start” phases of FRTB programmes subject to budget revisions and timeline changes.

Non-invasive, realistic model tuning

A realistic bank-specific IMA configuration requires 9 to 12 months of “model tuning”. This process includes refining RFET mappings, validating market data, and selecting proxy choices in order to understand the impact of changes in the portfolio, market liquidity and prices, or even the consequences of failing model validation.

Model tuning requires the risk analysts to be able to run realistic analyses in an accessible, non-invasive infrastructure while implementation is being executed in parallel.

Future proof your market risk capabilities with our multi award winning Traded Market Risk management solution.

Related financial services products you may be interested in

{"slidesToScroll": 1,"dots": true,"arrows": true,"autoplay":false}

Counterparty Credit Risk

A flexible, cloud-based solution that supports counterparty credit risk and regulatory capital requirements

Related financial services thought leadership

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2ftopic%2fcase-study-traded-market-risk.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2ftopic%2fcase-study-traded-market-risk.html&text=Case+Study+-+Traded+Market+Risk+Management+%7c+S%26P+Global","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2ftopic%2fcase-study-traded-market-risk.html","enabled":true},{"name":"email","url":"?subject=Case Study - Traded Market Risk Management | S&P Global&body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2ftopic%2fcase-study-traded-market-risk.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Case+Study+-+Traded+Market+Risk+Management+%7c+S%26P+Global http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2ftopic%2fcase-study-traded-market-risk.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}