Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Feb 21, 2022

Weekly Global Market Summary Highlights: February 14-18, 2022

All major US and European equity indices closed lower on the week, while APAC markets were mixed. US government bonds were almost flat on the week, while all benchmark European bonds were higher week-over-week. European iTraxx was wider on the week across IG and high yield, while CDX-NA was almost unchanged week-over-week. Gold, silver, copper, and natural gas closed higher on the week, the US dollar was flat, and oil was lower week-over-week.

Americas

All major US equity indices closed lower on the week; Russell 2000 -1.0%, S&P 500 -1.6%, Nasdaq -1.8%, and DJIA -1.9% week-over-week.

10yr US govt bonds closed 1.93% yield and 30yr bonds 2.24% yield, which is -1bp and flat week-over-week, respectively.

DXY US dollar index closed 96.04 (flat WoW).

Gold closed $1,900 per troy oz (+3.1% WoW), silver closed $23.99 per troy oz (+2.7% WoW), and copper closed $4.52 per pound (+0.3% WoW).

Crude Oil closed $90.21 per barrel (-3.1% WoW) and natural gas closed $4.43 per mmbtu (+12.4% WoW).

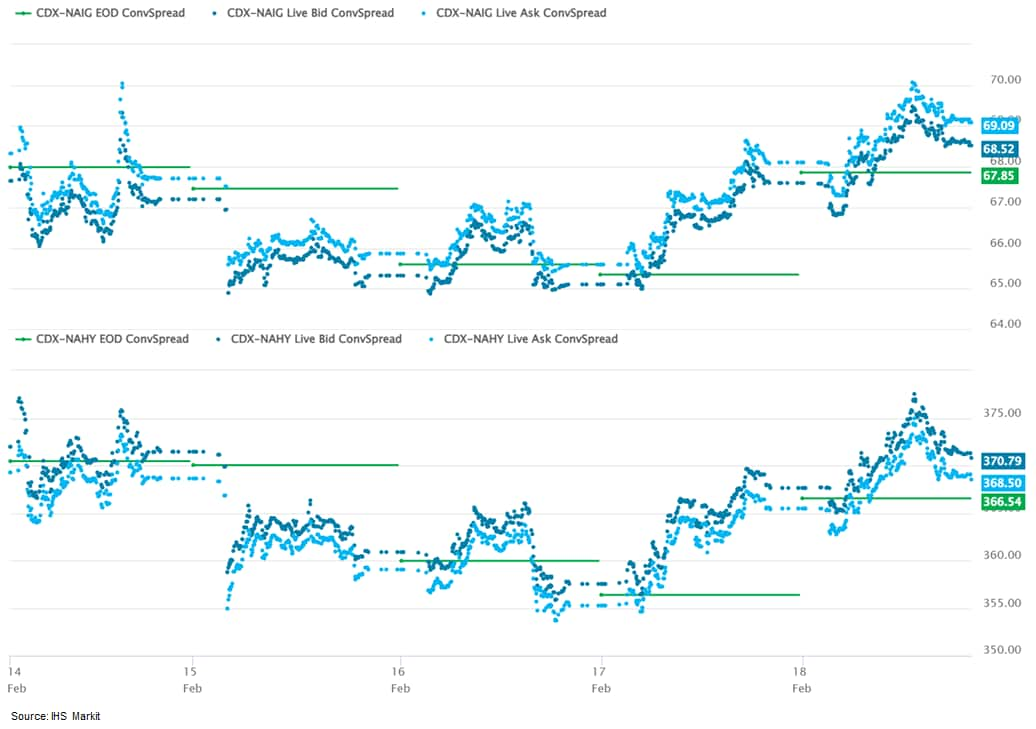

CDX-NAIG closed 69bps and CDX-NAHY 370bps, which is +1bp and

flat week-over-week, respectively.

EMEA

All major European equity indices closed lower on the week; France -1.2%, Italy -1.7%, UK -1.9%, Spain -2.4%, and Germany -2.5% week-over-week.

All major 10yr European government bonds closed higher on the week; UK closed -16bps, Germany -11bps, Italy -11bps, France -7bps, and Spain -1bps week-over-week.

Brent Crude closed $93.54 per barrel (-1.0% WoW).

iTraxx-Europe closed 70bps and iTraxx-Xover 341bps, which is

+3bps and +17bps week-over-week, respectively.

APAC

Major APAC equity indices closed mixed on the week; Mainland China +0.8%, Australia +0.1%, South Korea -0.1%, India -0.6%, Japan -2.1%, and Hong Kong -2.3% week-over-week.

Monday, February 14, 2022

- Global orange production for 2021/22 is estimated up 1.4

million tons from the previous year to 48.8 million tons as

favorable weather leads to larger crops in Brazil, Mexico, and

Turkey, according to a recent USDA report (January 2022). These

gains more than offset lower production in Egypt, the EU, and the

US. Most of the higher production is expected to go into fruit for

processing. (IHS Markit Food and Agricultural Commodities' Hope Lee)

- Brazil's production is forecast up 1.8 million tons to 16.5 million; favorable weather during flowering improved fruit set. Consumption is up slightly while fruit for processing is forecast up 16%, accounting for the majority of the increase in available supplies.

- China's production is projected up slightly to a record 7.6 million tons. The forecast is based on higher output in new navel planting areas in Jiangxi and higher yields in Hubei and Hunan provinces, offsetting decreases in southern Jiangxi province where citrus greening disease has affected crops for several years. Consumption and exports are forecast up with the higher production while imports are down.

- US production is forecast to drop 11% to a near record low 3.6 million tons due to poor fruit set in California and the continued decline in area and yields as a result of citrus greening in Florida. Consumption, exports, and fruit for processing are all lower with the drop in production, while imports are projected to be flat due to weak consumer demand.

- EU production is expected to decline 6% to 6.1 million tons due to unfavorable weather and a slight drop in area harvested. Fresh consumption, fruit for processing, and exports are down with the lower supplies. Imports are projected up with the drop in production.

- Egypt's production is forecast to drop by almost 16% to 3.0 million tons due to unfavorable weather during flowering which reduced fruit set. Consumption is forecast lower due to the reduced production. Exports are forecast down due to lower supplies, but a greater share of supply is expected to go towards exports (less to domestic consumption) given high global demand for the fruit.

- South Africa's production is forecast to increase 3% to 1.7 million tons (the highest level in eight years) due to favorable weather and a rise in area. Consumption and exports are up with the rise in production as well as strong demand. The EU is expected to remain the top market, accounting for over 40% of shipments

- Turkey's production is forecast to rise 40% to 1.8 million tons due to favorable weather and higher area and yields. Consumption and exports are up as a result of the increased supplies.

- US-based recycler Evergreen expects to increase its recycled

polyethylene terephthalate (rPET) production rate by around 48% in

June when it completes upgrades in its facility in Clyde, Ohio, the

company said last week. Evergreen said the expansion adds four

high-volume, food grade rPET manufacturing lines to its arsenal,

boosting its production capacity from an existing 147 million

pounds (66,678 mt/yr) to 217 million pounds (98,429 mt/yr) when

complete in June 2022. (IHS Markit Chemical Market Advisory

Service's Chuan Ong)

- The company plans to increase plastics recycling rates, and to convert more companies to rPET from virgin PET resin, Evergreen said.

- Evergreen cited a report noting a 10% increase in end-use rPET demand in 2020, with the food and beverage category fastest growing, rising 36% from 2019 to 2020.

- According to Evergreen's partner and investor, trade organization American Beverage, America's beverage companies are designing bottles to be 100% recyclable, so they can be remade into new bottles, reducing the use of new plastic.

- Evergreen said it processes 11.6 billion post-consumer bottles annually, and is one of North America's Top 3 PET recyclers and producer of rPET.

- The company's production base mushroomed from one to four within a single year in 2021 - besides its original facility in Clyde, Ohio, it gained capacities in Albany, New York, Amherst in Canada's Nova Scotia, and Riverside, California.

- Its Evergreen Albany facility, formerly UltrePET, and Evergreen Amherst, formerly Novapet) were acquired from wTe Corp. in November 2021. Evergreen Riverside was acquired from CarbonLite in May 2021. As a result, Evergreen's annual rPET capacity ballooned by 367%, adding 107 million pounds (48,534 mt/yr), additional to the 40 million pounds (18,143 mt/yr) capacity before.

- Paraxylene (PX) is the main feedstock of purified terephthalic acid (PTA). PTA is, in turn, a key raw material for virgin PET. Both PTA and PX are unnecessary in the recycling and production of rPET.

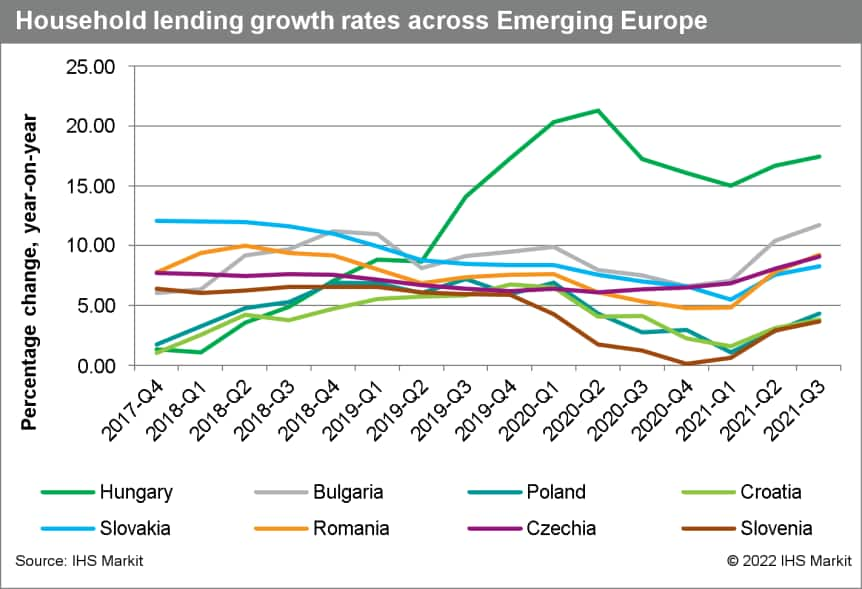

- The European Systemic Risk Board (ESRB) published five warnings

and two recommendations on medium-term residential real estate

(RRE) vulnerabilities on 11 February. The ESRB has a mandate to

issue warnings when significant systemic risks are identified and

to make recommendations for remedial action. Warnings were issued

to Bulgaria, Croatia, Hungary, Liechtenstein, and Slovakia for

failing to sufficiently address newly identified RRE-related

vulnerabilities. Moreover, recommendations were sent to competent

authorities in Germany and Austria, as both countries were

previously identified as having vulnerabilities, which "have not

been addressed sufficiently". The ESRB has confirmed that

authorities in Germany and Austria have since announced measures to

address the vulnerabilities in the RRE sector. (IHS Markit Banking

Risk's Natasha

McSwiggan and Pedram Moezzi)

- In Bulgaria, the key vulnerabilities identified are elevated house price growth, signs of house price overvaluation, and high mortgage credit growth. Although household indebtedness is relatively low as reflected by a household debt-to-GDP ratio of 24% in 2020, 98% of loans are at variable rates, exposing households to potential interest rate changes.

- Croatia displayed the same vulnerabilities as Bulgaria, plus the additional signs of loosening credit standards. The latter is confirmed by results of the Croatian National Bank (CNB)'s fourth-quarter 2021 lending survey. However, the ESRB has noted that "the quality of the data on lending standards should be ensured as promptly as possible".

- Hungary has similar vulnerabilities with a focus on house price and mortgage credit growth. The housing market in Hungary is characterized as suffering from a supply shortage, further fueling the growth in house prices. A combination of measures has been utilized by the authorities, such as preferential value-added tax for new constructions and "partially sufficient" macroprudential measures to dampen housing demand and price growth. Real estate and construction-purpose credit growth was the fastest growing sector, at 19.5% y/y in the third quarter of 2021.

- Slovakia's vulnerabilities are confined to house price growth,

house price overvaluation, and mortgage credit growth. However, it

has both the highest and second-highest growth rates for mortgage

credit growth and house price growth in the EU, respectively.

Credit growth in the household sector reached 8.3% y/y in the third

quarter of 2021, compared with 5.9% y/y for total banking-sector

loans, in the same period.

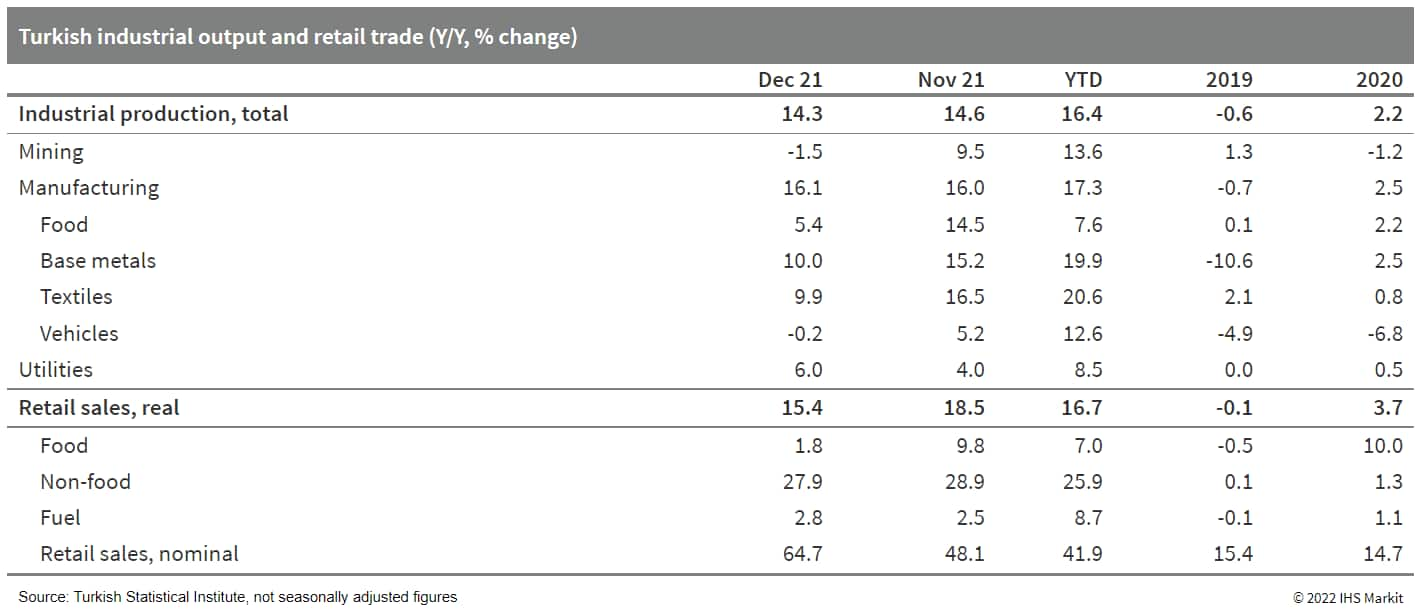

- In 2021 as a whole, Turkish industrial production increased by

16.4% according to data from the Turkish Statistical Institute

(TurkStat). Driven by rising external demand and easy credit to

finance increased production, growth was particularly strong

following two years of sluggish gains. (IHS Markit Economist Andrew

Birch)

- Despite waning export demand and growing supply problems, industrial activity continued to expand throughout the final quarter of the year. In each of the months October, November and December, monthly production continued to grow in seasonally and calendar adjusted terms according to data from TurkStat, rising by 1.6% month on month (m/m) in the final month of the year.

- Both for the year as a whole and over the final quarter, the production of capital goods - including base metals - grew particularly fast, pacing overall industrial output. Meanwhile, the once vibrant automotive sector posted below-average performance both for 2021 as a whole and during the final months of the year.

- TurkStat also reported a downturn of retail trade activity in

December. In seasonally and calendar adjusted terms, total retail

trade in volume terms dipped by 2.7% m/m in December, a sharp

turnaround from the preceding six months. Surging inflation

severely undermined purchasing power.

- Volvo Trucks plans to launch a large-size electrified truck in South Korea in 2023, in a bid to strengthen its position in the country's imported truck market, reports the Yonhap News Agency. "The domestic large truck market is expected to recover to 10,000 units this year, and demand for trucks will improve going forward," said Volvo Trucks Korea president Park Gang-serk. The truck maker sold 2,000 trucks in South Korea last year, accounting for 40% of the imported truck market. It aims to raise the ratio to 50% in 2025. Volvo Trucks entered the South Korean market in 1996, and its total sales in the country are expected to exceed 30,000 units during the first half of this year. It aims to achieve 40,000 in cumulative sales, or a market share of 50%, by 2025, highlights the report. Volvo Trucks's electric vehicle (EV) plans for South Korea are also in line with growing demand for alternative-powertrain vehicles in the country, thanks to positive demand for new models, as well as favorable policies and infrastructure initiatives by the government. (IHS Markit AutoIntelligence's Jamal Amir)

- The Dubai Road Transport Authority (RTA) will begin trials of digital maps required for deploying autonomous vehicles (AVs) developed by Cruise Automation by the end of 2022. RTA had a discussion with a delegation from Cruise on the latest developments relating to the agreement signed between the two entities for operating Cruise AVs in providing taxi and e-hailing services. A limited number of Cruise AVs will be deployed in 2023, with plans to progressively raise the number of deployed vehicles to 4,000 by 2030. Mattar Al Tayer, director-general and chairman of the board of executive directors of RTA, said, "The operation of autonomous vehicles contributes to the integration of transport systems by easing the mobility of public transport riders and helping them reach their final destinations. It fits well with RTA's first and last-mile strategy approved last year relating to the first and last sectors of journeys from and to the nearest public transport points. It consists of two sections: groups and individuals", reports Gulf News. (IHS Markit Automotive Mobility's Surabhi Rajpal)

Tuesday, February 15, 2022

- US producer prices for final demand spiked up 1.0% in January

and rose 9.7% from a year earlier. The December gain was revised

higher. Energy goods climbed by 2.5% to more than reverse the

Omicron-inspired December drop. Food prices climbed by 1.6%, also

reversing a December dip. Core goods prices rose 0.8% and were 9.4%

above 12 months earlier. (IHS Markit Economist Mike Montgomery)

- Final demand prices for services grew 0.7% in January. Retail and wholesale trade margins climbed by 0.6%. Transportation and warehousing prices were unchanged as air fares fell by 4.2% after climbing a total of 9.0% in the prior two months. The other services complex scored a 0.9% gain on a broad-based advance.

- The producer price report was, in a word, "ugly," but global supply chain woes and past fiscal and monetary stimulus have produced other ugly inflation reports. Indeed, the year-over-year increases for the three most common measures (finished goods, excluding food and energy, and also excluding trade) were all a tad worse in December. The 1% handle just ramps up the fear of double-digit inflation.

- Bottom line: Inflationary pressures persist and are endemic in the economy. There is no one source that can be whisked away, but instead a tangle of interconnected sources, including supply chain issues, the pandemic itself, and reluctant-to-work workers. It may not take decades to tamp down this inflation episode, but it will not happen overnight. The ugly number may also contribute to the size of the Federal Reserve's initial inflation-fighting efforts.

- Japan's real GDP rose in the fourth quarter of 2021, moving up

1.3% quarter on quarter (q/q; or 5.4% q/q annualized) after a 0.7%

q/q (or 2.7% q/q annualized) drop in the previous quarter.

Full-year GDP growth increased by 1.7% year on year (y/y) in 2021

after a 4.5% y/y decline in 2020, but the figure remains below the

pre-pandemic levels. The major reason behind the q/q improvement

was a rebound in private consumption, which offset declines in

public demand and residential investment, and changes in private

inventories. (IHS Markit Economist Harumi

Taguchi)

- Private consumption rose by 2.7% q/q in the fourth quarter of 2021 following a 0.9% q/q drop in the third quarter. Easing COVID-19 containment measures drove spending in services (up 3.5% q/q). Improved supply of autos thanks to the softer negative effects of shortages of semiconductors and parts led to a solid rebound in spending on durable goods (up 9.7% q/q).

- Increases in private capital expenditure (capex) and net exports also contributed to the q/q growth. Despite the improvement in auto production in the quarter, relatively modest rebounds of capex (up 0.4% q/q) and exports of goods and services (up 1.0% q/q) reflected the negative effects of supply chain constraints on production for a broad range of capital goods and softer external demand because of the spread of the Omicron variant. The improvement in net exports also stemmed from weak imports, partially reflecting declines in imports of COVID-19 vaccines in line with the progress in vaccine rollout.

- While easing COVID-19 containment measures contributed to the resumption of economic activity, residential investment remained in slump in the fourth quarter (down 0.9% q/q following a 1.6% q/q drop in the previous quarter), reflecting higher material prices. That also made it difficult for progress with public investment (down 3.3% q/q for the fourth consecutive quarter of decline) to meet budgets for infrastructure projects.

- Despite reports on industrial production suggesting increases in producers' inventories in the quarter for rebuilding stocks, changes in private inventories unexpectedly declined and had a 0.1-percentage-point negative contribution to q/q real GDP growth. The Cabinet Office estimates that work-in-process inventory declined.

- China's Ministry of Industry and Information Technology (MIIT) on 10 February published draft revisions to the country's data security regulation. An earlier version was published on 30 September 2021 for public commentary. The revisions seek to supplement China's Data Security Law - implemented on 1 September 2021 - which regulates all forms of data management such as collection, storage, processing, transfer, and disclosure across several industrial sectors. The September 2021 draft introduced a three-tier data classification mechanism based on perceived risk towards national security with "ordinary", "important", and "core data" categories. The revisions would also remove the requirement that core data are banned from being transferred abroad. However, the revisions specify that MIIT approval must be sought when sending "industrial, telecommunications or wireless radio" data abroad. Furthermore, data owners have a legal responsibility to report any "significant change" in data size or content for the important or core categories, or data that are determined to have an impact on China's political, territorial, military, economic, technological, digital, or ecological resources, or nuclear security stability. Although it is implied that important and core data are in principle allowed to be transferred abroad, companies handling these data categories are likely to be subject to more stringent review processes over potential national security concerns. The proposed revisions specify that local industry-specific regulators are responsible for the supervision of data management, effectively giving local government departments and regulatory authorities - particularly local-level MIIT and Cyberspace Administration offices - additional political power to govern data flow. In particular, the latest update remains vague about what types of data will be considered "important", thus increasing the discretionary power of local authorities. (IHS Markit Country Risk's David Li)

- Ford is evaluating the possibility of manufacturing electric vehicles (EVs) at one of its plants in India for export, reports Reuters. Kapil Sharma, director of communications at Ford India, has stated that the company is looking into restarting its India operations under the Production-Linked Incentive (PLI) scheme and has submitted a proposal to the Indian government. "We thank the Indian government for approving Ford's proposal under the PLI scheme for the automobile sector. As Ford leads customers through the global electric vehicle revolution, we're exploring the possibility of using a plant in India as an export base for EV manufacturing", said Sharma. The automaker has not revealed which of the two plants it intends to retain to build EVs. The latest move will mark a return for Ford as the automaker announced in September last year that it has ceased manufacturing vehicles in the country because of accumulated losses of over USD2 billion in the last 10 years. (IHS Markit AutoIntelligence's Isha Sharma)

- Chinese authorities will push for the expansion of the country's electric vehicle (EV) charging infrastructure in the next few years to meet demand for 20 million EVs on the road by 2025. According to gasgoo citing a statement issued by several Chinese governmental departments including the National Development and Reform Commission (NDRC), China will improve the public charging network in central urban areas, boost the construction of public charging facilities in peripheral urban areas, and deploy battery swapping stations based on local conditions of different regions. The authorities also urged the housing department to introduce regulations to facilitate the installation of EV chargers in residential buildings. (IHS Markit AutoIntelligence's Abby Chun Tu)

- Ørsted has completed the divestment of 50% stake in the 900MW Borkum Riffgrund 3 project off Germany to Glennmont Partners. This is the Ørsted's first farm-down to an institutional investor signed prior to taking a final investment decision. The transaction, which includes a commitment to fund 50% share of the payments under an EPC contract for the entire wind farm, is valued at approximately USD1.4 billion. As part of the agreement, Ørsted will construct the wind farm under a full-scope EPC contract, perform operations and maintenance services for 20 years, and provide a route to market for the power and green certificates generated by Borkum Riffgrund 3. Borkum Riffgrund 3 will feature Siemens Gamesa 11MW offshore wind turbines. Project commissioning is expected by 2025. (IHS Markit Upstream Costs and Technology's Chloe Lee)

- Canadian dairy giant Saputo has announced plans to streamline

its manufacturing footprint in the US and international markets,

while also optimizing and modernizing its manufacturing base. (IHS

Markit Food and Agricultural Commodities' Vladimir Pekic)

- The company stated it plans to invest CDN169 million ($133 million) towards the modernization and expansion of its cheese manufacturing facilities in Wisconsin and California. These initiatives will begin in the fourth quarter of fiscal 2022 and are expected to take approximately 24 months to implement. Furthermore, Saputo intends to close its Bardsley Street, Tulare, California, facility in fiscal 2023.

- In the international sector, the company will be streamlining operations in two of its manufacturing facilities in Australia.

- The capital investments and consolidation initiatives are expected to result in annual savings and benefits gradually, beginning in fiscal 2023, and reaching approximately $112 million ($83 million after tax) by the end of fiscal 2025. Costs connected with the capital investments and consolidation initiatives will be approximately $46 million after tax.

- Saputo's third quarter revenues for the fiscal year of 2022, which ended on 31 December, increased 3.7% y/y to CDN3.9 billion. Adjusted EBITDA amounted to CDN322 million, down CDN109 million or 25.3% y/y.

- The company warned that challenging market conditions, including labor shortages, supply chain disruptions, and inflationary pressures, continued to impact its sectors to varying degrees, with the US sector being the most impacted.

Wednesday, February 16, 2022

- The minutes of the last meeting of the Federal Open Market Committee (FOMC), held on 25-26 January, were released this afternoon (16 February). The minutes reflect widespread consensus that it will soon be appropriate to begin the process of removing monetary stimulus implemented during the pandemic, with increases in interest rates likely to be followed within a few months by a plan to begin shrinking the Federal Reserve's securities portfolio primarily through run-off—that is, through limits on the reinvestment of principal payments. The minutes provide no clear signal about whether the first increase in the target for the federal funds rate will be the "usual" increase of 25 basis points or a larger increase of 50 basis points. Differences of opinion among policymakers about the scope for further gains in labor supply and about how quickly inflation might recede suggest a high bar for an increase of 50 basis points in March. The minutes are consistent with IHS Markit analysts' expectation that rate hikes will be front-loaded this spring, then slow later in the year as inflation moderates and to allow for balance-sheet shrinkage by the Fed. (IHS Markit Economists Ken Matheny and Lawrence Nelson)

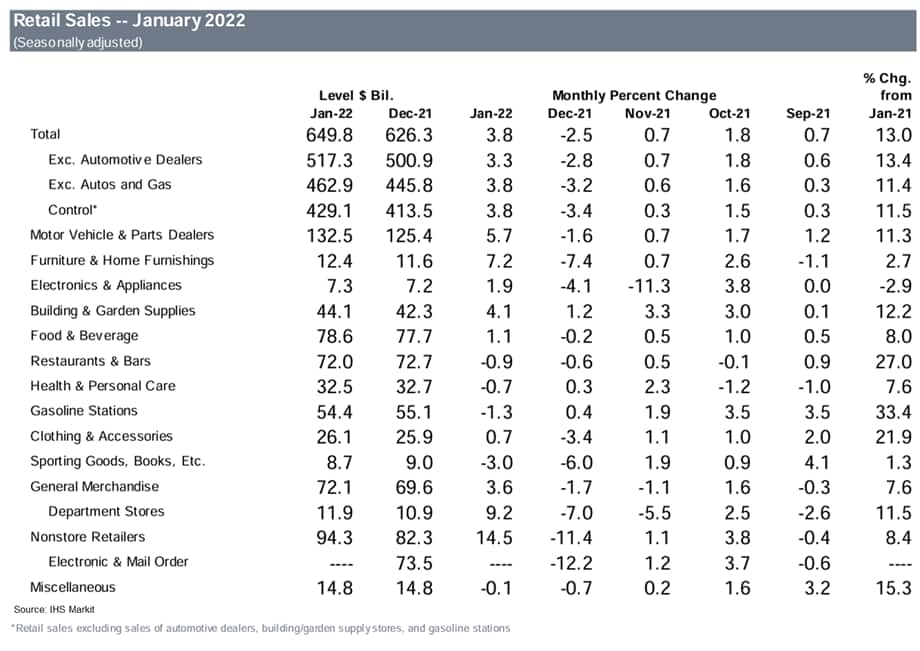

- US total retail trade and food services sales jumped 3.8% in

January, a stronger reading than expected. Nonautomotive sales rose

3.3%, while core sales rose 3.8%. (IHS Markit Economists Kathleen

Navin and William Magee)

- The surge in January followed a sharp decline in December, as news reports of supply chain issues and delays in shipping likely shifted sales forward into October and November. Seasonal factors, which anticipated a pop in December for holiday shopping and a reversal in January, are now playing a role in the data, contributing to the sharp decline in December and the jump in January.

- Sales at nonstore retailers, which are particularly sensitive to shipping delays, help illustrate this story. These sales, which make up less than one-sixth of total sales, rose 14.5% on the month and accounted for roughly half of the increase in total retail trade and food services sales in January. IHS Markit analysts had anticipated this swing after observing the same pattern last year.

- Elsewhere in today's (16 February) report, sales for food services and drinking places declined 0.9% in January. The weakness in January was previewed by soft readings from the OpenTable data as would-be diners became more cautious upon Omicron concerns. These data have since turned up, suggesting restaurant sales will improve in February.

- Meanwhile, retail sales at building materials stores continued to strengthen in January, with an increase of 4.1%. The strength in January came even as weather turned more severe.

- While some reversal in retail sales is expected in February,

IHS Markit analysts continue to anticipate that solid fundamentals,

including wages and net worth, will remain supportive of consumer

spending in the near term.

- Despite less stringent pandemic restrictions than the year-ago

Spring Festival holiday supporting mild improvement in service

prices, overall consumer demand remained weak. With the continued

zero-COVID-19 stance amid more frequent regional outbreaks, further

policy easing remains likely to counter the growth headwinds. (IHS

Markit Economist Lei Yi)

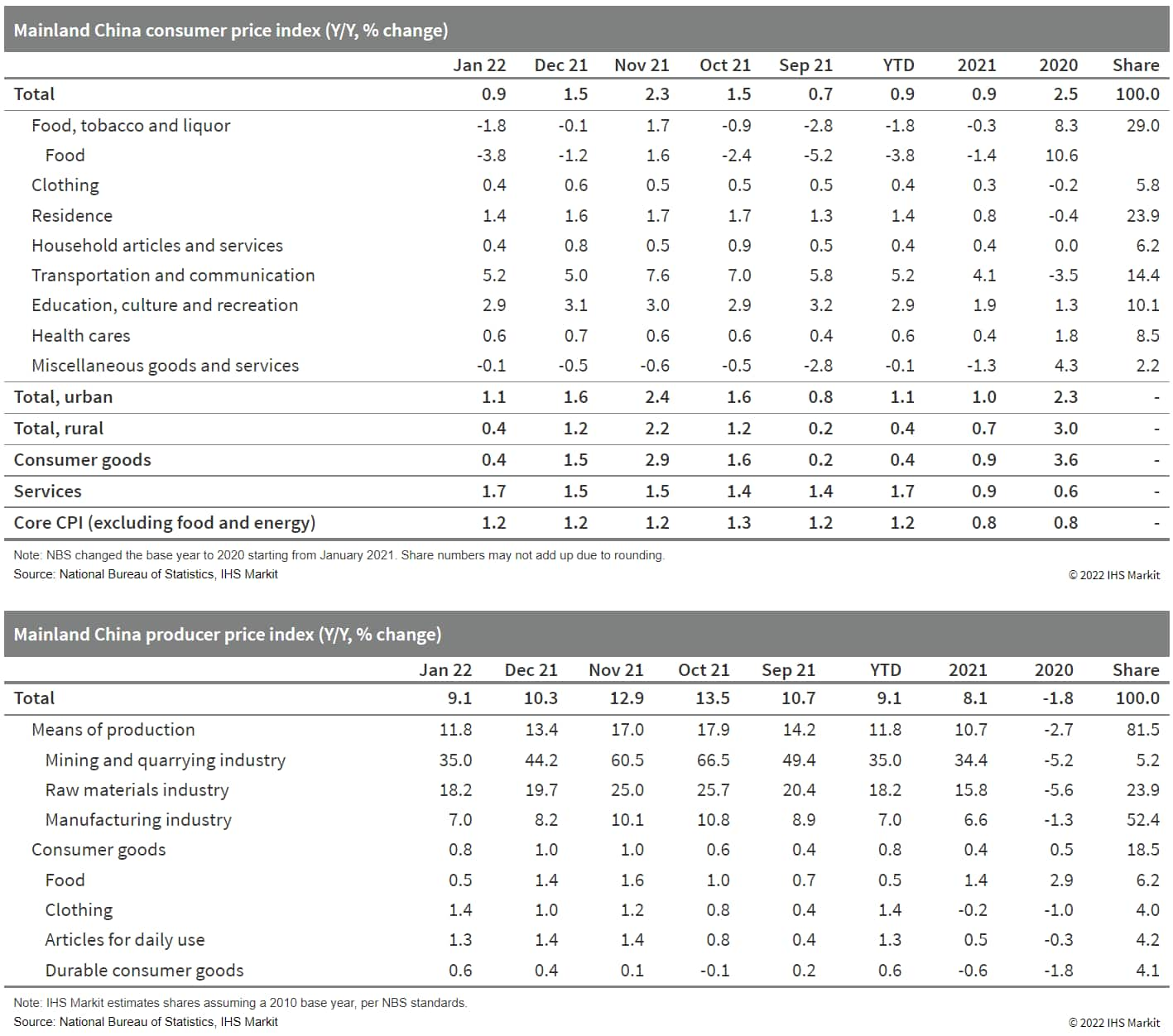

- Mainland China's consumer price index (CPI) increased by 0.9% year on year (y/y) in January, down by 0.6 percentage point from the December 2021 reading, according to the National Bureau of Statistics (NBS). Month-on-month (m/m) CPI inflation came in at 0.4%, bouncing back from the month-ago deflation of 0.3% m/m, owing to the seasonal demand pickup ahead of Spring Festival holiday (31 January—6 February) as well as the recent rise in oil prices.

- The headline CPI disinflation, on the other hand, was again largely driven by the falling food prices, which recorded deflation of 3.8% y/y in January compared with a 1.2% y/y decline in the prior month. In particular, pork price deflation widened further by 4.9 percentage points to 41.6% y/y owing to the relatively high base; while fresh vegetable prices slid into deflation territory, logging a 4.1% y/y decrease in January from the 10.6% y/y increase in the month before. Regarding the non-food components, service price inflation ticked up by 0.2 percentage point to 1.7% y/y thanks to eased travel restrictions ahead of the Spring Festival holiday than in 2021, with air ticket prices notably higher by 20.8% y/y. Excluding the volatile food and energy components, core CPI inflation kept unchanged at 1.2% y/y.

- The producer price index (PPI) rose by 9.1% y/y in January, lower by 1.2 percentage points from December 2021 and marking a third month of moderation thanks to government interventions. Month-on-month PPI deflation narrowed by 1.0 percentage point to 0.2%, which was almost entirely led by the 0.2% m/m decline in the means of production subindex; while the PPI subindex of consumer goods reported no change in January.

- By sector, coal and steel-related sectors including coal mining

and dressing and ferrous metal smelting and pressing continued to

register month-on-month price deflation in January. However, higher

crude oil and nonferrous metal prices—partially contributed by

the geopolitical tensions in Eastern Europe—led to

month-on-month re-inflation in prices of petroleum and natural gas

extraction as well as nonferrous metal smelting and pressing

sectors.

- Eurozone retail sales volumes plunged by 3.0% month on month

(m/m) in December 2021, the largest decline in eight months. The

weakness was much more pronounced than expected, undershooting the

market consensus expectation of a 0.5% m/m decline by some

distance. (IHS Markit Economist Ken

Wattret)

- Although retail sales in the fourth quarter of 2021 as a whole rose by 0.3% quarter on quarter (q/q), this was the weakest rate of increase for three quarters and given the December 2021 drop, carryover effects for sales growth in the first quarter of 2022 will be unfavorable.

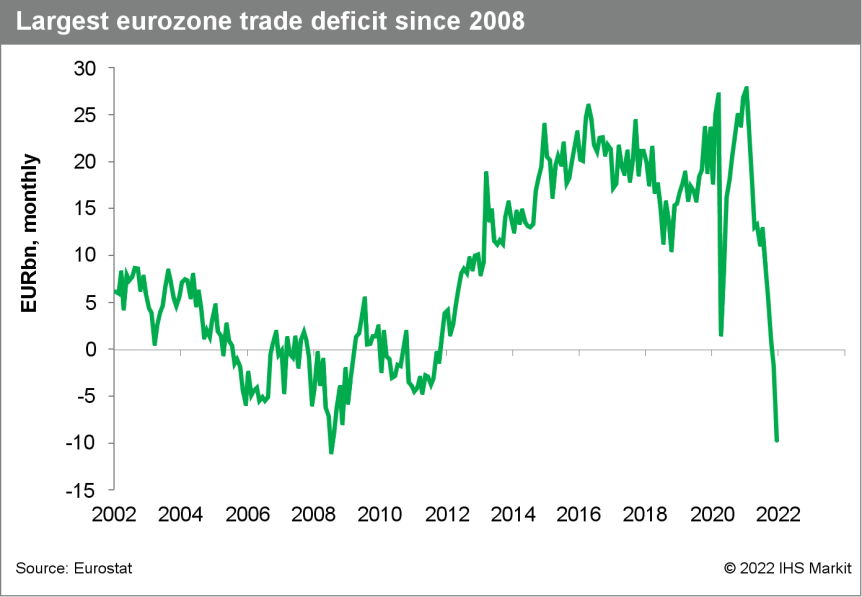

- The eurozone trade balance swung into the red in November 2021 for the first time in over a decade and the deficit increased markedly in December 2021, jumping from EUR1.8 billion to EUR9.7 billion, the highest since July 2008 amid the global financial crisis.

- By way of comparison, the eurozone's monthly trade surpluses peaked at over EUR25 billion prior to the pandemic.

- Eurozone exports (in value terms) fell by 0.6% m/m in December 2021. This followed consecutive strong increases in the two prior months, however, meaning that in the fourth quarter of 2021 as a whole, exports rose by 4.2%, the highest growth rate for four quarters. Relative to their pre-pandemic level, exports were up by 6.7% in December 2021.

- Imports (again in value terms) rose by 3.1% m/m in December 2021, the 11th straight increase, and surged by over 10% q/q in the fourth quarter of 2021 overall. Imports were up by over 27% in December 2021 relative to their pre-pandemic level.

- Eurozone industrial production rose by a much stronger-than-expected 1.2% m/m in December 2021. Given the November 2021 initial 2.3% m/m increase (subsequently revised up to 2.4%), the market consensus expectation had been for a modest 0.3% m/m gain. For the first time in five months, industrial production exceeded its pre-pandemic level, by 1%.

- The breakdown of the December 2021 output data by type of goods showed a mixed picture, with production of capital goods outperforming (2.6% m/m). Production of capital goods surpassed its pre-pandemic level in December last year for the first time in five months, although it continues to lag the recovery in output of consumer goods.

- Despite back-to-back strong increases, industrial production

contracted by 0.5% q/q in the fourth quarter of 2021, the third

consecutive q/q decline, with supply chain disruptions having

hindered the sector since early in 2021. Carryover effects for

growth in the first quarter of 2022 are very positive, however,

given the very strong end to last year, while leading indicators

have been improving in recent months.

- US-based upcycling start-up Novoloop has received funding that

brings it nearer to commercializing its polyethylene (PE)-to-

thermoplastic polyurethane (TPU) technology, the company announced

late-Tuesday. (IHS Markit Chemical Market Advisory Service's Chuan

Ong)

- The company said it received $11 million in Series A funding that will allow it to complete crucial pilot scale-ups and commercialize its technology.

- Novoloop did not detail where and when it plans to construct pilot plants for its process.

- The company said its proprietary process technology, termed 'Accelerated Thermal Oxidative Decomposition', is a form of chemical recycling that breaks down PE into chemical building blocks for synthesis into high-value products.

- According to Novoloop, PE is the most widely used plastic today but only 9% is recycled, and virtually none is upcycled. The company aims to increase commercial demand for waste PE, believing its technology can upcycle carbon content found in common plastic waste like grocery bags, packaging, and agricultural plastics that are too low value for material recovery facilities and instead sent into landfills or incinerators.

- Novoloop's first product based on its advanced recycling technology is a TPU, which can be used in footwear, apparel, sporting goods, automotive, and electronics. The company says its TPU is the first made from post-consumer PE waste that matches the performance characteristics of virgin TPU made from petrochemicals. Novoloop says its TPU has a carbon footprint 46% smaller than conventional TPUs.

- The flavor and essential oil processor IFF, listed on the New

York Exchange, has reported that it net sales reached $3.03 billion

(+139% y/y) in Q4 2021, bringing 2021 sales to $11.65 billion, 129%

more y/y, once the company has completed the merger with Nutrition

& Biosciences (N&B). (IHS Markit Food and Agricultural

Commodities'

Jose Gutierrez)

- The operating profit increased by 3% y/y to $585 million.

- Inventories totaled $2.51 billion in 2021, up from $1.13 billion in 2020.

- Nourish and Scent were the drivers of growth.

- Nourish sales rose by 9% on a combined currency-neutral (non-GAAP) basis to $2.6 billion due to robust activity in the ingredients industry. Scent grew by 8% to $2.25 billion thanks to strong demand for fine fragrances and cosmetic actives.

- The company projects that sales ranged between $12.3-12.7 billion in 2022.

- US electric vehicle (EV) maker Fisker Inc started taking orders for its second product, the Pear, on 15 February, according to a company announcement. Fisker has begun taking reservations for the Pear even though it has not yet started deliveries of its first model, the Ocean electric sport utility vehicle (SUV). According to a Fisker statement, the Pear is a compact, five-passenger electric utility vehicle and deliveries are expected to start in 2024. Fisker says the Pear - standing for Personal Electric Automotive Revolution - will have a starting price of USD29,900 before taxes and incentives in the United States. This will make it one of the more-affordable EVs in the market and potentially making it strong competition for General Motors (GM)'s Chevrolet Equinox EV, which the automaker has not yet shown. GM has said the price of the Chevrolet Equinox EV will start at USD30,000, and it is due on the market in 2024 as well. In a statement, Fisker Inc CEO Henrik Fisker said, "PEAR will feature the very latest technology in a beautifully designed, affordable urban mobility device. It's an exciting vehicle and an exciting time for the company as we expand our lineup." The Pear is to be produced for Fisker by Foxconn at a former GM facility in Ohio (US), acquired by Foxconn through Lordstown Motors. Meanwhile, the upcoming Ocean is being produced for Fisker by Magna. Fisker states that reservations for the Pear can be made for USD250 for a first reservation, or USD100 for a second reservation. (IHS Markit AutoIntelligence's Stephanie Brinley)

Thursday, February 17, 2022

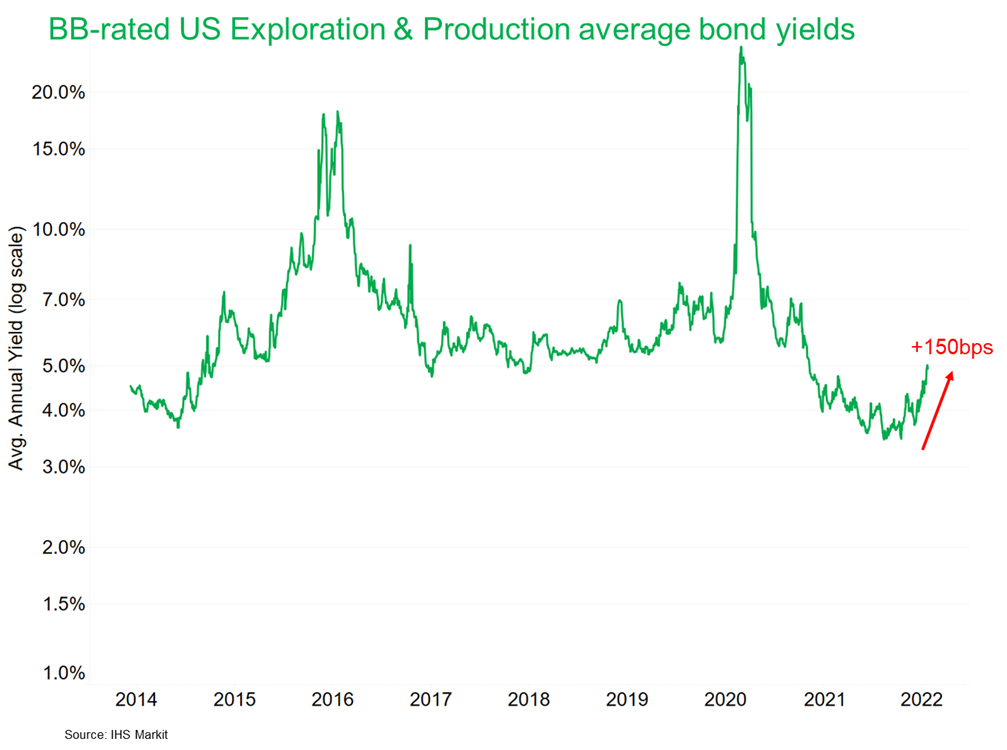

- BB-rated exploration and production company constituents in the

IHS Markit iBoxx Liquid USD High Yield debt index closed at an

average yield of 4.96% on 16 February, which is 150bps higher than

the all-time low yield of 3.46% on 9 November 2021 when WTI closed

at $84.15/barrel.

- While the offshore wind power sector is set to attract heavy

investment amid decarbonization efforts across the globe, one

crucial support sector is showing strain: wind turbine installation

vessels (WTIV). With wind turbines getting bigger and moving away

from the shorelines, many industry experts have warned of a

potential vessel shortage because the existing fleet cannot meet

all requirements. In its latest sector outlook published in

December, IHS Markit's Costs and Energy team estimated that at

least 21 new WTIVs will be delivered between this year and 2025.But

the fleet available to do the required work will only grow from 38

units to 44 units in the same period, as some vessels are too small

to handle forecast turbine hub heights and will be redeployed to

other support sectors like geotechnical work. (IHS Markit Net-Zero

Business Daily's Max Lin)

- The Global Wind Energy Council expects 235 GW of new offshore wind capacity will be added between 2021 and 2030. This will bring the total capacity to 270 GW before this decade ends.

- According to the Brussels-based industry group's forecast, new annual installations are to increase from 6.1 GW in 2020 to 23.1 GW in 2025 and, potentially, 40 GW in 2030.

- To gain economies of scale and operational efficiency, wind project developers have been shifting to larger turbines in deeper waters.

- Consultancy Rystad Energy said the average offshore turbine size globally has risen to the current level of 6.5 MW from 3 MW in 2010 (when China is excluded). Turbines larger than 8 MW are expected to account for 53% of total annual installations by 2030, compared with 3% in 2010-2021, according to Rystad.

- In the Chinese market, where developers focused on shallow-water installations and faced less cost pressure earlier, most turbines are expected to measure between 6 MW and 8 MW this decade.

- Excluding China, Rystad expects global WTIV demand to reach 79 vessels on an annual basis by 2030. Of them, 62 will need to be capable of installing turbines larger than 9 MW. This assessment does not consider non-operational days.

- U.S.-based multinational beverage maker The Coca-Cola Company

aims to have at least 25% of all beverages sold globally in

reusable packaging by 2030, the company said late last week. It

aims to do this across all of its beverage brands sold in

refillable or returnable glass or plastic bottles, or in refillable

containers through traditional fountain or dispensers, the company

said. (IHS Markit Chemical Market Advisory Service's Chuan Ong)

- The Coca-Cola Company said that accelerating reusable packaging use supports its goals of making 100% of primary consumer packaging recyclable by 2025, using 50% recycled material in its packaging by 2030, and 1:1 collection and recycling of bottles or cans for every one sold by 2030.

- Using reusable packaging promotes a circular economy, as refillable containers have high levels of collection and are low-carbon footprint beverage containers as container collection is built into the beverage delivery model, it explained.

- Citing a third-party report, the company said that converting 20% of global plastic packaging into reuse models is a $10 billion business opportunity that benefits customers and represents a crucial element in the quest to eliminate plastic waste and pollution.

- It said refillable packaging already accounts for 25% or more of sales in more than 40 markets, 50% or more of sales in over 20 markets, and 16% of its total global volume for 2020.

- Use of refillables is growing in several markets, outperforming non-refillables in Germany and parts of Latin America, where reusable bottles represented 27% of transactions in 2020, said The Coca-Cola Company.

- Waymo has partnered with truck fleet operator CH Robinson to test automated trucks in Texas (United States). Under this partnership, Waymo Via, the company's trucking and cargo transportation service, will conduct multiple pilot schemes by deploying its test fleet for CH Robinson's customers in the Dallas-Houston transportation lane. The companies will collaborate to shape the future development and expansion of autonomous technology as a new mode of transport. Charlie Jatt, head of commercialization for trucking at Waymo Via, said, "We look forward to this collaboration with C.H. Robinson, both for their deep roots and experience in logistics and transportation, but also as a company that shares our vision of how technology and autonomous trucking can change our industry for the better. C.H. Robinson's size, scale and platform gives us access to rich and unique transportation data along with customer relationships and pilot opportunities to help bring our Waymo Via solution to the market." (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Jaguar Land Rover (JLR) has announced that it will work with Nvidia to develop its artificial intelligence (AI)-powered autonomous vehicle and connected services, with a nearly all-encompassing use of Nvidia hardware and software sets. According to a press statement, starting in 2025, all Jaguar and Land Rover vehicles will be built on the Nvidia Drive software-defined platform. JLR says that this will enable a "wide spectrum of active safety, automated driving and parking systems as well as driver assistance systems", as well as AI inside the car. Interior elements will include driver monitoring and occupant monitoring and "advanced visualization of the vehicle's environment". Although software engineers from both companies will be involved, the full-stack solution is based on Nvidia Drive Hyperion with Drive Orin centralized AV computers; Drive AV and Drive IX software; safety, security, and networking systems; plus surround sensors. The company says that Drive Orin is the AI brain (a system-on-chip), and Drive Hyperion the central nervous system. JLR will use in-house-developed data center solutions with Nvidia DGX for training AI models and Drive Sim software built on Nvidia's Omniverse. With these developments in its collaboration with Nvidia, JLR will join other automakers in the promise of routine over-the-air updates that transform a vehicle during its lifecycle. This is JLR's next step towards the software-enabled and -defined car that many automakers are working towards, although JLR is focusing more on the partnership than developing as much as possible in-house, as some larger automakers are doing. JLR, however, is far from the only automaker working with Nvidia in one way or another. Volvo, Vinfast, Polestar, and others have announced work with Nvidia in the past year. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Shell BP SA Petroleum Refineries (Sapref), owner of the largest

oil refinery in the South African economy, announced the indefinite

suspension of its South African operations on 10 February. Sapref

said rising input costs, such as for crude oil, labour, and

electricity, combined with imminent changes in legislation, which

will become binding in 2023, contributed to the decision. The

state-owned Central Energy Fund, which manages the country's energy

assets, has shown an interest in buying the 180,000-barrels-per-day

refinery, although the authorities have made no final investment

decision. (IHS Markit Economists Thea

Fourie and Langelihle

Malimela)

- The South African downstream sector, although much more vibrant than elsewhere in sub-Saharan Africa, is facing a regulatory environment that is finally catching up with world standards. In recent years, investments were made by the South African refining industry to comply with CF1 regulations of 50 parts per million (ppm), which mandate motor fuels, gasoil, and gasoline (petrol) must not have a sulphur content of more than 50 ppm. This was followed by the updated Clean Fuel 2 (CF2) regulation, initially planned to come into effect in July 2017, which lowered the mandated maximum sulphur content in motor fuels, gasoil, and gasoline to 10 ppm. The CF2 regulation was gazetted in September 2021, with a deadline for implementation of 1 September 2023.

- The scale of new investment needed to upgrade the South African refineries to adhere to the CF2 legislation is massive, estimated at USD4 billion. Given the high complexity and high maintenance cost of the Sapref refinery, there is a likelihood of reassessment of the economic viability of the refinery under the new regulation. In such a case, a decision for its closure could be taken in the medium term if an interested buyer could not be found. One of South Africa's other main refineries, the Enref refinery owned by Engen in Durban, has been shut down officially and has been converted into a fuel storage facility. Meanwhile, the future of another of the country's main refineries, the Calref refinery owned by Astron in Cape Town, remains in the balance. The Calref refinery was shut down due to fire incidents in the second half of 2020.

- The last lifeline of South Africa's refining sector is the 150,000-barrels-per-day coal-to-liquid (CTL) plant operated by Sasol, Natref. Sasol has reportedly reduced operating rates since 2020, due to low demand. The CTL plant has recorded a strong operating rate of over 90% since 2018, with a slight decline to 85% in 2020. However, despite producing ultra-low-sulphur fuels, this plant reportedly would also need some investment to fully comply with the new regulation.

- Considering the sector's low margins and stressed finances, and the regulatory changes that mandate expensive upgrades, more refinery closures cannot be ruled out. In 2022, about 60% of South Africa's oil demand is forecast to be supplied by imports, marking a substantial increase from around 25% in 2019, prior to the refinery closure.

Friday, February 18, 2022

- Cryptocurrency miners are poised to play an increasingly large

role in addressing the vulnerabilities of the US power grid, even

as scrutiny from lawmakers intensifies after miners decamped in

droves to American shores following a Chinese government ban,

raising electricity price and climate impact concerns. (IHS Markit

Net-Zero Business Daily's Keiron Greenhalgh)

- Miners can currently provide speedy flexibility for grid operators, and at least one company recently stopped production during wintry blasts of weather to sell the power under its control. But the future offers even greater rewards for the backbone of President Joe Biden's climate goals, analysts and executives say.

- Cryptocurrency mining has possibilities as an additional revenue source for solar or wind developers, a storage asset, or even a strategy for regulated utilities to make money with, they say.

- The dominant cryptocurrency is Bitcoin. Bitcoin mining's total known power use globally was 3.338 GW at the end of December, according to data compiled by Coinshares Research, a Jersey, Channel Islands-headquartered digital investment house. The largest share of that mining power use was based in the US at 1.38 GW, or 41.3%, while 787 MW or 23.6% was in Kazakhstan.

- America's share of Bitcoin mining increased from 4% in August 2019 to 35% in July 2021, according to US Senator Elizabeth Warren, Democrat-Massachussets. The US' share of mining soared after the Chinese ban came into effect in May 2021 and then was updated in September 2021, which the lawmaker said left 500,000 mining operations looking for new homes.

- Computer servers known as "mining rigs" perform complex calculations to earn cryptocurrency blockchain such as Bitcoin. These servers require vast computational power and substantial amounts of electricity. As a result, miners typically seek out the cheapest power as a result. Where that is coal-fired generation, miners have attracted negative publicity against the backdrop of more ambitious US climate goals.

- Warren and fellow lawmakers Sheldon Whitehouse, Jeff Merkley, Maggie Hassan, Ed Markey, Katie Porter, Rashida Tlaib, and Jared Huffman, sent letters 27 January to crypto mining companies seeking answers on their grid and climate impact. The six companies—Riot Blockchain, Marathon Digital Holdings, Stronghold Digital Mining, Bitdeer, Bitfury Group, and Bit Digital—were given until 10 February to respond.

- "The extraordinarily high energy usage and carbon emissions associated with Bitcoin mining could undermine our hard work to tackle the climate crisis—not to mention the harmful impacts crypto mining has on local environments and electricity prices," said Warren in a statement revealing her latest consumer protection inquiries.

- Brazil's Braskem and France's Veolia will jointly invest in a

renewable energy project in Alagoas to power its petrochemical

production, Braskem said this week. The Brazilian petrochemical

company signed a BRL 400 million ($77 million) investment agreement

with French environmental services company Veolia to produce

renewable energy using steam from eucalyptus biomass, Braskem said.

(IHS Markit Chemical Market Advisory Service's Chuan Ong)

- The project will generate 900,000 mt/yr of steam for 20 years, which will mean emission reductions of approximately 150,000 mt/yr of CO2, said Braskem.

- Braskem plans to site the plant in Marechal Deodoro municipality in Brazil's state of Alagoas, and to begin operating in 2023.

- The company expects the project advances two of its objectives: a 15% reduction in greenhouse gas emissions by 2030, and achieving carbon neutrality by 2050.

- The eucalyptus biomass project is a new energy generation method for Braskem that is intended to sustainably fulfil steam demand for petrochemical plant operations, the company said.

- "We will reduce the greenhouse gas emissions generated by our operations in Alagoas by one-third, based on our 2020 emissions," said a Braskem executive.

- Veolia will manage most of the project, including agricultural and forestry management involving over 5,500 hectares of eucalyptus groves. It will also handle the engineering concept of the project, construction of biomass processing and steam production plants, plus operation and maintenance of the entire facility for the 20-year agreement period, said Braskem.

- It will make internal investments to adapt its Marechal Deodoro complex to this new thermoelectric system.

- Green hydrogen producer Hy2Gen AD has secured €200 million

($227.3 million) from a variety of investors to construct

facilities to deliver this clean fuel for use in a variety of

aviation, maritime, ground transport, and industrial applications

in Europe and North America. The Wiesbaden, Germany, company said

it raised the private capital from a variety of investors,

including Hy24, a green hydrogen investment platform launched in

October with the sole purpose of raising €1.5 billion ($1.7

billion) to accelerate large-scale clean hydrogen projects and

infrastructure. (IHS Markit Net-Zero Business Daily's Amena

Saiyid)

- "As early as 2021, we were looking for the best possible combination of financial and strategic investors to build e-fuel production facilities," Hy2Gen CEO said in the 17 February announcement. "These have the potential to decarbonize entire industries and transport sectors. We are now very pleased that all parties have sealed the largest investment in this segment."

- With growing demand from regulators and investors to decarbonize transportation and manufacturing sectors, hydrogen, especially the "green" variety produced from renewable power sources, is increasingly being viewed as an alternative to carbon-intensive fossil fuels. In liquid form, hydrogen can be transported in existing pipelines or shipped in specially designed seaborne carriers, while in solid form it can be used in fuel cells for automobiles, and can be used to produce steel and cement, two traditionally carbon-intensive industrial processes.

- The International Renewable Energy Agency in January said green hydrogen could be most economical in locations that have "the optimal combination of abundant renewable resources, space for solar or wind farms, and access to water, along with the capability to export to large demand centers."

- The Hy2Gen project is Hy24's first investment foray. It is funding the Hy2Gen from its clean hydrogen infrastructure fund for which it has raised €1 billion ($1.13 billion) to date, Hy24 CEO Pierre-Etienne Franc said in a statement accompanying the 17 February announcement. This investment will enable Hy24 to "step into its role as a catalyst for hydrogen-based projects at scale to foster the energy transition," Franc added. Other investors in the Hy2Gen project include French investment firm Mirova, Canada-based pension fund Caisse de dépôt et placement du Québec (CDQP), and French engineering and construction firm Technip Energies.

- Volkswagen (VW) is in talks with Chinese tech giant Huawei about acquiring an autonomous vehicle unit, reports Reuters citing German business magazine Manager Magazin. The automaker is said to have been negotiating the deal for several months, according to Manager Magazin citing inside sources. The automaker declined to comment when approached by Reuters on the matter. VW Group CEO Herbert Diess said on 16 February that the company was pursuing more partnerships to increase its self-sufficiency in software. Diess also said he expects widespread adoption of vehicle automation technologies in cars within 25 years. VW has been expanding its software development unit since 2019, with the aim for all of the group's new models to run on its own operating system from 2025 onwards. It is still too soon to tell if VW could reach a deal with Huawei on the development of automated technologies. A possible tie-up with the Chinese tech giant by either partnerships or acquisitions would strengthen VW's capacity to introduce competitive smart electric vehicles (EVs) to its key markets, especially China. Huawei already introduced its smart cabin and automated driving systems to several new models on sale in China. The Arcfox Alpha-S, an electric sedan introduced by Arcfox, is equipped with Huawei's automated operation systems, while the AITO M5, a new model introduced by Seres, also features Huawei's smart cabin systems. (IHS Markit AutoIntelligence's Abby Chun Tu)

- Stellantis is looking to close some of its non-production sites in France, reports Reuters. A company spokesperson told the new service that the company intends to reduce the number of sites in the Paris (France) region that focus on administration and research from five to three as staff shift to working from home. It said that the move would also reduce costs. The representative the sites most likely to close were those at Satory and Trappes. Separately, the Italian government has indicated that it will provide support for battery facility investment planned by Stellantis in the country. Minister of Economic Development Giancarlo Giorgetti was quoted as telling Il Sole 24 Ore in an interview, "We are convinced that Stellantis should continue to be engaged in Italy and the gigafactory in Termoli which [the Italian government] will support with EUR369 million of public money demonstrates this." The senior politician also told the newspaper that a package of measures to support the purchase of low emission vehicles and the conversion of facilities to battery electric vehicles (BEVs) worth around EUR1 billion per year for at least three years could be approved by the government on Friday (18 February). (IHS Markit AutoIntelligence's Ian Fletcher)

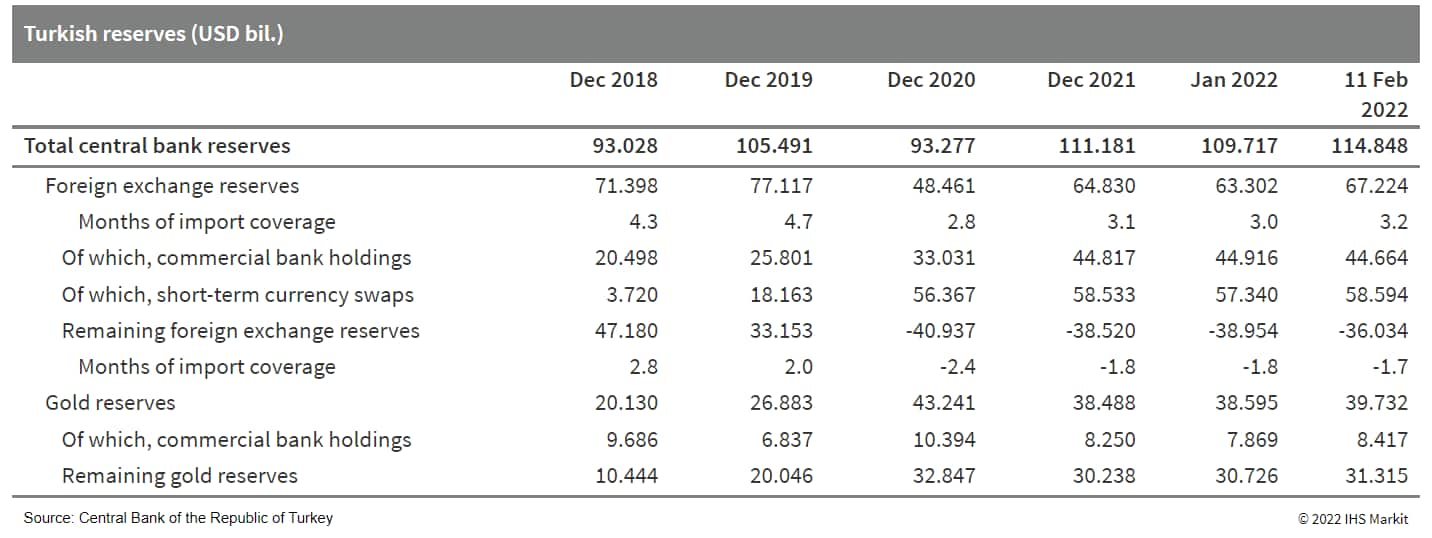

- The Monetary Policy Committee of the Central Bank of the

Republic of Turkey (Türkiye Cumhuriyet Merkez Bankası: TCMB) held

its main policy rate, the one-week repo rate, unchanged at 14.0% at

its regularly scheduled, monthly policy-setting meeting on 17

February. This was the second month in a row that the rate was held

steady after the bank reduced the rate by 500 basis points between

September and December 2021. (IHS Markit Economist Andrew

Birch)

- In its press release alongside the meeting, the TCMB states that current inflation is "driven by pricing formations that are not supported by economic fundamentals". Included in these pressures are global energy prices, food and commodity prices, ongoing supply constraints, and demand developments.

- The bank claims to be confident that a disinflation process will begin soon given actions taken by the TCMB and the government and due to shifting base effects. For those reasons, the bank declined to raise the policy rate even though the annual inflation rate soared to 48.7% in January.

- In recent weeks, President Recep Tayyip Erdoǧan has pushed through a couple of administrative changes to try to limit inflationary pressures. On 16 February, he announced that the government would adjust electricity tariff levels, benefiting 4 million households. Additionally, his energy secretary announced the next day a 25% reduction in electricity prices for small tradespeople. These moves partially reverse the sharp increase in energy prices that began immediately after the beginning of the year. Those price adjustments have triggered a wave of protests.

- Additionally, the government had previously announced the

reduction of sales taxes on many foods from 8% to 1% in the hope of

combatting inflationary pressures.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-global-market-summary-highlights-february-21-2022.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-global-market-summary-highlights-february-21-2022.html&text=Weekly+Global+Market+Summary+Highlights%3a+February+14-18%2c+2022+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-global-market-summary-highlights-february-21-2022.html","enabled":true},{"name":"email","url":"?subject=Weekly Global Market Summary Highlights: February 14-18, 2022 | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-global-market-summary-highlights-february-21-2022.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Weekly+Global+Market+Summary+Highlights%3a+February+14-18%2c+2022+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-global-market-summary-highlights-february-21-2022.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}