Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Mar 17, 2020

US equity shorts deliver alpha

Popular shorts underperform during market decline

- "Most shorted" US equities underperform by 5.5% on average

- Consumer Discretionary sector particularly profitable

- Short sellers add estimated $17bn in new shorts in March

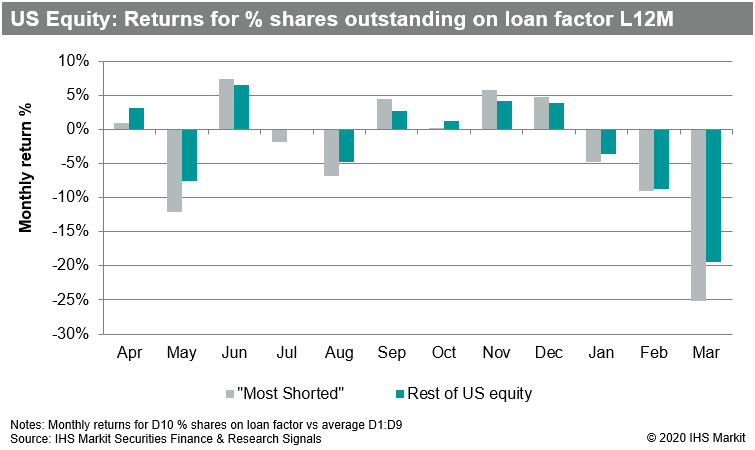

The deepening sell-off in US equities has presented opportunities for long-short managers, with the most heavily shorted shares underperforming the broader market. This is true for a variety of metrics for measuring short interest, including the cost of borrow, percentage of outstanding shares on loan, and percentage of lendable shares already on loan. The underperformance holds true for large and small market capitalization and for most sectors.

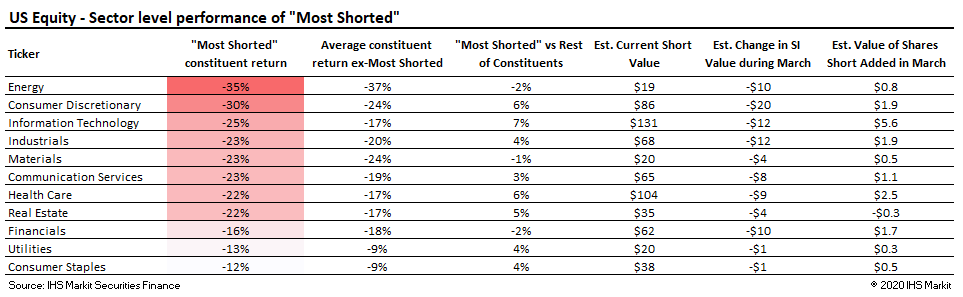

Energy equities certainly warrant a closer look, given that constituents have seen the largest decline in market valuation for any US equity sector. The Energy sector has faced the dual threat of increasing supply and decreasing demand, however it is worth noting that the most shorted constituents in the sector have outperformed the rest of the sector. The larger decline for the less shorted constituents is in part the result of some segments already exhibiting distressed valuations coming into the broad market collapse, particularly firms with US Shale exposure, and suggests broad selling of the sector by investors. Month to date, the only other sectors where the most shorted stocks have outperformed their peers are Materials and Financials. There has been a limited will to add shorts in the Energy sector, with the value of new shares short increasing by less than $1bn, while the total value of short positions has fallen by $10bn.

The Consumer Services sector has also been particularly put upon by the pandemic, with constituents returning -25% MTD, the 2nd worst sector return behind Energy. The sector was also fruitful for short sellers, with the most shorted equities declining by -30%. Particularly hard hit was Consumer Services industry group which contains hotels, cruise lines, casinos and restaurants. The most shorted stock in the Consumer Services industry group declined by 40% on average MTD.

Conclusion:

Volatile markets reveal the extent to which hedge funds have lived up to their name. Over the course of February the exchange short interest increased by 5% on average for the largest US equities vs 3% for the rest of US equities; Based on increases in borrowing reported to IHS Markit we estimate that the largest US equities have seen a further 4% average increase in shares short in March, while the average increase in shares for firms with smaller market capitalizations has only been 3%. The increase in short positions in larger capitalization equities suggests an increase in broad hedging of market exposure, also seen in the increasing short positions in exchange traded funds.

The total value of the exchange short interest peaked on January 15th at $872bn, before declining by 17%, to $725bn, for February 28th short interest snapshot. Estimating the current short interest based on borrowing trends, and the historical relationship between borrowing and short interest at a security level, we estimate the total short interest value declined to $648bn as of Friday, March 13th. The decline being broadly like the YTD decline in market valuations suggests that there hasn't been a significant overall change in short positioning.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-equity-shorts-deliver-alpha.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-equity-shorts-deliver-alpha.html&text=US+equity+shorts+deliver+alpha+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-equity-shorts-deliver-alpha.html","enabled":true},{"name":"email","url":"?subject=US equity shorts deliver alpha | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-equity-shorts-deliver-alpha.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=US+equity+shorts+deliver+alpha+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-equity-shorts-deliver-alpha.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}