Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Nov 03, 2021

Stocks not spooked by tales of October volatility

Research Signals - October 2021

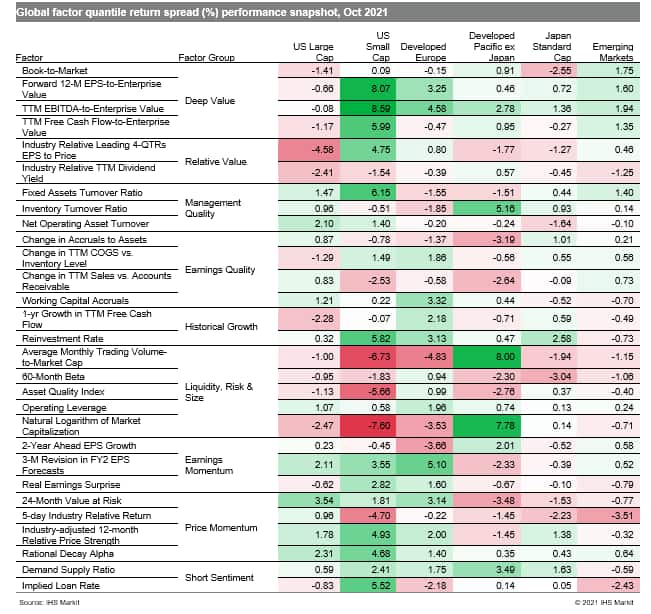

Global manufacturing growth continues to be stymied by supplier delays and stalling export trade, according to the J.P.Morgan Global Manufacturing PMI. However, fears of rising inflation and continued supply chain disruptions were not able to trick markets in October, a month historically associated with stock market crashes, as investors in the US, developed Europe and Japan were treated to a strong finish to the month. Furthermore, an overview of factor performance for the month (Table 1) unmasked a tendency towards high momentum shares, though with some variation across regions and capitalization ranges.

- US: Deep Value measures such as Forward 12-M EPS-to-Enterprise Value were especially favored among small caps, a theme that did not carry over to large caps

- Developed Europe: High momentum stocks measured by Industry-adjusted 12-month Relative Price Strength were strong performers

- Developed Pacific: High quality firms outperformed in markets outside Japan, as captured by Inventory Turnover Ratio

- Emerging markets: Investors rewarded Deep Value stocks, as gauged by TTM EBITDA-to-Enterprise Value, while short-term price reversal measures such as 5-day Industry Relative Return underperformed

Table 1

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fstocks-not-spooked-by-tales-of-october-volatility.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fstocks-not-spooked-by-tales-of-october-volatility.html&text=Stocks+not+spooked+by+tales+of+October+volatility+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fstocks-not-spooked-by-tales-of-october-volatility.html","enabled":true},{"name":"email","url":"?subject=Stocks not spooked by tales of October volatility | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fstocks-not-spooked-by-tales-of-october-volatility.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Stocks+not+spooked+by+tales+of+October+volatility+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fstocks-not-spooked-by-tales-of-october-volatility.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}