Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Mar 30, 2020

South Africa's junk status - a sign of things to come?

Moody's downgrade of South Africa to sub-investment grade didn't come as a great shock to the market. After all, the other two major rating agencies had already downgraded it junk and our IHS Markit colleagues in Country Risk rated its sovereign risk as BB+ with high strategic risk.

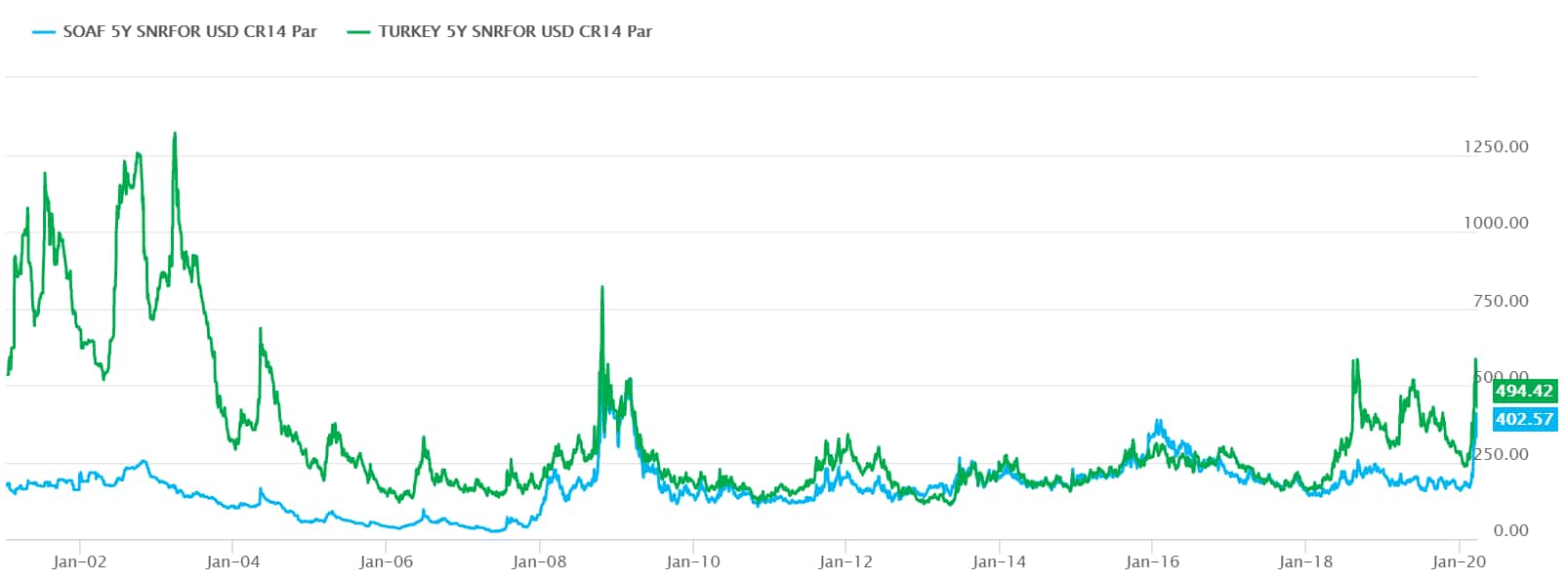

Nonetheless, no timing is opportune in the current febrile climate and the sovereign's CDS spreads have widened accordingly (they had an implied rating from the CDS market of 'B', prior to the downgrade). Five-year levels are trading 32bps wider at 440bps, the widest level for 11 years.

South Africa's CDS has historically been closely correlated with Turkey, both being liquid names that structural similarities (significant amounts of debt, net oil importers with current account deficits). That relationship broke down over the last two years as political instability and monetary policy uncertainties inflamed idiosyncratic risk in Turkey. But in this stressed period we are seeing considerable outflows from emerging market debt and names are starting to move in tandem again.

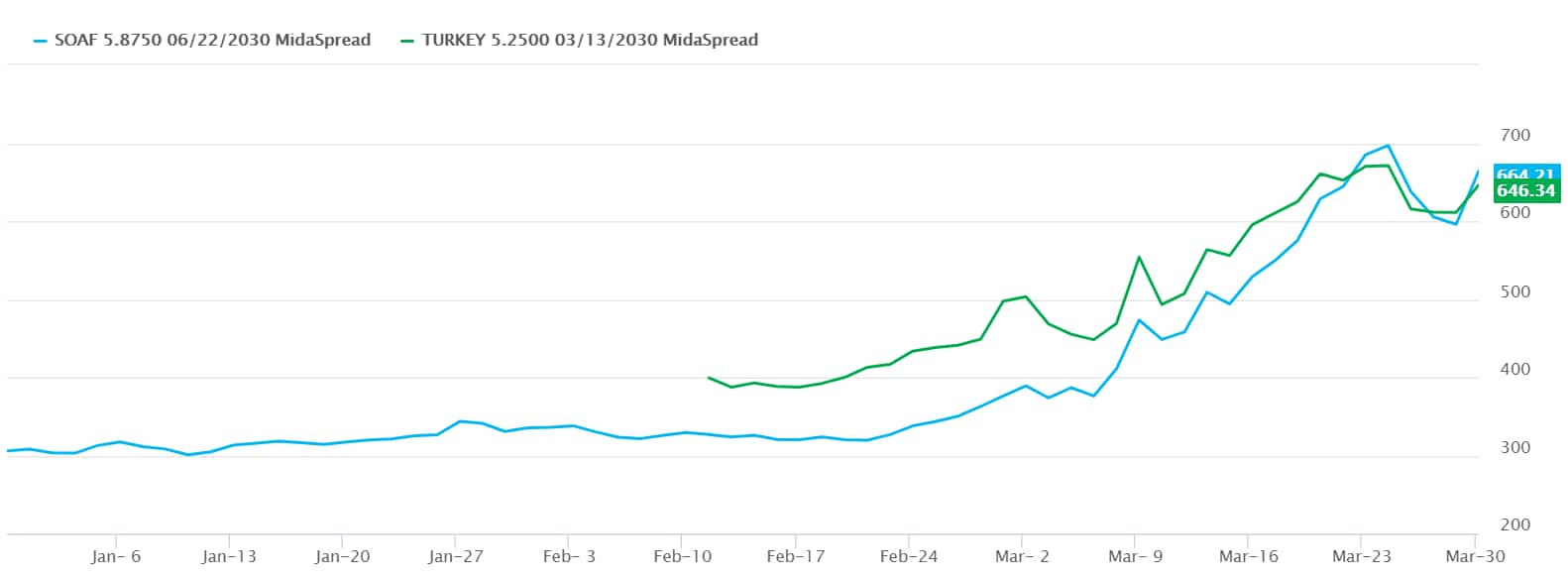

Inevitably, bonds as well as CDS also show evidence of credit deterioration. South Africa's 10-year bond trades with an asset swap spread of 646bps and the five-year is only 25bps lower. This gives a negative CDS-bond basis (CDS trading tighter than bonds) of 175-200bps. The outflow from bonds triggered by the Moody's downgrade may affect bonds disproportionately, yet the negative basis is nothing new to South Africa or many other emerging market sovereigns. Funding costs (along with the cost of warehousing risk on EM sovereigns) as well as liquidity differences impair the ability of institutions to implement negative basis trades (buy the bond, buy CDS protection).

IHS Markit last week forecast 0% GDP growth in South Africa for 2020. The government has already said that it may approach the IMF and World Bank for funds to help it deal with impact from the pandemic. This will no doubt become a familiar refrain across Africa as the situation worsens across the continent.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsouth-africas-junk-status--a-sign-of-things-to-come-.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsouth-africas-junk-status--a-sign-of-things-to-come-.html&text=South+Africa%27s+junk+status+-+a+sign+of+things+to+come%3f++%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsouth-africas-junk-status--a-sign-of-things-to-come-.html","enabled":true},{"name":"email","url":"?subject=South Africa's junk status - a sign of things to come? | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsouth-africas-junk-status--a-sign-of-things-to-come-.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=South+Africa%27s+junk+status+-+a+sign+of+things+to+come%3f++%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsouth-africas-junk-status--a-sign-of-things-to-come-.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}