Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Jun 04, 2021

Securities Finance May 2021

- May revenues increased by 23% YoY

- SPACs led US specials uptick

- Dividend reinstatement boosts EMEA equity revenues

- Corporate bond borrow demand remains elevated

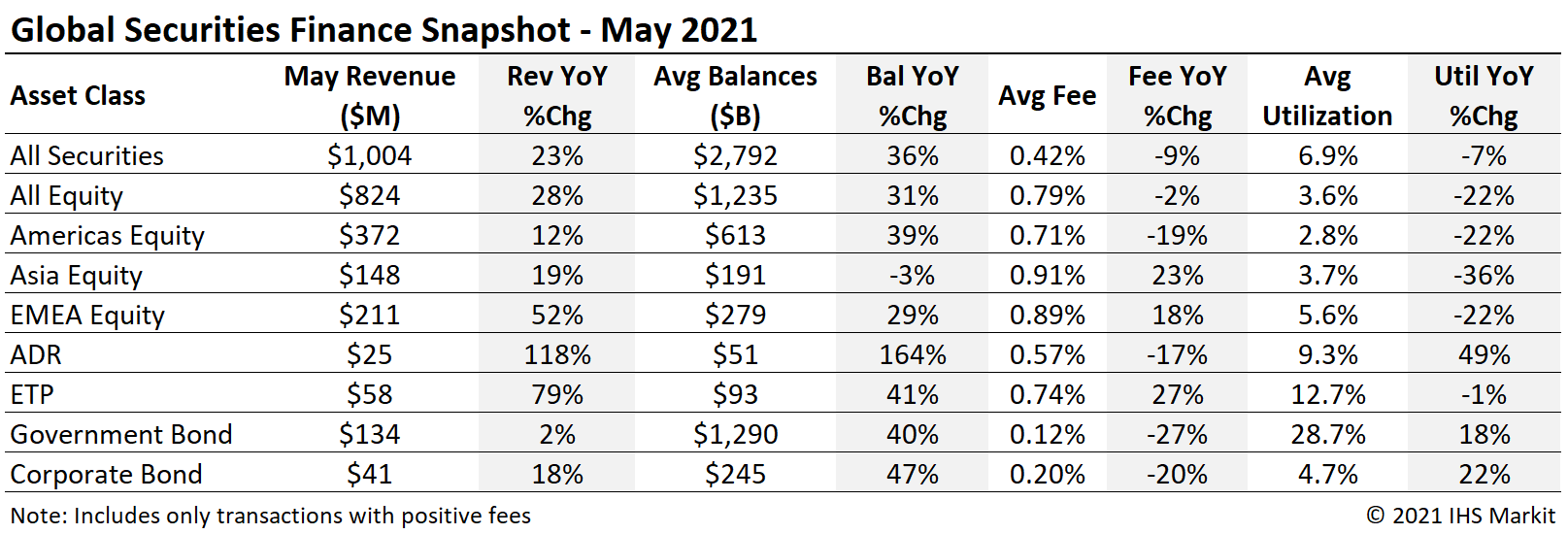

Global securities finance revenues totaled just over $1B in May, a 23% YoY increase. The YoY increase was primarily the result of increasing balances, with all major asset classes showing YoY growth. EMEA equities and global ETPs are notable for revenue growth driven by both YoY increase in balances and fees in May. Equity special balances remain well below the YTD peak in January, though May did see a resurgence in US equity specials, particularly those relating to current and former SPAC IPOs. In this note we'll discuss the drivers of May revenue, which put Q2 revenue on pace for a 20% YoY increase.

Americas Equity

Americas equity revenues came in at $372m for May, a 12% YoY increase and the most revenue since January's surge in specials balances drove a record $476m in revenue. The revenue increase is the result of growing loan balances, with fees declining YoY. The decline in average fees was driven by low-fee balances growing faster than special balances YoY.

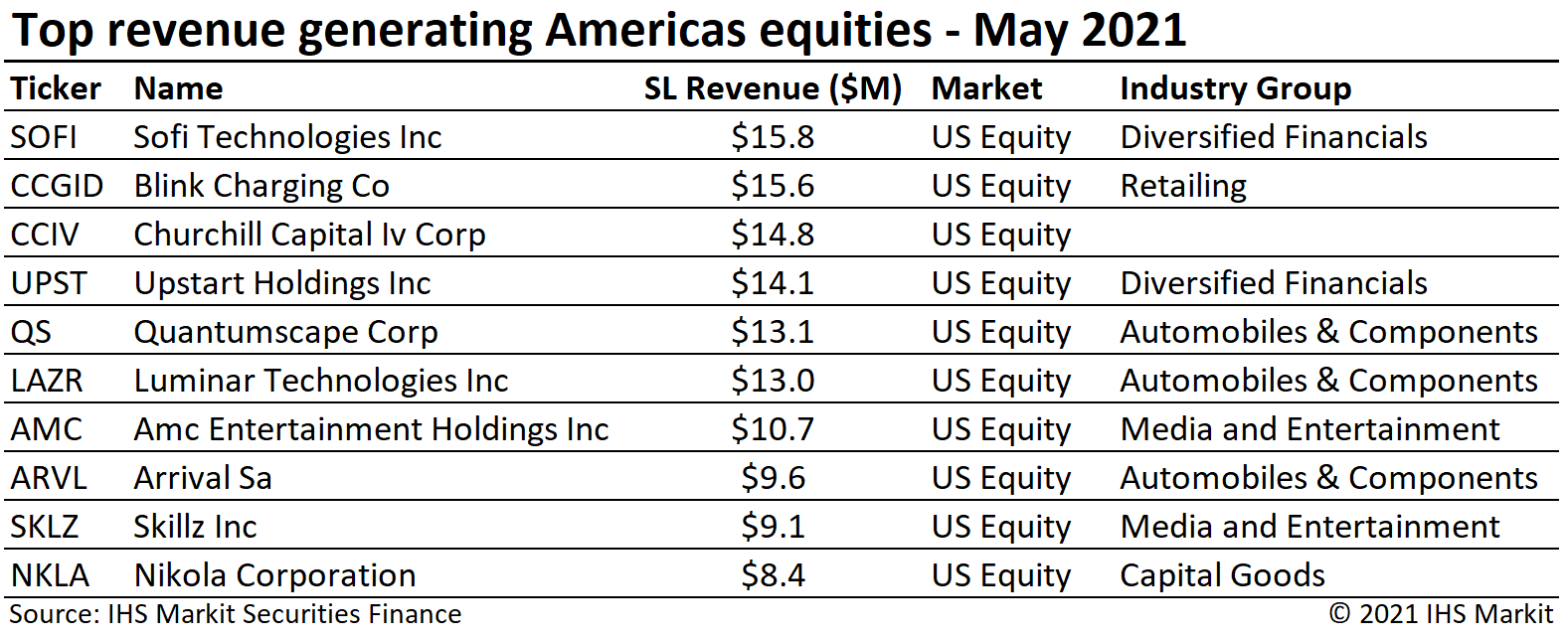

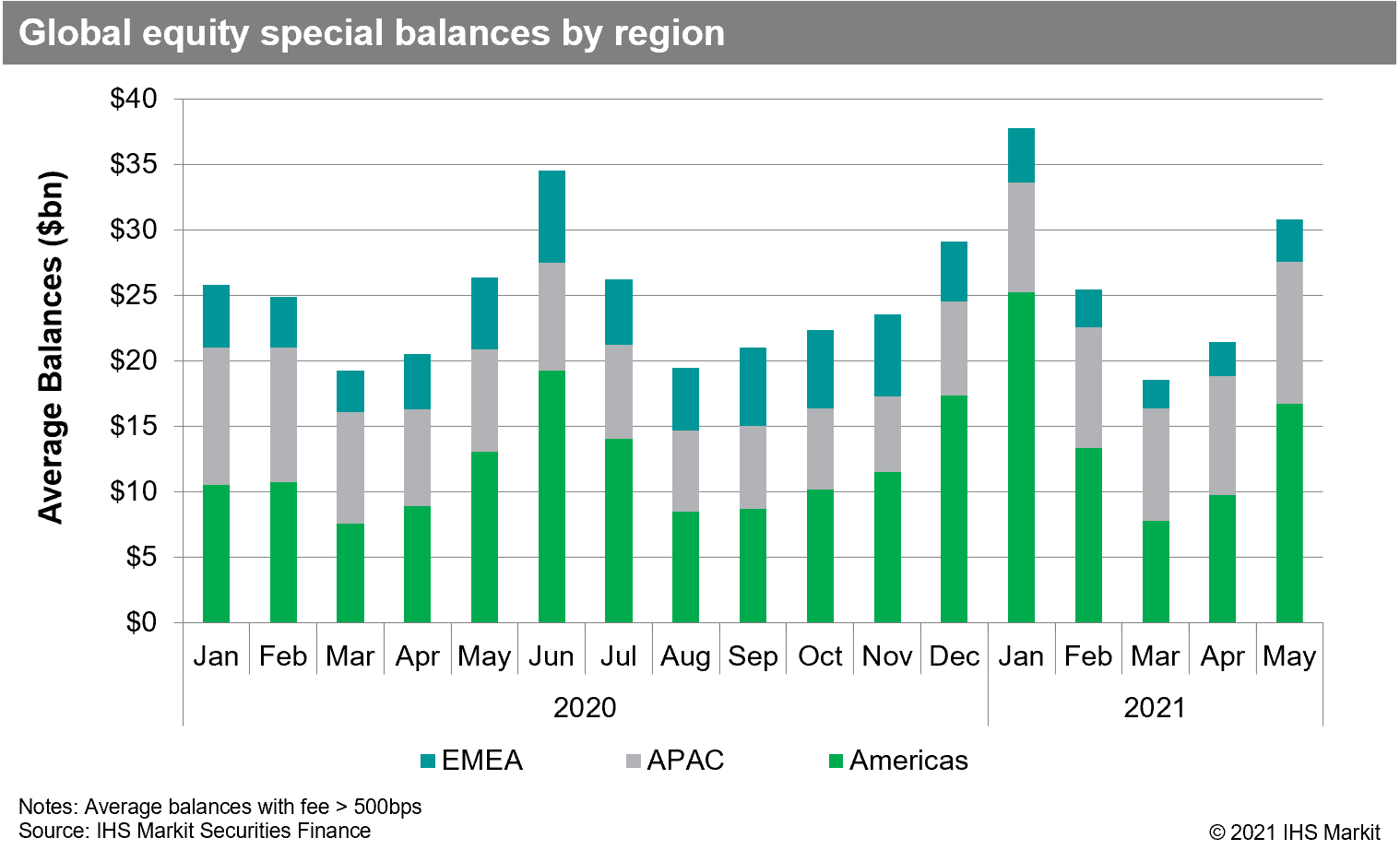

US equity revenues came in at $341m for May, a 17% YoY increase. US equity special balances increased by 77% MoM with an average of $16bn in May, remaining 35% below the average for January. Special balances are defined in this note as balances with a fee greater than 500bps.

The highest revenue generating US equity was Sofi Technologies Inc, with $15.8m in May revenue. Apart from AMC Entertainment Holdings, the top 10 Americas equity revenue generators were all current or former SPACs. A challenging YoY comparable awaits US equities in June, the most revenue generating month of 2020 coinciding with the broad short squeeze and Carnival convertible bond related revenue.

Canadian equity lending revenue of $29.2m reflected a 26% YoY decline for May. The YoY decline was primarily driven by a 49% decline in average fees. Canadian equity specials balances averaged $763m for May, the highest monthly average since August 2020. Aurora Cannabis was the most revenue generating CA equity, with daily returns increasing with fees and the share price despite a decline in shares on loan.

European Equity

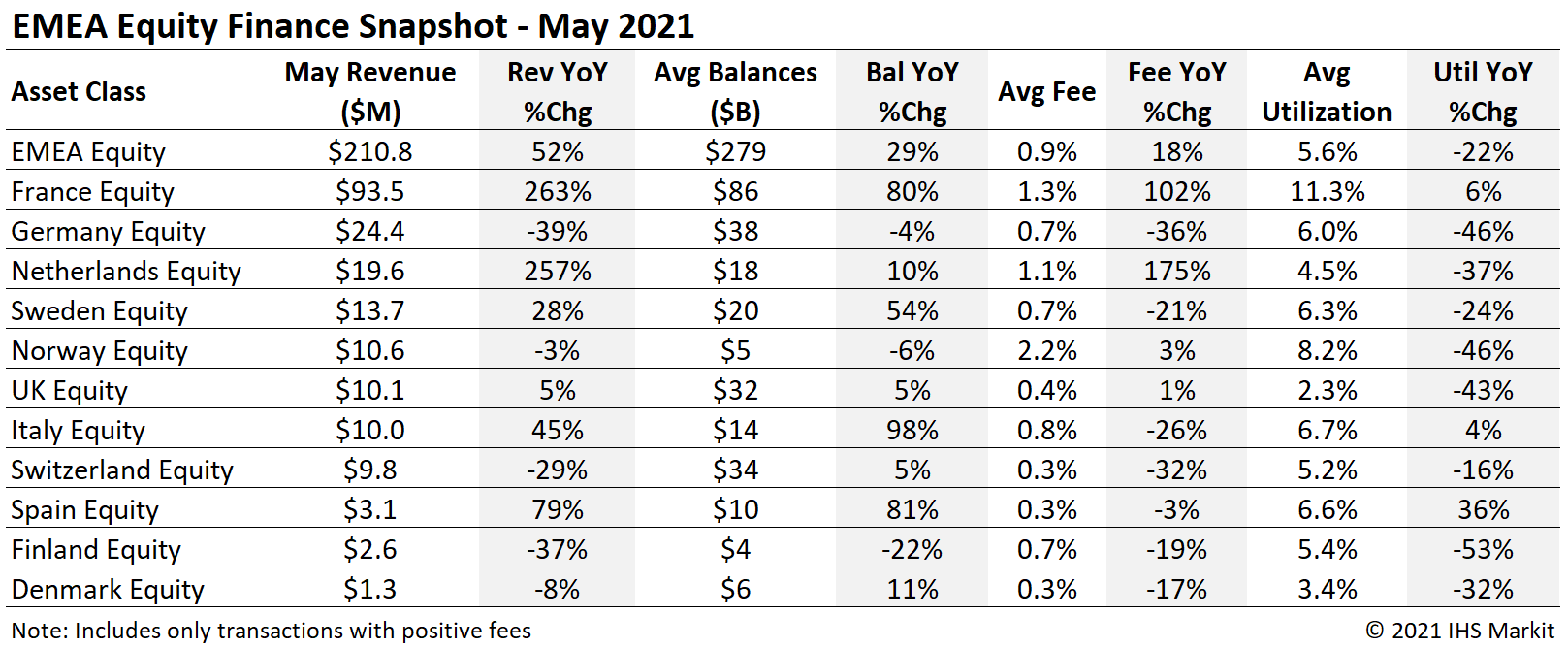

European equity returns increased by 52% YoY for May, with $210.8m in monthly revenue. The YoY increase was driven by both increasing balances and fees, in part the result of reinstated dividends which had been cancelled or reduced in 2020. For some context, May 2021 revenues were still down 36% compared with 2019.

France listed equity revenue increased 263% YoY, led by Credit Agricole Sa and Axa Sa. The resumption of dividend payouts is boosting borrow demand from the securities finance channel and IHS Markit Dividend Forecasting expects a 17% YoY increase in payout for EMEA issuers in 2021.

The YoY decline in German equity revenues is due to a lack of specials to fill the space left by Wirecard, Deutsche Lufthansa and Varta in May of 2020, though Varta has seen an increase in borrow demand following the January short squeeze (Grenke AG led German equities in May).

APAC Equity

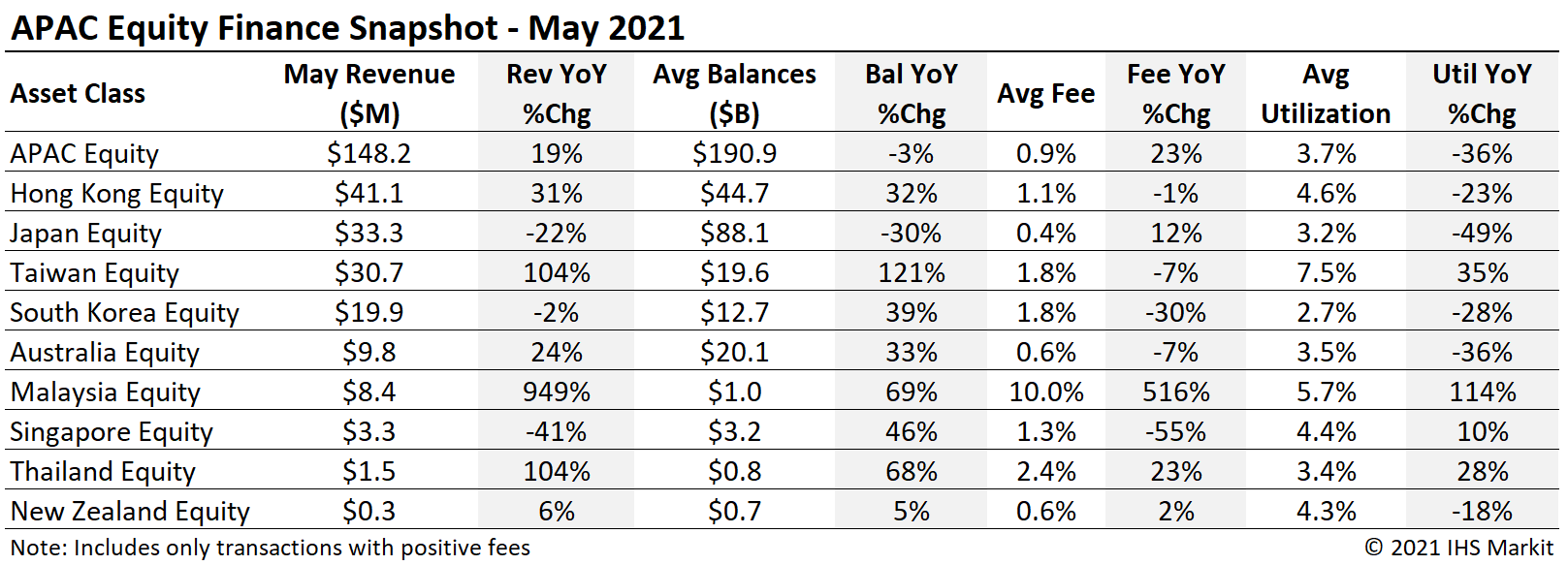

APAC equity finance revenues increased by 19% YoY in May, with returns holding steady compared with April. Asia equity special balances continue to have an upward trajectory from the 2020 low point in early November, May's $10.8bn in daily average special balances reflects a 20% MoM increase and the largest monthly average since November 2019.

Hong Kong SAR equity finance revenues increased by 31% YoY in May, overtaking Japan as the most revenue generating equity market in the region. The most revenue generating HK equity was China Evergrande New Energy Vehicle Group Ltd., the result of new share issuance offered at a discount in the aim of reducing the percentage ownership of the largest shareholder. The announcement sent the fee for new loans above 100% annualized, but the spike was short lived with fees and shares on loan declining, along with the share price, over the last two weeks of May.

Malaysian firm Top Glove Corporation continues to be the most revenue generating equity in APAC, single-handedly boosting MY equity revenues; Top Gove on-loan balances were steady in May, the result of decreasing share price and increasing shares on loan, with average fees trending higher. Thailand equity revenues have also steadily increased YTD, with $1.5 in May revenues reflecting a 104% YoY increase.

South Korea's short selling ban has concluded for larger market capitalization firms, with new short sales will be allowed for the benchmark Kospi 200 Index and the small-cap Kosdaq 150. Loan balances and fees increased steadily throughout the month, with the daily revenue on May 31st representing a 141% increase from the start of May. South Korea revenues decreased YoY, which may be surprising given the ban was in place then, but the comparison is impacted by HLB Inc, which was still generating returns on pre-ban balances in May 2020.

Depository Receipts

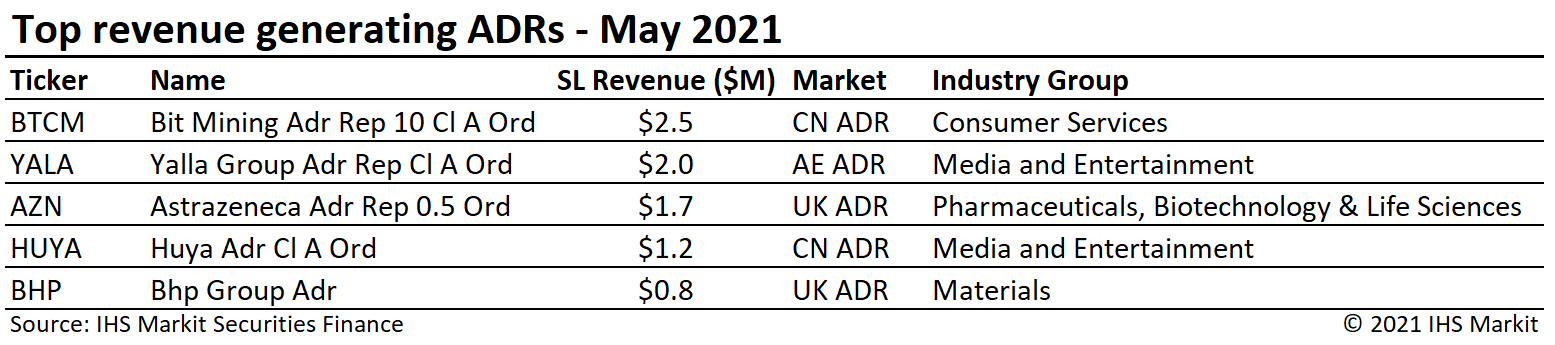

Revenues from lending American Depository Receipts (ADRs) declined again MoM, with the spectacular lending returns for Futu Holdings in Q1 and early April now a fading memory. The general uptrend in ADR revenue remains in-tact, with May revenues increasing 118% YoY despite being the lowest monthly revenue since November 2020. Depository receipts listed outside the US generated $7.3m in May, a 171% YoY increase, led by the Thailand listed receipts.

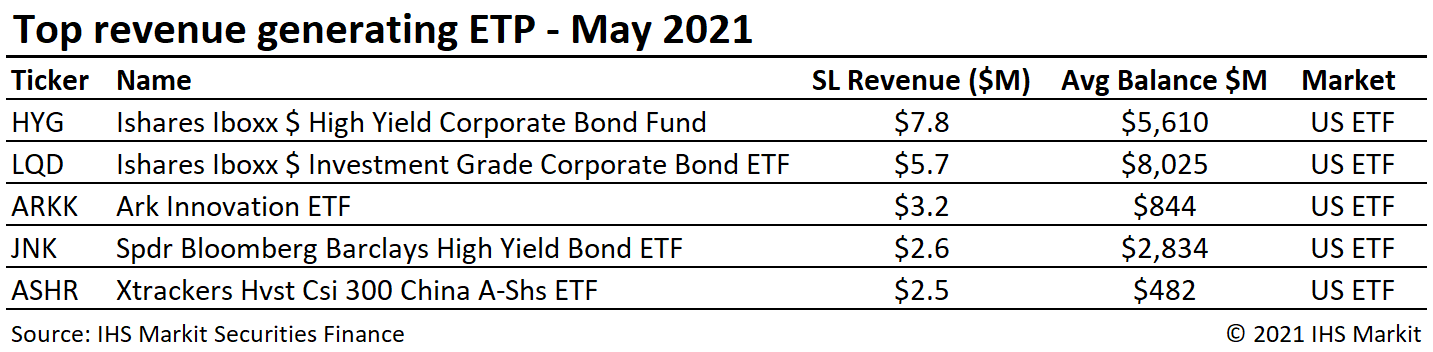

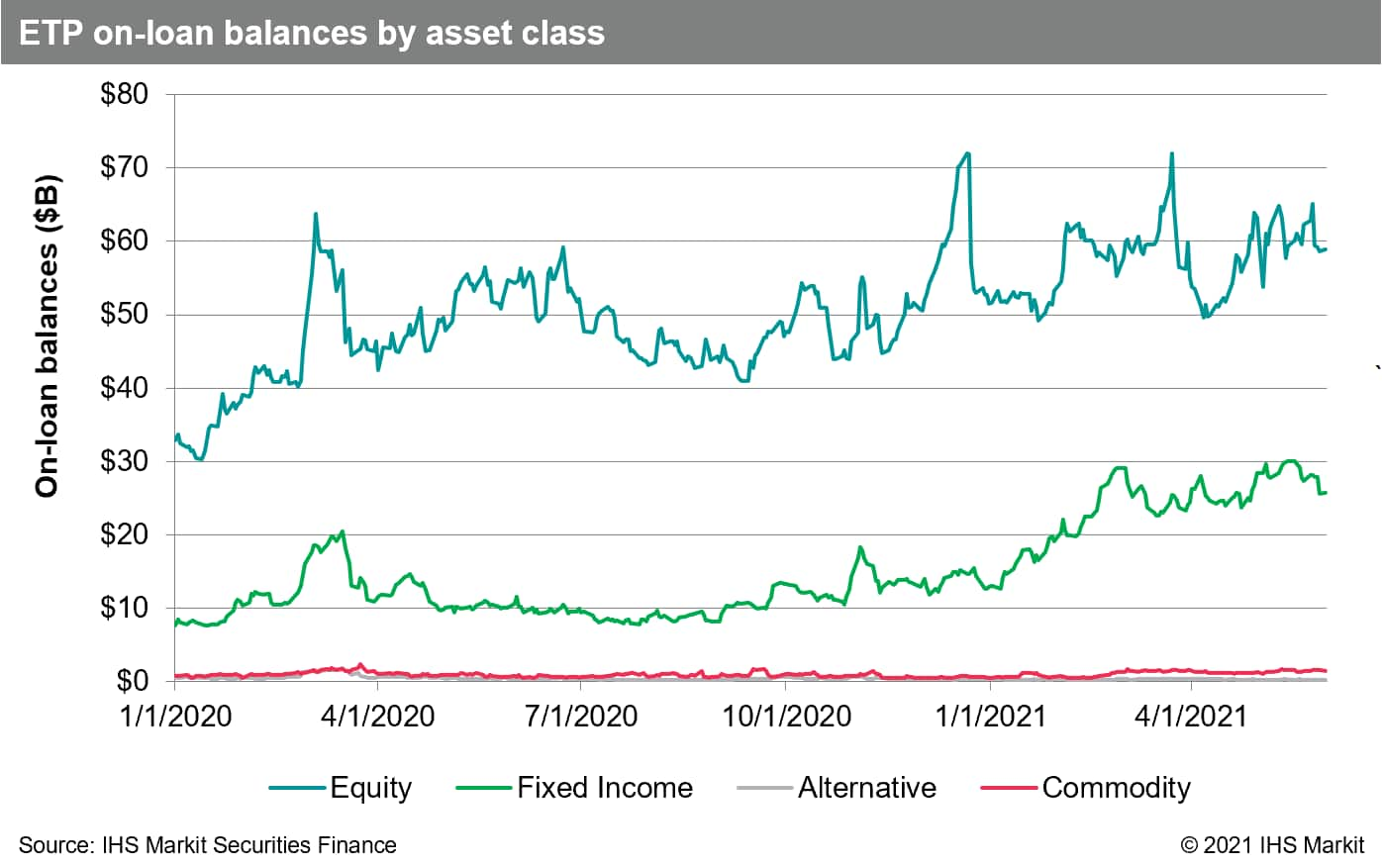

Exchange Traded Products

Global ETP revenues totaled $58m for May, a 79% YoY increase, making May the 2nd most revenue generating month of 2021, lagging only March. Loan balances had the highest monthly average on record, despite failing to exceed the March 23rd single day record. Lendable assets continued to increase, reaching an all-time high of $455bn in the last week of May. Revenues for fixed income products increased 27% MoM, as HYG, LQD and JNK borrow demand increased; FI products generated 42% of May revenue, up from 33% in April.

Corporate Bonds

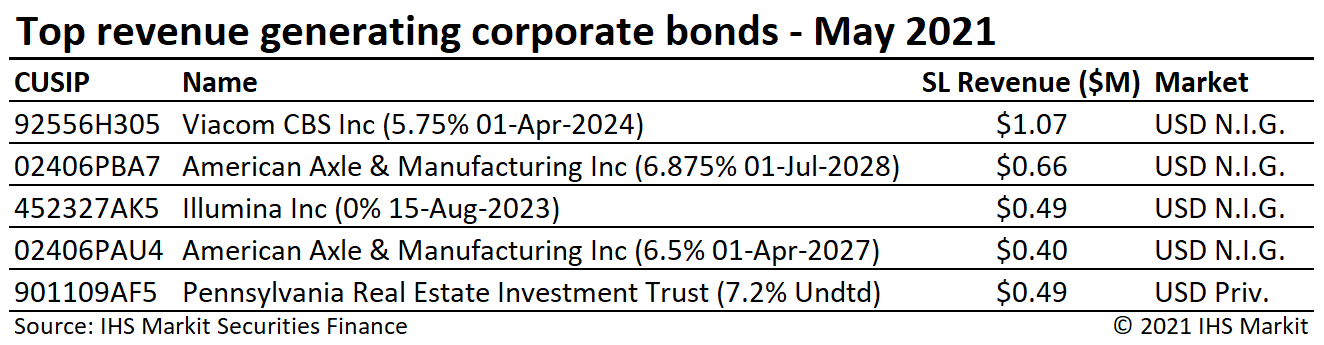

For the 2nd consecutive month, corporate bond lending revenues increased both MoM and YoY, reflected the general uptrend in borrow demand YTD. Lendable assets have also steadily increased, reaching an all-time high in May, however the increase in loan balances exceeded the increase in supply resulting in utilization reaching 4.65%, the highest level since May 2019. Convertible bonds contributed 8% of May corporates revenue, up from 6% in April, led by the Viacom CBS Inc 5.57% convertible note due April 2024.

Government Bonds

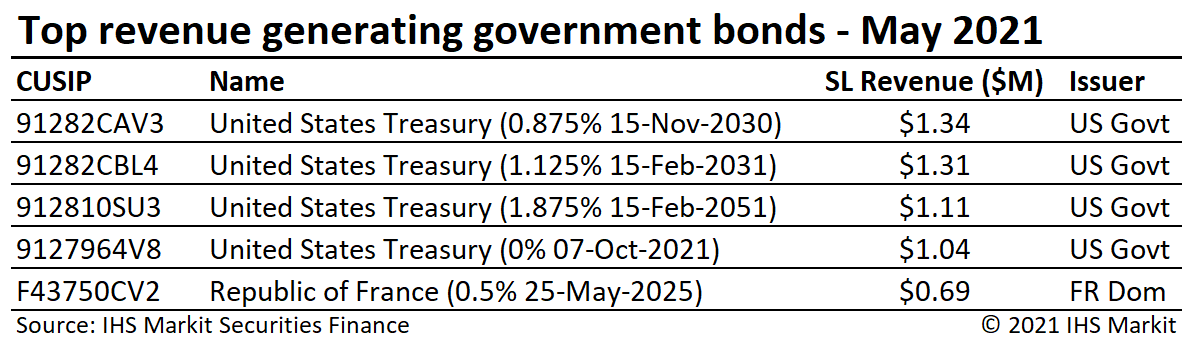

Government bond borrow demand remains robust, with $1.29T in positive-fee global balances for May reflecting an 40% YoY increase. The $367bn increase in positive-fee balances is the result of a $260bn YoY increase in total on-loan balances along with $107bn moving from negative to positive fee. Fee-spread revenues totaled $130m for May, a 9% YoY decline compared with May 2020. Total government bond lending revenues for agency programs, including reinvestment returns and negative fee trades declined by 12.3% YoY, as the result of narrower reinvestment spreads.

US government bond lending revenue came in at $76m for May, an 8% YoY decrease, though very similar to the April return. The Nov 2030 UST 10Y took the top rank on revenue generator table from the Feb 2031 UST 10Y note. Returns from lending European sovereigns were $45m for May, a 23% YoY increase.

Conclusion

Overall revenues increased 23% YoY for May, as global loan balances continue to trend upward. US equity specials mounted a timely comeback, after a thin stretch from late- February to April. Current and former SPACs took over the top of the US leader board, a phenomenon likely to continue as the record outstanding SPACs seek business combinations over the remainder of 2021. The usage of exchange traded products in institutional long portfolios and for short hedges has resulted in record highs for lendable assets and loan balances, respectively, with increased borrow demand likely continue to boost revenues going forward. Many of the drivers expected to boost returns in 2021 are playing out, from SPACs to convertible hedging to dividend reinstatements and the conclusion of short sale bans.

Stay tuned for monthly revenue snapshots from IHS Markit Securities Finance!

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsecurities-finance-may-2021.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsecurities-finance-may-2021.html&text=Securities+Finance+May+2021+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsecurities-finance-may-2021.html","enabled":true},{"name":"email","url":"?subject=Securities Finance May 2021 | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsecurities-finance-may-2021.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Securities+Finance+May+2021+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsecurities-finance-may-2021.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}