Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Jan 03, 2024

Securities Finance December Snapshot 2023

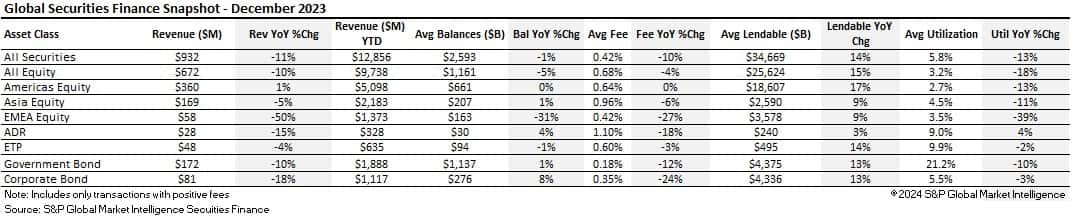

- 2023 securities lending revenues $12.856B (+3% YoY), the highest since 2008

- Increases in average fees push annual revenues higher

- December revenues decline by 11% YoY to $932M

- EMEA equities continue to struggle with lowest revenues of the year

Securities lending revenues for 2023 increased by 3% YoY to $12.856B. This increase was driven by some of the highest specials revenues ever seen across US equities, persistently strong average fees across a number of asset classes, and strong demand across corporate bonds. Despite the robust market wide revenues, the nature of the year's activity means that not all market participants would have benefited to the same degree. Whilst the market as whole produced another year of banner revenues, in a specials dominated market, it is unlikely that any one lender would have held all of the stocks trading special. Revenues are therefore likely to show a large level of dispersion across portfolios.

Another year of banner market revenues should however still be celebrated as it is reflective of the strength and adaptability of the financing markets during a period of heightened geopolitical risk, volatility, and interest rate uncertainty. Not only did 2023 witness the first bank failures since the global financial crisis but interest rates continued along one of the fastest and most aggressive tightening paths in history. For the securities lending market to continue to produce higher returns for asset owners during this turbulent year is a testament to its dynamism and discipline.

During December, $932M of revenues were generated, an 11% decline YoY. December was a poor month for securities lending activity with declines seen across nearly all metrics. EMEA equities suffered their worst revenues of 2023, APAC revenues suffered from a decline in demand and government bonds experienced lower demand over year end than they have experienced for many years.

Americas equities

The final month of 2023 saw increased gains across the Americas equity markets. The S&P 500 index, which has risen by approximately 14% since October, finished the year posting a 3.8% increase during December and a 24% increase during 2023, leaving the benchmark just shy of an all-time high. In Canada, despite slightly more modest gains, the TSX60 index closed 2.7% higher during the month and 8.2% higher over the year. The monthly gains were driven higher by a momentum fueled Santa rally, which pushed share prices continually higher during November and December, leading the S&P 500 to nine straight weeks of gain, one of the longest positive streaks since 2004.

The gains seen across Americas equities continue to be powered by a striking change in interest rate expectations, especially in the US, where inflation continues to fall quicker than expected. This trend was boosted by the Federal Reserve during December when Fed policy changed to include three predicted rate cuts for 2024. Investors' expectations of deeper and faster cuts led to higher equity valuations, as investors started to believe that the speed in the decline in inflation may have taken the Fed by surprise.

The handful of stocks known as the magnificent seven, continued to drive a large part of the gains seen across the US this year, although the rally did start to broaden out heading into the second half of December. The tech-dominated NASDAQ closed the year 43% higher, its best performance in twenty years, after adding 4.94% during the month. The Dow Jones Industrial index closed at a record high during the month, after posting a smaller decline than the other US indices during 2022 and thanks to its composition of mostly old-economy stocks.

In the securities lending markets, Americas equities was the only region to experience an increase in revenues YoY during the month. Revenues increased by only 1% YoY but by an impressive 9% MoM (November revenues $329.9M). Average fees remained flat YoY as did balances. Utilization declined by 13% as the value of lendable increased in line with market valuations. Across Americas equities, yearly revenues of $5.098B were produced during 2023 which represents an increase of 6.8% YoY. Average fees for the year were 78bps (12% increase YoY) whilst balances remained 5% lower YoY and utilization declined by 7% YoY. This shows the value that the specials market has contributed throughout the year.

Across US equities, annual revenues were 5.7% ($4.64B) higher during 2023 when compared with 2022. Average fees were also 13% higher YoY (79bps), mainly due to some very expensive specials that helped the asset class produce some exceptional revenues for lenders throughout the period. This is shown further by the fact that average balances declined by 6% YoY, lendable increased by 3% YoY and utilization declined by 9% YoY. Revenues for US equities peaked in July when $477.9M was generated.

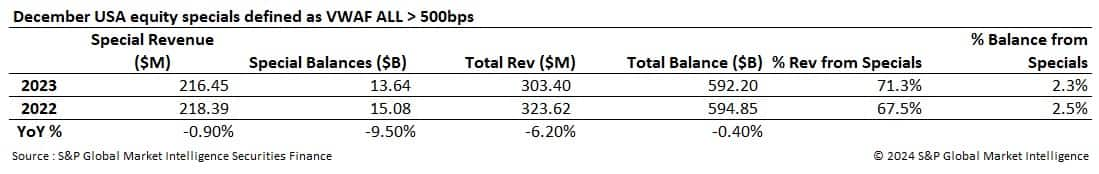

The specials market has been a key component of the strong revenues that have been produced by the asset class throughout the year. USA equity specials generated a total of $3.573B over 2023, the highest specials revenue total since 2008, and one of only two years since 2008 that has surpassed the $3B mark (2022 and 2023). This total equates to 70% of all revenues across Americas equities and represents a 14% YoY increase on 2022. During December specials revenues dipped MoM ($216.4M vs 218.39M) along with the percentage of revenues that were derived through specials activity 71.3% vs 73.8%.

Across Canada, securities lending revenues of $37M were generated throughout the month. This represents a 9% increase YoY. Canada was one of the only markets to also experience a YoY increase in average fees and balances during December. The market generated a total of $412.75M in revenues throughout 2023 which is 16.7% higher YoY. 2023 average fees also increased by 8% (66bps) YoY and utilization was up by 11% YoY (7.14%). The Canadian equity market experienced much improvement when compared with the previous year's performance. Only two months (June and August) experienced YoY declines in revenues and average fees remained well above the 60bps mark throughout 2023.

Specials activity declined YoY by just under 2% across Canadian equities. November proved to be the worst month for specials revenues within the country so an improvement in this figure was welcome. Over the year, special revenues from Canadian equities remained under whelming. A total of $99.6M was generated from specials activity throughout 2023 which compares favorably to 2022 ($87.9M) but remains significantly under the totals seen during 2019 ($453.4M) and 2020 ($295.4M).

During the month, the top ten revenue generating stocks in the Americas earned $141.81M, accounting for 40% of the total revenues for the region. The revenues generated from the top ten earners increased by 9.7% MoM despite many of the names remaining unchanged. Sirius XM Holdings Inc (SIRI) topped the December revenue table and was also the second highest earning stock of 2023 after generating $235.1M over the year. This was followed by Beyond Meat Inc (BYND) $191.3M, Lucid Group (LCID) $159.3M and Nikola Corp (NKLA) $139.9M. As in previous years, the top ten generating equities of 2023 were all US stocks. It is no surprise that AMC Entertainment Holdings Inc (AMC) was the highest revenue generator of 2023 (and possibly all time) after producing $661.3M in revenues during the year.

Across Canada, Energy, Telecommunications and Banking stocks all remained the top borrows. Energy stocks have remained a firm favorite amongst borrowers throughout 2023. The energy sector underperformed during the year as growth stocks outpaced value stocks. The decline in gas and oil prices has also been impacting the sector. Over the course of 2023 however, despite appearing regularly in the monthly top ten revenue generator tables, the sector only appeared three times. Enbridge Inc (ENB) was the top revenue producing stock having generated $32.3M, TC Energy Corp (TRP) appeared in seventh place generating $13.99M and Canadian Natural Resources Ltd (CNQ) took ninth place with $12.37M. The rest of the top ten was dominated by banking stocks and one pharmaceutical, biotech company, Canopy Growth Corp (CGC) which generated $13.9m over the year.

APAC equities

The APAC equity markets showed strong divergence during 2023 as Japan's benchmark index touched a 33-year high, whilst Hong Kong marked its fourth straight year of decline. India emerged as a leader in the IPO market and whilst South Korea chose to ban short selling, the Philippines chose to embrace the practice in a pursuit of broader and deeper capital markets.

2023 was supposed to be the year of the of much anticipated COVID reopening across China. The absence of any real economic uplift as expected and the ongoing geopolitical risks across the county proved to be two real drivers of divergence across the region's equity markets. Hong Kong's blue-chip index, the Heng Seng fell 13.8% this year, despite showing a 1.32% increase during December, posting its first four year losing streak since 1969. The CSI 300, the benchmark index which covers mainland Chinese shares across Shanghai and Shenzhen, followed suit, declining 11.4% during the year. Many Southeast Asian equity markets were impacted by the poor performance of the Chinese share prices during the year as they remain heavily dependent upon the effects of the Chinese economy and tourists. Thailand's SET index for example, declined 15.2% over the year.

Not all Asian markets fared the same. Strong gains were seen across Japan, India and the technology-heavy markets of Taiwan and south Korea as they all experienced strong gains. Japan was the standout equity market within the region, with the Nikkei 225 posting a 28.24% increase during 2023. Improved corporate governance and divestment from China benefited the country's equity market, along with strong corporate profits and company buy backs. Higher valuations helped to stimulate investment from international investors.

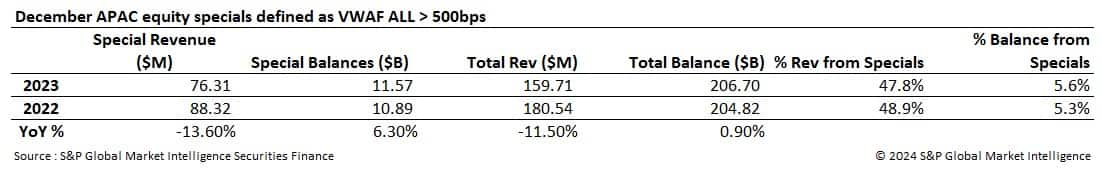

In the securities lending markets Asian equities produced $168.56M during the month of December which represents a 5.3% decline YoY and a 1% decline MoM. Average fees declined over the month (96bps December from 106bps during November) which impacted the headline revenue figure. The fall in revenues and average fees was a result of a 34% MoM decline in revenues produced by South Korean equities and a 27% MoM decline in average fees.

Asian equities remained a bright spot in the securities lending markets during the second half of the year, picking up some of the short fall in revenues left by a decline in specials activity in US equities. Japanese equities had a strong end to the year with December producing $50.8M of revenues (+21% YoY). $644.14M was generated during 2023 (+24% YoY). Average fees across Japanese equities stood at 50bps for the year (+17% YoY) and on loan balances were 6% higher YoY. Another strong market in the region was South Korea. Despite the imposition of a short selling ban during November, the country produced revenues of $21.1m during December and $393.6M during 2023 (+21% YoY). Specials activity has pushed revenues higher with Q2/3 experiencing some of the highest increases in YoY returns across any market (Aug +100% YoY, Sep +138% YoY and Oct +97% YoY). Utilization declined by 13.8% during December but over the year was 12% higher. The other main market in the region that makes a strong contribution to regional revenues, Hong Kong, produced $31.5M of revenues during December (-34.5% YoY) and $412.77M during 2023 (flat on 2022). The Hong Kong market produced some of the highest revenue generating stocks over the year and average fees for 2023 were 20% higher than during 2022 (150bps 2023 vs 126bps 2022) which supported annual revenues. A 16% YoY decline in balances and a 10% YoY decline in utilization affected the general performance of this market.

Specials activity across the region suffered during the month with $76.3M being generated (-13.6% YoY). During 2023 specials revenues generated by Asian equities surpassed the $1B mark for the first time since 2019 ($1.052B 2023 vs $959.3M 2022, $942.2M 2021, $653.7m 2020, $1.045B 2019). Throughout 2023, specials revenues provided an average of 47.8% of all monthly revenues from approximately 5.8% of all on loan balances.

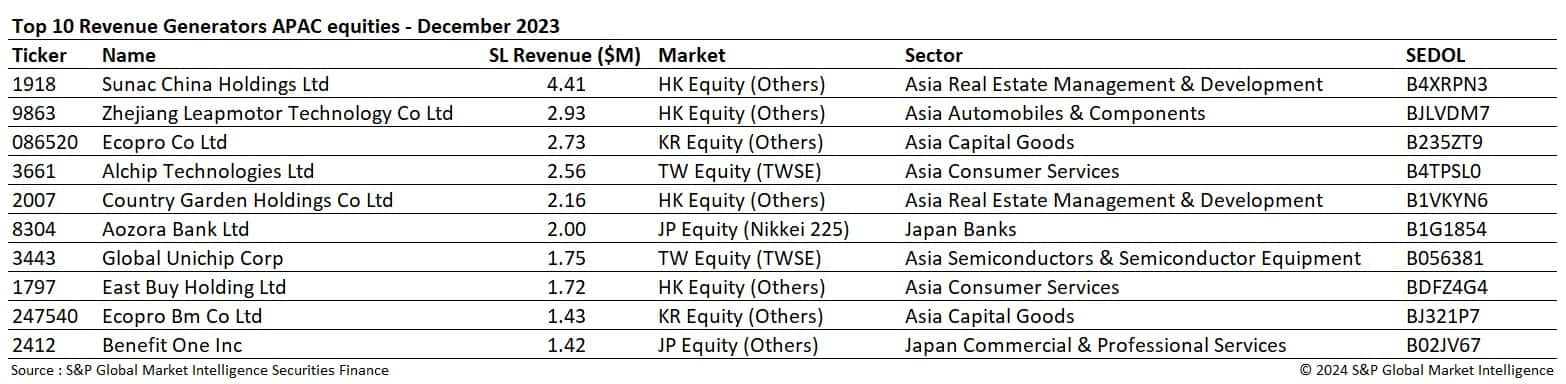

Sunac China Holdings Ltd (1918) remained the highest revenue generating stock over the month of December. The property sector remains in focus across the region as well publicized issues regarding funding requirements remain in the headlines. The two property companies seen in the table are also present in the top ten revenue generators of the year. Sunac China Holdings Ltd (1918) generated a total of $20.1M during 2023 (5th place) and Country Garden Holdings Co Ltd (2007) generated $37.1M during the year (2nd place). The highest revenue generating Asian equity stock of 2023 was Ecopro Co Ltd (247540) which produced $67.1m in revenues during 2023.

EMEA equities

European equity markets posted strong gains during 2023. The Euro Stoxx 600 gained 2.33% during December and posted 19.19% increase during the year. Strong annual gains were seen across Italy's FTSE MIB (+28.03%), Spain's IBEX 35 (+22.76%), Germany's Dax (+20.31%) and France's CAC 40 (+16.52%) during the year. Optimism fueled by an expectation that central bankers will soon need to pivot to interest rate cuts, protecting regional economies from major contractions, pushed European markets higher.

London's FTSE 100 lagged behind the majority of European markets after posting an annual gain of just 3.78% during the year. The index's preponderance to mining groups reliant upon the slowing Chinese economy and oil exposed energy companies, along with the relatively stubborn inflation rate, weighed on the country's benchmark index during the year. Economists have also warned that the Bank of England may have to keep interest rates higher for longer than its peers to combat inflation. Investors don't currently expect the Bank of England to be able to cut rates until June 2024, which is later than both the European central Bank and the US federal Reserve, as inflation still remains over double the target and wage growth remains strong.

During the month, the UK and Switzerland signed a financial services agreement, the European Central Bank left borrowing costs unchanged, the Bank of England said that there was "still some way to go" to control inflation and Norges Bank surprised the markets with an unexpected interest rate hike.

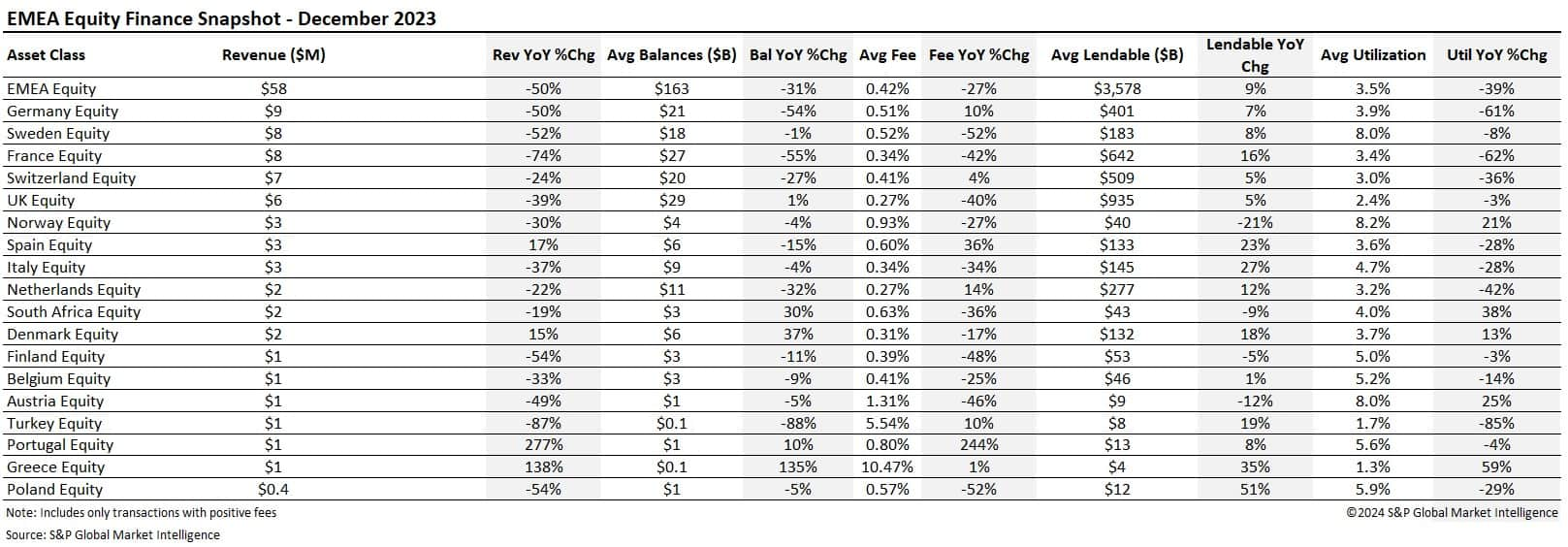

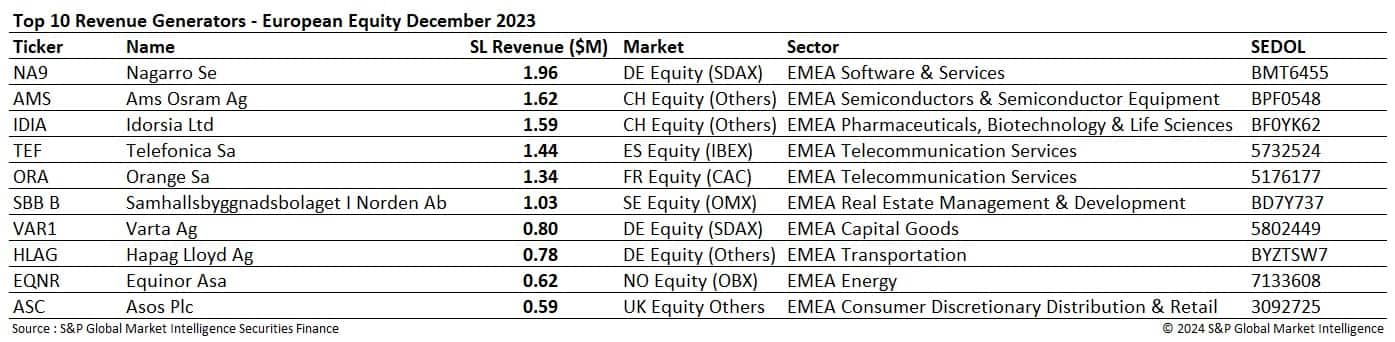

EMEA equities continued to experience a disappointing run in regard to securities lending revenues during December. $58m was generated representing a 50% decrease YoY and a 15% decrease MoM. December was the worst performing month for the asset class during 2023. Average fees across EMEA equities declined during the month after peaking during November. The average fee was 42bps, a decline of 27% YoY. Average fees surpassed those of 2022 throughout the first three quarters of 2023 but declined by 20% YoY during Q4 (45bps). Balances continued to decline over the month (-31% YoY) and utilization fell to 3.54%. Average utilization for 2023 stood at 4.63%, a 23% decline YoY.

As can be seen in the table, the majority of markets experienced heavy declines YoY in monthly revenues. When looking over the full year, the same is true. EMEA equities generated $1.37B of revenues during 2023, a decline of 8% YoY. Whilst balances declined 20% YoY average fees increased by 11% to 64bps.

During the month, revenues remained low. Revenues generated by France, Germany, and Sweden - three of the best performing markets of 2023 - all experienced YoY declines of over 50%. Fees remained subdued, declining 27% YoY, and balances declined by 31% YoY.

France was the highest revenue generating country during 2023 producing $243M in revenues but this represents an 18% decline compared with 2022. This was followed by Sweden ($206M, a decline of 8% YoY), Germany ($204m, decline 19% YoY) and UK ($123M, a decline of 11% YoY). All four of these markets experienced an increase in average fees over the year by the decline in balances (average decline across these markets of 21%) offset any potential gains. Austria was the standout European market during the year with annual revenues increasing 234% to $33M. This was due to a 281% increase in average fees to 328bps. Oesterreichische Post Ag (B1577G7) was the main contributor to the large move in these numbers (generated $12.7M during 2023).

Specials activity remained subdued. December represented the second lowest specials revenue producing month of the year after October ($22.16M December vs $22.08M October). Specials revenues over the month declined by 52% YoY in line with specials balances which also declined by over 50%. During 2023, EMEA equities generated $440.26M in specials revenues, the lowest since 2017 ($340.87M). Over the year an average of 36% of all revenues were derived from specials activity from an average of 1.6% of all balances.

During December the top ten revenue generating stocks accounted for 20% of all EMEA equity revenues which is slightly higher than the 2023 average of 18%. During the year, the top earners were Swiss Biotech companies Roche Holdings (7110388) $52.02M and Idorsia Ltd (BF0YK62) $32.3M, which represented 33% of the total top ten revenue figures for the year. Despite remaining a popular borrow throughout 2023, Nagarro SE (BMT6455) was in tenth place producing $16.18M during the year.

ADRs

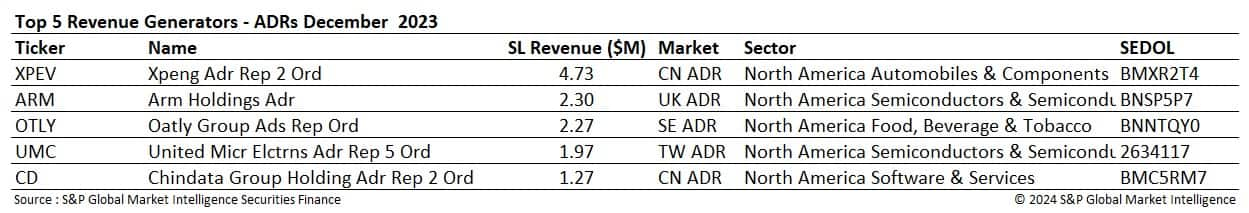

ADR revenues declined by 15% YoY to $28M during December, marking a 3% increase MoM. Average fees fell by 18% YoY to 110bps which is a 10bps decline when compared with the November average. On loan balances increased over the month both YoY and MoM and utilization increased to top 9% for only the second time this year.

ADR revenues were 7.8% higher during 2023 as stocks associated with the electric vehicle sector continued to produce strong revenues for lenders. Throughout 2023, the top revenue generating ADRs were Xpeng ADR (XPEV) $64.47M and Polestar Automotive (PSNY) $20.38M.

Exchange Traded Products

European exchange traded products reportedly amassed their second-best year of asset gathering during 2023 gaining ground on traditional mutual funds which suffered an estimated $100B of outflows during the year. The largest inflows were seen across low-cost tracker funds such as the iShares Core MSCI World UCITS ETF (SWDA) and the iShares MSCI ACWI UCITS ETF (SSAC) followed by the iShares Core S&P 500 UCITs ETF (CSPX) and Invesco's S&P 500 UCITS ETF.

Fixed income ETFs also benefited from strong inflows during the year as investors looked to position for central bank rate pivots. Inflows were seen across corporate bonds as recession risk declined and a change in interest rate expectations benefited corporate issuers, the iShares Core Euro corporate Bond UCITS ETF (IEAC) reportedly marked the second highest inflow of any ETF in Europe. Across the government bond sector, investors were seen favoring a barbell strategy with strong inflows in ETFs covering both the short end and long end of the curve.

Across the US, after the most recent Federal reserve meeting on December 13th, the SPDR S&P 500 ETF Trust (SPY) benefited from the furious stock market rally that was ignited by the US central bank signaling that it could cut rates three times during 2024. Over $20B of inflows into the fund followed on December 15th, the largest daily inflow for any ETF ever. The ETF has amassed over $54B of inflows during the year, the highest amount in the funds 30-year history. The ETF also now has over $490B in assets under management, putting it firmly on track to become the first ETF in history with over half a trillion dollars' worth of assets.

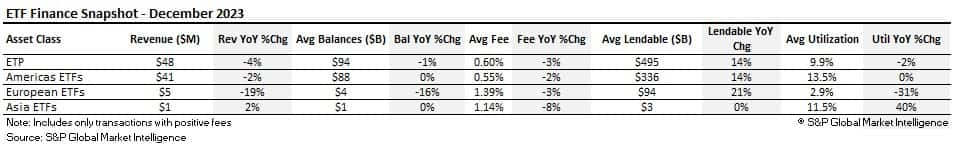

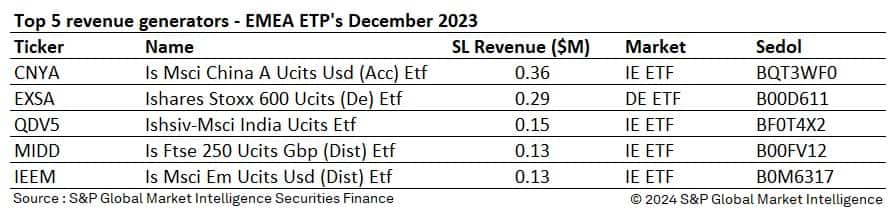

In the securities lending markets ETFs generated $48M in revenues during the month. Average utilization for both Americas and Asia ETFs remained above 10% with Asia ETFs posting a 40% increase YoY. Average fees declined YoY across the board despite increases in average fees MoM seen across both European and Asian ETFs.

Americas ETFs generated $544.19M in revenues during 2023, a decline of 25% YoY. Average annual fees also declined 15% YoY from 71bps during 2022 to 61bps during 2023. After one of the best performing years during 2022, every month during 2023 experienced a decline YoY in both revenues and average fees. European ETFs followed suit with a 28.4% decrease YoY in annual revenues ($66.58M) and Asia ETFs suffered a 32.5% decrease YoY in annual revenues ($12.06M).

Throughout 2023, as was seen during 2022, high yield and investment grade ETFs dominated the revenue tables. Ishares Iboxx High Yield Bond ETF (HYG) generated $64.4M during 2023 and was the top earner. This was followed by Ishares Iboxx Invt Grade Bond ETF (LQD) which generated $25.8M. Fixed income ETFs dominated the top ten table as moves in interest rates continued to produce opportunities for lenders. SPDR S&P Biotech ETF (XBI) $25.19M and ARK Innovation (ARKK) $19.96M were the top equity ETF revenue generators of the year.

Government Bonds

2023 was supposed to be the year for government bonds as central banks forced global economies into recession in an attempt to control inflation, leading to a rally in global bond prices. As the most predicted recession ever failed to materialize and the likelihood of a soft landing, with a limited impact upon levels or employment and GDP took hold, equity markets rallied and despite a brief volatile period during October and November, government bond prices remained suppressed.

During December, bond traders grew increasingly confident that the rate-raising cycle had ended. Discussions swiftly moved on to how many rate cuts should be expected throughout 2024. As levels of inflation continued to fall closer to target levels, pressure started to mount on central bankers to pivot from their tightening cycles faster than previously expected. In the US, market expectations indicated at least 1.25 percentage points of easing next year, with the possibility of lower yields and an extended rally, despite potential bouts of volatility and data discrepancies that may emerge in the coming weeks. Across the Eurozone, the European Central Bank kept interest rates unchanged warning that the fight against inflation had not yet been won, despite an easing in inflation from 2.9% to 2.4% in November. In the UK, interest rates also remained unchanged, and markets started to price in three Bank of England cuts starting in June 2024. Markets expect the stickiness of the UK's inflation figure to mean that it will be last to cut benchmark rates.

Looking to 2024, speculation regarding the "big ease" continues to grow. Market participants have set expectations for far more policy easing than central bankers are likely to be willing to provide. As global geopolitical risks continue to grow, inflation may still have further to run.

Across Asia, Moody's downgraded its outlook for Chinese sovereign bonds from stable to negative while maintaining a long-term rating of A1. The ratings agency cited concerns over the country's increased use of fiscal stimulus to support local governments and the country's deepening property crisis. In Japan, speculation that the Bank of Japan may be preparing for an end to its long-held negative interest rate policy grew as Deputy Governor Ryozo Himino stated that "we will carefully assess the situation and consider the timing and procedure of how to exit" negative rates. A Bank of Japan deputy governor commenting specifically on the impact of a potential exit from current policy is unprecedented.

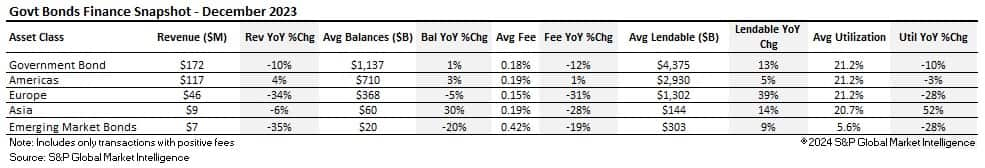

In the securities lending markets government bond revenues across all regions, apart from the Americas, declined during the month. Revenues of $172m were produced, which was a 10% decline YoY but a 23% increase MoM. Average fees increased during December across the Americas and Asia but declined across European government bonds. Whilst December usually sees a spike in borrowing activity, across Europe, December reported the lowest monthly revenues of the year ($46M). Across the Americas, monthly revenues increased by 38% MoM and 4.2% YoY. Despite the volatility seen across the bond markets, balances have remained lower than those seen during 2022. Over the year, balances of Americas government bonds declined by 14% and balances of European government bonds declined by 10% YoY. Asian government bonds noted a 10% YoY increase in annual balances, however.

US Treasuries dominated the highest revenue generator table for 2023. Ten-year issues generated the strongest returns (United States Treasury (3.375% 15-May-2033), United States Treasury (2.875% 15-May-2032), United States Treasury (3.5% 15-Feb-2033)) but the top revenue generator was the United States Treasury (4.125% 31-Jul-2028) which produced over $53.8M in revenues during the year. In Europe, the United Kingdom of Great Britain and Northern Ireland (Government) (1% 22-Apr-2024) produced $8.5M and across Canada, the Canada (Government) (2% 01-Dec-2041) was the highest revenue generator with $7.1M in revenues produced.

Corporate Bonds

Expectations that central banks' monetary tightening cycles have peaked benefited corporate bonds throughout the month. Investment grade corporate bond risk premiums fell to 107 basis points during December, their tightest level since February. The decline in spreads prompted firms to issue $17B of new debt during the first week of the month, which is a lot higher than usually seen. The increase in issuance was thought to reflect pent-up volume from deals that had been delayed during October and early November when volatility was seen throughout the bond markets. In general, issuance is expected to be flat throughout 2023 when compared to 2022, but investors are expected to start issuing again in early 2024 as companies seek to refinance or issue debt at lower costs. Lower borrowing costs, combined with tightening credit spreads, are favorable conditions for issuance, and many borrowers have been waiting for central banks to cut interest rates before refinancing.

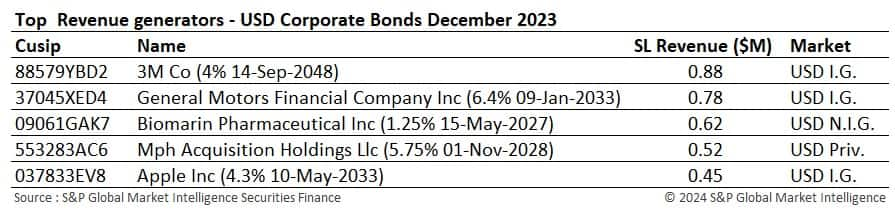

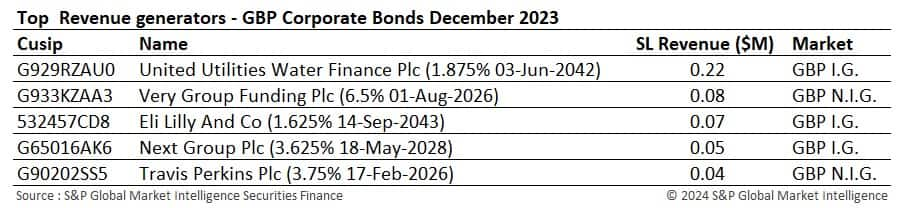

Corporate bonds generated $81m in securities lending revenues during the month of December, a decline of 18% YoY but an increase MoM. Despite a slowdown in monthly revenues seen towards the end of the year, corporate bonds generated $1.117B in revenues throughout the year, marking an impressive 16% increase on the bumper revenues that were produced throughout 2022. Corporate bonds have benefited from a change in the interest rate environment and have produced very strong returns throughout the year. Average fees declined to 35bps during the month but averaged 42bps over 2023 which is a YoY increase of 19%. Annual average balances were 1% lower during 2023 but utilization was slightly higher (+1%). The strength of demand, pushing the average fee higher, has produced record returns for the asset class over the year as corporate bonds remain one of the asset classes to watch throughout 2024.

The highest revenue generating bonds of 2023 are reflective of the top 5 USD corporate bonds that have been seen in the monthly tables through much of the year. 3M Co (4% 14-Sep-2048), the top earning bond, generated annual returns of $12.16M followed by Microchip Technology Inc (0.125% 15-Nov-2024) which produced $9.7M in revenues for lenders.

Repo Markets

Over the past month, data from S&P Global Market Intelligence Repo Data Analytics showed that global repo volumes increased whilst reverse repo volumes declined. Average haircuts remained unchanged and heading into year end, average terms across both repo and reverse repo increased.

Repo activity: Volume +0.89%, Weighted Average Haircuts unchanged, Average Term increase of 6.05 days (95.54 days current average).

Reverse repo activity: Volume -0.44%, Weighted Average Haircuts unchanged, Average Term increase of 7.32 days (135.81 days current average).

EMEA

Across the EMEA region, government bond repo volumes declined by 1.2% and reverse repo volumes declined by 2.2% during the month. The largest increases in volumes were seen across Irish (47%), Spanish (29%), and Swedish (26%) reverse repo activity. In the repo market, the largest increases in volumes were seen across Irish (24%), and Spanish (14%) government bonds, whilst the largest declines were seen across Italian (repo -8%) and Belgium (repo -19%) government bonds. French government bond volumes remained unchanged when compared with November (repo and reverse repo) whilst UK Gilts experienced an increase of 4% in reverse repo volumes and a decline of 7% in repo volumes. Austrian repo (-15%) and reverse repo (-23%) activity declined over the month.

Ten-year Spanish bonds became increasingly expensive over the month with the 3.15% 04/30/33 issue trading 68% more special in the repo market. Italian and French 2024 maturities started to become more expensive as they approached their respective maturity dates. A significant cheapening of the 1.45% 10/31/27 and 5.9% 07/30/26 issues in Spain also took place as the issues traded cheaper by 99% and 74% respectively in reverse repo markets.

In the corporate bond market, repo volumes increased by 3% and reverse repo volumes grew by 7% during the month. German investment grade USD denominated reverse repo, Spanish investment grade EUR denominated repo and French EUR denominated high yield repo all became more expensive by over 30% during month. The largest decline in average rates was seen across Italian EUR denominated investment grade repo activity where rates declined by an average of 26%.

US

Increases were seen across both US treasury and Canadian government bond repo and reverse repo volumes during the month. Whilst Canadian repo and reverse repo markets cheapened, US treasury activity became slightly more expensive.

The US treasury 4.75% 11/15/43 became very special during the month. Average rates increased by 126% in the repo market and 124% in the reverse repo market. A significant increase in volumes in this bond was also seen. As witnessed across EMEA, 2024 maturities started to trade more special during the month with reverse repo volumes starting to spike.

In the corporate bond markets, an increase in volumes was seen across USD denominated US high yield reverse repo (18%) and USD denominated US investment grade reverse repo (5%) during December. Average rates remained unchanged for both. An increase in volumes of Canadian USD denominated high yield reverse repo (23%) was also seen.

APAC

APAC Government bond repo increased by 8% and reverse repo activity decreased by 16% during the month. Japanese government bonds traded increasingly special over the year end period with repo rates increasing by 55% and reverse repo rates increasing by 77%. Volumes in Japanese government bonds declined by 19% over the period in repo markets whilst increasing by 22% in the reverse repo markets. The JGB 10yr 0.8% 09/20/33 traded very special over the month with increased volumes being seen in both markets.

Australian government bond average repo and reverse repo rates remained unchanged when compared with November. Reverse repo volumes increased by 22% whilst reverse repo volumes decreased by 25%. Sub 10-year Australian government bonds cheapened throughout the month in both markets.

In the corporate bond markets the largest decreases in volumes were seen across Chinese high yield USD denominated reverse repo (-29%) and USD denominated Singapore high yield reverse repo (-27%). The largest increases in volumes were seen across Korean investment grade and high yield USD denominated bonds.

Conclusion

2023 tuned out to be a blockbuster year that very few predicted. The S&P 500 finished the year 24% higher and despite a slow-down in securities lending revenues towards the end of the year, 2023 was another banner year for securities lending revenues. Annual revenues of $12.856B were produced, an increase of 3% YoY. 2023 was a year of higher fees and lower balances, a trend that was driven by some incredibly special stocks that generated some impressive returns. AMC Entertainment was the stand-out stock of the year generating a massive $661.25M in revenues alone. Without this trade, annual revenues would have been 3% lower than those produced during 2022. US equities provided some impressive returns and opportunities for lenders over the year and remained a strong focus throughout.

In the fixed income markets, the momentum that produced some of the best returns for corporate bonds continued throughout much of 2023, to the benefit of corporate bond lenders. Annual revenues surpassed $1.1B for the first time, which is going to be the milestone to beat going forward. Government bonds also produced strong returns thanks to higher average fees, a trend that is likely to continue as interest rate uncertainty is likely to remain heading into 2024.

Looking towards the new year, interest rate easing, the strength of the Chinese economy, elections across more than a quarter of the global population and the slowdown in demand for sustainable funds are only a few subjects that are likely to impact financial markets. The securities lending markets have shown throughout 2023 that they remain well equipped and well positioned to benefit from market volatility and further uncertainty. Following two years of successive banner market revenues, 2024 has a lot to live up to.

Please join us to review and discuss Q4, 2023 and the opportunities for the securities lending markets during 2024 at our upcoming webinar on Tuesday January 23rd at 10am EST / 3pm GMT. To join us, please complete the registration page by clicking HERE. As we review both 2023 and Q4, as well as look towards what 2024 may bring, to help us in our analysis, we will be welcoming Tom Kehoe, Managing Director, Global Head of Research and Communications at AIMA (Alternative Investment Management Association). Tom will be discussing Hedge Fund performance throughout 2023, reviewing the results of AIMA's most recent Hedge Fund Confidence Index, and running us through what regulations have the potential to impact Hedge Fund demand during 2024.

From all of the Securities Finance team at S&P Global Market Intelligence we wish you a happy, healthy, and prosperous 2024.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsecurities-finance-december-snapshot-2023.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsecurities-finance-december-snapshot-2023.html&text=Securities+Finance+December+Snapshot+2023+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsecurities-finance-december-snapshot-2023.html","enabled":true},{"name":"email","url":"?subject=Securities Finance December Snapshot 2023 | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsecurities-finance-december-snapshot-2023.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Securities+Finance+December+Snapshot+2023+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsecurities-finance-december-snapshot-2023.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}