Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Nov 09, 2022

Regulatory pressures, complexity, and competition impose greater strain on PE CFOs

To understand how chief financial officers (CFOs) of private equity (PE) firms are coping with the ever-changing investment landscape, we surveyed 30 CFOs in the U.S. and Western Europe, representing firms ranging in size between US $2bn and $40bn in assets under management (AUM). The survey, conducted by Mergermarket on behalf of S&P Global Market Intelligence, offers insights about the shifting demands and responsibilities of today's CFOs.

CFOs expect more AUM growth despite headwinds

In 2021, dealmakers inked transactions worth more than US $1.2tn—nearly a sixfold increase compared to a decade ago. The relentless growth of these transactions has been mirrored by a rise in demand for assets and a rapid increase in deal multiples, driven by stiff competition from rival firms, strategic buyers and institutional investors with deep pockets.

Despite macroeconomic and geopolitical headwinds — including inflation, interest rate hikes, trade wars and disruption to global supply chains—more than half (53%) of CFOs said their firms will raise new funds over the next 12 months. Of those, nearly one-third (31%) report that the offering will be larger than their most recently raised fund, while 44% say that their next fund will likely be equal in size.

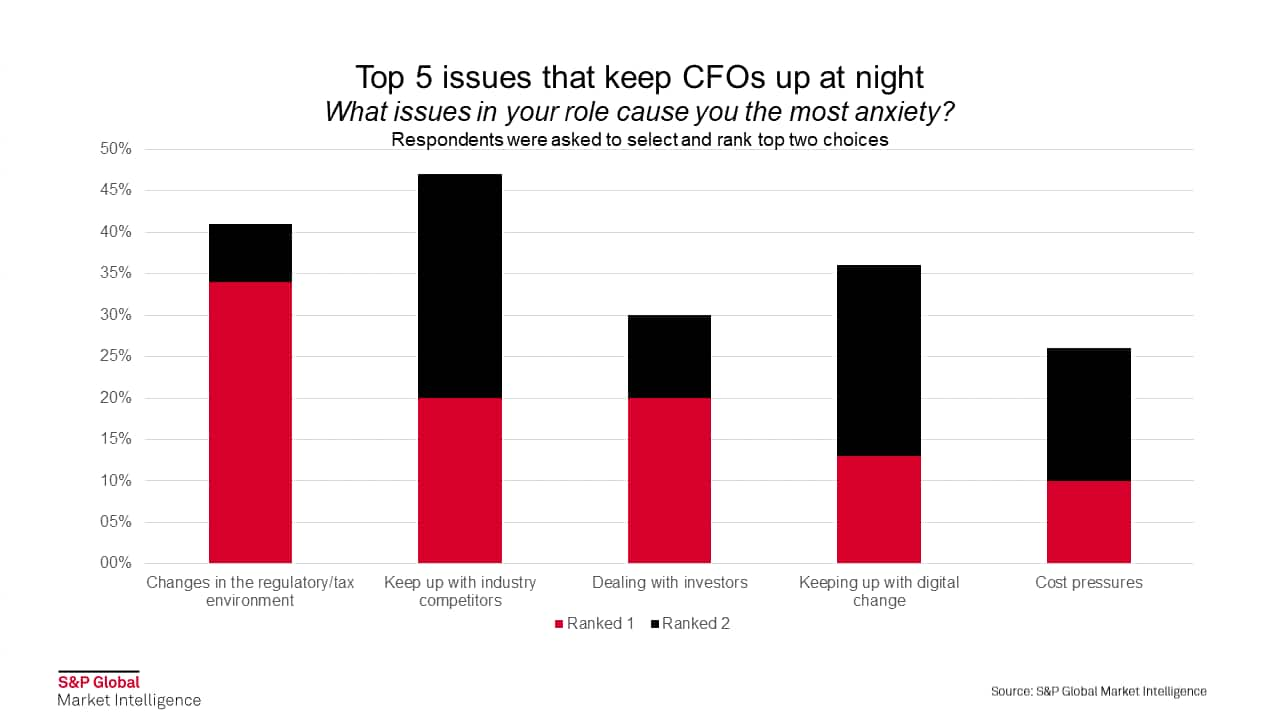

Keeping up with regulatory changes is a major source of anxiety for CFOs

When asked about what keeps them up at night, 41% of respondents ranked changes in the regulatory/tax environment as the first or second issue that causes them the greatest anxiety. As the CFO of a US firm put it, "There are faster policy changes than we anticipate and faster decisions to be taken within a short amount of time. The cost pressures are also increasing because of the weak global economy."

Among other concerns, competition, investor demands and technology rank high

Competitive pressure is also a top concern for CFOs: 20% of respondents rated it as their top anxiety, while 27% cite competition as their second-greatest concern. "Industry competitors are advancing steadily. There are new entrants competing for investors' capital. There is competition to retain investors, apart from competing for targets," says the CFO of a large US firm. A further 20% report that dealing with investors causes them the greatest anxiety. "Dealing with investors is a concern because of the newer investment models and allocation techniques," says a US-based CFO with more than 10 years of experience. "Investors, at times, insist that we change our investment criteria also. But we cannot change our procedures based on their assumptions alone." Digital transformation woes are ranked by 13% of respondents as a primary concern and 23% as a secondary one. A CFO in Germany noted that, "The digital changes are too overwhelming at times. We invest a lot into technology solutions; when they suddenly become obsolete, it raises a lot of decisions into our investments."

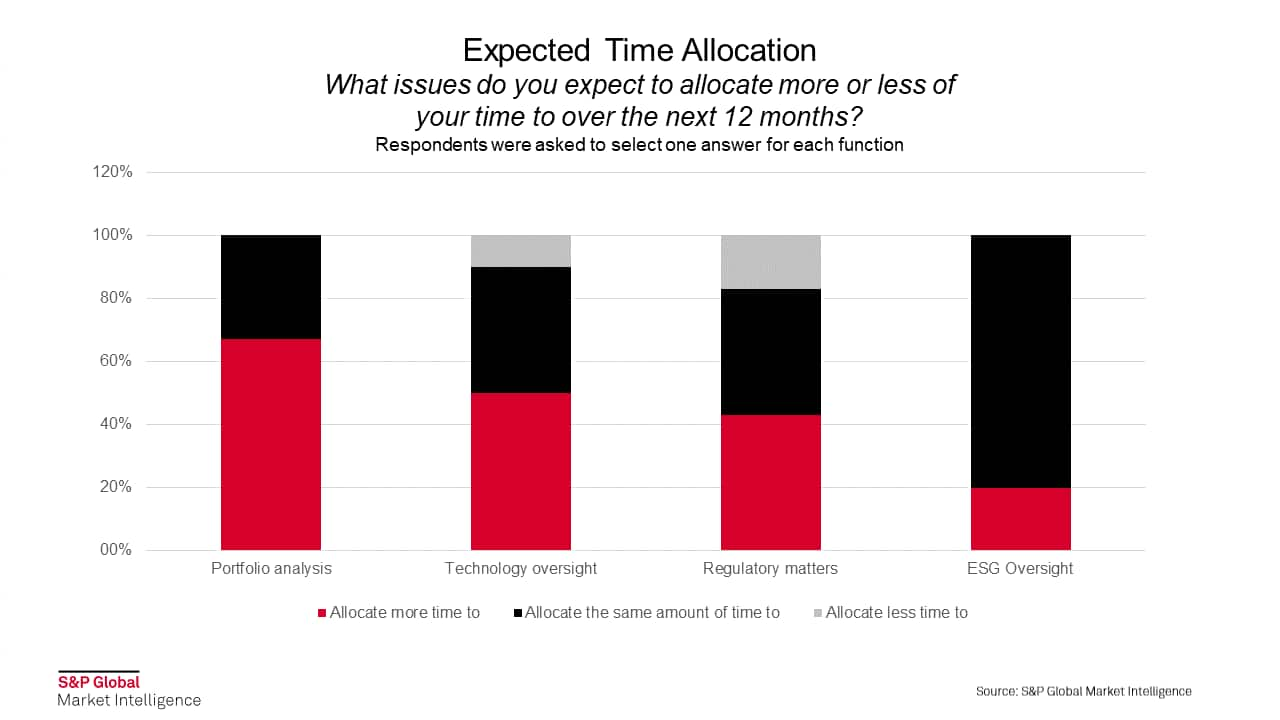

The road ahead: How CFOs plan to spend their time over the next 12 months

How are CFOs planning to reapportion their time over the next 12 months? Our survey shows that portfolio analysis, technology oversight and regulatory matters will consume more of their time in the year ahead. More than two-thirds (67%) of respondents say they expect to devote more time to portfolio analysis — the largest share for any CFO function. "We will conduct deeper portfolio analysis to identify the problem areas and most recent risk factors affecting the performance of underlying companies," says the CFO of a US firm. The CFO of a UK firm says, "There are additional market risks now, which will make portfolio analysis much more important over the next year."

For 43% of CFOs surveyed, regulatory matters are also expected to soak up a greater share of their time budgets over the next year. "Allocating more time to regulatory oversight is essential," says the CFO of a Dutch firm. "Regulations are changing more often, and we need to increase our preparedness to avoid any issues with the authorities." These include a potential tightening of scrutiny of the PE sector in the US, as well as stricter checks on foreign direct investment just about everywhere. All of this is increasing the amount of time allocated to target selection. "By spending more time on assessing the regulatory environment, we will be more prepared during deal sourcing, selecting the right geographies and opting for specific sectors," says the CFO of an Italian firm.

Download our whitepaper to read the full results.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fregulatory-pressures-complexity-and-competition-impose-greater.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fregulatory-pressures-complexity-and-competition-impose-greater.html&text=Regulatory+pressures%2c+complexity%2c+and+competition+impose+greater+strain+on+PE+CFOs+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fregulatory-pressures-complexity-and-competition-impose-greater.html","enabled":true},{"name":"email","url":"?subject=Regulatory pressures, complexity, and competition impose greater strain on PE CFOs | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fregulatory-pressures-complexity-and-competition-impose-greater.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Regulatory+pressures%2c+complexity%2c+and+competition+impose+greater+strain+on+PE+CFOs+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fregulatory-pressures-complexity-and-competition-impose-greater.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}