Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Oct 15, 2021

2021-Q3 release of GTAS Forecasting model - Strong recovery followed by moderation

Key findings

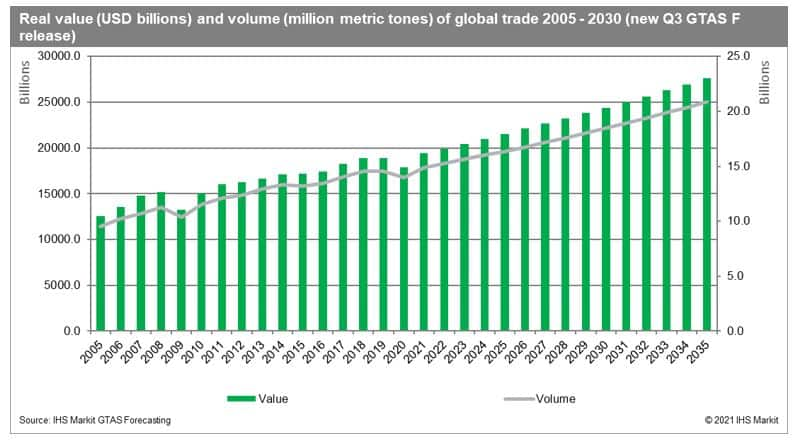

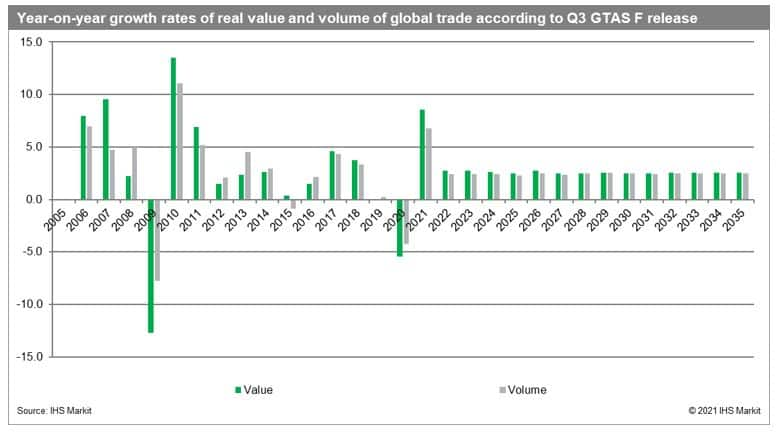

- We now predict the real value of global trade to go up to USD 19,393 billion in 2021 and USD 19,929 billion in 2022. Therefore, we now anticipate a year-on-year increase in the real value of global trade by 8.5% in 2021 and 2.8% in 2022

- The predicted CAGR for the period 2021-2030 equals 2.6%

- We forecast the global merchandise trade volume to grow to 14.9 billion metric tons in 2021 and 15.3 billion metric tons in 2022. It points to a recovery in the forthcoming years with year-on-year growth rates of 6.8% in 2021 and 2.4% in 2022.

- The forecasted CAGR for global trade volume stands at 2.4% in 2021-30

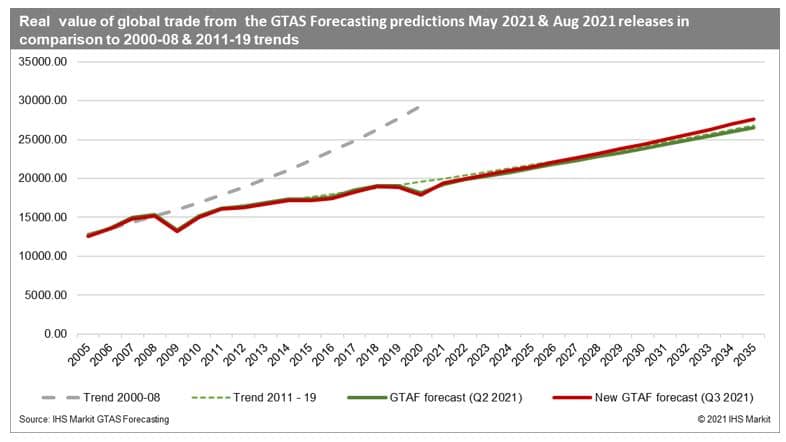

- The estimated recovery is strong enough to allow a trade to reach its pre-pandemic levels already in 2021 and presently predicted higher CAGR over the period 2021-2035 is strong enough for global trade to achieve a higher trajectory path of the pre-pandemic trend (2011-2019) in the forecasted time horizon.

- Global uncertainty is declining, growth prospects are positive, with growth rates predicted to moderate after the fast recovery phase is over; nonetheless, there are some still ongoing concerns: the further path of the COVID-19 pandemic, rising transport costs including containerized freight, disrupted GVCs in various key sectors, geopolitical tensions in several key regions

2021-Q3 release of the GTAS Forecasting models

The new release of the GTAS Forecasting model accommodated the most recent macroeconomic forecasts from IHS Markit Global Link Model, Q1 data for 2021 from the Global Trade Atlas (GTA) for monthly reporting states, and updated COVID-response factors.

GTAS Forecasting model now estimates the contraction of global merchandise trade in 2020 to USD 17,871 billion or -5.5% year-on-year.

We now predict the real value of global trade to go up to USD 19,393 billion in 2021 and USD 19,929 billion in 2022. Therefore, we now anticipate a year-on-year increase in the real value of global trade by 8.5% in 2021 and 2.8% in 2022 (which is +2.5% and -0.2%, respectively, in comparison to our Q2 forecasts).

It accommodates the recovery in global GDP in 2021 and a powerful growth impulse in Q2 of 2021. The predicted CAGR for the period 2021-2030 equals 2.6%, and for 2022-2035 equals 2.6% (an increase by +0.2% and +0.3% respectively on prior release results). It represents an upward adjustment in CAGR compared to the prior release, driven mainly by adjustments of GDP forecasts in the GLM model and better than initially expected results for the first two quarters of 2021.

In terms of volumes, we estimate a contraction of global trade in 2020 to 13.94 billion metric tons or by -4.2% year-on-year.

We forecast the global merchandise trade volume to grow to 14.9 billion metric tons in 2021 and 15.3 billion metric tons in 2022. It points to a recovery in the forthcoming years with year-on-year growth rates of 6.8% in 2021 and 2.4% in 2022.

The forecasted CAGR for global trade volume stands at 2.4% in 2021-30 and 2.2% over 2022-35 (an increase by +0.1% and +0.2%, respectively, on prior release results). The predicted growth rates over 2021-2030(5) are faster than CAGR over the period 2011-19 (higher trajectory) predating the pandemic but significantly lower than the growth rates in trade preceding the financial crisis.

The estimated recovery is strong enough to allow a trade to reach its pre-pandemic levels already in 2021 and presently predicted higher CAGR over the period 2021-2035 is strong enough for global trade to achieve a higher trajectory path of the pre-pandemic trend (2011-2019) in the forecasted time horizon.

Contributing factors

The ongoing COVID-19 pandemic

The reaction in trade in 2020 was to a large extent consistent with the escalating global COVID-19 pandemic and steps taken by individual countries/territories in controlling or mitigating it. The overall impact of COVID-19 on global trade and the global economy will depend on the duration, severity, and spatial distribution of the pandemic and directly and directly linked to the severity of containment efforts taken by individual states. It seems that with the duration of the pandemic, governments and international organizations learned to react to it and mitigate it in a more balanced and less harmful for their economies way. The health crises create problems both on the supply side (e.g., due to lockdowns, forced production stoppages, disrupted global value chains) and demand-side (e.g., lower consumer confidence, delayed consumption, lower incomes). The impact of COVID-19 on the global economy clearly outweighed the prior outbreaks of SARS or MERS and resembles more the effect of the infamous Spanish Flu of 1918-20.

Recent econometric analysis on monthly processed bilateral trade flows by the GTAS Forecasting team has shown that COVID-19 still exerts an adverse impact on international trade flows; however, the effect is slowly diminishing in magnitude (it is observed both for new cases, new deaths, as well as COVID-19 monthly average of daily Oxford's Government Response Tracker on the stringency of response to the pandemic by individual states).

The cumulative number of confirmed cases of COVID-19 globally by 26 September 2021 reached 231.4 (and is likely to get 250 million cases threshold by November 2021) and 4.74 million deaths. The cumulative number of cases is currently the largest in Asia (75.2 million), Europe (58.9 million), North America (51.6 million), and South America (37.7 million).

The 2-week moving averages of global new cases globally started to decline by mid-August 2021, with international average death rates following with a two-week delay; it seems that the peak of the fourth wave is behind us, and the number of restrictions is subsiding; thus, the impact on global trade is weakening

The reported number of vaccinations by the end of September globally reached 6.18 billion with 2.67 billion people fully vaccinated (with two doses or equivalent one dose), which is equal to 33.2% of the global population; to bust immunity, some countries, most advanced, started to distribute the third dose mostly among the population aged 50+. The inequalities in vaccination levels and rates observed are the area of significant concern as a pandemic is global and needs to be globally resolved. The size of the non-vaccinated population increases the chances of the emergence of new potentially more hostile variants of the virus. The pace of vaccination globally is a significant concern as we are still far from the herd immunity threshold.

Good overall growth prospect with peak of the recovery behind

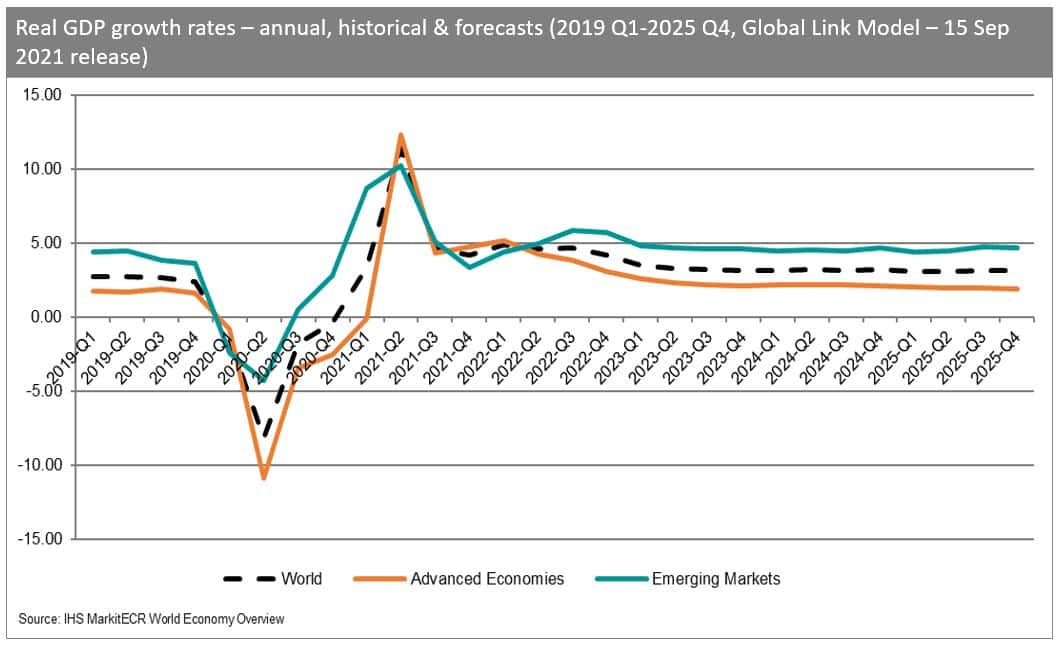

The most recent real GDP growth forecasts from IHS Markit were published on 15 September 2021 and are based on the baseline scenario of the impact of COVID-19 on the global economy and rising global concerns over inflation and the presence of increasing once-again GVCs disruptions

The now estimated contraction in real global GDP is -3.4% in 2020, varying between -4.5% for advanced, -1.6% for emerging, and -5.1% for the most affected developing economies. Real global GDP contracted in every quarter of 2020, with Q2 being the worst quarter for the global economy in years. In contrast to prior crises, advanced countries were more affected than the emerging markets and started recovering later, thus taking their role in the global economy. The impact on global trade relations was more significant.

We now foresee a global recovery in 2021, with year-on-year real GDP growth rates predicted to reach 5.6%.The growth rates are expected to vary between 5.1% (4.1% in 2022) for advanced, 6.5% (5.1%) for emerging, and 4.1% (5.0%) for developing states.

In Q2 2021, real global GDP is estimated to have grown by 11.5%, with the growth impulse stronger for advanced (12.3%) than emerging economies (10.2%). The prospects for Q3 and Q4 are positive, with growth rates moderating to 4.7% and 4.2% (lowered in comparison to prior forecasts from August), with growth more robust overall in advanced economies (this should continue till Q2 of 2022).

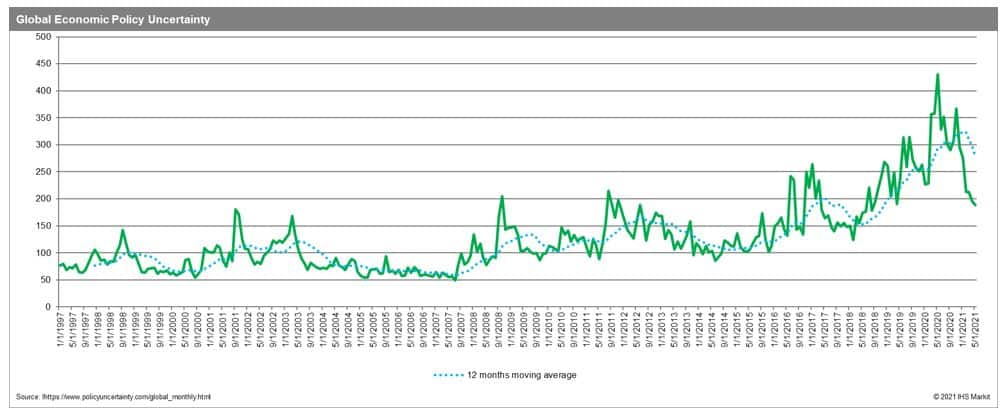

Global Uncertainty falling

The monthly index of Global Economic Policy Uncertainty is continuously declining after reaching its historically highest levels in 2020. The fall in the 12-month average followed. It could positively affect global demand as well as an investment decision by firms boosting growth rates.

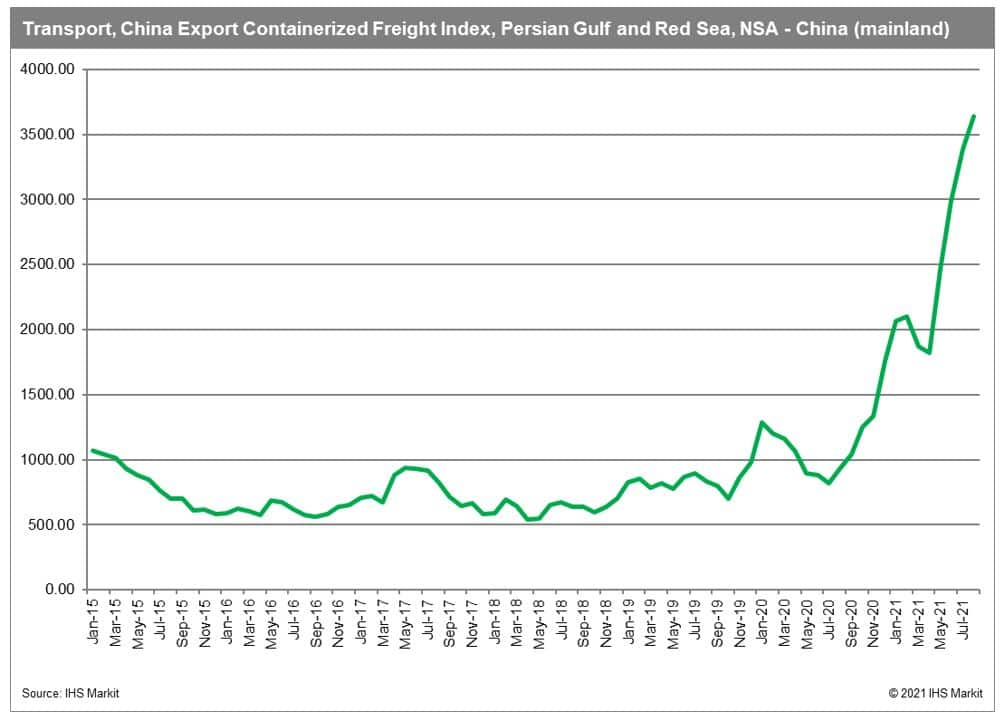

High transport costs

In our GTAS forecasting model, the prices of crude oil and natural gas approximate transport costs. It is clear that the price has reached the highest levels in the last six years thus rising overall transport costs.

The rising cost can put negative pressure on global trade, further aggravating disruptions of already existing global value chains. The hike in prices is due to reduced supply and enormously increasing demand. Due to the coming winter season in the northern hemisphere and thus the increased demand in the heating season, natural gas prices are unlikely to decrease soon.

The containerized freight index from China to different destinations globally, as shown by the Shanghai Shipping Exchange, clearly points to skyrocketing costs of containerized shipments. For the example of transport costs to the Persian Gulf and Red Sea regions, it is clear the cost of containerized transport climbed sharply compared to the pre-COVID-19 period. They are unlikely to return to moderate levels in the foreseeable future.

The rise in container transport costs is only partially related to rising fuel prices. It is also due to problems with supply for containers (global shortage of containers), still significant congestion in many seaports, particularly in China, still existing restrictions due to COVID-19, and growing global demand in the recovery phase from the pandemic. The present delays in transport with increased transport costs will further adversely affect many already stretched global value chains. The longer the problem lasts, the more likely are more serious adjustments to the existing value chains concerning both trade routes and production location (more backshoring and more nearshoring could be expected).

The rising transport costs could, to some extent, impact the global prices, increasing chances for another hike in global inflation levels.

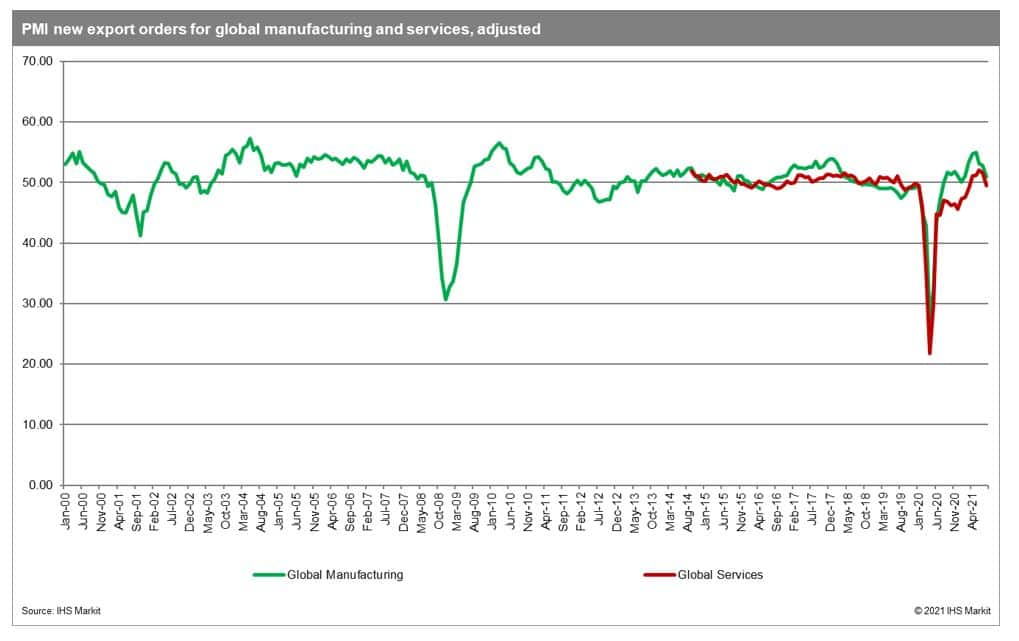

PMI New Export Orders readouts point to rising optimism, at least in the short-run

PMI New Export Orders (adjusted) by IHS Markit is an excellent trade predictor in the coming quarter. The 50.0 points is a benchmark value with a value above pointing to recovery and below indicative of contraction. The analyses performed show a high correlation between PMI NExO and changes in GTA monthly data reported by states over the coming quarter (mostly the following month).

PMI NExO in August 2021 for global manufacturing (50.97) is above, and global services are below (49.52) the 50.0 points. The adjusted PMI new exports orders (PMI NExO) readouts for the worldwide manufacturing industry in August 2021 were above the benchmark value the 12th month in a row showing a sustained recovery and pointing to a positive short-term outlook for global trade. However, PMI NExO for global services fell for the second time in more than half a year and, the manufacturing PMI NEx0 decreased for the third time in a row. Taking these values into account, we can assume that global trade is going to grow more moderately in the forthcoming quarters.

Subscribe to our monthly newsletter and stay up-to-date with our latest analytics

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fq3-release-of-gtas-forecasting-model.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fq3-release-of-gtas-forecasting-model.html&text=2021-Q3+release+of+GTAS+Forecasting+model+-+Strong+recovery+followed+by+moderation+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fq3-release-of-gtas-forecasting-model.html","enabled":true},{"name":"email","url":"?subject=2021-Q3 release of GTAS Forecasting model - Strong recovery followed by moderation | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fq3-release-of-gtas-forecasting-model.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=2021-Q3+release+of+GTAS+Forecasting+model+-+Strong+recovery+followed+by+moderation+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fq3-release-of-gtas-forecasting-model.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}